In its latest reported quarter, Yelp Inc. (YELP) achieved an unprecedented peak in net revenue bolstered by a record-breaking increase in advertising revenue across all categories.

The company saw its net revenue grow 13% year-over-year, setting a record while broadening its net income margin and adjusted EBITDA margin by two percentage points each over the previous year’s period. YELP also boosted its outlook for the full year on strong local advertising demand.

“As we remain focused on enhancing our already strong product pipeline, we’re confident in our ability to gain market share and deliver long-term shareholder value,” said Jeremy Stoppelman, Yelp’s co-founder and chief executive officer.

Despite a competitive landscape, Yelp appears to be in an advantageous position for expansion. I think investing in Yelp could yield profitable returns. Let’s delve deeper into some of the company’s key metrics.

Yelp Inc.’s Financial Performance: A Comprehensive Review from 2020 to 2023

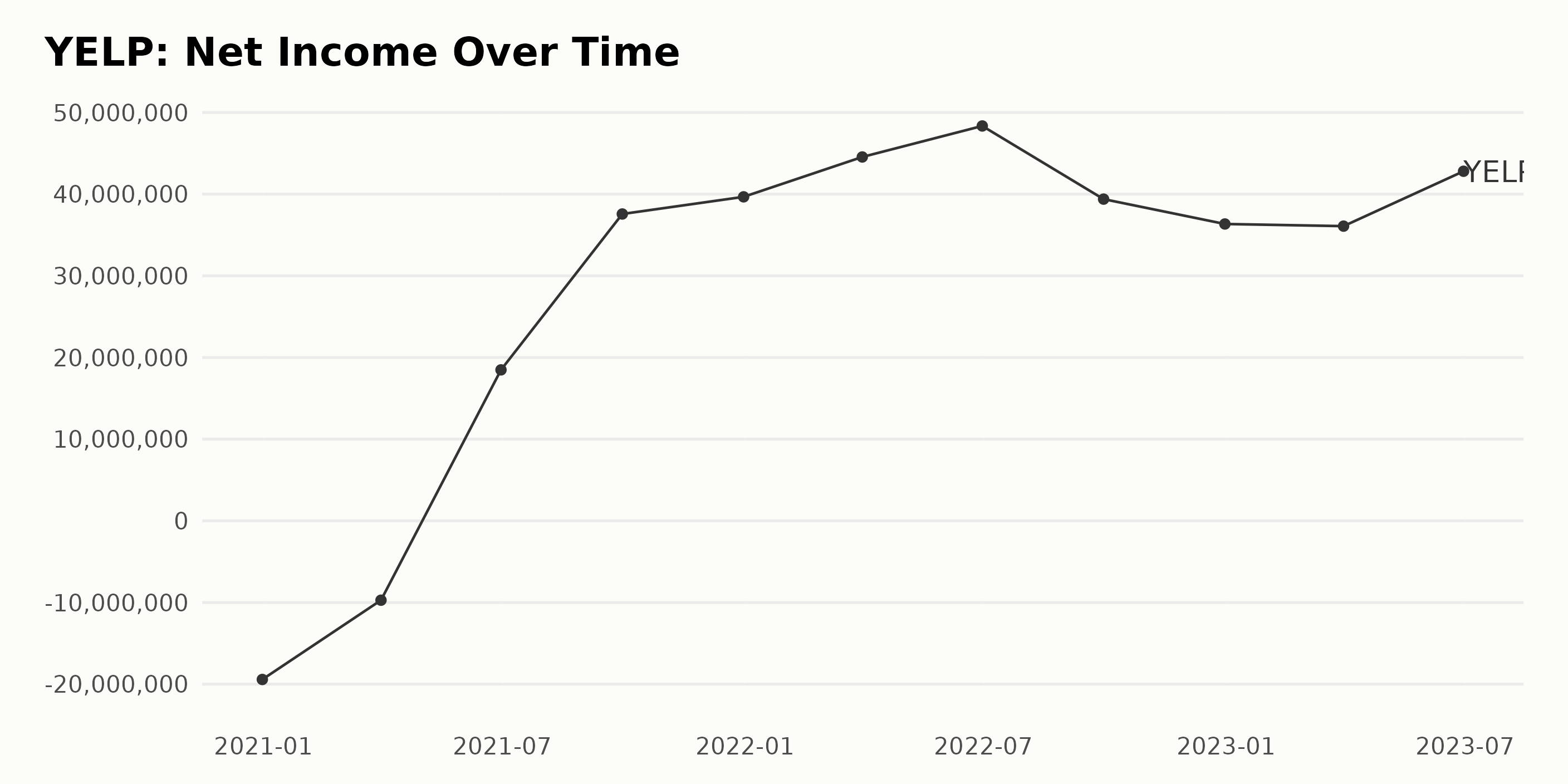

The trailing-12-month net income for YELP has displayed an overall positive trend from December 2020 to June 2023, with some noticeable fluctuations.

- In December 2020, the Net Income was reported at a negative $19.42 million.

- The income improved to a negative $9.72 million in March 2021.

- By June 2021, Yelp Inc. turned the deficit into a net income of $18.49 million.

- This upward trend continued, and by September 2021, Yelp Inc.’s net income soared to $37.57 million, more than doubling the previous quarter’s figure.

- The income increased marginally to $39.67 million by December 2021.

- There was a series of growth from the end of 2021 through mid-2022, with the income peaking at $48.35 million in June 2022.

- A slight decline was observed in September 2022, with a net income of $39.92 million.

- The downward trend continued till the end of 2022, with December recording an income of $36.35 million.

- There was a minimal dip in March 2023 as the income fell slightly to $36.08 million.

- The latest update in June 2023 shows a rebound to $42.80 million.

From an overarching perspective, YELP net income demonstrated resilience by transforming from a deficit in 2020 to a profitable status in 2023. The growth from negative $19.42 million in December 2020 to the last value of $42.80 million in June 2023 shows a significant turnaround.

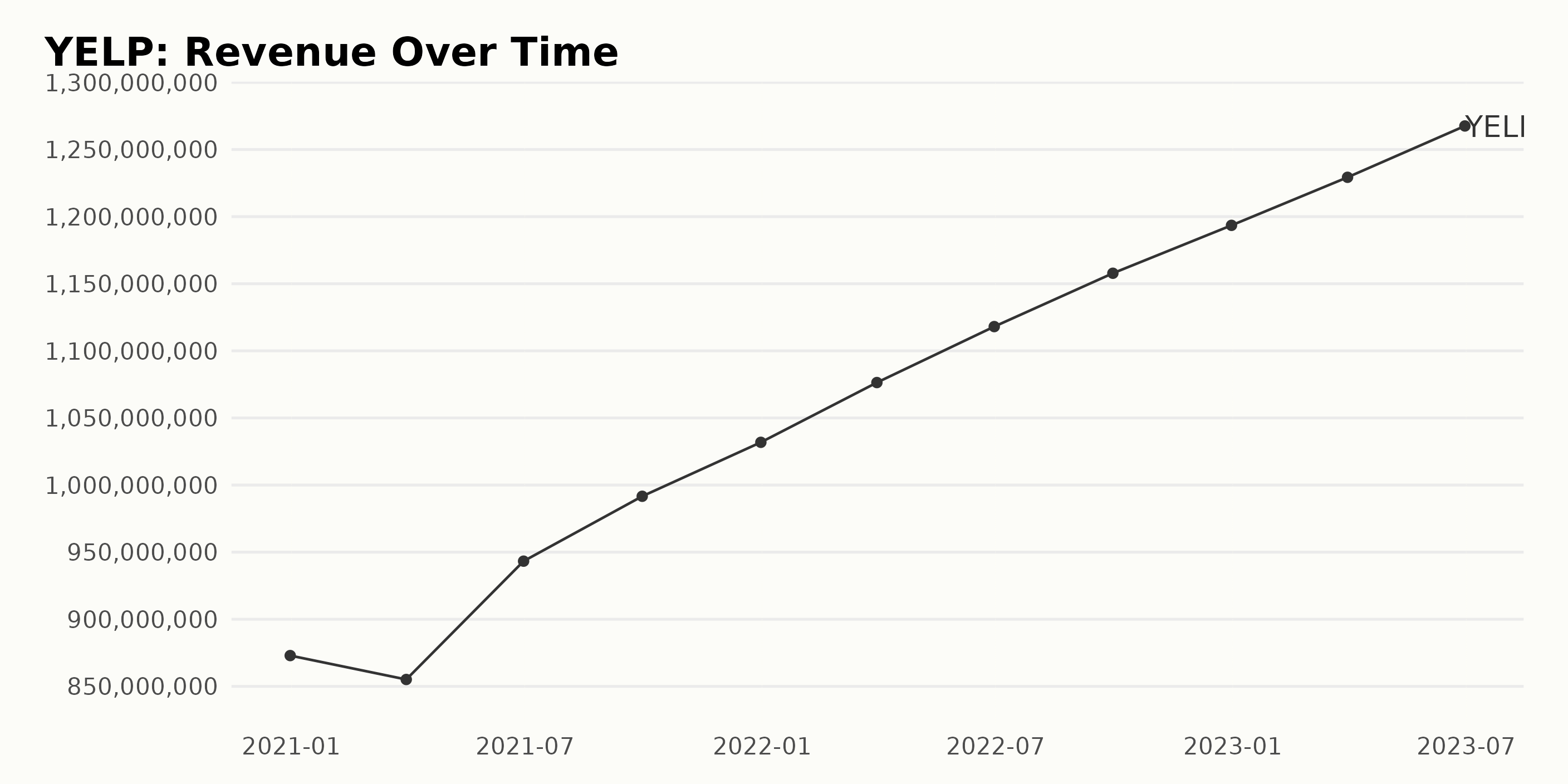

The data provided presents the trend and fluctuations of YELP’s trailing-12-month revenue from December 2020 to June 2023. Snapshot Summary:

- The gain in December 2020 was $872.93 million.

- A temporary dip was observed at the end of the first quarter of 2021, with revenue dropping to $855.13 million.

- Since the dip, the financial performance improved sequentially over the following quarters.

- From the second quarter of 2021 onwards, the company successively increased its revenue, reaching $1.19 billion by the end of 2022.

- Expansion carried on into 2023, with revenue amounts of $1.23 billion and $1.27 billion in the first quarter and second quarter, respectively.

Growth Rate Calculation: Looking at the growth rate, measured as the percentage change from the first to the last value in this series, Yelp Inc. displayed substantial growth in its revenue from December 2020 to June 2023. The revenue grew from $872.93 million to $1.27 billion, indicating an increase of approximately 45%. This demonstrates a generally rising revenue trend for YELP over the period under analysis, despite short-term fluctuations.

Recent Emphasis: While positive growth has been recorded throughout, the more recent data shows heightened momentum - from the start of 2022 onwards, Yelp Inc. consistently reported Revenue acceleration quarter-by-quarter, indicative of robust financial performance. In the second quarter of 2023, Yelp reported its highest-ever Revenue of $1.27 billion. In