Valued at a market cap of $34 billion, Ingersoll Rand Inc. (IR) provides various mission-critical air, fluid, energy, and medical technologies services and solutions. The Davidson, North Carolina-based company is ready to announce its fiscal Q4 earnings for 2025 after the market closes on Thursday, Feb. 12.

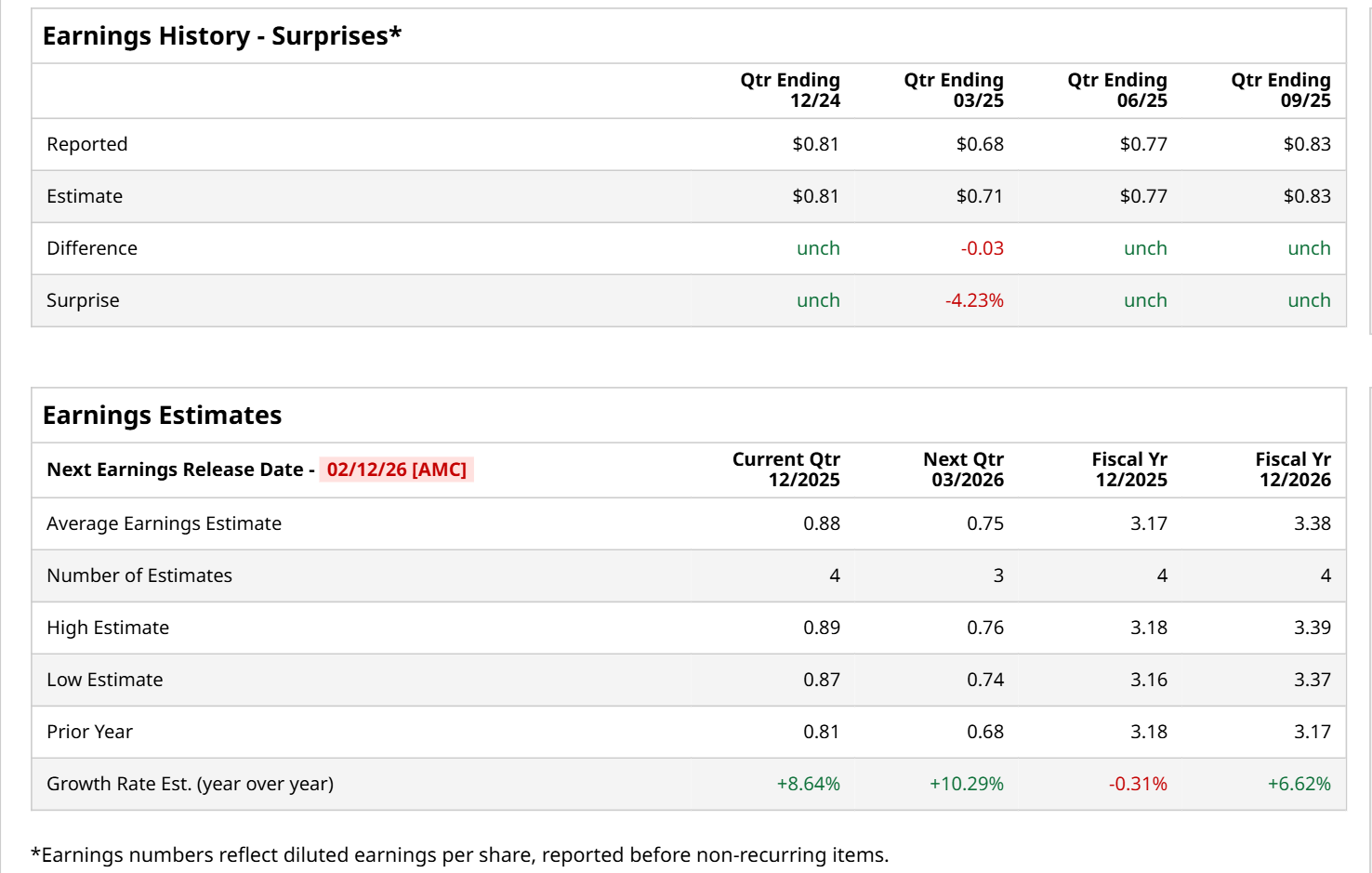

Before this event, analysts expect this industrial company to report a profit of $0.88 per share, up 8.6% from $0.81 per share in the year-ago quarter. The company has met Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. Its earnings of $0.83 per share in the previous quarter came in line with the consensus estimates.

For the current fiscal year, ending in December, analysts expect IR to report a profit of $3.17 per share, down marginally from $3.18 per share in fiscal 2024. Nonetheless, its EPS is expected to grow 6.6% year-over-year to $3.38 in fiscal 2026.

