Pool products retailer Leslie’s (NASDAQ: LESL) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 6.1% year on year to $177.1 million. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $1.34 billion at the midpoint. Its non-GAAP loss of $0.25 per share was 4.2% below analysts’ consensus estimates.

Is now the time to buy Leslie's? Find out by accessing our full research report, it’s free.

Leslie's (LESL) Q1 CY2025 Highlights:

- Revenue: $177.1 million vs analyst estimates of $184.5 million (6.1% year-on-year decline, 4% miss)

- Adjusted EPS: -$0.25 vs analyst expectations of -$0.24 (4.2% miss)

- Adjusted EBITDA: -$36.06 million vs analyst estimates of -$35.14 million (-20.4% margin, 2.6% miss)

- Adjusted EPS guidance for the full year is $0.03 at the midpoint, beating analyst estimates by 11.1%

- EBITDA guidance for the full year is $106 million at the midpoint, above analyst estimates of $105 million

- Operating Margin: -27.3%, down from -16.2% in the same quarter last year

- Free Cash Flow was -$55.76 million compared to -$56.48 million in the same quarter last year

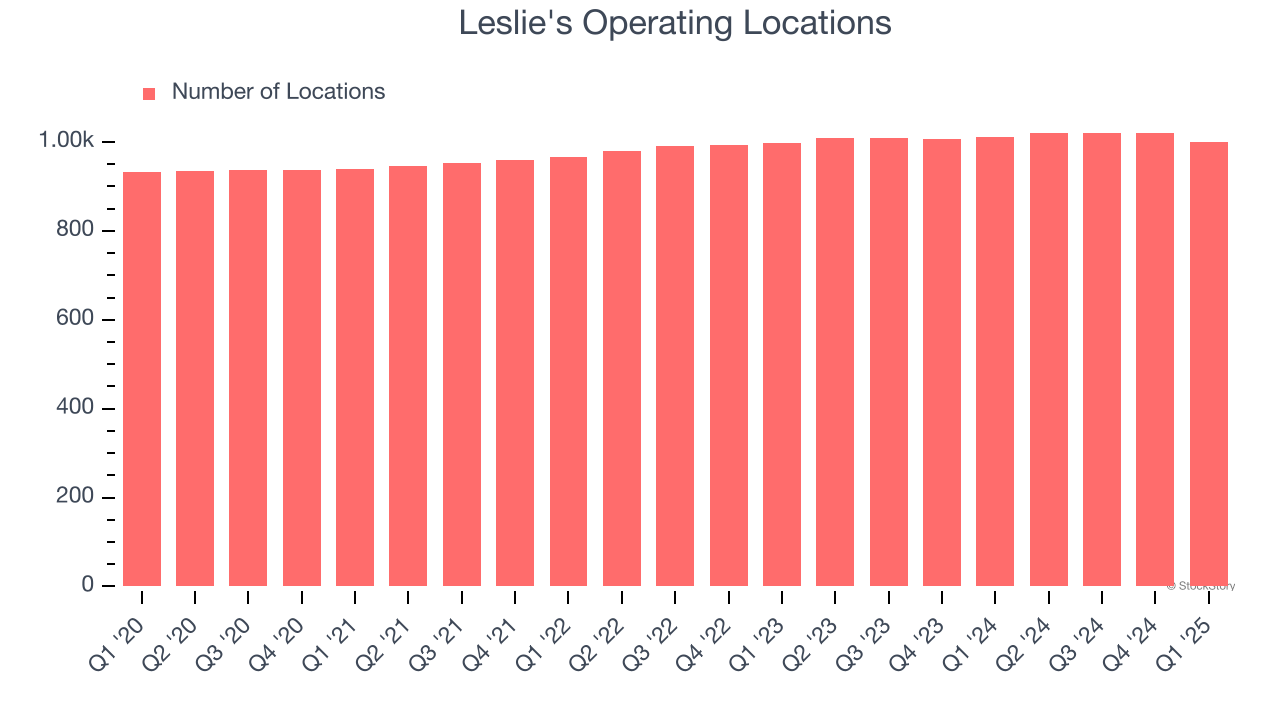

- Locations: 1,000 at quarter end, down from 1,010 in the same quarter last year

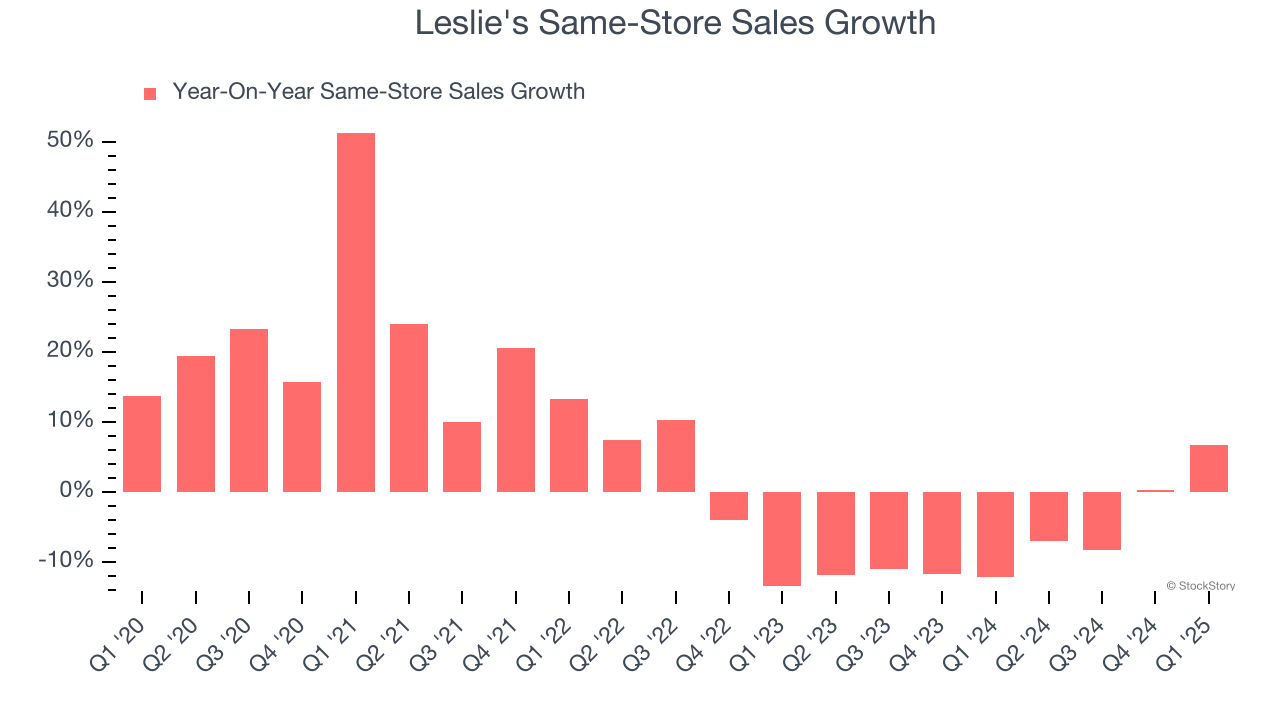

- Same-Store Sales rose 6.7% year on year (-12.1% in the same quarter last year)

- Market Capitalization: $129.1 million

“I am proud of our team’s dedication, resiliency and customer first mindset as we move forward in our transformation journey. Our team remains focused on the fundamentals of our business to deliver progress against our strategic initiatives,” said Jason McDonell, Leslie’s Chief Executive Officer.

Company Overview

Named after founder Philip Leslie, who established the company in 1963, Leslie’s (NASDAQ: LESL) is a retailer that sells pool and spa supplies, equipment, and maintenance services.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $1.32 billion in revenue over the past 12 months, Leslie's is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

As you can see below, Leslie's grew its sales at a tepid 6.8% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts).

This quarter, Leslie's missed Wall Street’s estimates and reported a rather uninspiring 6.1% year-on-year revenue decline, generating $177.1 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 2.3% over the next 12 months, a deceleration versus the last six years. This projection doesn't excite us and implies its products will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Leslie's operated 1,000 locations in the latest quarter. It has generally opened new stores over the last two years and averaged 1.3% annual growth, faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Leslie’s demand has been shrinking over the last two years as its same-store sales have averaged 6.9% annual declines. This performance is concerning - it shows Leslie's artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

In the latest quarter, Leslie’s same-store sales rose 6.7% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Leslie’s Q1 Results

It was good to see Leslie's provide full-year EPS and EBITDA guidance that beat analysts’ expectations. On the other hand, its revenue, EPS, and EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 9.2% to $0.64 immediately after reporting.

Leslie's underperformed this quarter, but does that create an opportunity to invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.