With a market cap over $3.4 trillion, Microsoft (MSFT) is one of the most prominent stocks within the equity markets. It is for this reason that its upcoming fiscal Q2 2026 earnings announcement, scheduled for Jan. 28, is generating such interest. After the volatile beginning to the year and the sharp pullback from 2025 levels, this announcement may represent something of a turning point for investors.

The backdrop is intriguing. Microsoft is still reporting double-digit earnings growth, but the stock has underperformed the overall tech sector recently. Questions about the cost of investing in AI, and specifically OpenAI, have creeped into the discussion. This earnings cycle is looking less about validating growth and more about regaining investor trust on margins and capital allocation discipline.

About Microsoft Stock

Microsoft Corporation is a world leader in technology and is incorporated in Redmond, Washington. The company focuses on developing and servicing software, cloud platforms, devices, and solutions for enterprises via platforms such as Microsoft 365, Azure, Windows, LinkedIn, Dynamics, Xbox, and Surface. Its well-diversified business and leadership within the enterprise software space have made it one of the most resilient large-cap stocks.

For the last 52 weeks, MSFT is up around 6%, which is behind the S&P 500 Index's ($SPX) increase of 16.2% and the Technology Select Sector SPDR ETF's (XLK) increase of 23%. However, it is important to acknowledge that it is currently trading far above its 52-week low of $344.79, indicating that long-term investors have not lost faith in the company.

In terms of valuations, Microsoft is currently trading at 29 times forward earnings and 12 times sales. These valuations are slightly above the historical average, but this is not unexpected given the company's expectations in the area of cloud computing and AI. The question is whether the company can continue to grow its earnings to sustain the premium.

Microsoft Beats on Earnings, but Costs Matter

The most recent earnings report from Microsoft was for fiscal Q1 2026, in which the company beat street estimates with an EPS of $4.13 on revenue of $77.67 billion. This was a sharp improvement over the prior year and came as a pleasant surprise to investors, though the shares declined by 3% the next day.

The crucial question has been margin pressure driven by AI investment. Microsoft reported around $3.1 billion, or $0.41 per share, in losses driven by OpenAI. Although the investment has been strategic in nature, the market has been debating the duration of the cost phase before AI contributes to margins.

Moving on to the forecast for the Jan. 28 earnings release, fiscal Q2 2026 normalized EPS is seen at $3.86, an increase of 19.5% from the previous year. Looking ahead to the fiscal year, normalized EPS is forecast at $15.86, an increase of 16.3% from fiscal 2025. The Microsoft earnings release is as much about the numbers as it is about the words.

What Do Analysts Expect for MSFT Stock?

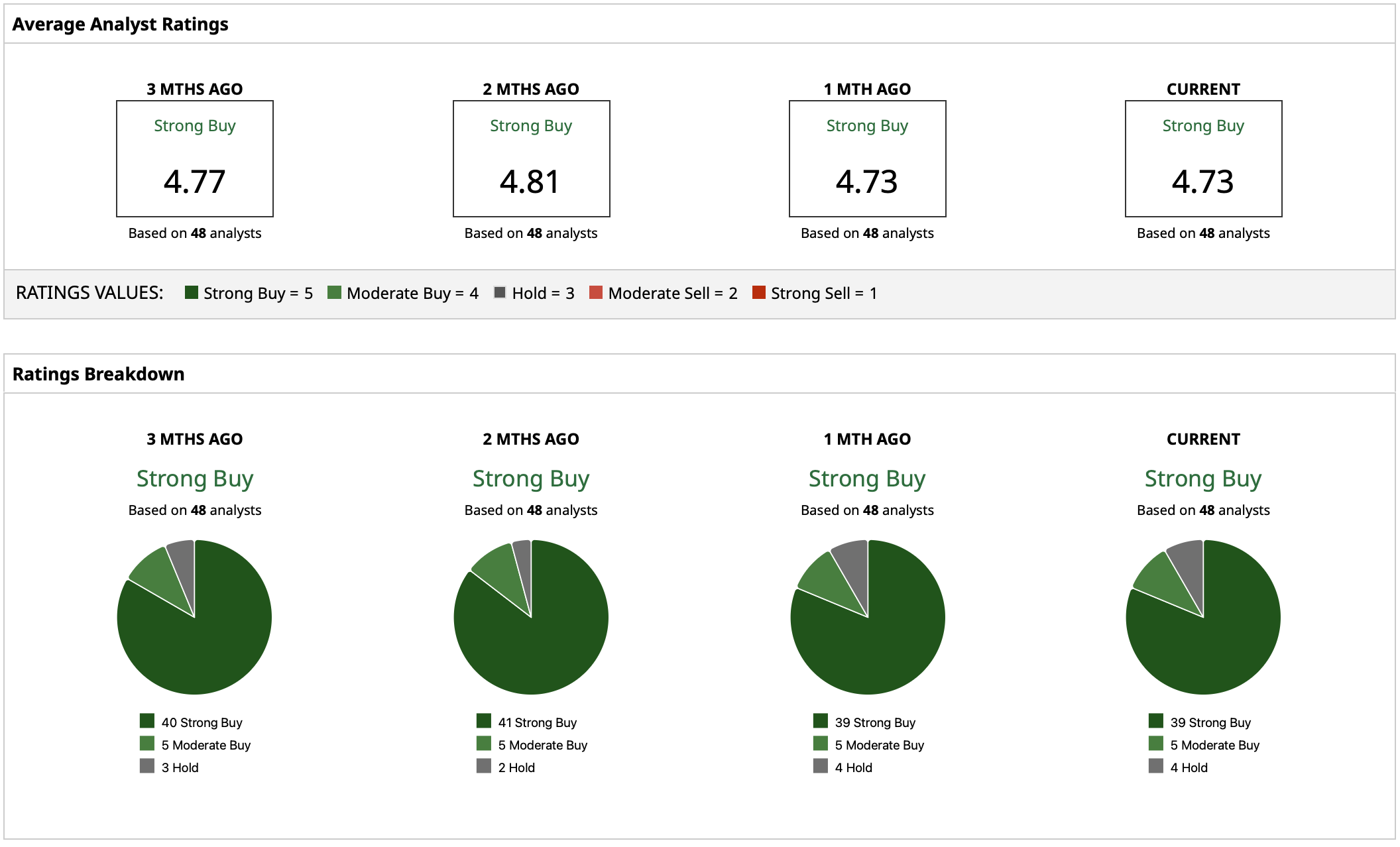

Analysts on Wall Street are strongly optimistic about MSFT stock with a “Strong Buy” rating consensus and a mean price target of approximately $630, implying an upside of about 38% from current market prices. The Street-high price target of $690 reflects analysts’ views of material multiple expansion opportunity if execution on earnings improves and AI investments scale profitably.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Lockheed Martin Stock Hits New 52-Week High as the Greenland Crisis Heats Up

- Trump Bought CoreWeave’s Debt. What Does That Mean for CRWV Stock?

- Magnificent 7 State of the Union: How It Started, How It's Going, And What's Next for the Mag 7 in 2026

- What This $2M Options Bet on Corporate Bonds is Saying About the 10-Year Yield Curve