Plenity product revenue increased 142% year-over-year to $7.5 million in the quarter, driven by the debut of the national media campaign in February 2022

Q1 2022 gross margin increased 277% year-over-year

Company reiterates guidance of $58M in projected product revenue for 2022

Gelesis (NYSE: GLS), the maker of Plenity for weight management, today reported financial results for the first quarter of 2022.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220512005826/en/

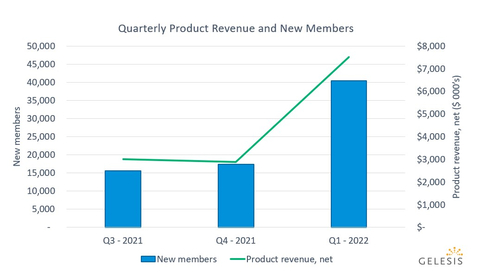

Gelesis' net product revenue was $7.5 million for the first quarter 2022, a 142% increase over the first quarter 2021, driven by the launch of the company’s first national broad awareness media campaign for Plenity on January 31. (Graphic: Business Wire)

“We saw all-time highs of people seeking and starting Plenity prescriptions. It’s no surprise: we offer a proven, nature-inspired, and FDA-cleared therapy that has the potential to help over 150 million people in the United States whose needs are largely unmet by existing therapies on the market. Based on the results of the first quarter, we are encouraged that our message is resonating with the right people,” said Yishai Zohar, Founder and CEO of Gelesis. “We are committed to delivering an accessible and affordable new option for weight loss. We were pleased with the immediate reception from the first wave of our broad media awareness campaign and we look forward to continuing to help many more people achieve their weight loss goals.”

Gelesis CFO Elliot Maltz commented, “This quarter we focused on beginning to build broad consumer awareness of Plenity. Our strong performance across February and March, which accounted for more than 80% of our revenue this quarter, demonstrates the effectiveness of our marketing efforts and the tremendous potential for this product. We were pleased by the improvement in our gross margin this quarter that resulted from completing the first phase of our commercial manufacturing scale-up last year. We believe this is just the beginning and it could take 4-plus years to reach peak market share in the United States. We are targeting a consumer acquisition cost of less than $100 at the point when there is broad awareness of Plenity. We intend to focus our business plan on creating strong consumer awareness of our product.”

Key Business Metrics

|

|

For the Three Months Ended March 31, |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

New members acquired |

|

|

40,400 |

|

|

|

14,100 |

|

Units sold |

|

|

114,570 |

|

|

|

48,761 |

|

Product revenue, net |

|

$ |

7,514 |

|

|

$ |

3,101 |

|

Average selling price per unit, net |

|

$ |

65.58 |

|

|

$ |

63.60 |

|

Gross profit |

|

$ |

2,601 |

|

|

$ |

285 |

|

Gross margin |

|

|

34.6 |

% |

|

|

9.2 |

% |

First Quarter 2022 Results

- Net product revenue was $7.5 million for the first quarter 2022, a 142% increase over the first quarter 2021, driven by the launch of the company’s first national broad awareness media campaign on January 31.

- Gross profit was $2.6 million for the first quarter 2022, with gross margin for the first quarter 2022 increasing 276% over the first quarter 2021, attributable to increased sales volume and lower costs of goods sold.

- Net loss for the quarter was $(5.7) million and Adjusted EBITDA was $(26.9) million.

- Following the broad awareness media campaign launch, a total of 40,400 members joined during first quarter 2022, a 187% increase over first quarter 2021. In one quarter, with two months of broad awareness media, the company more than doubled the number of new members quarter over quarter.

A reconciliation of Adjusted EBITDA, a non-GAAP financial measure, to net loss, its most comparable financial measure under generally accepted accounting principles in the United States (“U.S. GAAP”), is included in the tables accompanying this press release. See “Non-GAAP Financial Measures” for additional important information regarding Adjusted EBITDA.

Recent Business Highlights

Gelesis launched the first wave of its national broad awareness media campaign for Plenity on January 31, which was subsequently associated with its record high levels of web traffic and prescription requests. Based on data from the first quarter 2022 and the first wave of the media campaign, the company shares the following findings about these new members.

- More than 80% of new member acquisition and product revenue occurred in February and March following the successful media launch.

-

Quarter over quarter, web traffic increased 140% and the number of individuals seeking a new prescription increased 140%. This conversion rate remained consistent with previous quarters, despite the large influx of new potential members, suggesting that the right message is reaching the appropriate target audience.

