Performance marketing company QuinStreet (NASDAQ: QNST) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 1.9% year on year to $287.8 million. On top of that, next quarter’s revenue guidance ($335 million at the midpoint) was surprisingly good and 4.5% above what analysts were expecting. Its non-GAAP profit of $0.24 per share was 21.2% above analysts’ consensus estimates.

Is now the time to buy QuinStreet? Find out by accessing our full research report, it’s free.

QuinStreet (QNST) Q4 CY2025 Highlights:

- Revenue: $287.8 million vs analyst estimates of $276.2 million (1.9% year-on-year growth, 4.2% beat)

- Adjusted EPS: $0.24 vs analyst estimates of $0.20 (21.2% beat)

- Adjusted EBITDA: $20.98 million vs analyst estimates of $19.43 million (7.3% margin, 8% beat)

- Revenue Guidance for the full year is $1.28 billion at the midpoint, above analyst estimates of $1.23 billion

- EBITDA guidance for the full year is $112.5 million at the midpoint, above analyst estimates of $101.5 million

- Operating Margin: 0.4%, in line with the same quarter last year

- Free Cash Flow Margin: 6.3%, down from 12.7% in the same quarter last year

- Market Capitalization: $654.3 million

Company Overview

Founded during the dot-com era in 1999 and specializing in high-intent consumer traffic, QuinStreet (NASDAQ: QNST) operates digital performance marketplaces that connect clients in financial and home services with consumers actively searching for their products.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

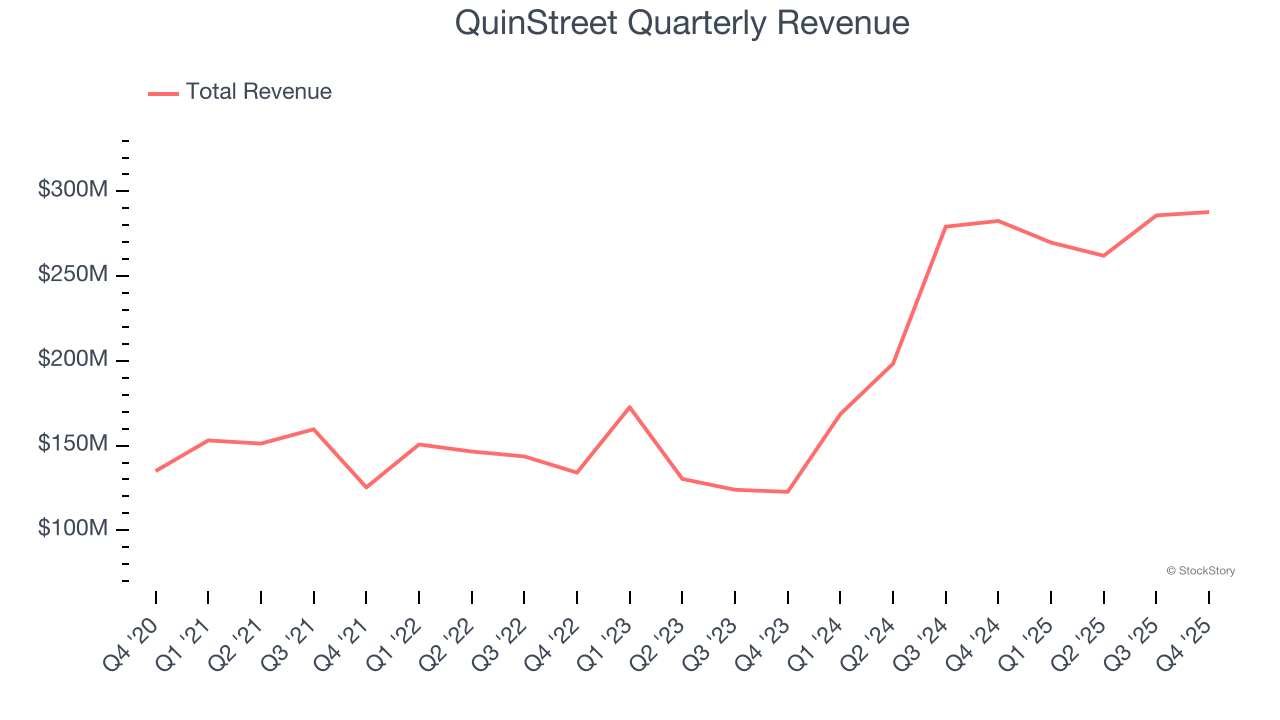

With $1.11 billion in revenue over the past 12 months, QuinStreet is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