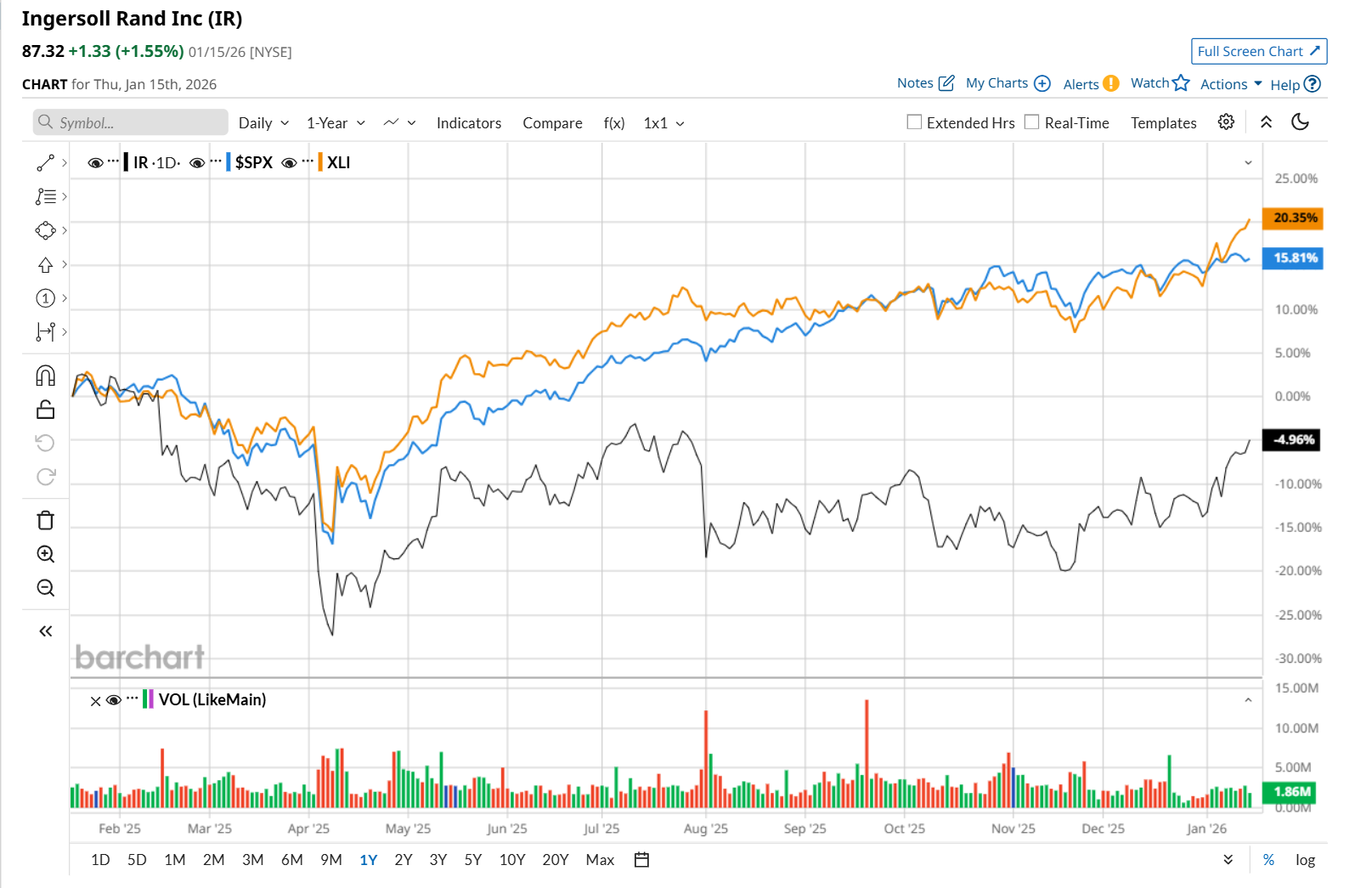

IR has declined 3.6% over the past 52 weeks, considerably lagging behind both the S&P 500 Index's ($SPX) 16.7% return and the State Street Industrial Select Sector SPDR ETF’s (XLI) 22.5% uptick over the same time period.

On Jan. 5, IR shares rose 3.1% following the acquisition of Scinomix, Inc., which strengthened the company’s life sciences portfolio. The deal is expected to enhance IR’s ability to offer more end-to-end solutions by leveraging technologies that improve workflow efficiency through higher levels of automation and accuracy for customers.

Wall Street analysts are moderately optimistic about IR’s stock, with a "Moderate Buy" rating overall. Among 16 analysts covering the stock, eight recommend "Strong Buy," and eight suggest "Hold.” The mean price target for IR is $89.64, indicating a 2.7% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is Intel Stock a Buy at New 52-Week Highs?

- How to Dial In on the Best Option Strategy and Strike for Your Trading Goals

- Why Unity Software (U) Stock Could Be Due for a Big Earnings Surprise

- NAND Demand Stays Strong as Chip Sales Slump. Is Sandisk or Western Digital Stock a Better Buy in January 2026?