- 90% of new members typically complete a treatment request within 24 hours of first visiting the website, indicating they are coming with the intention of seeking a prescription and do not require additional advertising investment.

- The online visit takes about 15 minutes. On average, people find out whether they have been approved for a prescription within 24 hours. The product is shipped directly to their home and arrives within 2 days.

- The company demonstrated its operational ability to scale to meet the significant increase in consumer demand. Manufacturing Plenity is a proprietary process to Gelesis, and the company completed a manufacturing scale up at the end of 2021 which helped enable significant improvement in gross margin.

-

Notable among growth with traditional healthcare provider (“HCP”) interaction prescriptions, 40-50% of these prescriptions were requested by the consumer (the company’s baseline before the media campaign began was 25%).

- Of the prescriptions requests initiated by the patient, 40% of the time the patient specifically made an appointment with their HCP to seek out a prescription; 60% of the time they brought it up during an already-scheduled visit.

-

Plenity has the largest addressable market of any prescription weight management approach and 150 million American adults could qualify for treatment, including the tens of millions of Americans with a BMI between 25 and 30 who generally do not qualify for other prescription weight loss treatments. Unlike other available prescription treatments for obesity, Plenity does not contain any black box safety warnings.

- About 70% of Plenity members had never tried a prescription weight management product before, indicating Plenity is bringing new people into the category of prescription weight management products.

- During its limited time on the market, Plenity members are already ordering multiple units: three monthly kits on average within the first year. The company expects this number to increase over time as obesity and excess weight are chronic in nature, and Gelesis intends to support members’ episodic and longer-term needs. There is no limit to how long a person can take Plenity and the company expects that those members who had success will seek Plenity out the next time they are looking to manage their weight.

- Gelesis presented results from the LIGHT-UP clinical trial at the European Congress on Obesity 2022. The study looked at adults with overweight or obesity who have prediabetes or type 2 diabetes and were treated with either GS200 (one of the company’s clinical stage hydrogels) or placebo. Approximately 6 out of 10 adults treated with GS200 achieved clinically meaningful response to treatment (achieving at least 5% body weight loss), losing on average 11% of their body weight (~23 pounds) and an average reduction of 5.5 inches off their waist circumference in only 24 weeks. Approximately 1 out of 3 GS200-treated adults were “super responders,” losing at least 10% of their body weight and on average losing 13% (~30 pounds), or 7 inches off their waist circumference. The overall incidence of adverse events (AEs) in adults treated with GS200 was similar to the incidence of AEs in the placebo group.

- Gelesis completed its business combination with Capstar SPAC on January 13, 2022, resulting in gross proceeds of $105 million.

Financial Outlook for Fiscal Year 2022

Based on current market conditions, results of the first quarter of 2022, and expectations for the remainder of the year, Gelesis estimates product revenue, net, of about $58 million in 2022. This is contingent on the timing and amount of future anticipated financing, in addition to the company’s current expectations regarding the amount and timing of investments in broad awareness media, which could be impacted by available liquidity and other considerations as it monitors the rate of growth in new Plenity members and units sold during upcoming quarters.

The guidance provided above constitutes forward-looking statements which are subject to uncertainty. Actual results may differ materially and we cannot anticipate the effect of changes in marketing investment on our results from operations. Refer to the "Forward-Looking Statements" safe harbor section below for information on the factors that could cause our actual results to differ materially from these forward-looking statements.

Q1 2022 Conference Call and Webcast Information

Gelesis management will host a conference call today at 4:30 pm ET to discuss the first quarter 2021 results, followed by a question-and-answer period. The conference call can be accessed by dialing +1 (844) 200-6205 for U.S. participants and +1 (929) 526-1599 for all other participants. The conference ID is 726898.

A live webcast will also be available here, or on the company’s investor relations website at https://ir.gelesis.com/. A replay of the webcast will be available shortly afterwards.

About Gelesis

Gelesis Holdings Inc. (NYSE: GLS) (“Gelesis”) is a consumer-centered biotherapeutics company and the maker of Plenity®, which is inspired by nature and FDA cleared to aid in weight management. Our first-of-their-kind non-systemic superabsorbent hydrogels are made entirely from naturally derived building blocks. They are inspired by the composition and mechanical properties of raw vegetables, taken by capsule, and act locally in the digestive system, so people feel satisfied with smaller portions. Our portfolio includes Plenity® and potential therapies in development for patients with Type 2 Diabetes, Non-alcoholic Fatty Liver Disease (NAFLD)/Non-alcoholic Steatohepatitis (NASH), and Functional Constipation. For more information, visit gelesis.com, or connect with us on Twitter @GelesisInc.

