Over the last six months, Renasant’s shares have sunk to $35.22, producing a disappointing 5.3% loss - a stark contrast to the S&P 500’s 11.2% gain. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Renasant, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Is Renasant Not Exciting?

Even though the stock has become cheaper, we're sitting this one out for now. Here are three reasons why RNST doesn't excite us and a stock we'd rather own.

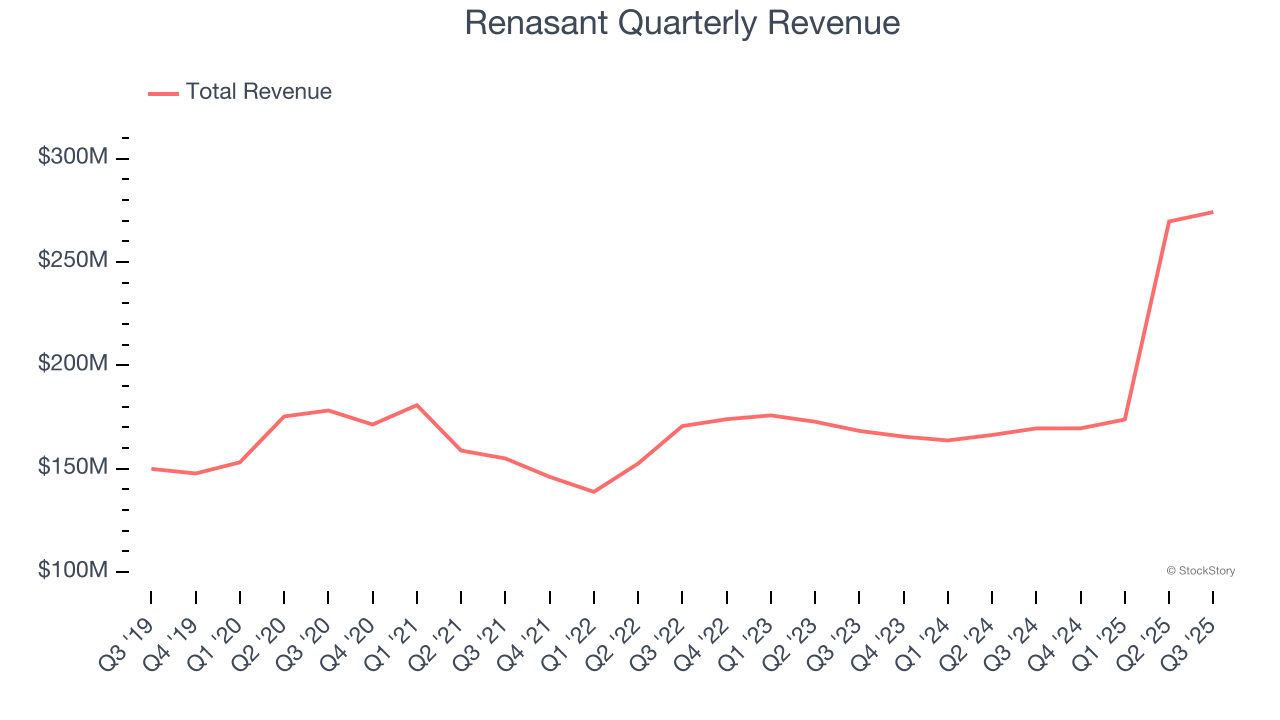

1. Long-Term Revenue Growth Disappoints

From lending activities to service fees, most banks build their revenue model around two income sources. Interest rate spreads between loans and deposits create the first stream, with the second coming from charges on everything from basic bank accounts to complex investment banking transactions.

Over the last five years, Renasant grew its revenue at a tepid 6.3% compounded annual growth rate. This fell short of our benchmark for the banking sector.

