Global music entertainment company Warner Music Group (NASDAQ: WMG) announced better-than-expected revenue in Q4 CY2025, with sales up 10.4% year on year to $1.84 billion. Its GAAP profit of $0.33 per share was 7% below analysts’ consensus estimates.

Is now the time to buy Warner Music Group? Find out by accessing our full research report, it’s free.

Warner Music Group (WMG) Q4 CY2025 Highlights:

- Revenue: $1.84 billion vs analyst estimates of $1.77 billion (10.4% year-on-year growth, 4.1% beat)

- EPS (GAAP): $0.33 vs analyst expectations of $0.35 (7% miss)

- Adjusted EBITDA: $463 million vs analyst estimates of $407.6 million (25.2% margin, 13.6% beat)

- Operating Margin: 15.7%, up from 12.8% in the same quarter last year

- Free Cash Flow Margin: 22.8%, up from 17.8% in the same quarter last year

- Market Capitalization: $14.73 billion

Company Overview

Launching the careers of legendary artists like Frank Sinatra, Warner Music Group (NASDAQ: WMG) is a music company managing a diverse portfolio of artists, recordings, and music publishing services worldwide.

Revenue Growth

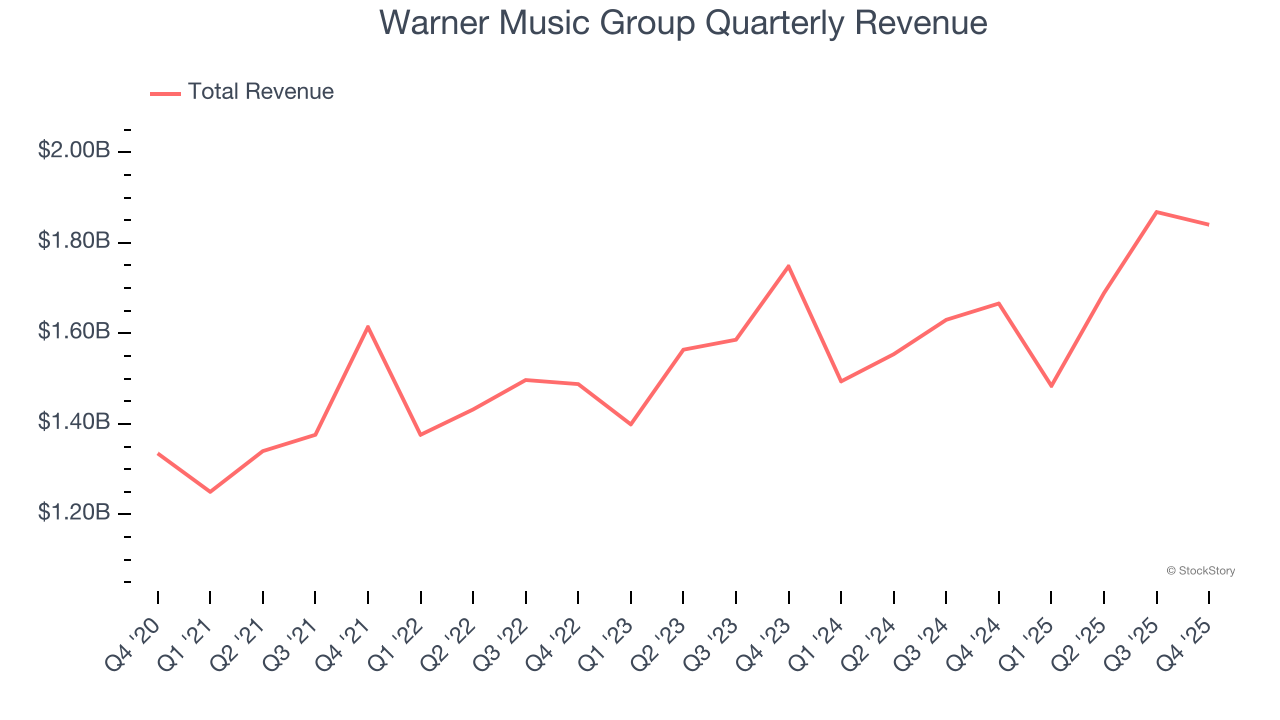

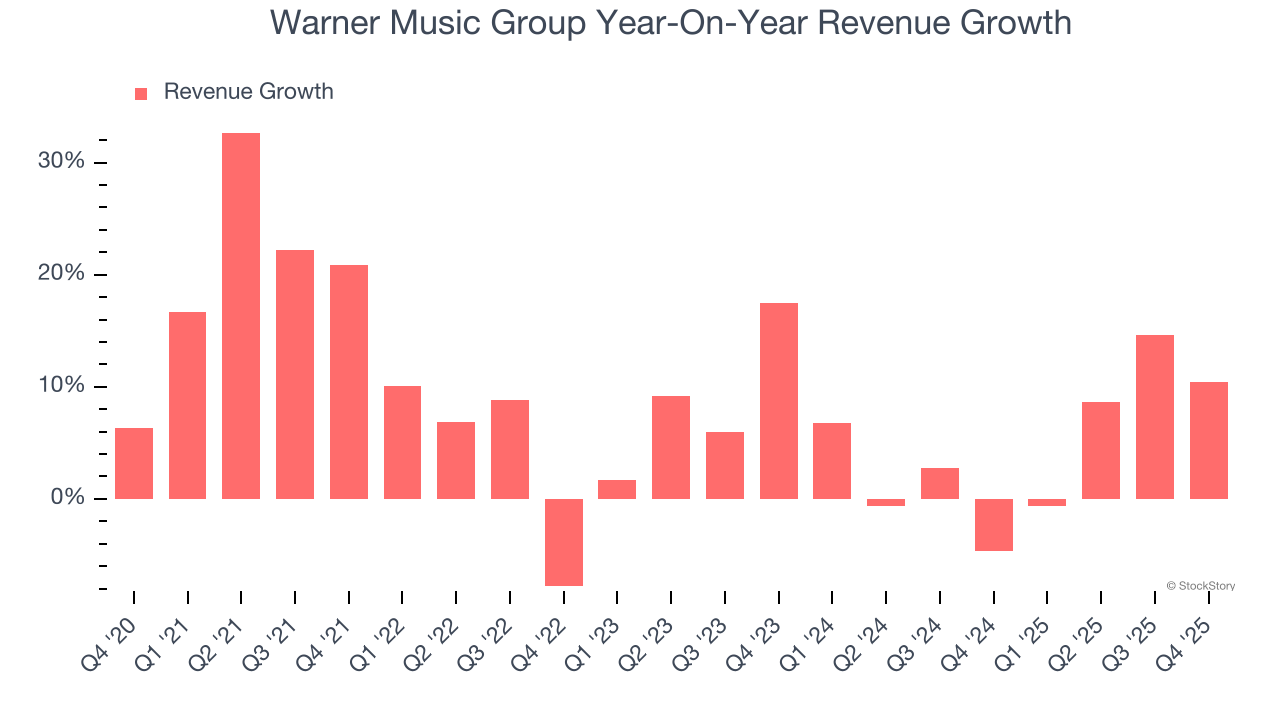

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Warner Music Group grew its sales at a weak 8.7% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Warner Music Group’s recent performance shows its demand has slowed as its annualized revenue growth of 4.5% over the last two years was below its five-year trend.

