Weak markets create opportunities; that's a given. But those opportunities can be significantly enhanced when companies in the right sectors at the right time get caught in the broader market downdraft. That's the case with Surge Battery Metals, Inc. (OTC: NILIF), a well-capitalized, multi-country battery metals exploration company advancing projects in several of the world's most mining-friendly jurisdictions. But that's not all. NILIF is also engaged in making lithium a significant contributor to its planned revenue streams. And with lithium and most EV metals selling at all-time high prices, seizing the valuation disconnect in NILIF stock now could be a wise consideration.

Why the interest in micro-cap Surge Battery Metals? The biggest reason is that despite its size, they are positioning themselves to compete against many of the more established mining players. And with a lower cost of getting metals and elements unearthed, they have the potential to compete effectively in an EV metals market experiencing exponential increases in demand. Better still, demand isn't expected to slow anytime soon. In fact, the sector is forecasted to become a trillion-dollar industry by 2030. That means if NILIF can find, dig, and unearth the metals needed, they could become a revenue-generating juggernaut in the process.

Thus, taking a position in promising mining companies where market prices have disconnected from surging demand and record-setting prices may be more than a wise consideration; it can be an investment opportunity too big to ignore. And Surge Battery Metals is one to check. After all, by advancing several projects giving them exposure to the lucrative metals and lithium markets, there can be no denying that Surge Battery Metals is in the right markets at the right time. Better still, with ample cash reserves and accretive assets coming online, they are better positioned than ever to create sustainable shareholder value.

EV Sector Is Surge Battery Metals Focus

In fact, they are doing that now by leveraging a stable of assets that capitalize on potentially massive revenue-generating opportunities as demand for electric vehicles (EVs) and the battery metals required to power them are pricing at record highs. And the more excellent news is that the exponential growth in the sector is allowing Surge Battery Metals to execute deals that can be immediately accretive to revenues. Better yet, by drilling into the potential from being close by historically proven properties in two countries, leveraging its working partnerships could spark transformational growth for Surge as they serve one of the generation's fastest-growing and most important global industries.

There's more to like. Surge Battery Metals isn't going into the fields unprepared. On the contrary, NILIF is arguably in its best-ever condition financially and operationally to exploit the booming battery metals markets. That's, of course, excellent news for both Surge Battery and its shareholders. And that's not an unjustified assumption. It's a reasonable calculation knowing that Surge has inked multiple deals to expedite near and long-term market opportunities and transform itself from a metals exploration company into one that unearths and markets valuable battery metals and elements.

Incidentally, that could happen faster than many think, especially with geographic mapping suggesting that NILIF could be sitting on potentially hundreds of millions of dollars in underground assets. And, with even more deals expected to come online this year, investors taking advantage of what appears to be significantly undervalued share prices could score appreciable gains in the near and long term.

A Valuation Disconnect Exposes Bullish Proposition

There are reasons to be bullish. In fact, justifications trace back to 2021 when Surge enhanced its already impressive list of operating assets, completed a capital raise that put them in one of its best cash positions ever, and mitigated many of the inherent risks in the exploration sector by conducting its operations in some of the world's most mining-friendly jurisdictions. And they haven't slowed in 2022. In fact, they are gaining more momentum to create value by announcing additional agreements expected to accelerate expansion while diversifying their revenue sources.

A potentially massive deal is an option agreement with Lithium Corporation (OTCQB: LTUM) that could create substantial near-term shareholder value. In fact, this agreement alone could be the potential catalyst that propels Surge Battery from a small-cap exploration company into one of the industry's most reliable suppliers of battery metals and elements. Moreover, the terms are attractive and allow NILIF to expand its business footprint and retain the lion's share of its excess $3.8 million in working capital.

