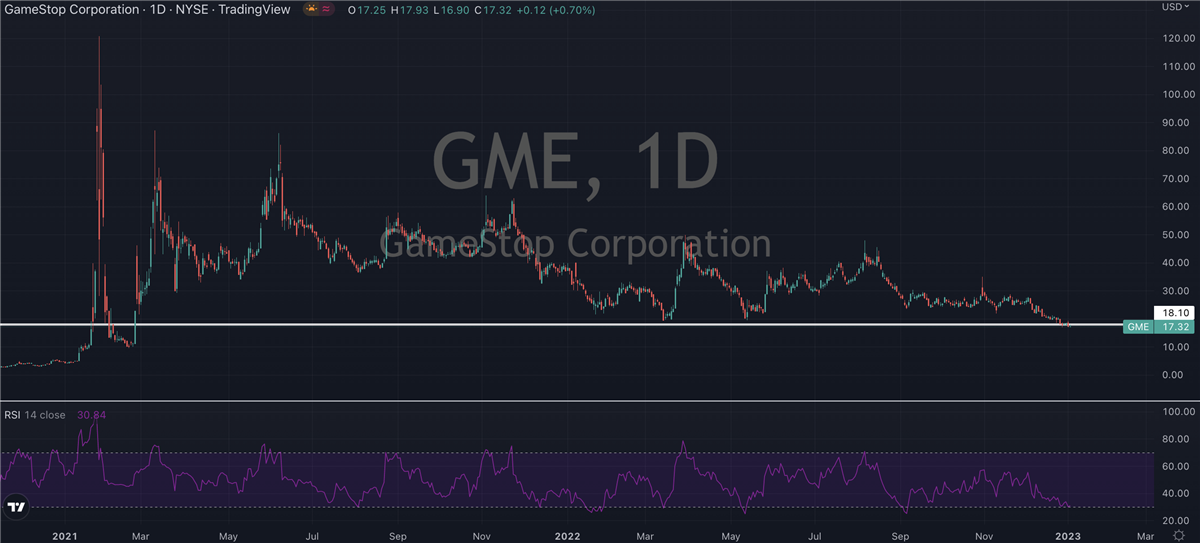

After keeping investors on their toes with multiple swings up and down in the past two years, GameStop (NYSE: GME) shares look ready to go again. This time the compass is pointing north, and will be a welcome change of momentum for any bulls out there. They’ve had to sit back and watch shares drop 50% lower over the past month alone, but after last night’s news, we might be looking at a trend reversal into the fall.

After keeping investors on their toes with multiple swings up and down in the past two years, GameStop (NYSE: GME) shares look ready to go again. This time the compass is pointing north, and will be a welcome change of momentum for any bulls out there. They’ve had to sit back and watch shares drop 50% lower over the past month alone, but after last night’s news, we might be looking at a trend reversal into the fall.The Texas-headquartered video game store, almost as well known for its historic short squeeze in January 2021, reported Q2 earnings after yesterday’s session. At first glance, it was a bit of a “meh” report, with earnings slightly better than expected and revenue slightly worse. There were more positive signs from metrics like sales attributable to collectibles, which is a segment GameStop intends to grow over the long-term. This were $223.2 million for the quarter, compared to $177.2 million in the same quarter last year. Additionally, management's efforts to remain well stocked to meet periodic surges in demand are also bearing fruit, with inventory at $734.8 million at the close of the quarter, compared to $596.4 million this time last year.

The operating loss for the quarter though was $108 million, which was almost double that from last year. There was no debt reported on the balance sheet other than a low-interest, unsecured term loan associated with the French government’s response to COVID-19.

Bullish Action

So what was the response? Well, GameStop shares jumped more than 10% in the after-hours session as Wall Street digested the report, but it wasn’t because of any of these run of the mill numbers. It was the company's announcement that it has entered into a partnership with FTX that seemed to have sparked immediate demand for shares, and they were holding onto these gains in Thursday’s pre-market session. Indeed it looks like the bounce will eclipse both candles of the past two days at the open which is regarded as a strong technical buying signal.

For context, FTX is a cryptocurrency exchange, based out of the Bahamas, and the partnership is intended to introduce more GameStop customers to FTX’s community and its marketplaces for digital assets. In addition to collaborating with FTX on new ecommerce and online marketing initiatives, it was reported that GameStop will begin carrying FTX gift cards in certain stores.

The surprising news helped prevent any would-be damage from a report that otherwise basically confirmed the company’s sales are still falling while its cash pile is also shrinking. Having launched their own NFT earlier in the summer, it’s perhaps not all that much of a shock that GameStop has waded further into cryptocurrency waters as they look to start generating additional revenue streams. It might just be the start of the most interesting pivot we see this year.

Getting Involved

It has to be said that at the very least the new leadership is working hard to continue its evolution from a traditional brick-and-mortar retailer to a more digital and ecommerce based one. New board chair Ryan Cohen, the founder of Chewy and former activist investor for Bed Bath & Beyond (NASDAQ: BBBY), as well as CEO Matt Furlong, an Amazon (NASDAQ: AMZN) veteran seem to be steadying the ship after the volatility of last year, but they’ve struggled to turn a consistent profit. This has caused many on Wall Street to throw in the towel in frustration, leaving GameStop shares in the purview of Reddit loving retail traders.

But CEO Furlong urged patience on the investor call last night, saying GameStop must go through a significant transformation to keep up with customers. He told investors “our path to becoming a more diversified and tech-centric business is one that obviously carries risk and will take time. This said, we believe GameStop is a much stronger business than it was 18 months ago.”

If you’re comfortable buying into the transformation story, this could well be one of those rare entry points that people look back on in years to come while shaking their heads. NYSE: GME) Just Flashed A Buy Signal " width="1200" height="500">

NYSE: GME) Just Flashed A Buy Signal " width="1200" height="500">