Bellevue, Washington-based Expeditors International of Washington, Inc. (EXPD) is a global logistics and freight-forwarding company that provides air and ocean freight consolidation, customs brokerage, warehousing, and supply chain solutions. Valued at a market cap of $18.6 billion, the company is known for its emphasis on customer service, technology-driven operations, and disciplined cost management.

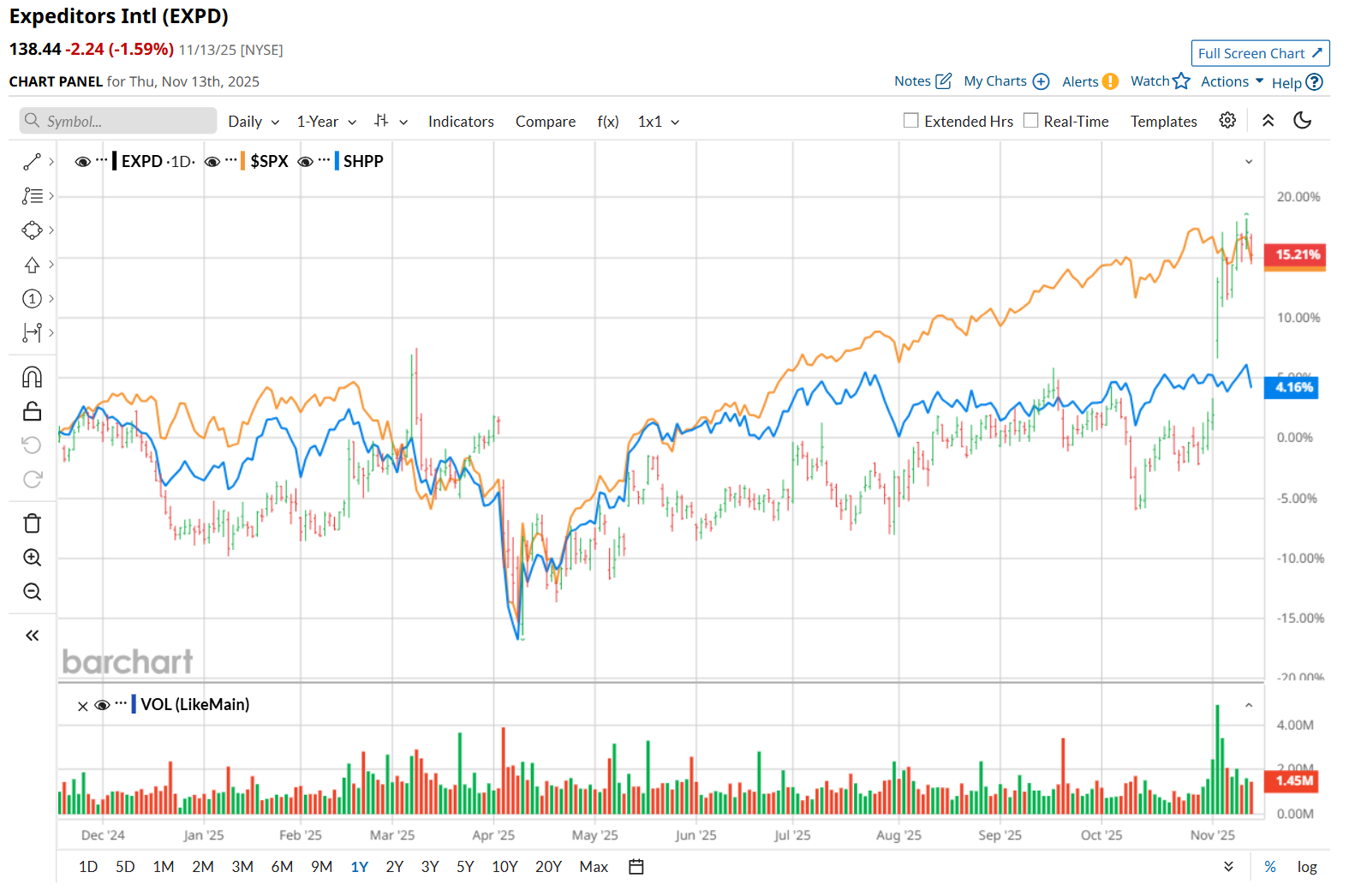

Shares of this freight and logistics company have outpaced the broader market over the past 52 weeks. EXPD has rallied 15.9% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.6%. Moreover, on a YTD basis, the stock is up 25%, compared to SPX’s 14.6% uptick.

Zooming in further, EXPD has also outperformed the Pacer Industrials and Logistics ETF (SHPP), which has gained 3.1% over the past 52 weeks and 7.8% on a YTD basis.

On Nov. 4, shares of EXPD surged 10.8% after its impressive Q3 earnings release. While the company’s revenue declined 3.5% year-over-year to $2.9 billion, it topped the consensus estimates by 7.8%. However, despite the fall in revenue, its EPS increased marginally from the year-ago quarter to $1.64 and came in 17.1% ahead of analyst estimates. During the quarter, airfreight tonnage grew on exports, particularly from North and South Asia, while ocean container volume decreased from the prior-year quarter.