Terms provide Surge with substantial claim interest in a 5,560-acre prospect region, which should allow the company to maximize revenue-generating interests while keeping its balance sheet strong. That's because the deal's terms are quite "investor-friendly" to NILIF. Instead of a significant capital draining cash outlay, the deal structure allows Surge to make staged cash and share payments and incur a defined $1,000,000 in exploration expenditures to earn an undivided 80% working interest in the San Emidio Lithium-in-Brine property. This means they can keep most of its $3.8 million in excess working capital reported in a recent update. But don't expect them to sit on that cash. NILIF has made clear it intends to grow by acquisition, a part of its business plan that has never softened.

Surge isn't stopping there, either. In January, the company announced that it has staked a 1,640-acre property in the Teels Marsh Playa in Mineral County, Nevada. Located roughly 84km northeast of Albemarle's Silver Peak brine mining operation, the agreement should be accretive to Surge's expected revenue streams by drilling into new opportunities in a region with high lithium concentrations. It's important to note that prior performance is a solid predictor of future success in the mining and exploration industry. And, with the region having proven its worth as an ideal location for lithium mining and exploration, NILIF and its investors could expect a substantial return from this new interest.

Here's an important consideration that could significantly benefit Surge- they are focused on choosing operating sites within the world's most mining-friendly jurisdictions. Consequently, Surge could avoid many potential operational disruptions caused by environmental groups or geopolitical uncertainty. Thus, unlike many of its competitors facing potentially turbulent and unpredictable local circumstances, Surge can confidently invest its resources in its properties without fearing unplanned closures.

That's assuring when serving a generational market opportunity that is already a mega-billion dollar industry.

EV Industry On Its Way To A Trillion-Dollar Market

Further, with the EV industry becoming one of the world's fastest-growing and most important sectors, Surge's target market is only continuing to grow in size. As noted, recent estimates predict that the already massive industry could reach a trillion-dollar valuation by 2030. This represents an exponential growth rate in market opportunity over the next eight years.

And with NILIF in its best operational position in history, the expectation that NILIF can grow along with those increases is a likely proposition.

Metal-Rich Assets Expose Valuation Disconnect

Already, several indicators point to the possibility that Surge stock could stay in play and jump into hyper-rally mode. In addition to the company's deal with LTUM and expansion into Teels Marsh Playa, NILIF's stake in three mining locations known to be rich in battery metals could bring considerable near-term returns. Surveys and geological mapping indicate potentially lucrative mining results.