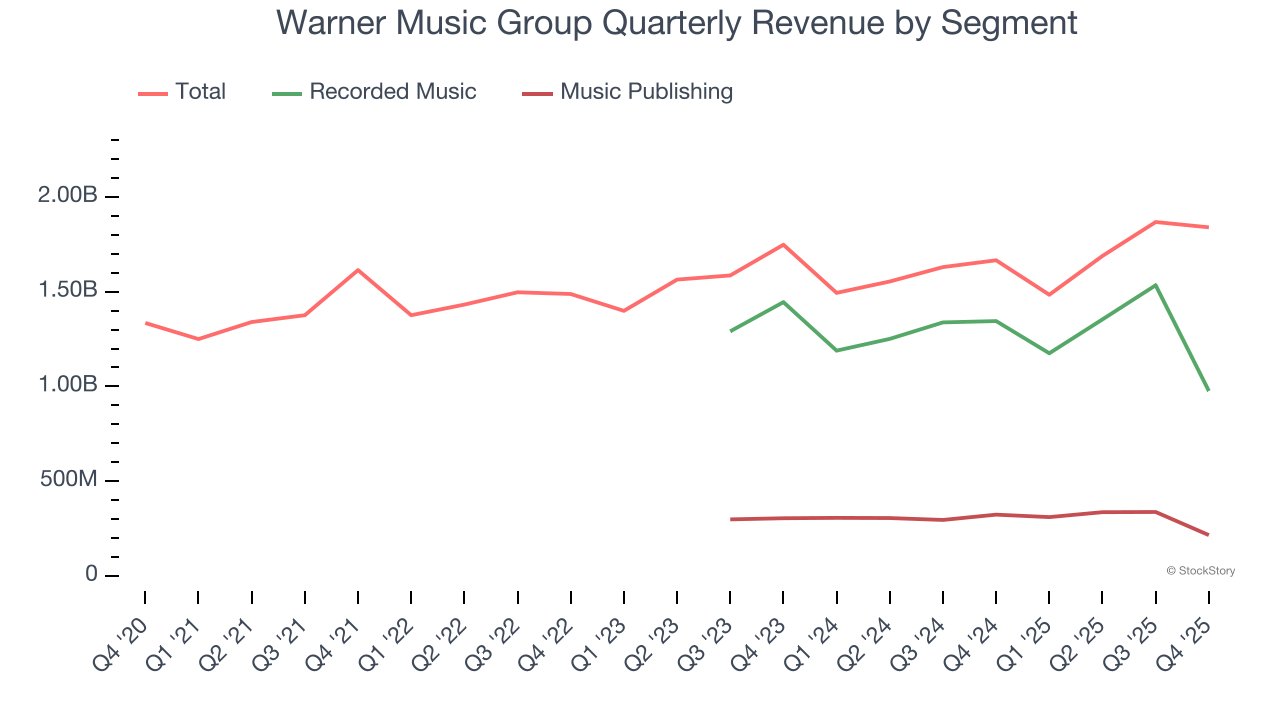

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Recorded Music and Music Publishing, which are 53% and 11.7% of revenue. Over the last two years, Warner Music Group’s Recorded Music revenue (new music production) averaged 1.5% year-on-year declines while its Music Publishing revenue (royalties from catalog music) was flat.

This quarter, Warner Music Group reported year-on-year revenue growth of 10.4%, and its $1.84 billion of revenue exceeded Wall Street’s estimates by 4.1%.

Looking ahead, sell-side analysts expect revenue to grow 3.6% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and indicates its newer products and services will not lead to better top-line performance yet.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