Plenity® is indicated to aid weight management in adults with excess weight or obesity, a Body Mass Index (BMI) of 25–40 kg/m², when used in conjunction with diet and exercise.

Important Safety Information about Plenity

- Patients who are pregnant or are allergic to cellulose, citric acid, sodium stearyl fumarate, gelatin, or titanium dioxide should not take Plenity.

-

To avoid impact on the absorption of medications:

- For all medications that should be taken with food, take them after starting a meal.

- For all medications that should be taken without food (on an empty stomach), continue taking on an empty stomach or as recommended by your physician.

- The overall incidence of side effects with Plenity was no different than placebo. The most common side effects were diarrhea, distended abdomen, infrequent bowel movements, and flatulence.

- Contact a doctor right away if problems occur. If you have a severe allergic reaction, severe stomach pain, or severe diarrhea, stop using Plenity until you can speak to your doctor.

Rx Only. For the safe and proper use of Plenity or more information, talk to a healthcare professional, read the Patient Instructions for Use, or call 1-844-PLENITY.

Forward-Looking Statements

Certain statements, estimates, targets and projections in this press release may constitute “forward-looking statements” within the meaning of the federal securities laws. The words “anticipate,” “believe,” continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that statement is not forward looking. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future, including those relating to Gelesis’ business combination with Capstar Special Purpose Acquisition Corp. (“Capstar”) and its expected benefits, Gelesis’ performance following the business combination, the competitive environment in which Gelesis operates, the expected future operating and financial performance and market opportunities of Gelesis and statements regarding Gelesis’ expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts, or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Gelesis assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Gelesis gives no assurance that any expectations set forth in this press release will be achieved. Various risks and uncertainties (some of which are beyond our control) or other factors could cause actual future results, performance or events to differ materially from those described herein. Some of the factors that may impact future results and performance may include, without limitation: (i) the size, demand and growth potential of the markets for Plenity® and Gelesis’ other product candidates and Gelesis’ ability to serve those markets; (ii) the degree of market acceptance and adoption of Gelesis’ products; (iii) Gelesis’ ability to develop innovative products and compete with other companies engaged in the weight loss industry; (iv) Gelesis’ ability to finance and complete successfully the commercial launch of Plenity® and its growth plans, including new possible indications and the clinical data from ongoing and future studies about liver and other diseases; (v) failure to realize the anticipated benefits of the business combination, including as a result of a delay or difficulty in integrating the businesses of Capstar and Gelesis; (vi) the ability of Gelesis to issue equity or equity-linked securities or obtain debt financing in the future; (vii) the outcome of any legal proceedings instituted against Capstar, Gelesis, or others in connection with the business combination; (viii) the ability of Gelesis to maintain its listing on the New York Stock Exchange; (ix) the risk that the business combination disrupts current plans and operations of Gelesis as a result of Gelesis being a publicly listed issuer; (x) the regulatory pathway for Gelesis’ products and responses from regulators, including the FDA and similar regulators outside of the United States; (xi) the ability of Gelesis to grow and manage growth profitably, maintain relationships with customers and suppliers and retain Gelesis’ management and key employees; (xii) costs related to the business combination, including costs associated with the Gelesis being a publicly listed issuer; (xiii) changes in applicable laws or regulations; (xiv) the possibility that Gelesis may be adversely affected by other economic, business, regulatory and/or competitive factors; (xv) Gelesis’ estimates of expenses and profitability; (xvi) ongoing regulatory requirements, (xvii) any competing products or technologies that may emerge, (xviii) the volatility of the telehealth market in general, or insufficient patient demand; (xix) the ability of Gelesis to defend its intellectual property and satisfy regulatory requirements; (xx) the impact of the COVID 19 pandemic on Gelesis’ business; (xxi) the limited operating history of Gelesis; (xxii) the potential impact of inflation on our operating expenses and costs of goods; and (xxiii) other important factors discussed in the “Risk Factors” section of Gelesis’ most recent Annual Report on Form 10-K, and in other filings that Gelesis makes with the Securities and Exchange Commission. These filings address other important risks and uncertainties that could cause actual results and events to differ materially from those contained in the forward-looking statements.

Disclaimer

Gelesis assumes no obligation and does not intend to update or revise the results provided in this press release. The results provided in this press release represent past performance and are not necessarily predictive of future results.

