With a market cap of $138.5 billion, CrowdStrike Holdings, Inc. (CRWD) is a leading provider of cloud-delivered cybersecurity solutions. Its Falcon platform offers comprehensive protection for endpoints, cloud workloads, identities, and data through a subscription-based SaaS model.

Shares of the Austin, Texas-based company have significantly outpaced the broader market over the past 52 weeks. CRWD stock has jumped 82.1% over this time frame, while the broader S&P 500 Index ($SPX) has gained 19.6%. Moreover, shares of the company have increased 61.3% on a YTD basis, compared to SPX's 16.5% rise.

Looking closer, shares of CrowdStrike Holdings have also outperformed the Technology Select Sector SPDR Fund's (XLK) return of 34.8% over the past 52 weeks.

Shares of CrowdStrike rose 4.6% following its Q2 2026 results on Aug. 27 as the company delivered record performance ahead of expectations, including record net new ARR of $221 million and 20% year-over-year ARR growth to $4.66 billion. Investors reacted positively to its 21% revenue growth to $1.17 billion and record free cash flow of $284 million. Additionally, management raised confidence in continued ARR acceleration and guided for Q3 adjusted EPS of $0.93 - $0.95.

For the fiscal year, ending in January 2026, analysts expect CRWD's EPS to drop 57.1% year-over-year to $0.21. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

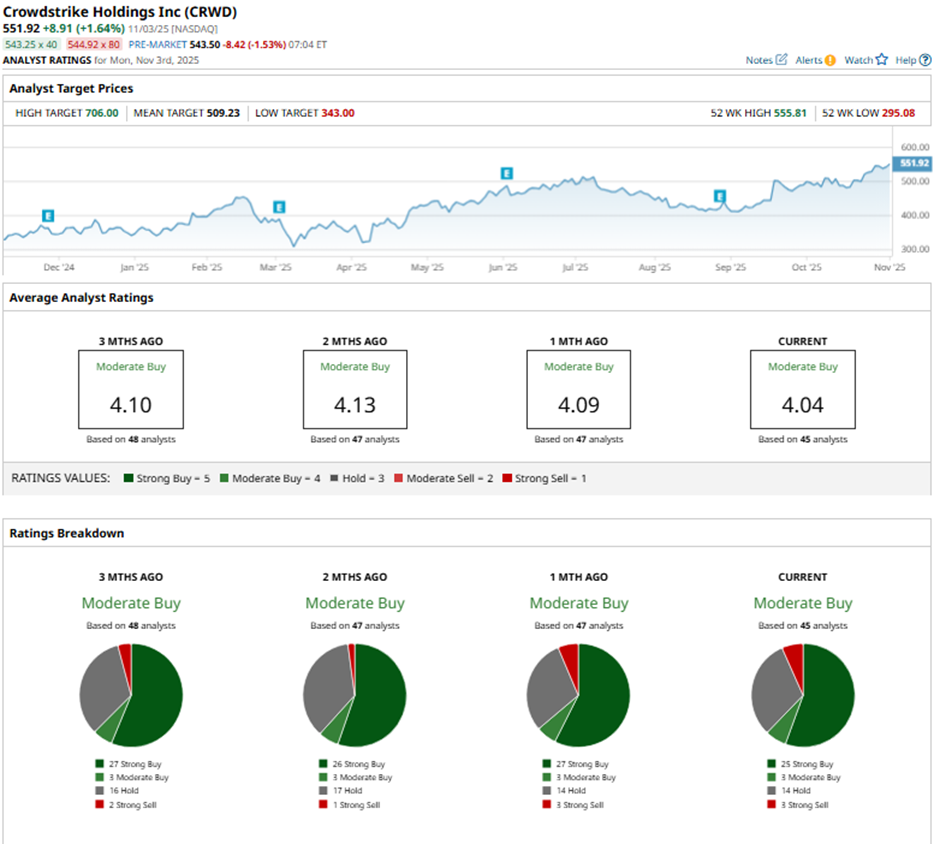

Among the 45 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 25 “Strong Buys,” three “Moderate Buy” ratings, 14 “Holds,” and three “Strong Sells.”

This configuration is less bullish than three months ago, with 27 “Strong Buy” ratings on the stock.

On Nov. 4, BTIG analyst Gray Powell reiterated a “Buy” rating on CrowdStrike Holdings and raised the price target to $640.

As of writing, the stock is trading above the mean price target of $509.23. The Street-high price target of $706 suggests a 27.9% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart