The recent insider selling activity at JPMorgan Chase & Co. (NYSE: JPM), a leading banking and financial institution, has drawn notable attention, with CEO Jamie Dimon making his first-ever stock sale since assuming leadership 18 years ago.

Dimon sold approximately $150 million worth of shares, representing about 822,000 shares, while still retaining about 7.7 million shares in the company. Under Dimon's tenure, which began in 2006, the company's assets and stock value have tripled, with record profits reported and sustained value being delivered to shareholders.

The CEO cited financial diversification and tax planning as reasons for the sale, expressing confidence in the company's strong prospects. Additional insider sales were observed, including by other top executives such as general counsel member Stacey Friedman and insider Lori Beer, indicating a broader trend within the company.

So amidst the recent insider selling, with the financial giant up an impressive 7.82% year-to-date and almost 30% over the previous year, is now a time to be cautious on the stock? Let’s take a closer look.

Snapshot of JPMorgan & Co.

JPMorgan Chase & Co. is the largest bank in the US and the 5th largest worldwide. It resulted from mergers, with its oldest predecessor, The Bank of The Manhattan Company, founded in 1799. Operating through four segments, it offers services across 48 US states and globally through branches, ATMs, online, mobile, and telephone.

The company recently reported its earnings, falling short of analysts' expectations with $3.04 earnings per share for the quarter, compared to the anticipated $3.73. Despite revenue of $38.57 billion, slightly below the consensus estimate of $39.73 billion, the company saw an 11.7% increase year-over-year.

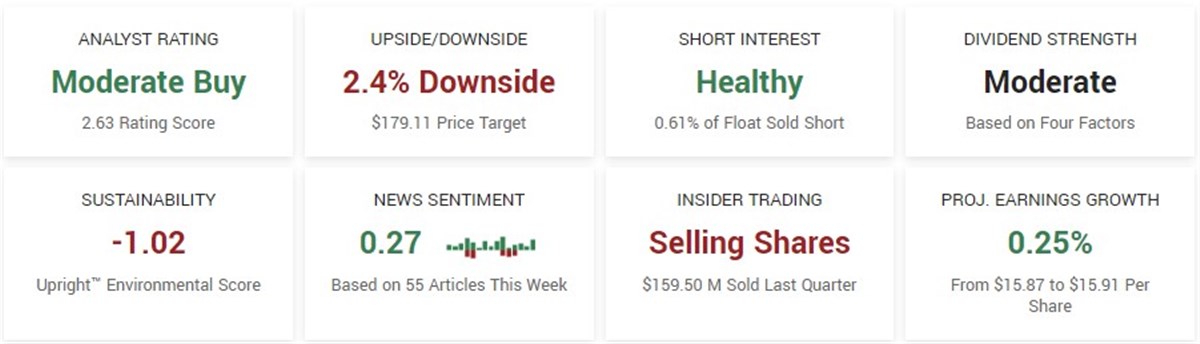

With a trailing twelve-month earnings per share of $16.22 and a price-to-earnings ratio of 11.3, JPMorgan Chase & Co. is projected to experience a modest 0.25% earnings growth in the upcoming year, from $15.87 to $15.91 per share.

A technical perspective

While insider selling has made headlines and perhaps even shocked a few investors and stakeholders, one couldn’t tell from the chart.

On a higher timeframe, the banking giant's shares have been in a steady uptrend, trading firmly above its key Simple Moving Averages (SMAs). More recently, the stock is up almost 8% this year and close to 30% over the previous year. The insider selling news has had little to no impact on the stock, with the stock up almost 6.5% over the month.

So, while the news made several headlines, the market was not concerned at all by the selling.

It is worth noting, however, that JPM currently has an RSI of 73.71, placing it in overbought territory. The stock is also beginning to extend from its rising 50- and 200-day SMAs, hinting at overbought conditions and making it susceptible to a pullback.

Analysts remain bullish

The company has a moderate buy rating based on nineteen analyst ratings. Notably, this consensus rating is greater than other finance companies in the S&P 500, with a consensus of hold, and the S&P 500 consensus rating is also a hold rating.

While the rating is comparatively bullish, the consensus price target is not. The consensus price target forecasts downside for the first time in over a year. Analysts’ consensus price target of $179.11 forecasts a 2.36% downside for JPM.

However, sticking with the bullish rating, recent analyst actions have been favorable. On February 1, The Goldman Sachs Group reiterated its rating as a buy. On January 30, both Oppenheimer and Morgan Stanley boosted their targets, with the former raising its target to $238 and the latter to $221, both forecasting significant upside potential.