Technology and consulting giant IBM (NYSE: IBM) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, but sales were flat year on year at $14.54 billion. Guidance for next quarter’s revenue was better than expected at $16.56 billion at the midpoint, 1.9% above analysts’ estimates. Its non-GAAP profit of $1.60 per share was 12% above analysts’ consensus estimates.

Is now the time to buy IBM? Find out by accessing our full research report, it’s free.

IBM (IBM) Q1 CY2025 Highlights:

- Revenue: $14.54 billion vs analyst estimates of $14.39 billion (flat year on year, 1% beat)

- Adjusted EPS: $1.60 vs analyst estimates of $1.43 (12% beat)

- Adjusted EBITDA: $3.4 billion vs analyst estimates of $2.81 billion (23.4% margin, 20.8% beat)

- Revenue Guidance for Q2 CY2025 is $16.56 billion at the midpoint, above analyst estimates of $16.25 billion

- Operating Margin: 7.2%, in line with the same quarter last year

- Free Cash Flow Margin: 11.9%, down from 13.2% in the same quarter last year

- Market Capitalization: $223.4 billion

"We exceeded expectations for revenue, profitability and free cash flow in the quarter, led by strength across our Software portfolio. There continues to be strong demand for generative AI and our book of business stands at more than $6 billion inception-to-date, up more than $1 billion in the quarter," said Arvind Krishna, IBM Chairman, President and CEO.

Company Overview

With a corporate history spanning over a century and once known for its iconic mainframe computers, IBM (NYSE: IBM) provides hybrid cloud computing platforms, AI solutions, consulting services, and enterprise infrastructure to help businesses modernize their operations.

IT Services & Consulting

IT Services & Consulting companies stand to benefit from increasing enterprise demand for digital transformation, AI-driven automation, and cybersecurity resilience. Many enterprises can't attack these topics alone and need IT services and consulting on everything from technical advice to implementation. Challenges in meeting these needs will include finding talent in specialized and evolving IT fields. While AI and automation can enhance productivity, they also threaten to commoditize certain consulting functions. Another ongoing challenge will be pricing pressures from offshore IT service providers, which have lower labor costs and increasingly equal access to advanced technology like AI.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $62.83 billion in revenue over the past 12 months, IBM is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. For IBM to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

