W. R. Berkley has been treading water for the past six months, recording a small loss of 3.2% while holding steady at $68.23. The stock also fell short of the S&P 500’s 9.6% gain during that period.

Is now the time to buy WRB? Find out in our full research report, it’s free.

Why Does W. R. Berkley Spark Debate?

Founded in 1967 and operating through more than 50 specialized insurance units across the globe, W. R. Berkley (NYSE: WRB) underwrites commercial insurance and reinsurance through specialized subsidiaries serving industries from healthcare to construction to transportation.

Two Things to Like:

1. Net Premiums Earned Skyrocket, Fueling Growth Opportunities

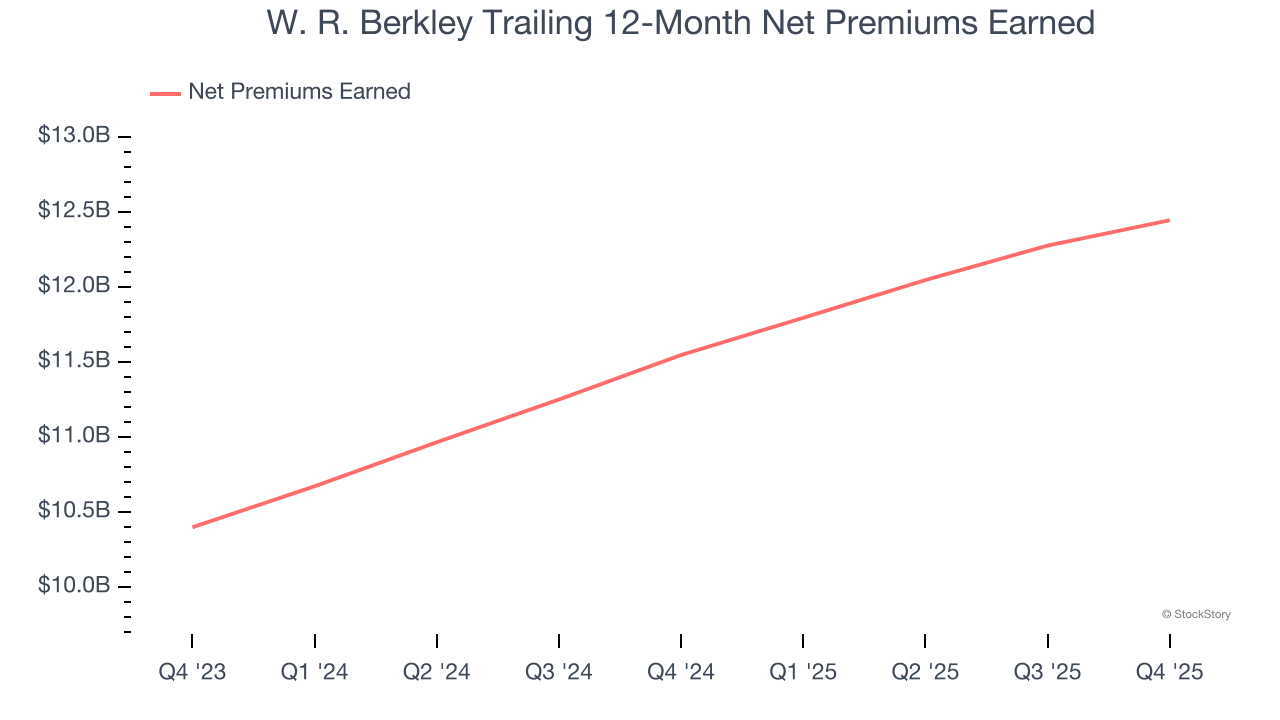

Insurers sell policies then use reinsurance (insurance for insurance companies) to protect themselves from large losses. Net premiums earned are therefore what's collected from selling policies less what’s paid to reinsurers as a risk mitigation tool.

W. R. Berkley’s net premiums earned has grown at a 12.4% annualized rate over the last five years, better than the broader insurance industry and in line with its total revenue.

2. Outstanding Long-Term EPS Growth

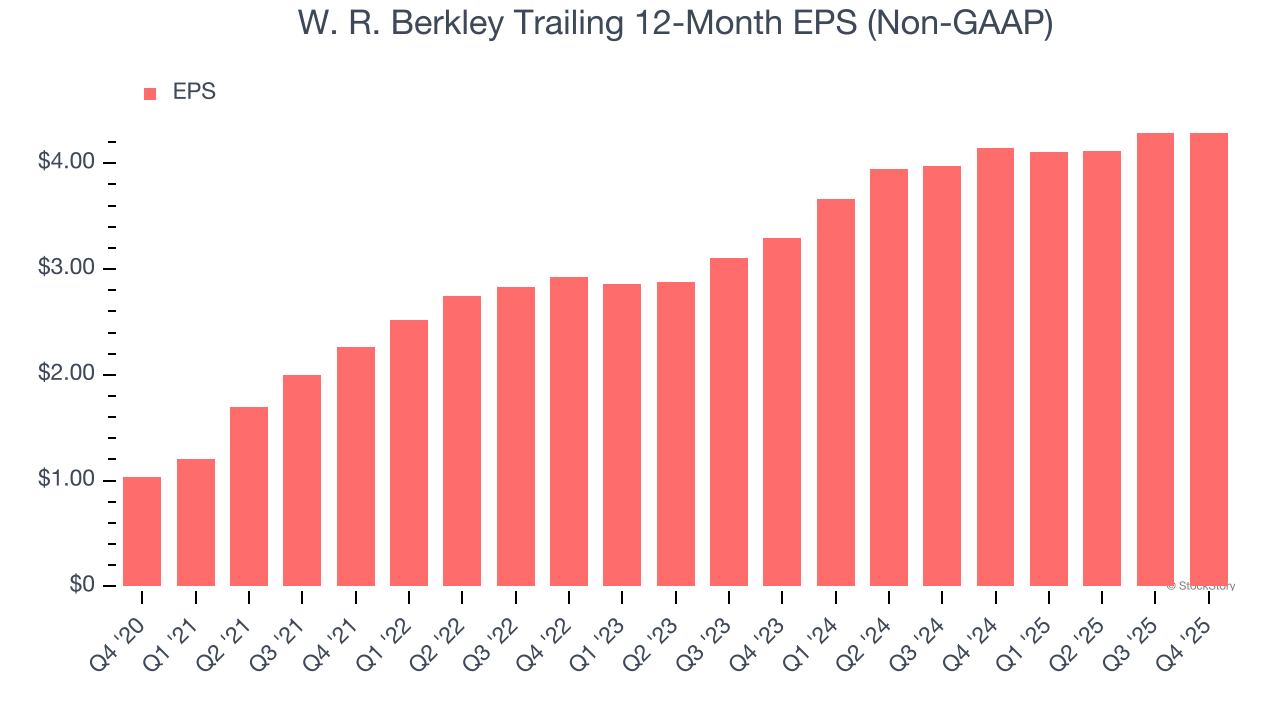

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

W. R. Berkley’s EPS grew at an astounding 33% compounded annual growth rate over the last five years, higher than its 12.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect W. R. Berkley’s revenue to rise by 4.5%, a deceleration versus its 10.1% annualized growth for the past two years. This projection is underwhelming and implies its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Final Judgment

W. R. Berkley’s merits more than compensate for its flaws. With its shares lagging the market recently, the stock trades at 2.4× forward P/B (or $68.23 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than W. R. Berkley

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.