First Merchants currently trades at $38.65 per share and has shown little upside over the past six months, posting a small loss of 3.4%. The stock also fell short of the S&P 500’s 4.5% gain during that period.

Is there a buying opportunity in First Merchants, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is First Merchants Not Exciting?

We're cautious about First Merchants. Here are three reasons why you should be careful with FRME and a stock we'd rather own.

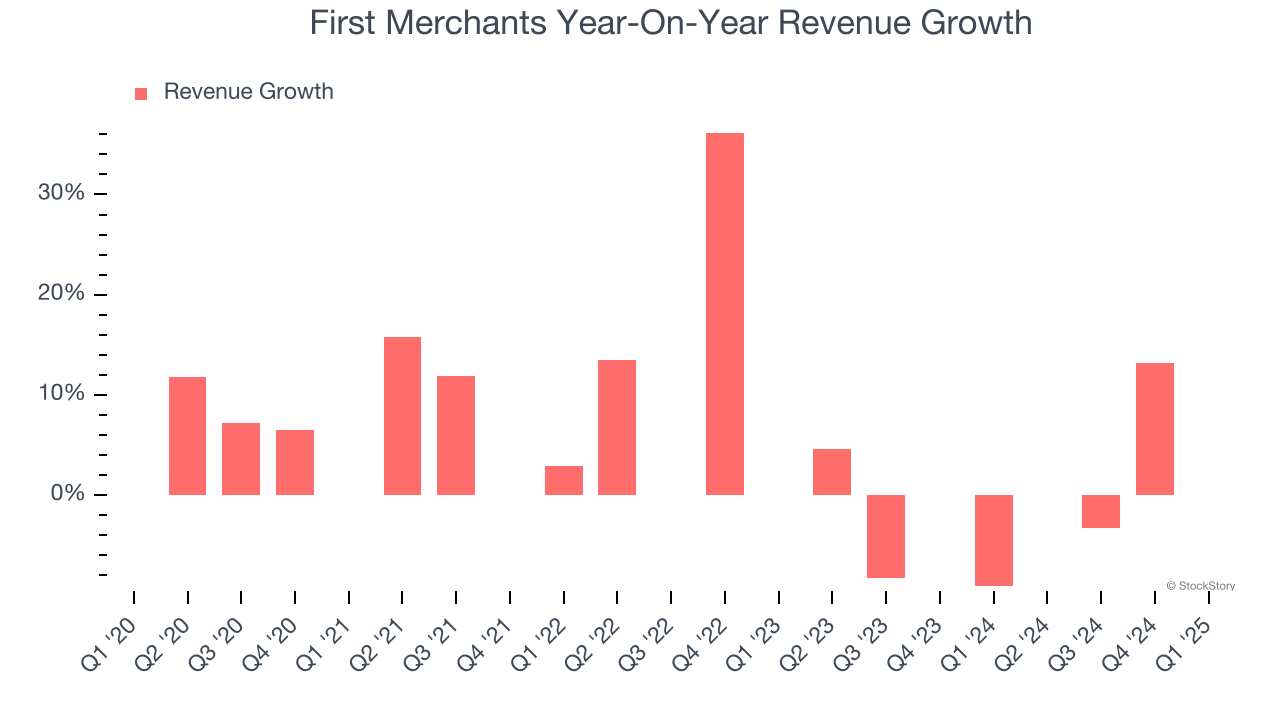

1. Revenue Tumbling Downwards

Long-term growth is the most important, but within financials, a stretched historical view may miss recent interest rate changes and market returns. First Merchants’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 1.2% over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

