Fresh produce company Calavo Growers (NASDAQ: CVGW) reported Q3 CY2024 results exceeding the market’s revenue expectations, but sales fell by 29.5% year on year to $170 million. Its non-GAAP profit of $0.05 per share was 83.1% below analysts’ consensus estimates.

Is now the time to buy Calavo? Find out by accessing our full research report, it’s free.

Calavo (CVGW) Q3 CY2024 Highlights:

- Revenue: $170 million vs analyst estimates of $161.9 million (29.5% year-on-year decline, 5% beat)

- Adjusted EPS: $0.05 vs analyst expectations of $0.30 (large miss)

- Adjusted EBITDA: $6.69 million vs analyst estimates of $10.93 million (3.9% margin, miss)

- Operating Margin: 1.8%, up from 0.1% in the same quarter last year

- Market Capitalization: $419.6 million

Management Commentary “We made good progress in 2024 improving our financial performance and executing our strategy,” said Lee Cole, President and Chief Executive Officer of Calavo Growers, Inc.

Company Overview

A trailblazer in the avocado industry, Calavo Growers (NASDAQ: CVGW) is a pioneering California-based provider of high-quality avocados and other fresh food products.

Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years.

Calavo is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage.

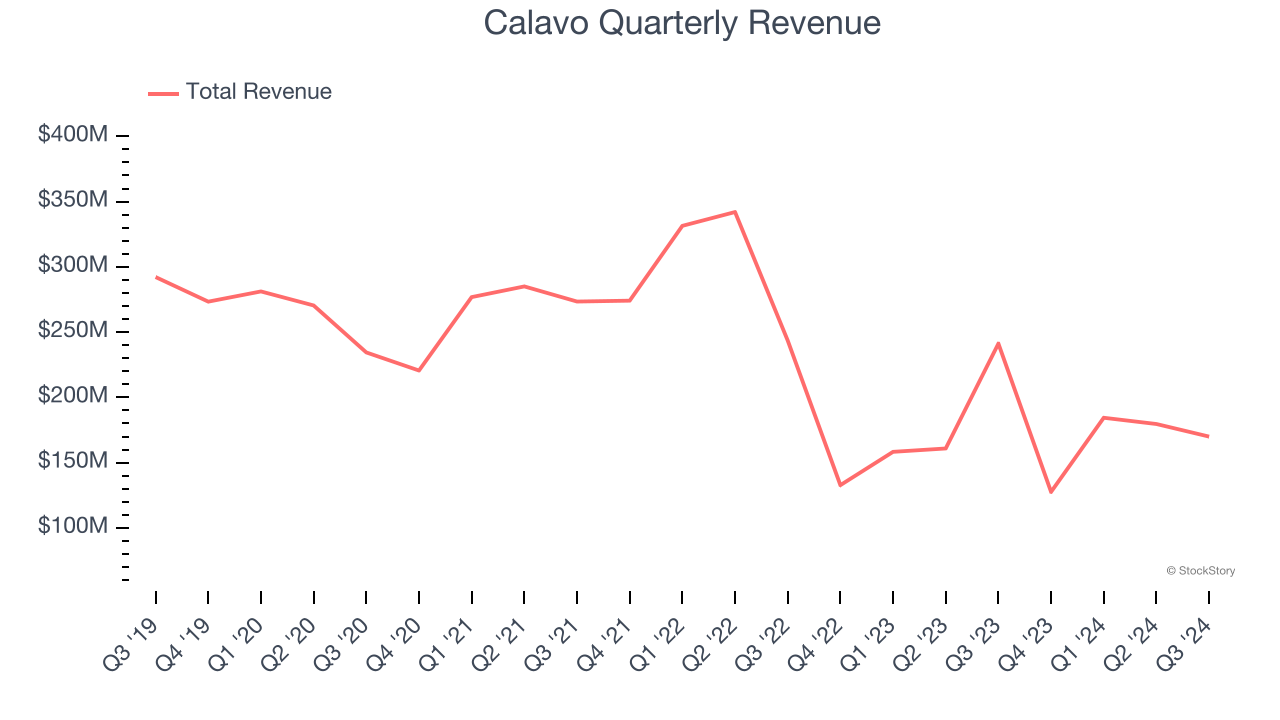

As you can see below, Calavo struggled to generate demand over the last three years. Its sales dropped by 14.4% annually, showing demand was weak. This is a tough starting point for our analysis.

