Hotel franchising company Wyndham (NYSE: WH) missed Wall Street’s revenue expectations in Q4 CY2024, but sales rose 6.2% year on year to $341 million. Its non-GAAP profit of $1.04 per share was 5% above analysts’ consensus estimates.

Is now the time to buy Wyndham? Find out by accessing our full research report, it’s free.

Wyndham (WH) Q4 CY2024 Highlights:

- Revenue: $341 million vs analyst estimates of $348 million (6.2% year-on-year growth, 2% miss)

- Adjusted EPS: $1.04 vs analyst estimates of $0.99 (5% beat)

- Adjusted EBITDA: $168 million vs analyst estimates of $167 million (49.3% margin, 0.6% beat)

- Adjusted EPS guidance for the upcoming financial year 2025 is $4.72 at the midpoint, missing analyst estimates by 1.3%

- EBITDA guidance for the upcoming financial year 2025 is $750 million at the midpoint, above analyst estimates of $739.8 million

- Operating Margin: 38.1%, up from 32.4% in the same quarter last year

- Free Cash Flow Margin: 32%, down from 35.5% in the same quarter last year

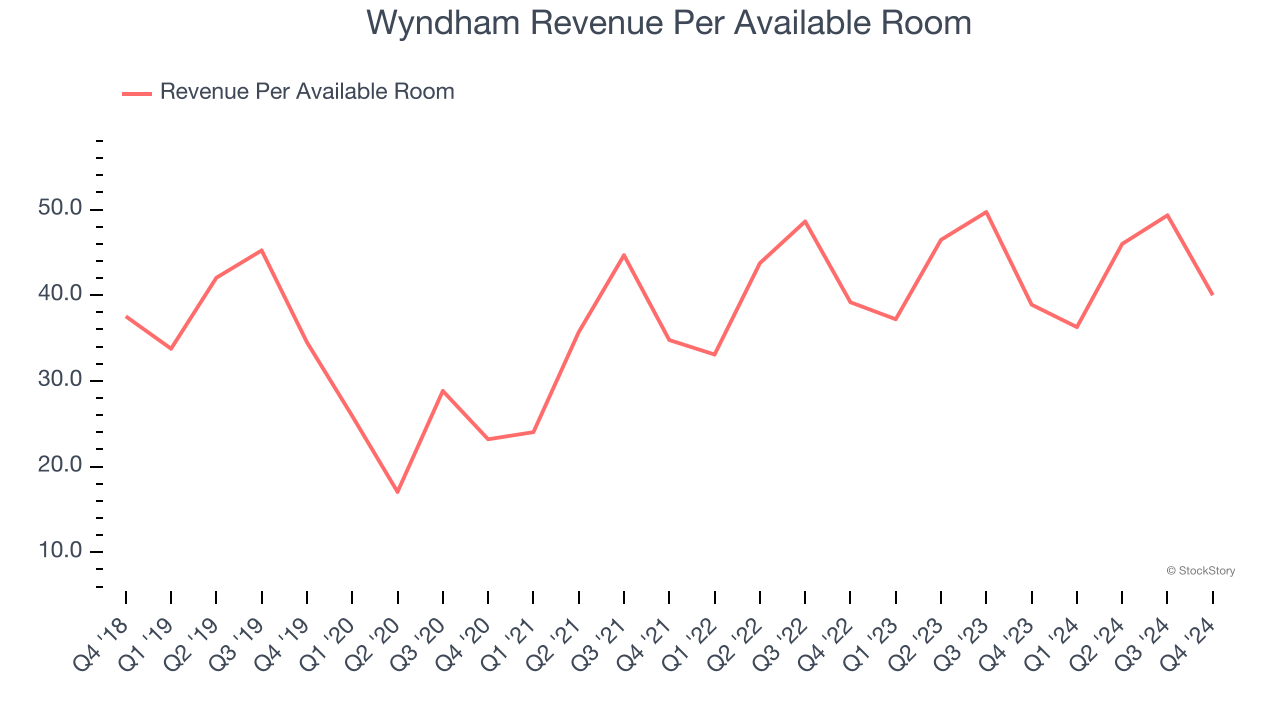

- RevPAR: $40.01 at quarter end, up 2.9% year on year

- Market Capitalization: $8.36 billion

Company Overview

Established in 1981, Wyndham (NYSE: WH) is a global hotel franchising company with over 9,000 hotels across nearly 95 countries on six continents.

Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Sales Growth

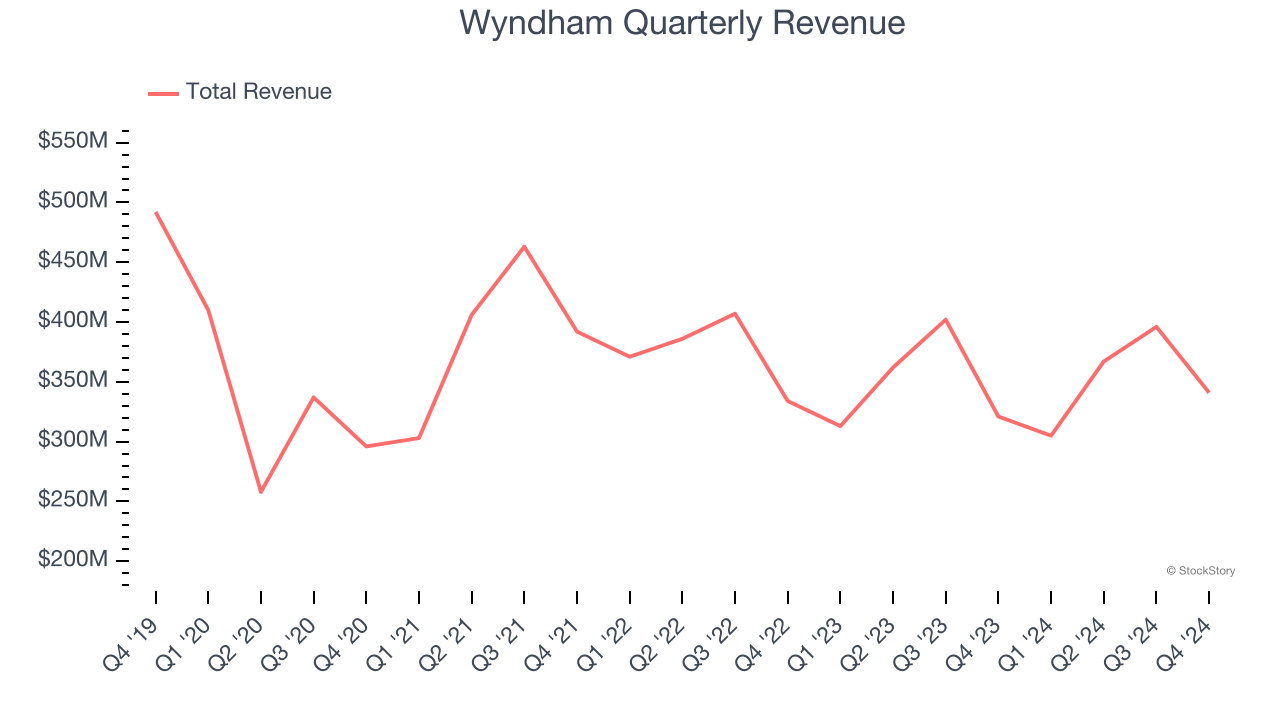

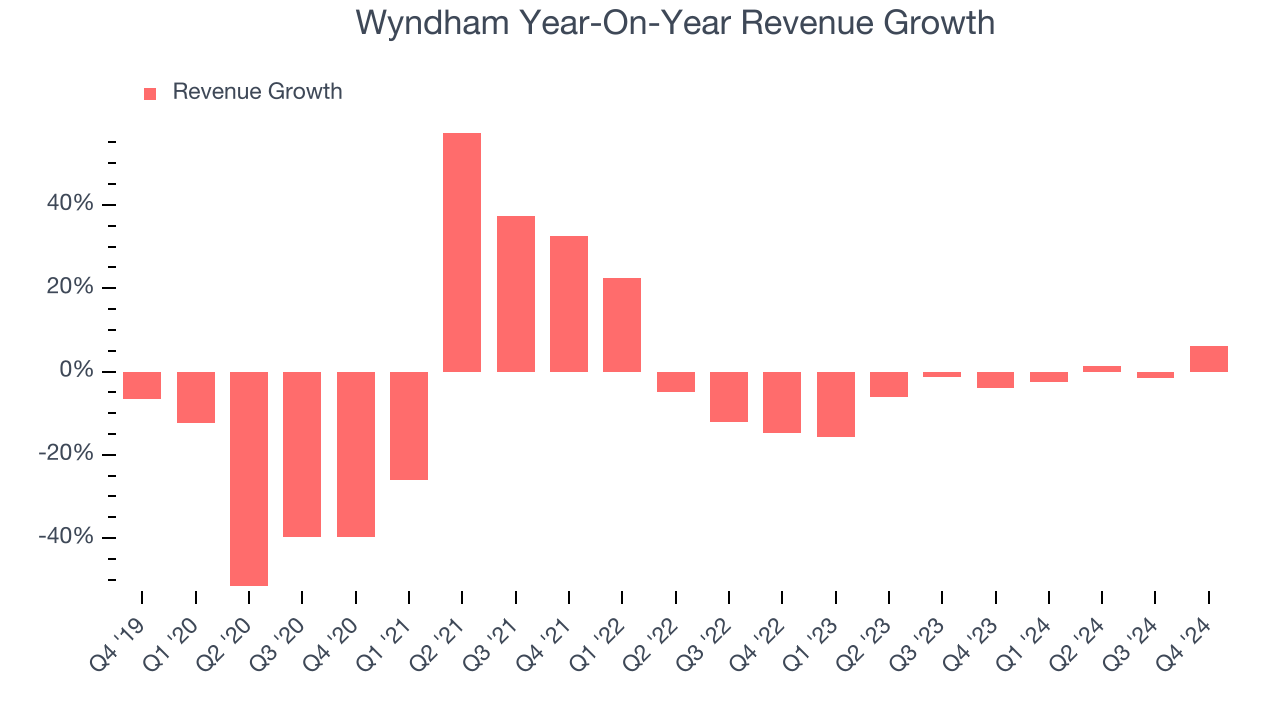

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Wyndham’s demand was weak and its revenue declined by 7.3% per year. This was below our standards and signals it’s a lower quality business.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Wyndham’s annualized revenue declines of 3% over the last two years suggest its demand continued shrinking.

We can better understand the company’s revenue dynamics by analyzing its revenue per available room, which clocked in at $40.01 this quarter and is a key metric accounting for daily rates and occupancy levels. Over the last two years, Wyndham’s revenue per room averaged 2.4% year-on-year growth. Because this number is better than its revenue growth, we can see its room bookings outperformed its sales from other areas like restaurants, bars, and amenities.