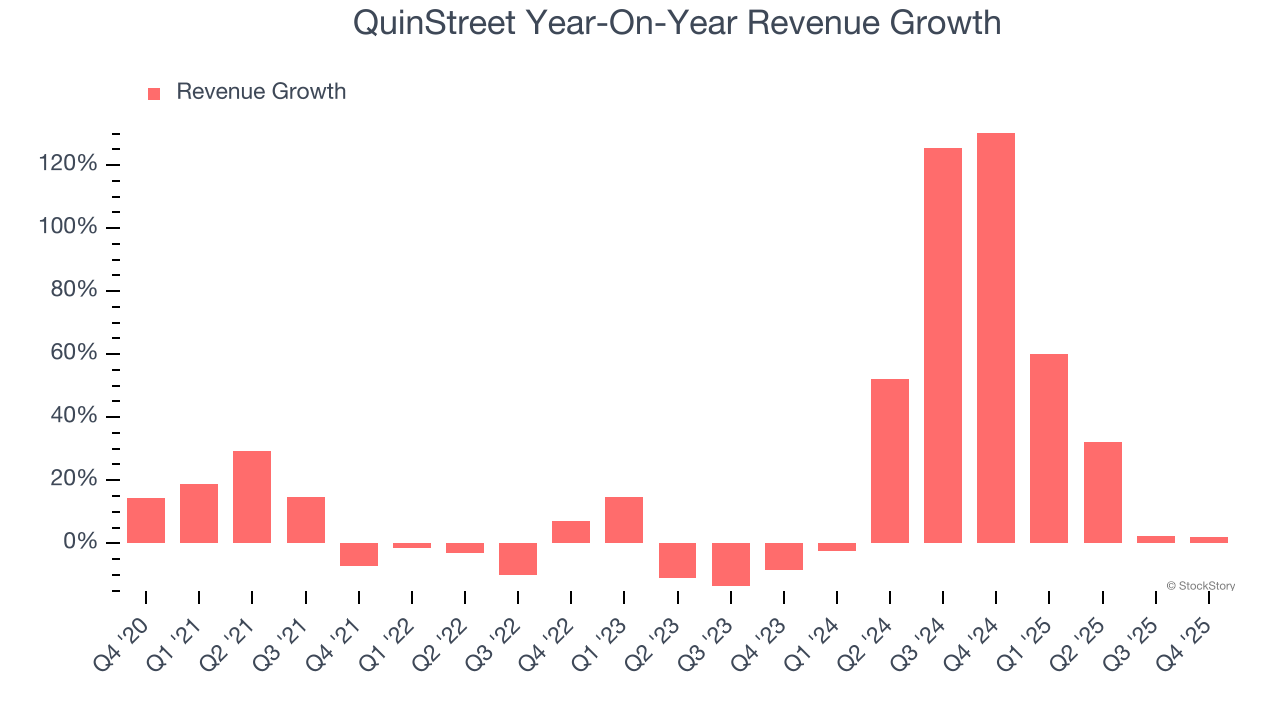

As you can see below, QuinStreet’s sales grew at an incredible 16.3% compounded annual growth rate over the last five years. This is a great starting point for our analysis because it shows QuinStreet’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. QuinStreet’s annualized revenue growth of 41.8% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, QuinStreet reported modest year-on-year revenue growth of 1.9% but beat Wall Street’s estimates by 4.2%. Company management is currently guiding for a 24.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 14.3% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is admirable and implies the market is forecasting success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