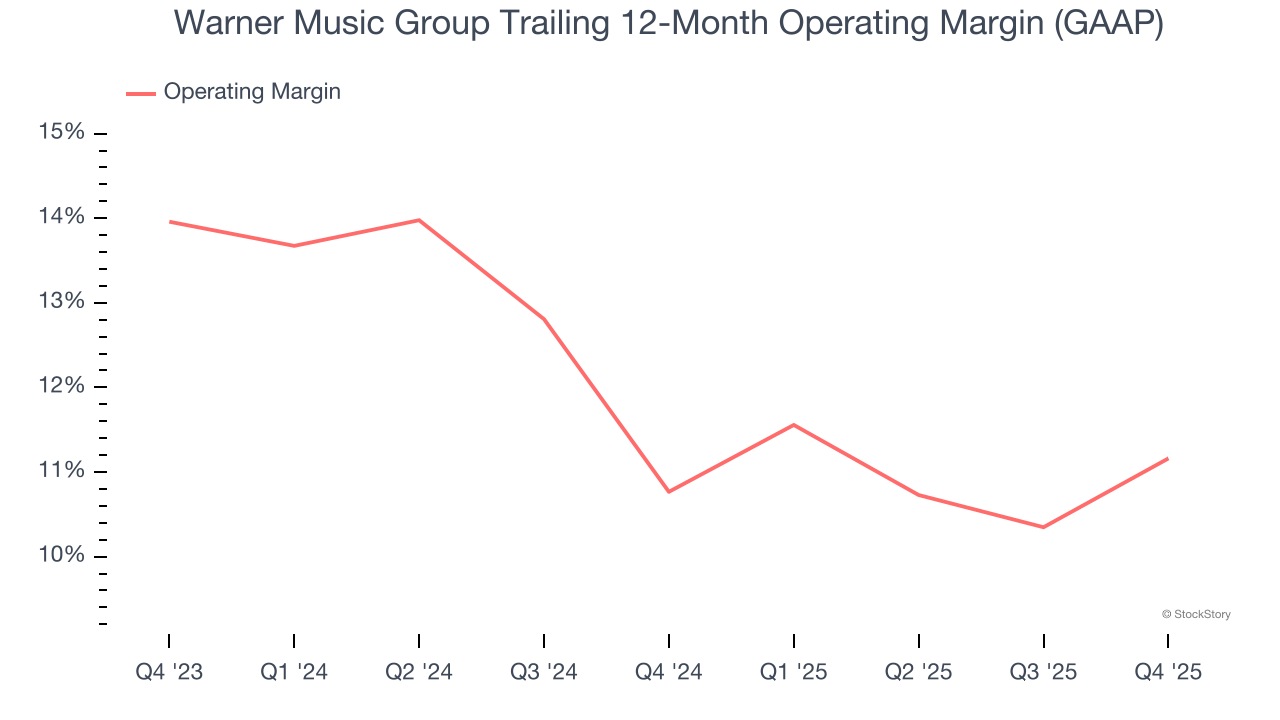

Warner Music Group’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 11% over the last two years. This profitability was inadequate for a consumer discretionary business and caused by its suboptimal cost structure.

This quarter, Warner Music Group generated an operating margin profit margin of 15.7%, up 2.8 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

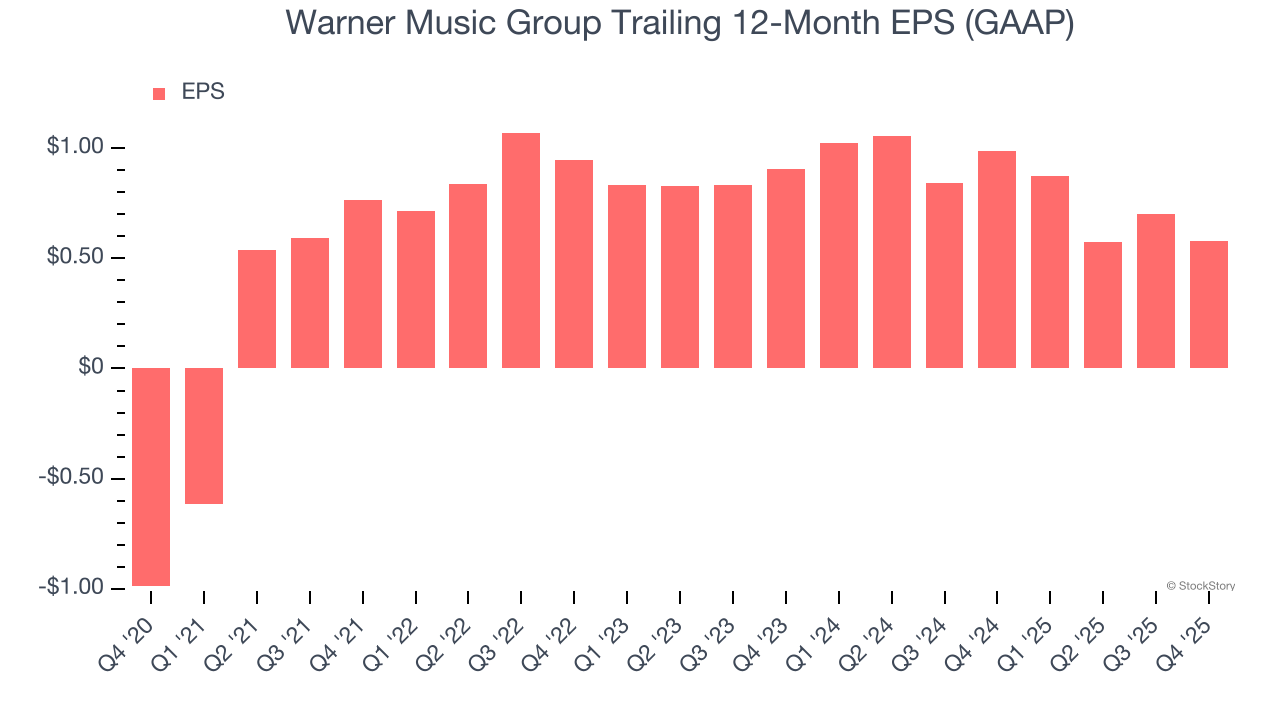

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Warner Music Group’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Warner Music Group reported EPS of $0.33, down from $0.46 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Warner Music Group’s full-year EPS of $0.58 to grow 152%.

Key Takeaways from Warner Music Group’s Q4 Results

We enjoyed seeing Warner Music Group beat analysts’ EBITDA expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its EPS missed. Overall, this print had some key positives. The stock remained flat at $27.92 immediately after reporting.

So do we think Warner Music Group is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).