Key Business Metrics

We monitor the following key metrics to help us evaluate our business, identify trends affecting our business, formulate business plans and make strategic decisions. We believe the following metrics are useful in evaluating our business:

New members acquired

We define new members acquired as the number of consumers in the United States who have begun their weight loss journey with Plenity during the financial period presented. This is the total number of recurring and non-recurring consumers who have begun their weight loss journey during the financial period presented. We do not differentiate from recurring and non-recurring consumers as of this date as (i) we strongly believe every member’s weight-loss journey is chronic and long-term in nature, and (ii) we have not initiated our long-term strategy and mechanisms to retain and/or win-back members. We will continue to evaluate the utility of this business metric in future periods.

Units sold

Units sold is defined as the number of 28-day supply units of Plenity sold to consumers based on prescriptions, through our strategic partnerships with online pharmacies and telehealth providers as well as the units sold to our strategic partners outside the United States. Note that the terms “units” and “monthly kits”, as mentioned in Gelesis’ various public disclosures and filings, are synonymous when used to describe the sales volume of Plenity.

Product revenue, net

We recognize product revenue in accordance with Accounting Standards Codification Topic 606, Revenue from Contracts with Customers, when we transfer promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.

Our product revenue is derived from product sales of Plenity, net of estimates of variable consideration for which reserves are established for expected product returns, shipping charges to end-users, pharmacy dispensing and platform fees, merchant and processing fees, and promotional discounts offered to end-users.

Average selling price per unit, net

Average selling price per unit, net is the gross price per unit sold during the period net of estimates of per unit variable consideration for which reserves are established for expected product returns, shipping charges to end-users, pharmacy dispensing and platform fees, merchant and processing fees, and promotional discounts offered to end-users.

Gross profit and gross margin

Our gross profit represents product revenue, net, less our total cost of goods sold, and our gross margin is our gross profit expressed as a percentage of our product revenue, net. Our gross profit and gross margin have been and will continue to be affected by a number of factors, including the prices we charge for our product, the costs we incur from our vendors for certain components of our cost of goods sold, the mix of channel sales in a period, and our ability to sell our inventory.

Non-GAAP Financial Measures

In addition to our financial results determined in accordance with GAAP, we believe that Adjusted EBITDA, a non-GAAP measure, is useful in evaluating our operating performance. We define “Adjusted EBITDA” as net (loss) income before depreciation and amortization expenses, provision for (benefit from) income taxes, interest expense, net, stock-based compensation and (gains) and losses related to changes in fair value of our warrant liability, our convertible promissory note liability, our tranche rights liability and the One S.r.l. call option. We use Adjusted EBITDA to evaluate our ongoing operations and for internal planning and forecasting purposes because it facilitates internal comparisons of our historical operating performance. We believe that this non-GAAP financial measure, when taken together with the corresponding GAAP financial measure, net loss, provides meaningful supplemental information regarding our performance by excluding certain items that may not be indicative of our business, results of operations, or outlook. We consider Adjusted EBITDA to be an important measure because it helps illustrate underlying trends in our business and our historical operating performance on a more consistent basis. We believe that Adjusted EBITDA is helpful to our investors as it is a metric used by management in assessing the health of our business and our operating performance.

However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. In addition, other companies, including companies in our industry, may calculate similarly-titled non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of Adjusted EBITDA as a tool for comparison. A reconciliation is provided below for Adjusted EBITDA to the most directly comparable financial measure stated in accordance with GAAP. Investors are encouraged to review the related GAAP financial measure and the reconciliation of this non-GAAP financial measure to its most directly comparable GAAP financial measure, and not to rely on any single financial measure to evaluate our business.