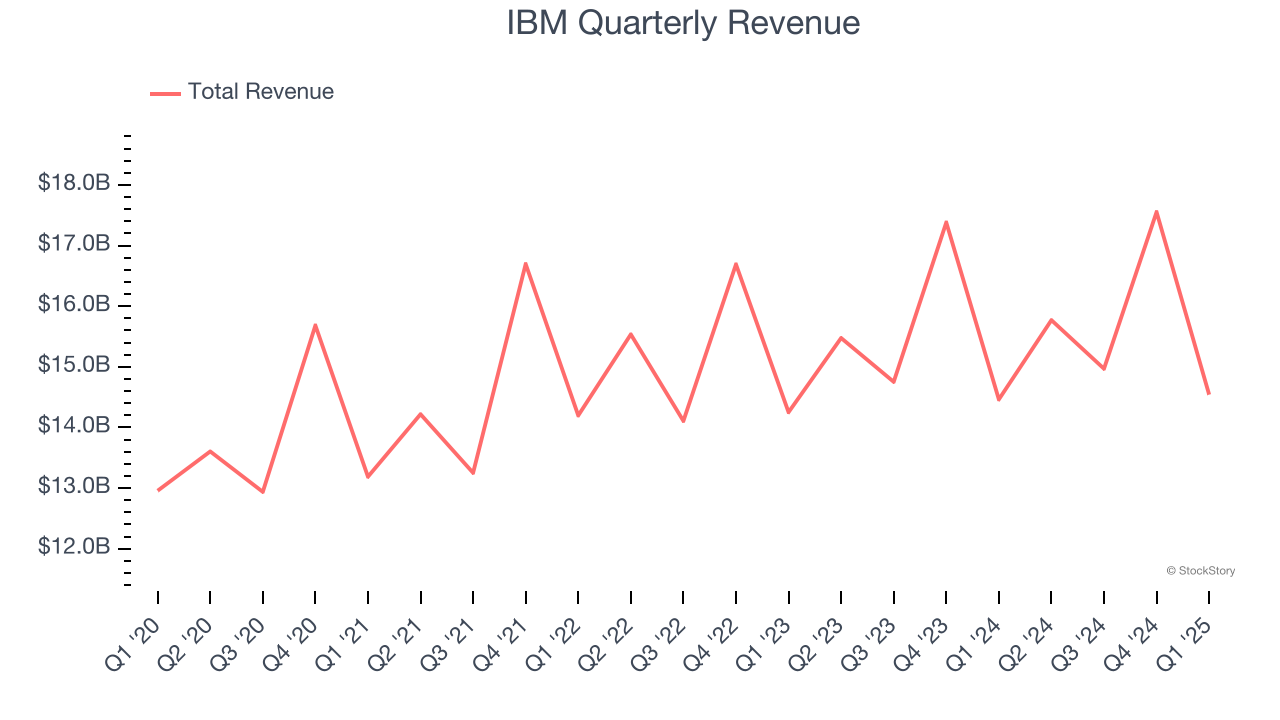

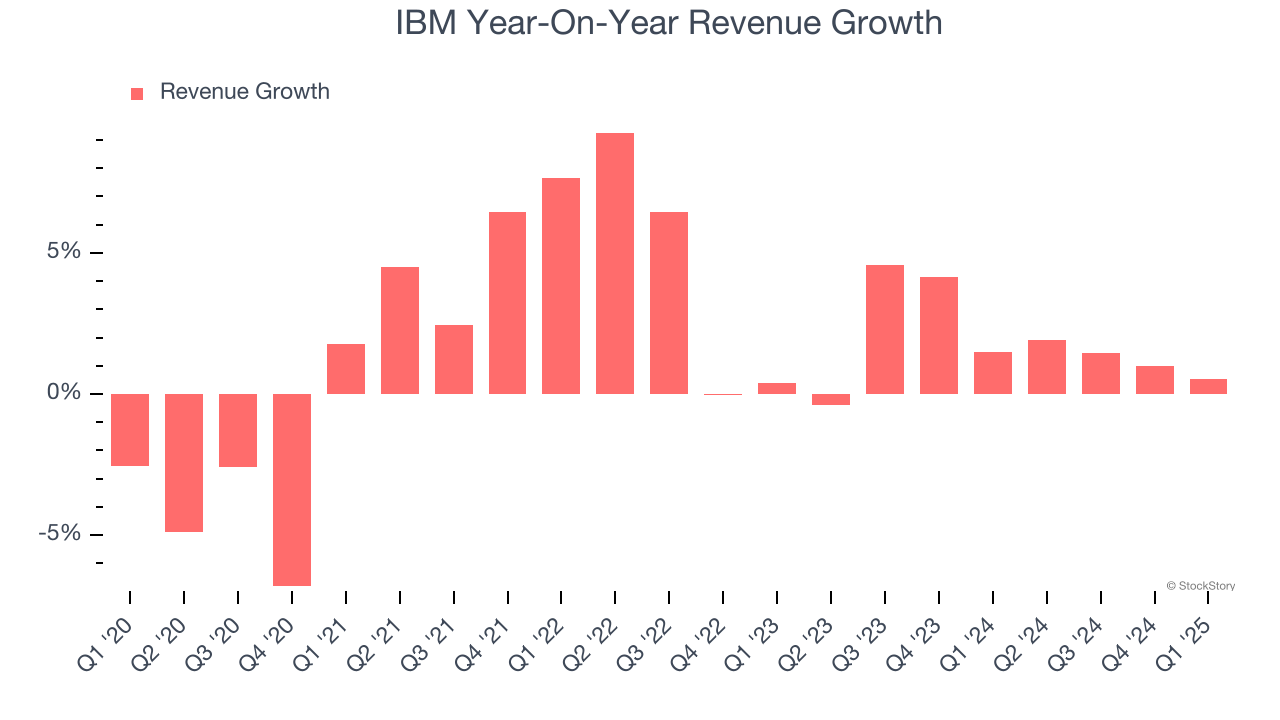

As you can see below, IBM grew its sales at a sluggish 1.8% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. IBM’s annualized revenue growth of 1.8% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

IBM also breaks out the revenue for its most important segment, Software. Over the last two years, IBM’s Software revenue averaged 7.6% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, IBM’s $14.54 billion of revenue was flat year on year but beat Wall Street’s estimates by 1%. Company management is currently guiding for a 5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and suggests its newer products and services will fuel better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