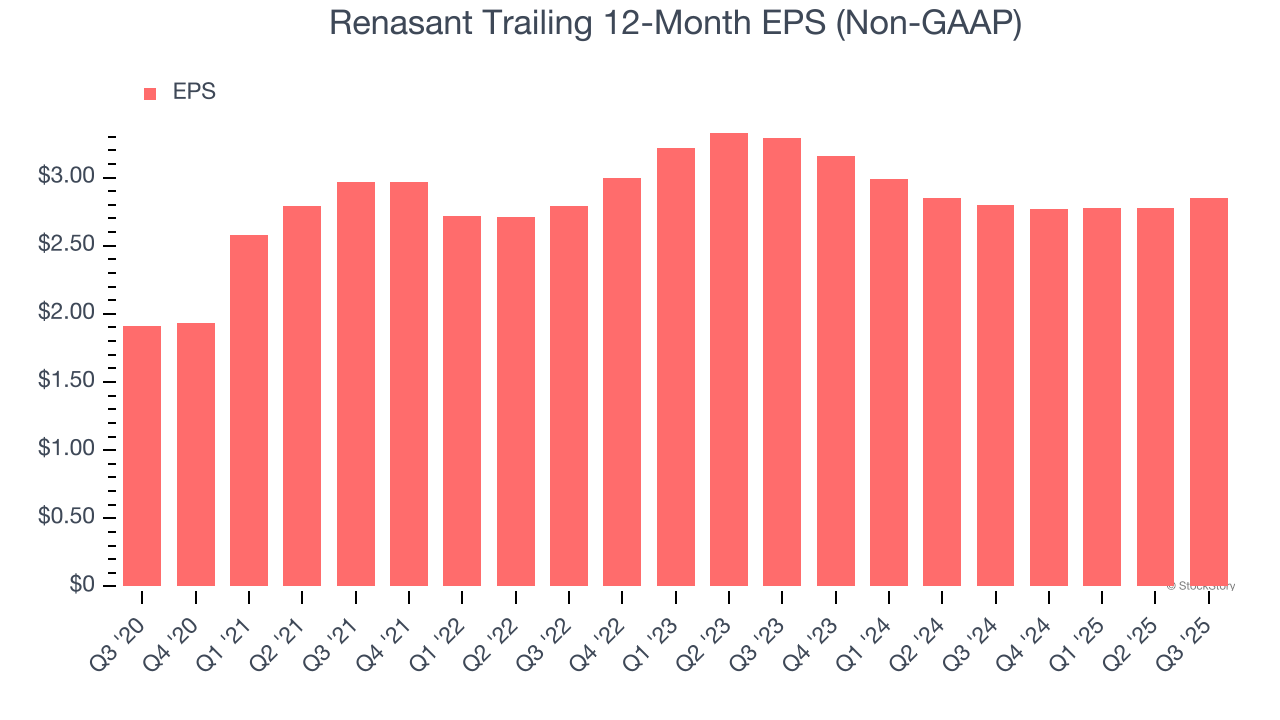

2. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Renasant’s EPS grew at an unimpressive 8.3% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 6.3% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

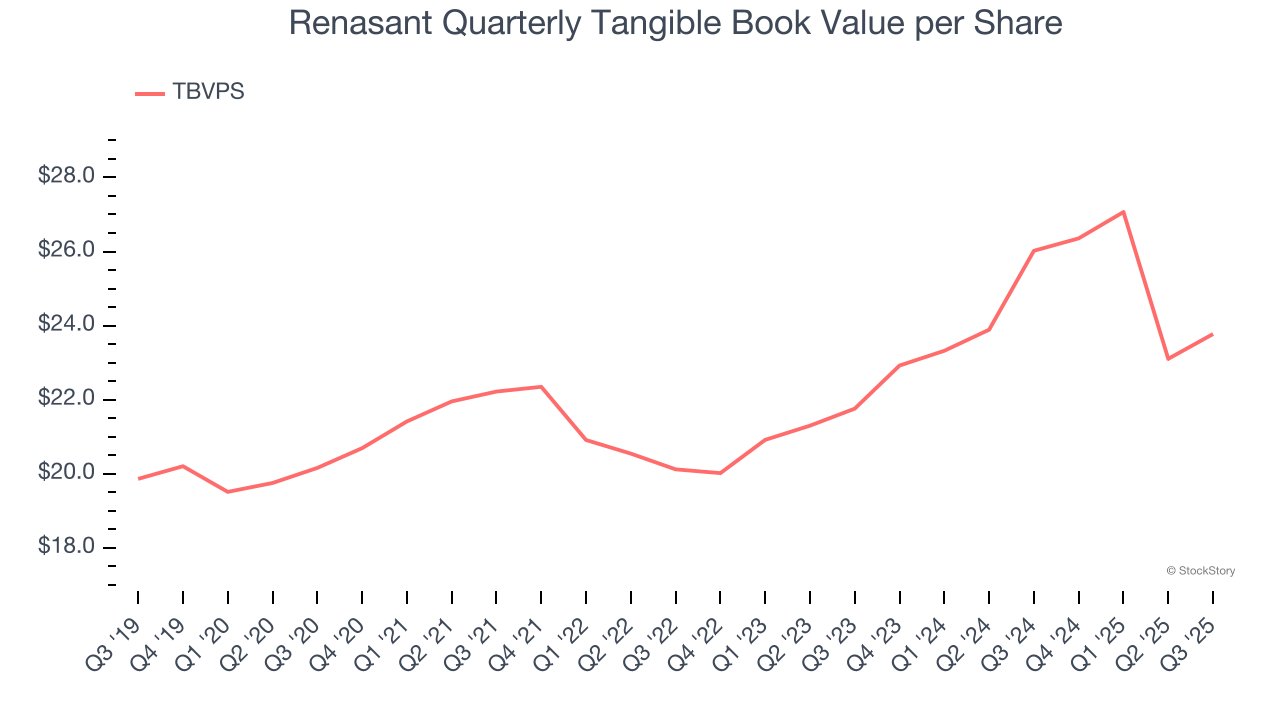

3. Substandard TBVPS Growth Indicates Limited Asset Expansion

We consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation.

Disappointingly for investors, Renasant’s TBVPS grew at a sluggish 4.5% annual clip over the last two years.

Final Judgment

Renasant isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 0.9× forward P/B (or $35.22 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now. We’d recommend looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Would Buy Instead of Renasant

Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.