This quarter, Wyndham’s revenue grew by 6.2% year on year to $341 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.5% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

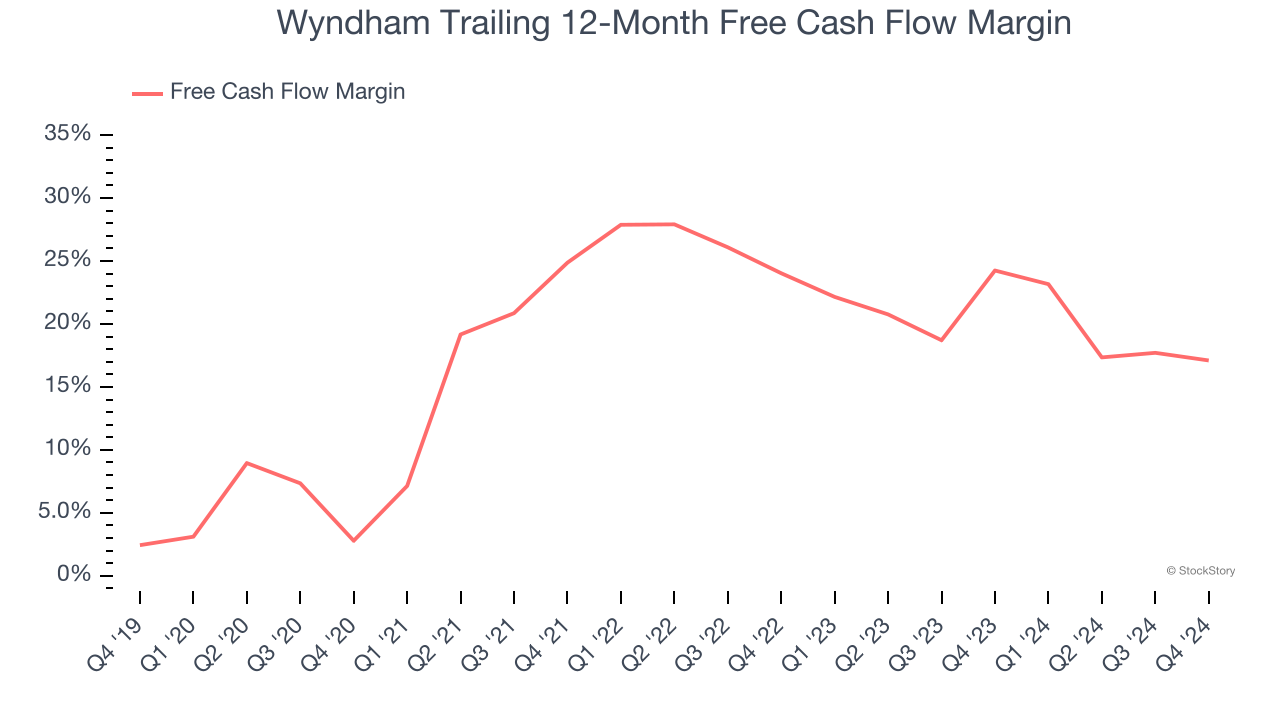

Wyndham has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 20.7% over the last two years, quite impressive for a consumer discretionary business.

Wyndham’s free cash flow clocked in at $109 million in Q4, equivalent to a 32% margin. The company’s cash profitability regressed as it was 3.5 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

Key Takeaways from Wyndham’s Q4 Results

It was encouraging to see Wyndham beat analysts’ EPS expectations this quarter. We were also glad its full-year EBITDA guidance came in slightly higher than Wall Street’s estimates. On the other hand, its revenue missed. Overall, this quarter could have been better. The stock remained flat at $109.10 immediately following the results.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.