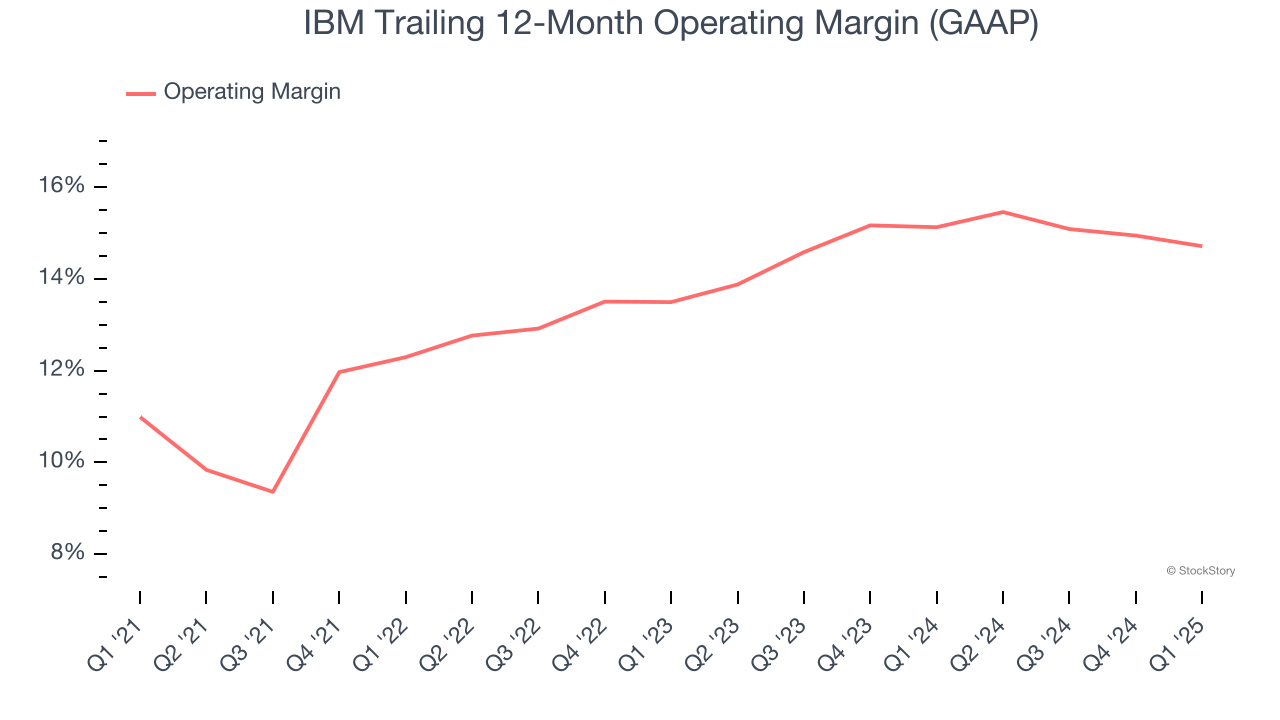

IBM has managed its cost base well over the last five years. It demonstrated solid profitability for a business services business, producing an average operating margin of 13.4%.

Analyzing the trend in its profitability, IBM’s operating margin rose by 3.7 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q1, IBM generated an operating profit margin of 7.2%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