For the current fiscal year, ending in December, analysts expect EXPD’s EPS to grow 2.3% year over year to $5.85. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

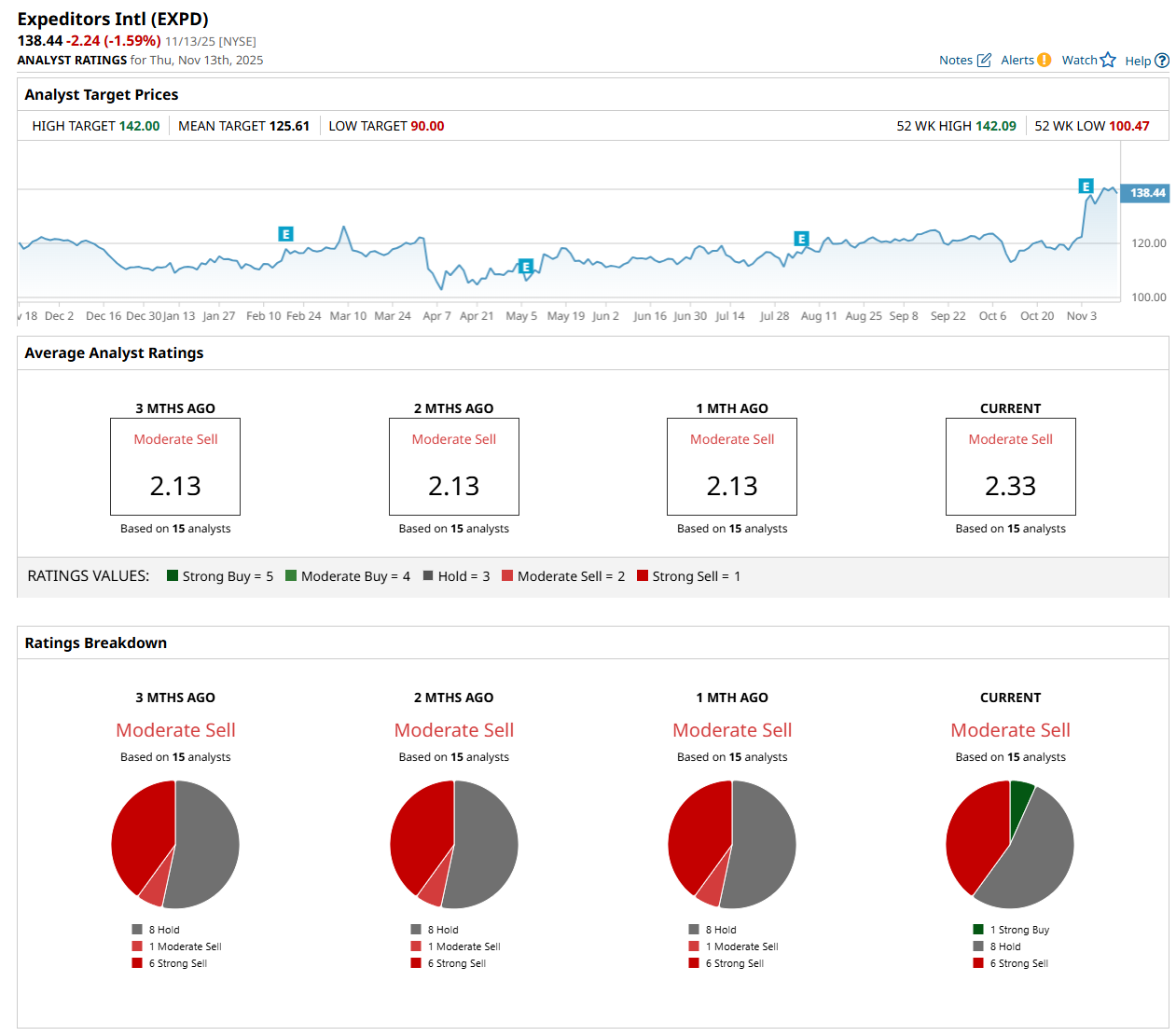

Among the 15 analysts covering the stock, the consensus rating is a "Moderate Sell,” which is based on one “Strong Buy,” eight "Hold,” and six "Strong Sell” ratings.

This configuration is slightly less bearish than a month ago, with no analyst suggesting a “Strong Buy” rating.

On Nov. 6, Stifel Financial Corp. (SF) maintained a "Hold" rating on EXPD and raised its price target to $130.

While the company is trading above its mean price target of $125.61, its Street-high price target of $142 suggests a 2.6% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Cisco Sets a New 20-Year High. Will CSCO Stock Climb Even Higher?

- Should You Buy the Post-Earnings Dip in Monday.com Stock?

- The ARKK ETF Is Leaking, and the Tech Stock Flood Could Reach Biblical Proportions. What Should You Do With Cathie Wood’s Fund Here?

- 1 Outperforming Growth Stock to Buy as the Government Shutdown Ends