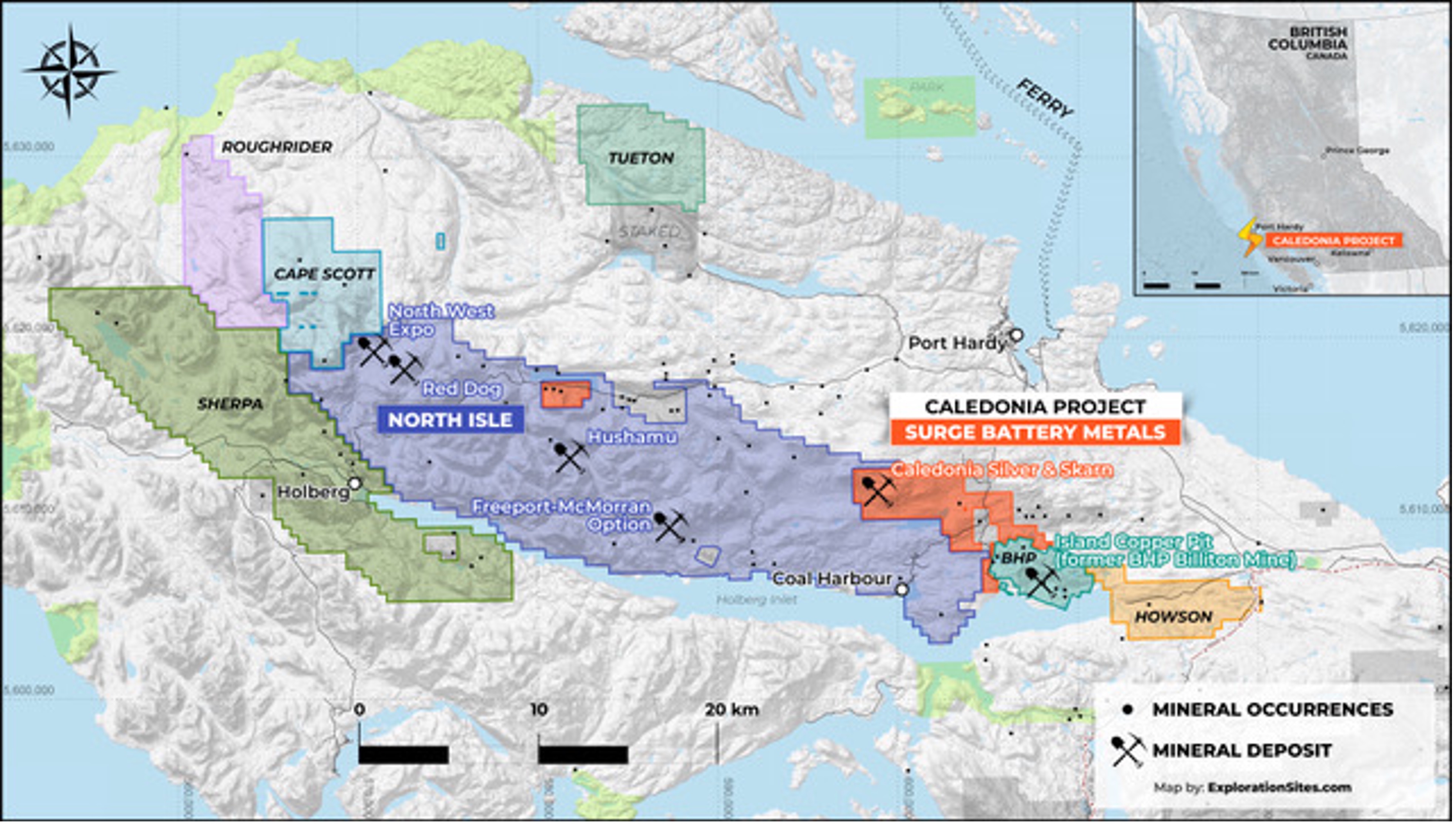

Surge's exploration initiatives within British Columbia are expected to contribute significantly. This project encompasses two locations known to have high reserves of copper, nickel, and other vital metals used in producing EV batteries. The 4,302-acre Caledonia claim has a proven track record of being rich in copper and silver, located just 7 miles away from BHP's Island Copper Mine. The second site is close to known nickel deposits, implying that more metal is likely found in the area. Notably, surveys of the site indicate high concentrations of hard nickel, cobalt, chromium, and awaruite, all of which can generate excellent income potential to Surge.

Furthermore, Surge is also developing its Northern Nevada Lithium Project in collaboration with Lithium America, America's sole active lithium producer. Lithium is one of the most critical components in battery production. Its demand is skyrocketing as electric vehicles become more commonplace and because it is a required element for most battery-powered electronics. With this in mind, Surge intends to capitalize on the plethora of resources in Northern Nevada by combining new breakthroughs in mining efficiency with its marketing expertise to get its unearthed battery metals into clients' hands.

A Revenue-Generating Tailwind Gets Stronger

Keep in mind, too, NILIF is also on pace to reach several milestones, giving investors more to look forward to. Moreover, they can count on another thing: the unprecedented demand for next-generation batteries is here to stay. Indeed, the need for metals and elements required to manufacture EV batteries will grow in tandem to meet that demand. Best of all, unlike the historically volatile asset valuations of other rare earth metals, the battery metals and elements being mined by Surge are predicted to be a long-term necessity to an industry still in its relative infancy.