This quarter, Calavo’s revenue fell by 29.5% year on year to $170 million but beat Wall Street’s estimates by 5%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection suggests its newer products will fuel better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

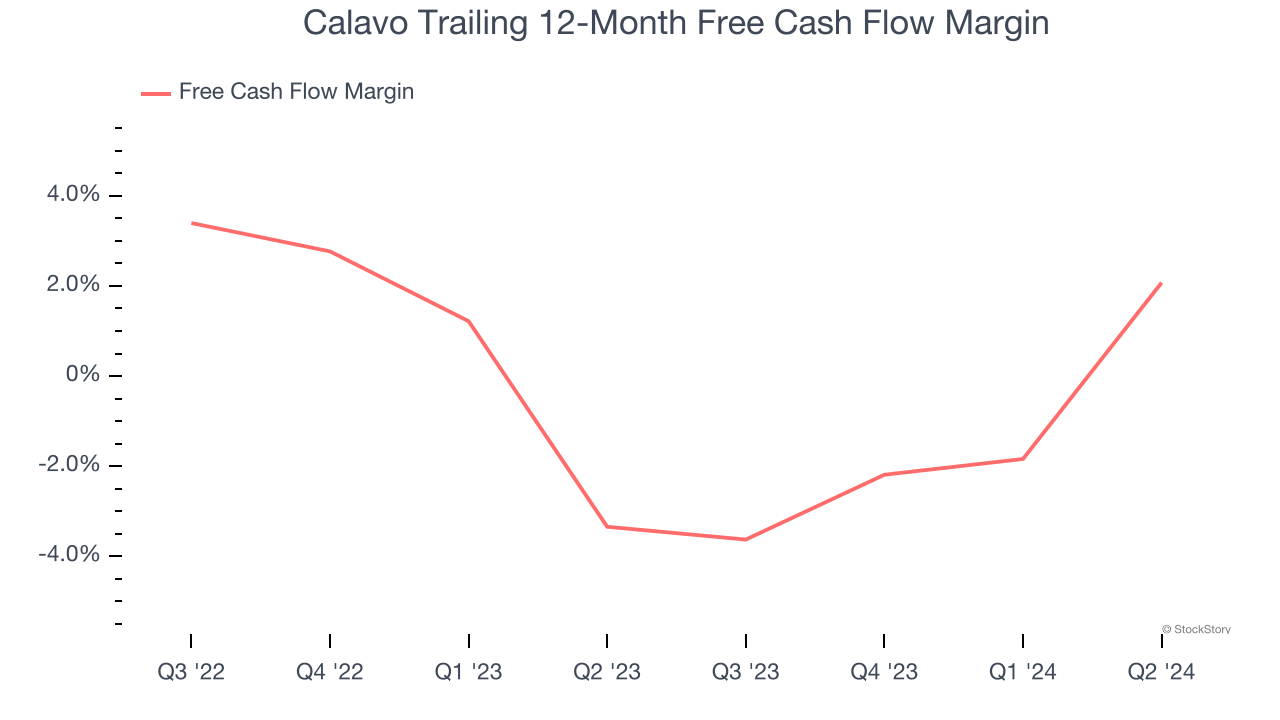

Calavo’s demanding reinvestments have consumed many resources over the last two years, contributing to an average free cash flow margin of negative 1.2%. This means it lit $1.19 of cash on fire for every $100 in revenue.

Key Takeaways from Calavo’s Q3 Results

We enjoyed seeing Calavo exceed analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed significantly and its gross margin fell short of Wall Street’s estimates. The company blamed both higher fruit costs as well as higher compensation expenses. Overall, this quarter could have been better. The stock traded down 7.7% to $22.30 immediately following the results.

Calavo’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.