SELECTED UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands) |

||||||||

|

|

March 31, |

|

|

December 31, |

|

||

|

|

2022 |

|

|

2021 |

|

||

ASSETS |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

33,985 |

|

|

$ |

28,397 |

|

Accounts receivable and grants receivable |

|

|

9,762 |

|

|

|

9,903 |

|

Inventories |

|

|

16,276 |

|

|

|

13,503 |

|

Property and equipment, net |

|

|

58,321 |

|

|

|

58,515 |

|

All other current and non-current assets |

|

|

34,535 |

|

|

|

35,983 |

|

Total assets |

|

$ |

152,879 |

|

|

$ |

146,301 |

|

LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ EQUITY (DEFICIT) |

|

|

|

|

|

|

||

Accounts payable |

|

$ |

13,241 |

|

|

$ |

10,066 |

|

Accrued expenses and other current liabilities |

|

|

10,124 |

|

|

|

13,660 |

|

Deferred income, current portion |

|

|

25,533 |

|

|

|

32,370 |

|

Notes and convertible notes payable, current portion |

|

|

2,001 |

|

|

|

29,078 |

|

Warrant liabilities |

|

|

3,730 |

|

|

|

15,821 |

|

Earnout liability |

|

|

25,002 |

|

|

|

— |

|

Deferred income, non-current portion |

|

|

9,984 |

|

|

|

8,914 |

|

Notes payable, non-current portion |

|

|

33,958 |

|

|

|

35,131 |

|

All other current and non-current liabilities |

|

|

7,565 |

|

|

|

7,648 |

|

Total liabilities |

|

|

131,138 |

|

|

|

152,688 |

|

Noncontrolling interest |

|

|

11,704 |

|

|

|

11,855 |

|

Redeemable convertible preferred stock |

|

|

— |

|

|

|

311,594 |

|

Total stockholders’ equity (deficit) |

|

|

10,037 |

|

|

|

(329,836 |

) |

Total liabilities, noncontrolling interest, redeemable convertible preferred stock and stockholders’ equity (deficit) |

|

$ |

152,879 |

|

|

$ |

146,301 |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands) |

||||||||

|

|

Three Months Ended March 31, |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

Revenue: |

|

|

|

|

|

|

||

Product revenue, net |

|

$ |

7,514 |

|

|

$ |

3,101 |

|

Total revenue, net |

|

|

7,514 |

|

|

|

3,101 |

|

Operating expenses: |

|

|

|

|

|

|

||

Costs of goods sold |

|

|

4,913 |

|

|

|

2,816 |

|

Selling, general and administrative |

|

|

37,706 |

|

|

|

11,945 |

|

Research and development |

|

|

7,410 |

|

|

|

4,376 |

|

Amortization of intangible assets |

|

|

567 |

|

|

|

567 |

|

Total operating expenses |

|

|

50,596 |

|

|

|

19,704 |

|

Loss from operations |

|

|

(43,082 |

) |

|

|

(16,603 |

) |

Change in the fair value of earnout liability |

|

|

33,869 |

|

|

|

— |

|

Change in the fair value of convertible promissory notes |

|

|

(156 |

) |

|

|

— |

|

Change in the fair value of warrants |

|

|

3,484 |

|

|

|

(2,074 |

) |

Interest expense, net |

|

|

(135 |

) |

|

|

(361 |

) |

Other income, net |

|

|

317 |

|

|

|

469 |

|

Loss before income taxes |

|

|

(5,703 |

) |

|

|

(18,569 |

) |

Provision for income taxes |

|

|

— |

|

|

|

17 |

|

Net loss |

|

|

(5,703 |

) |

|

|

(18,586 |

) |

Accretion of senior preferred stock to redemption value |

|

|

(37,934 |

) |

|

|

(33,761 |

) |

Accretion of noncontrolling interest put option to redemption value |

|

|

(88 |

) |

|

|

(94 |

) |

Net loss attributable to common stockholders |

|

$ |

(43,725 |

) |

|

$ |

(52,441 |

) |

Net loss per share attributable to common stockholders—basic and diluted |

|

$ |

(0.70 |

) |

|

$ |

(9.38 |

) |

Weighted average common shares outstanding—basic and diluted |

|

|

62,743,154 |

|

|

|

5,589,290 |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) |

||||||||

|

|

Three Months Ended March 31, |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

