Veritex Holdings has had an impressive run over the past six months as its shares have beaten the S&P 500 by 5.7%. The stock now trades at $27.52, marking a 12.6% gain. This performance may have investors wondering how to approach the situation.

Is now the time to buy Veritex Holdings, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Veritex Holdings Not Exciting?

We’re happy investors have made money, but we don't have much confidence in Veritex Holdings. Here are three reasons why there are better opportunities than VBTX and a stock we'd rather own.

1. Revenue Tumbling Downwards

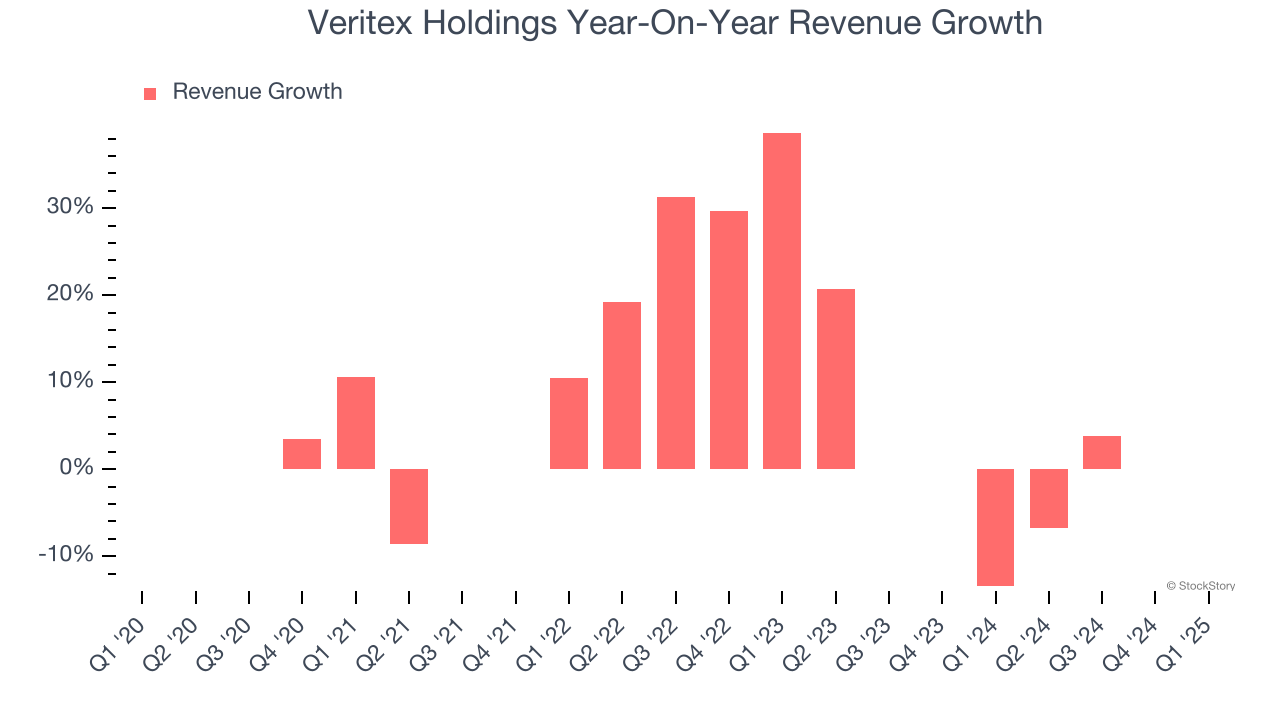

We at StockStory place the most emphasis on long-term growth, but within financials, a stretched historical view may miss recent interest rate changes, market returns, and industry trends. Veritex Holdings’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 1.7% over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

2. Projected Net Interest Income Growth Is Slim

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Veritex Holdings’s net interest income to rise by 2.6%.

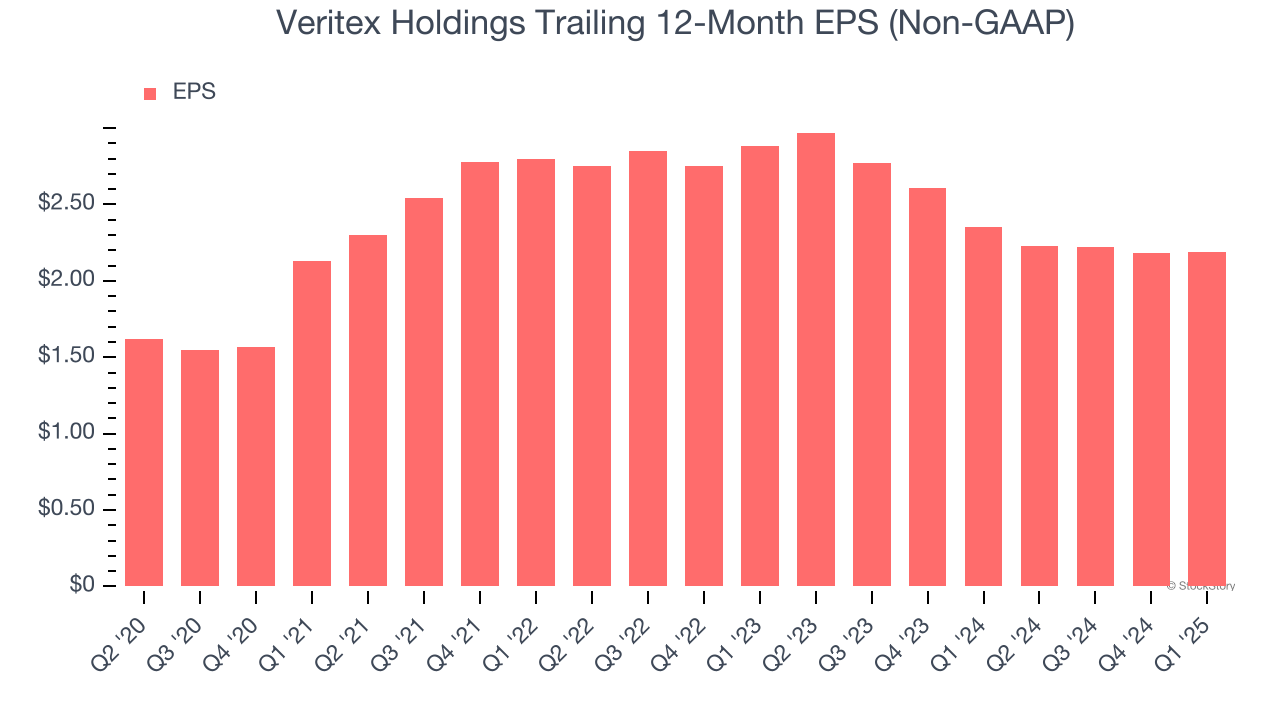

3. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Veritex Holdings, its EPS declined by more than its revenue over the last two years, dropping 12.8%. This tells us the company struggled to adjust to shrinking demand.

Final Judgment

Veritex Holdings isn’t a terrible business, but it doesn’t pass our bar. With its shares topping the market in recent months, the stock trades at 0.9× forward P/B (or $27.52 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. Let us point you toward the Amazon and PayPal of Latin America.

Stocks We Would Buy Instead of Veritex Holdings

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.