Genuine Parts Company (GPC) is a leading consumer discretionary enterprise within the auto parts industry, headquartered in Atlanta, Georgia. Its market cap stands at $17.4 billion, reflecting its enduring position as a major player in both automotive and industrial replacement parts distribution.

GPC operates two core segments, Automotive Parts Group and Industrial Parts Group, offering extensive product and service lines across vehicles, industrial machinery, and equipment sectors, while boasting a global footprint.

GPC stock returned 7.4% on a year-to-date (YTD) basis, underperforming the broader S&P 500 Index’s ($SPX) gain of 12.9%. Also, over the past 52 weeks, the stock has trailed behind, gaining 3.4%, in contrast to the SPX’s gain of 12.3%.

Relative to its sector, GPC stock outperformed on a YTD basis with the Consumer Discretionary Select Sector SPDR Fund’s (XLY) marginal returns. However, XLY has gained 4.2% over the past year, surging past GPC stock.

GPC stock has delivered a muted performance in 2025, largely because the company is grappling with weak discretionary demand and rising costs. Although Genuine Parts Company is investing in restructuring, digital tools, and global expansion, these strategic moves have yet to translate into strong near-term earnings, keeping the stock under pressure.

For the current fiscal year, ending in December 2025, analysts expect GPC to report an EPS decline of 6.6% YoY to $7.62, on a diluted basis. The company has a history of surpassing consensus EPS estimates. It has topped the Street’s bottom-line estimates in three out of the past four quarters, while missing on one other occasion.

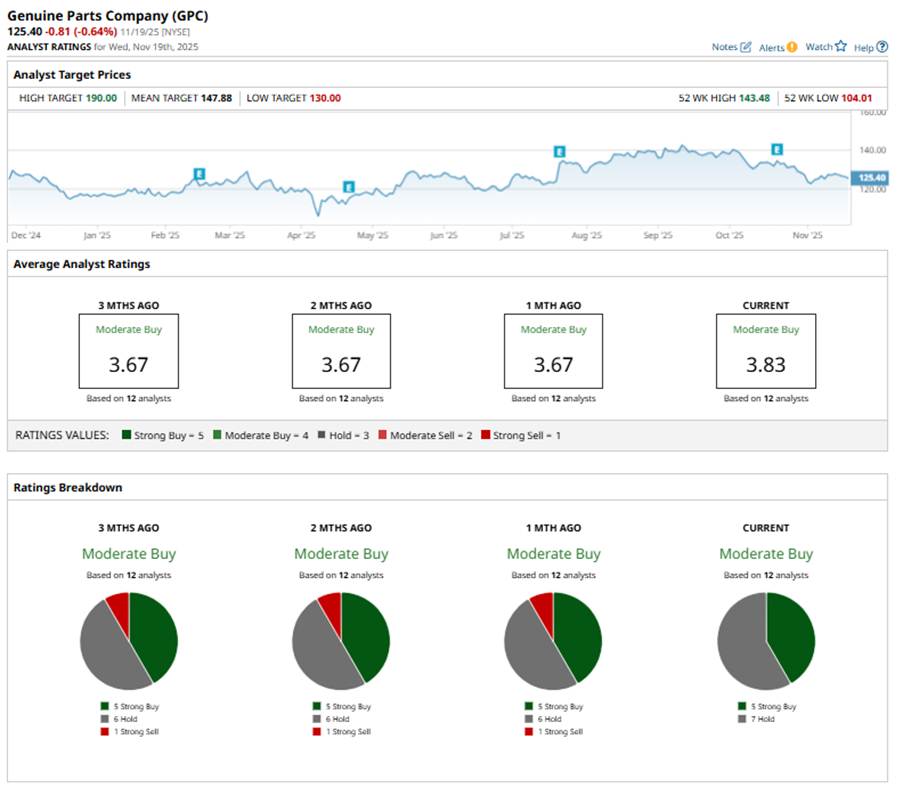

Overall, Wall Street appears optimistic but with a dash of caution, with a consensus “Moderate Buy” rating. Of the 12 analysts offering recommendations, five are all in with a “Strong Buy,” while seven maintain a “Hold” rating.

This configuration is slightly more bullish than a month ago, when there was a “Strong Sell” rating.

Earlier this month, Goldman Sachs (GS) upgraded Genuine Parts to a “Neutral” from a “Sell,” lifting its price target to $142 from $130.

GPC’s average analyst price target of $147.88 suggests an upside of 17.9%, while the Street-high target price of $190 suggests the stock can still rise by 51.5%.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Broadcom Just Unveiled a New Key Product for AI Workflows. Does That Make AVGO Stock a Buy Today?

- JPMorgan Is Bracing for a ‘Correction’ in AI Stocks. Should You Sell NVDA After Q3 Earnings?

- This Stock Is Up 704% in 2025 But Has No Products to Its Name

- IonQ Stock is on Discount: Here’s How to Tackle It From a Quantitative Angle