Cash flows from operating activities: |

|

|

|

|

|

|

||

Net loss |

|

$ |

(5,703 |

) |

|

$ |

(18,586 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

. |

|

||

Amortization of intangible assets |

|

|

567 |

|

|

|

567 |

|

Reduction in carrying amount of right-of-use assets |

|

|

132 |

|

|

|

41 |

|

Depreciation |

|

|

1,019 |

|

|

|

174 |

|

Stock-based compensation |

|

|

13,989 |

|

|

|

1,455 |

|

Unrealized loss on foreign currency transactions |

|

|

65 |

|

|

|

143 |

|

Noncash interest expense |

|

|

40 |

|

|

|

19 |

|

Accretion on marketable securities |

|

|

— |

|

|

|

(1 |

) |

Change in the fair value of earnout liability |

|

|

(33,869 |

) |

|

|

— |

|

Change in the fair value of warrants |

|

|

(3,484 |

) |

|

|

2,074 |

|

Change in the fair value of convertible promissory notes |

|

|

156 |

|

|

|

— |

|

Change in fair value of One S.r.l. call option |

|

|

258 |

|

|

|

48 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

||

Account receivables |

|

|

(1,177 |

) |

|

|

(169 |

) |

Grants receivable |

|

|

(198 |

) |

|

|

(1,273 |

) |

Prepaid expenses and other current assets |

|

|

(2,010 |

) |

|

|

318 |

|

Inventories |

|

|

(2,888 |

) |

|

|

846 |

|

Other assets |

|

|

— |

|

|

|

(1,222 |

) |

Accounts payable |

|

|

3,502 |

|

|

|

(1,192 |

) |

Accrued expenses and other current liabilities |

|

|

528 |

|

|

|

200 |

|

Operating lease liabilities |

|

|

(134 |

) |

|

|

(37 |

) |

Deferred income |

|

|

(5,550 |

) |

|

|

8,459 |

|

Other long-term liabilities |

|

|

(426 |

) |

|

|

(158 |

) |

Net cash used in operating activities |

|

|

(35,183 |

) |

|

|

(8,294 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

||

Purchases of property and equipment |

|

|

(1,963 |

) |

|

|

(6,354 |

) |

Maturities of marketable securities |

|

|

— |

|

|

|

24,000 |

|

Net cash (used in) provided by investing activities |

|

|

(1,963 |

) |

|

|

17,646 |

|

Cash flows from financing activities: |

|

|

|

|

|

|

||

Proceeds from Business Combination, net of transaction costs |

|

|

70,478 |

|

|

|

— |

|

Principal repayment of notes payable |

|

|

(418 |

) |

|

|

(186 |

) |

Repayment of convertible promissory notes due to related party, held at fair value |

|

|

(27,284 |

) |

|

|

— |

|

Proceeds from issuance of promissory notes (net of issuance costs of $0 and $30, respectively) |

|

|

— |

|

|

|

3,506 |

|

Proceeds from the exercise of warrants |

|

|

4 |

|

|

|

10 |

|

Proceeds from exercise of share-based awards |

|

|

— |

|

|

|

4 |

|

Net cash provided by financing activities |

|

|

42,780 |

|

|

|

3,334 |

|

Effect of exchange rates on cash |

|

|

(46 |

) |

|

|

(973 |

) |

Net increase in cash |

|

|

5,588 |

|

|

|

11,713 |

|

Cash and cash equivalents at beginning of year |

|

|

28,397 |

|

|

|

48,144 |

|

Cash and cash equivalents at end of period |

|

$ |

33,985 |

|

|

$ |

59,857 |

|

Noncash investing and financing activities: |

|

|

|

|

|

|

||

Purchases of property and equipment included in accounts payable and accrued expense |

|

$ |

1,721 |

|

|

$ |

889 |

|

Recognition of earnout liability |

|

$ |

58,871 |

|

|

|

— |

|

Recognition of private placement warrant liability |

|

$ |

8,140 |

|

|

|

— |

|

Supplemental cash flow information: |

|

|

|

|

|

|

||

Interest paid on notes payable |

|

$ |

95 |

|

|

$ |

43 |

|

NET LOSS TO ADJUSTED EBITDA RECONCILIATION (In thousands, Unaudited) |

||||||||

|

|

For the Three Months Ended March 31, |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

Adjusted EBITDA |

|

|

|

|

|

|

||

Net loss |

|

$ |

(5,703 |

) |

|

$ |

(18,586 |

) |

Provision for income taxes |

|

|

— |

|

|

|

17 |

|

Depreciation and amortization |

|

|

1,586 |

|

|

|

741 |

|

Stock based compensation expense |

|

|

13,989 |

|

|

|

1,455 |

|

Change in fair value of earnout liability |

|

|

(33,869 |

) |

|

|

— |

|

Change in fair value of warrants |

|

|

(3,484 |

) |

|

|

2,074 |

|

Change in fair value of convertible promissory notes |

|

|

156 |

|

|

|

— |

|

Change in fair value of One S.r.l. call option |

|

|

258 |

|

|

|

48 |

|

Interest expense, net |

|

|

135 |

|

|

|

361 |

|

Adjusted EBITDA |

|

$ |

(26,932 |

) |

|

$ |

(13,890 |

) |

View source version on businesswire.com: https://www.businesswire.com/news/home/20220512005826/en/

Contacts

Media & Investor Relations

Katie Sullivan

ksullivan@gelesis.com