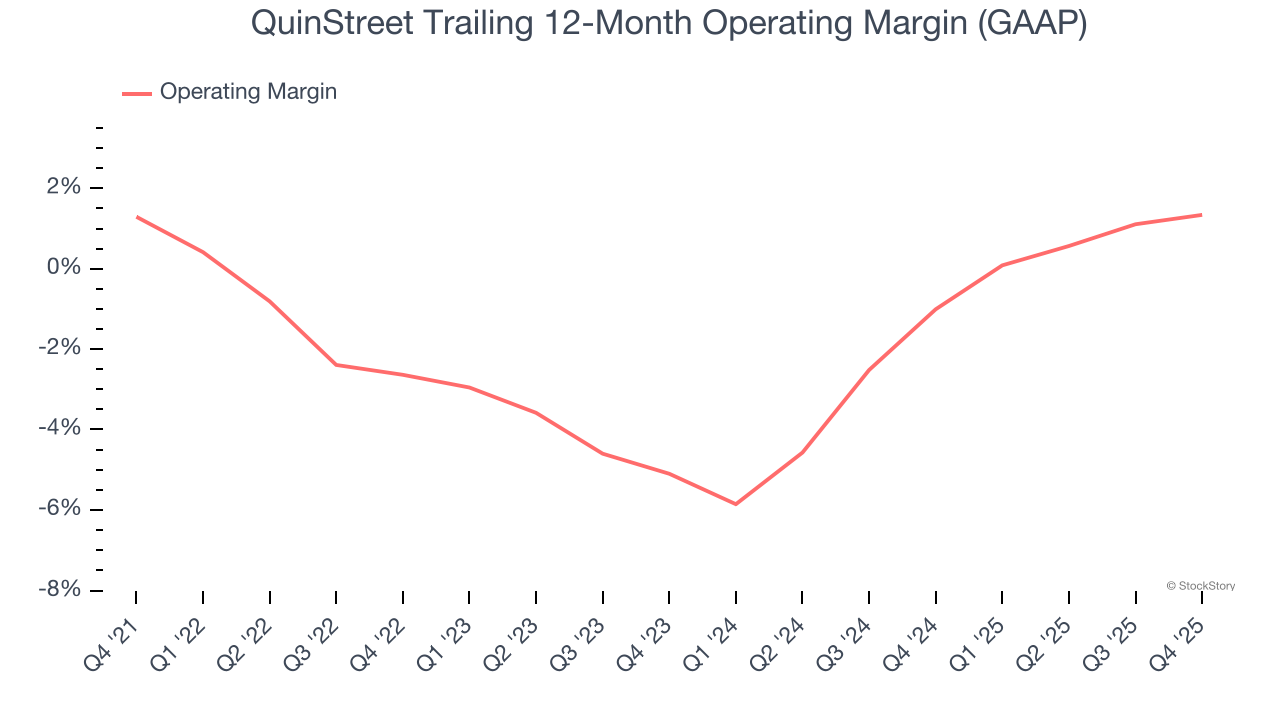

Operating Margin

QuinStreet’s operating margin has risen over the last 12 months, leading to break even profits over the last five years. Although this result isn’t exceptional, we can see its elite revenue growth is giving it operating leverage as it scales. This gives it a shot at long-term profitability if it can keep expanding.

Analyzing the trend in its profitability, QuinStreet’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, QuinStreet’s breakeven margin was 0.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

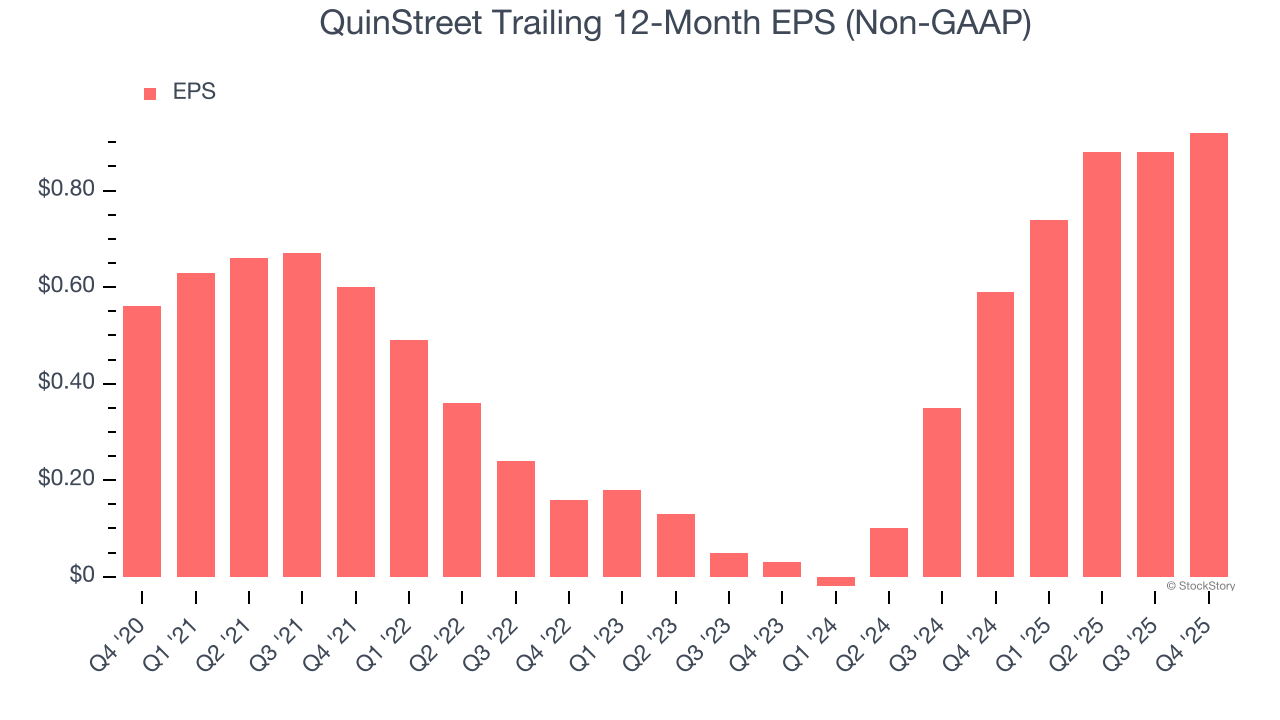

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

QuinStreet’s EPS grew at a solid 10.4% compounded annual growth rate over the last five years. However, this performance was lower than its 16.3% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For QuinStreet, its two-year annual EPS growth of 454% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, QuinStreet reported adjusted EPS of $0.24, up from $0.20 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects QuinStreet’s full-year EPS of $0.92 to grow 43.4%.

Key Takeaways from QuinStreet’s Q4 Results

It was good to see QuinStreet beat analysts’ EPS expectations this quarter. We were also glad its revenue guidance for next quarter trumped Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 1.6% to $11.24 immediately after reporting.

Sure, QuinStreet had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).