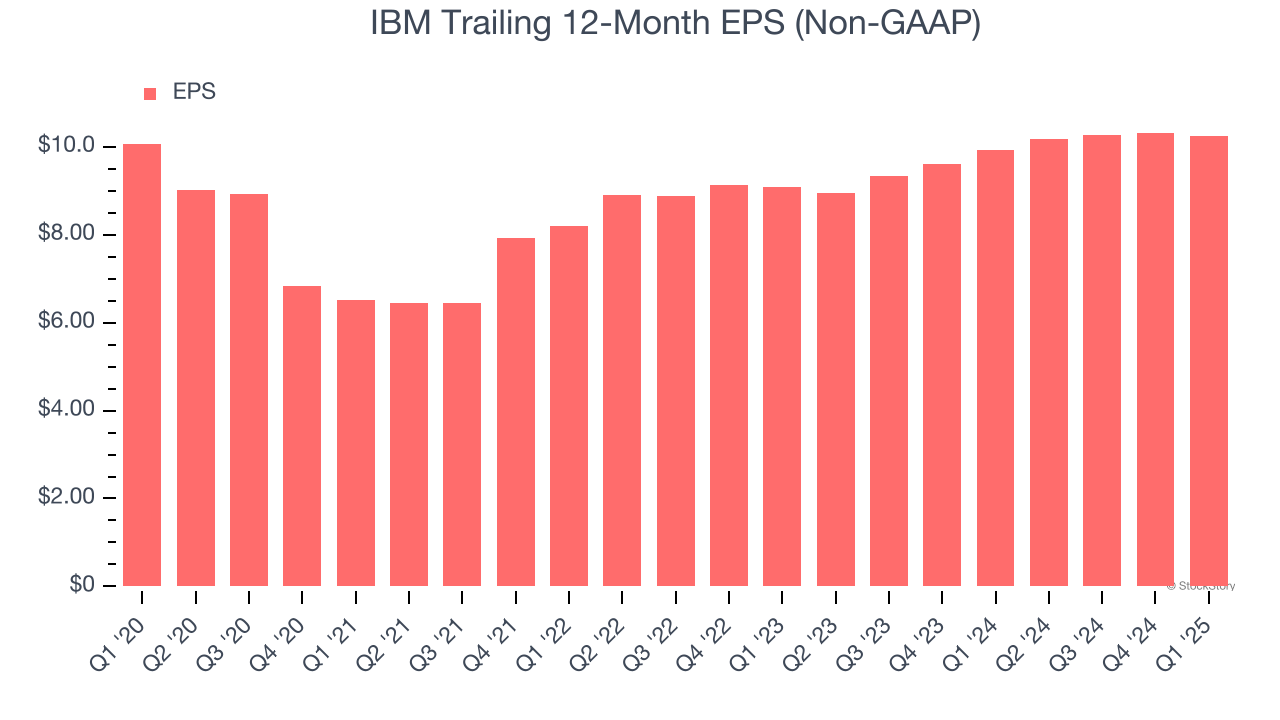

IBM’s flat EPS over the last five years was below its 1.8% annualized revenue growth. However, its operating margin actually expanded during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

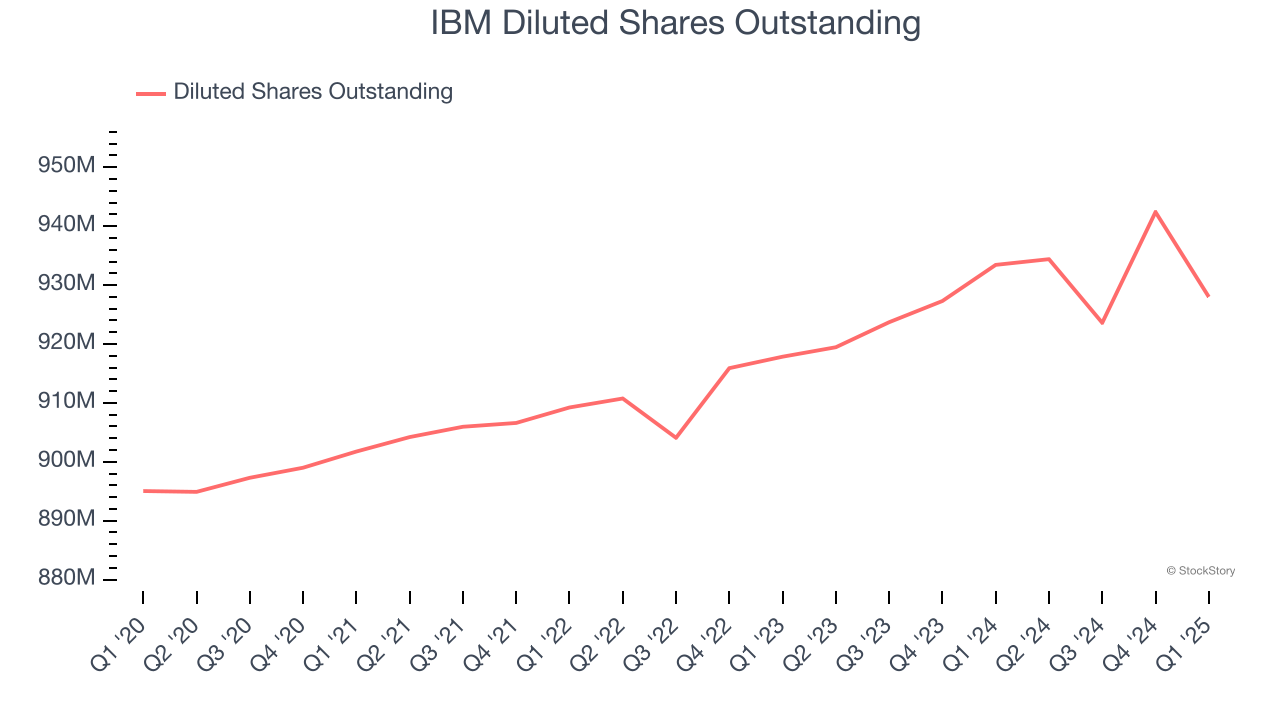

Diving into the nuances of IBM’s earnings can give us a better understanding of its performance. A five-year view shows IBM has diluted its shareholders, growing its share count by 3.7%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, IBM reported EPS at $1.60, down from $1.68 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects IBM’s full-year EPS of $10.25 to grow 6.5%.

Key Takeaways from IBM’s Q1 Results

We enjoyed seeing IBM beat analysts’ revenue, adjusted EPS, and EBITDA expectations this quarter. We were also glad its revenue guidance for next quarter exceeded Wall Street’s estimates. On the other hand, its operating income missed significantly. Overall, we think this was a decent quarter with some key metrics above expectations. The areas below expectations seem to be driving the move, and shares traded down 5% to $233 immediately after reporting.

Is IBM an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.