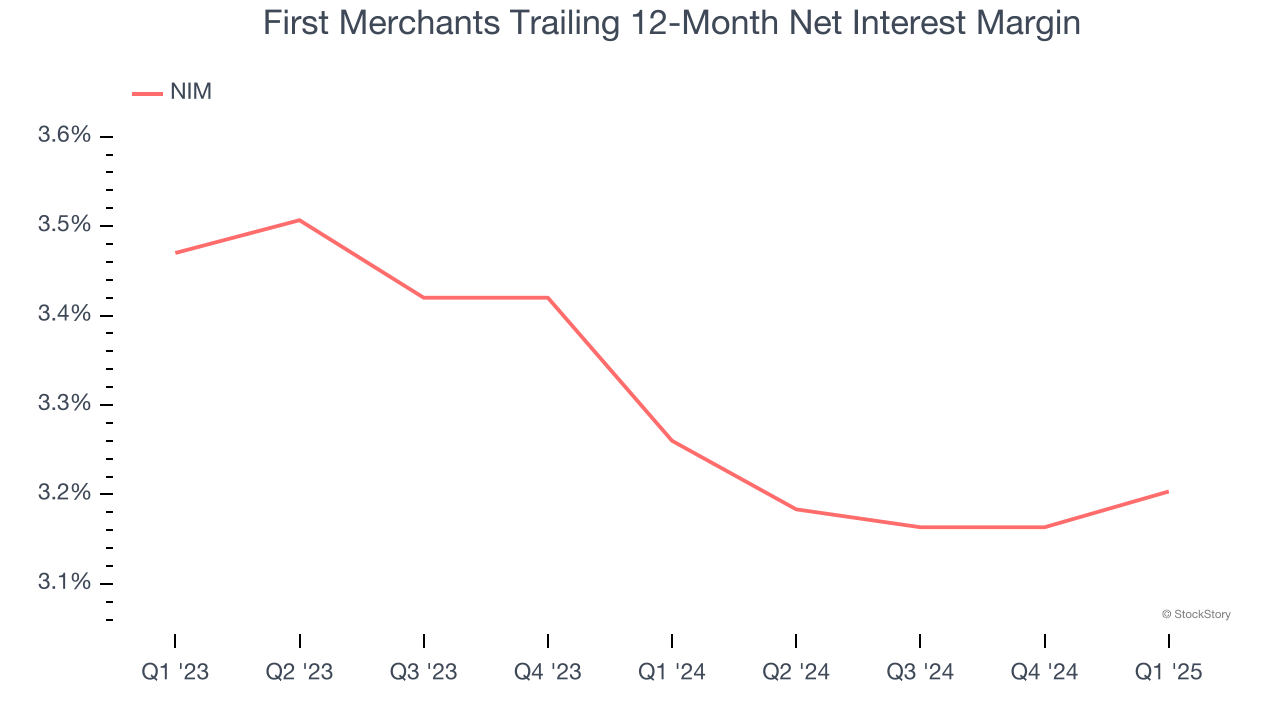

2. Net Interest Margin Dropping

Revenue is a fine reference point for banks, but net interest income and margin are better indicators of business quality for banks because they’re balance sheet-driven businesses that leverage their assets to generate profits.

Over the past two years, First Merchants’s net interest margin averaged 3.2%. Its margin also contracted by 26.7 basis points (100 basis points = 1 percentage point) over that period.

This decline was a headwind for its net interest income. While prevailing rates are a major determinant of net interest margin changes over time, the decline could mean First Merchants either faced competition for loans and deposits or experienced a negative mix shift in its balance sheet composition.

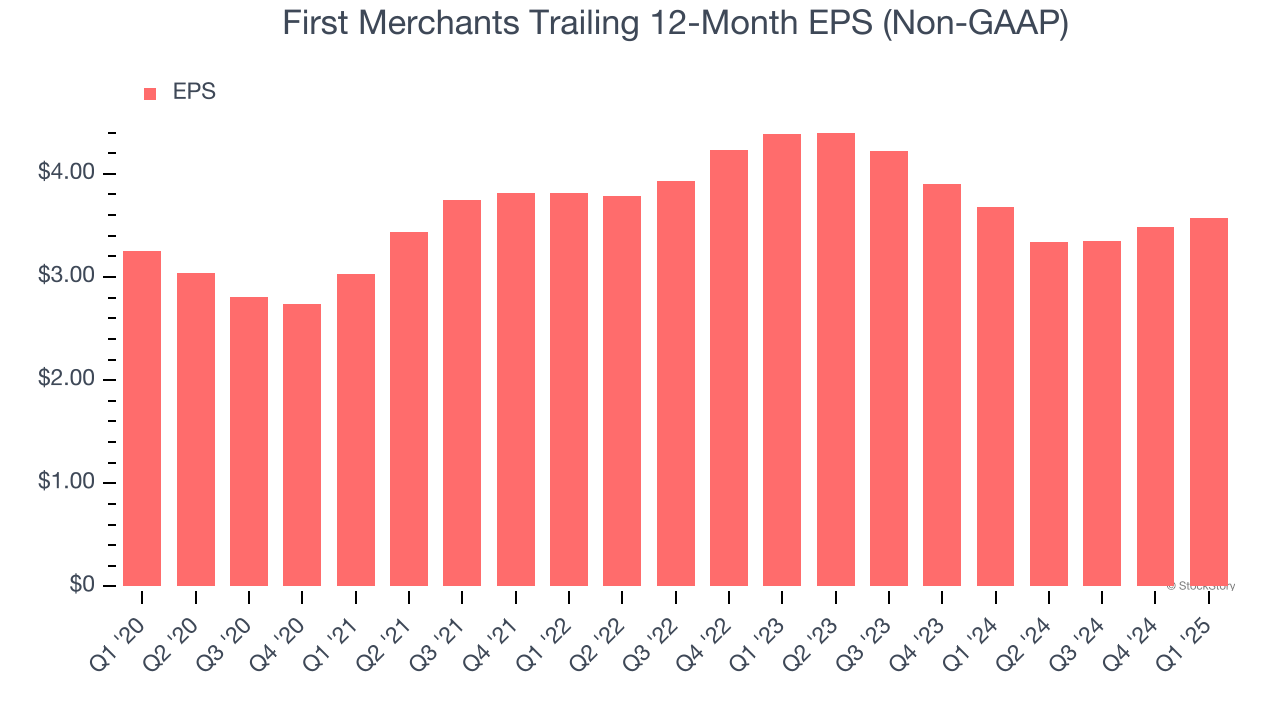

3. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

First Merchants’s EPS grew at an unimpressive 1.9% compounded annual growth rate over the last five years, lower than its 7.3% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

First Merchants’s business quality ultimately falls short of our standards. With its shares lagging the market recently, the stock trades at 0.9× forward P/B (or $38.65 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. We’d recommend looking at the most entrenched endpoint security platform on the market.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.