For element and metals exploration companies like Surge, that visibility is a critical component of developing a successful business strategy. The good news is that there will undoubtedly be no shortage of demand for other battery-related technologies, and analysts have emphasized that metals prices are sure to reflect that value.

Of course, an exploration and metal mining business must be able to meet those record-high demands to be successful. Surge has indicated it can, confirming that it is fully funded to complete its planned 2022 explorations. Not only that, but the company also has an impressive cash reserve to continue building its asset portfolio. Thus, it's worth repeating: current share prices may be a value proposition too good to ignore.

Surge Battery ESG Mandated; Big Advantage

While all the above can generate potentially enormous value, there's still more to make the NILIF investment proposition more compelling. By adopting the most efficient and responsible mining technologies and processes, Surge Battery Metals and its investors benefit from the advantage of operating with reduced risk. The company has also taken measures to ensure that its exploration and mining operations do not suffer from the same risks as other operators by utilizing advanced prospecting, geological mapping, and rock and soil sampling to determine which properties can provide the most significant potential for return on investment. Furthermore, Surge has already built a formidable network of sales channels, meaning that supply chain issues shouldn't impact its business when that time comes.

Perhaps the biggest differentiator to note, though, is that Surge benefits from the status of being an ESG (Environmental, Social, and Corporate Governance)-mandated company. This designation could potentially triple the revenue-generating opportunities compared to those without the ESG status. This ESG designation allows Surge to meet the demands of a competitive market and seize opportunities that even some of the more senior mining companies can't. Thus, though Surge may be a small-cap exploration company in size, its revenue potential based on the sum of its parts puts them in the big leagues.

A Sum Of Its Parts Justifies A Raise

Accordingly, investors can't look at NILIF as a one-dimensional company. Instead, the entirely of the Surge Battery investment proposition is where investors should focus their considerations. Even a basic calculation of its assets suggests that its current market cap falls well short of an appropriate valuation. Not only that, as noted, NILIF is definitely in the right markets at the right time and has demonstrated its ability to decouple from market weakness on sector news. Remember, too, NILIF has ample cash reserves, is boosting its shareholder value by leveraging several accretive business deals, and continues to seek out new opportunities to expand its growing portfolio.

Thus, heading into 2022, NILIF has the parts in place to seize on a perfect storm of revenue-generating opportunities by focusing its exploration projects in the world's most mining-friendly jurisdictions. In addition, they aren't slowing. Instead, over the past few months, NILIF has enhanced its asset portfolio, secured accretive deals in locations around proven metal reserves, and has expanded its business footprint to take advantage of a lithium market that is purchasing at record level prices. Therefore, when evaluating Surge Battery Metals, consider the totality of the opportunity and the position of strength they work from. Not many exploration companies the size of Surge Battery Metals can claim the same or even similar capabilities.

In fact, checking peer companies, NILIF has competitive and financial advantages many wish for. Hence, by all measures, Surge Battery Metals is earning its place to be a viable and competitive provider in an expected trillion-dollar sector. Therefore, for investors liking risk with potentially massive returns, Surge Battery Metals can be an ideal consideration. Not only that, investment in NILIF's vision, ahead of imminent updates, is more than attractive; it's timely.

Disclaimers: Shore Thing Media, LLC. (STM, LLC.) is responsible for the production and distribution of this content. STM, Llc. is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by STM, Llc. is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall STM, Llc. be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by STM, Llc., including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. STM, Llc. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, STM, Llc., its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. STM, LLC.has been compensated up to twenty-thousand-dollars via wire transfer to produce and syndicate content for Surge Battery Metals, Inc. for a period lasting one month. As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website by visiting primetimeprofiles.com/disclaimer.

The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

Media Contact

Company Name: STM, LLC.

Contact Person: Michael Thomas

Email: contact@primetimeprofiles.com

Phone: 973-820-3748

Country: United States

Website: https://surgebatterymetals.com/