conclusion, Yelp’s Revenue has seen a positive trajectory with consistent growth from 2020 to 2023. The data suggests the business is on an upward trend, reporting increasingly higher Revenue figures each quarter - an encouraging sign demonstrating continued financial improvement for Yelp Inc.

Here is the summary of YELP’s Return on Assets (ROA) from late 2020 to mid-2023, based on the given data: Key Trend: The main trend over this period was an overall increase in ROA. Yelp Inc.’s ROA went from -0.017 in December 2020 to 0.042 in June 2023. This indicates a substantive turnaround in the company’s asset profitability over the given period. Fluctuations: Despite the overall upward trend, Yelp’s ROA presented some fluctuations:

- The ROA value increased consistently until June 2022. The highest peak during this period was 0.046 in June 2022.

- A slight decrease was observed between June and December 2022, as the ROA dropped from 0.046 to 0.035.

- From December 2022, the ROA remained stable at 0.035 till March 2023 before showing an increase again in June 2023.

Growth Rate: Calculating from the first value to the last, the growth rate of Yelp Inc.’s ROA over this period was approximately 347%. Latest Value: The most recent value in the series being June 2023 displayed the ROA as 0.042, indicating a slight recovery following the earlier dip at the end of 2022. Remember, Yelp Inc.’s financial health and profitability have improved notably over the analyzed period as indicated by the increasing trend in its ROA.

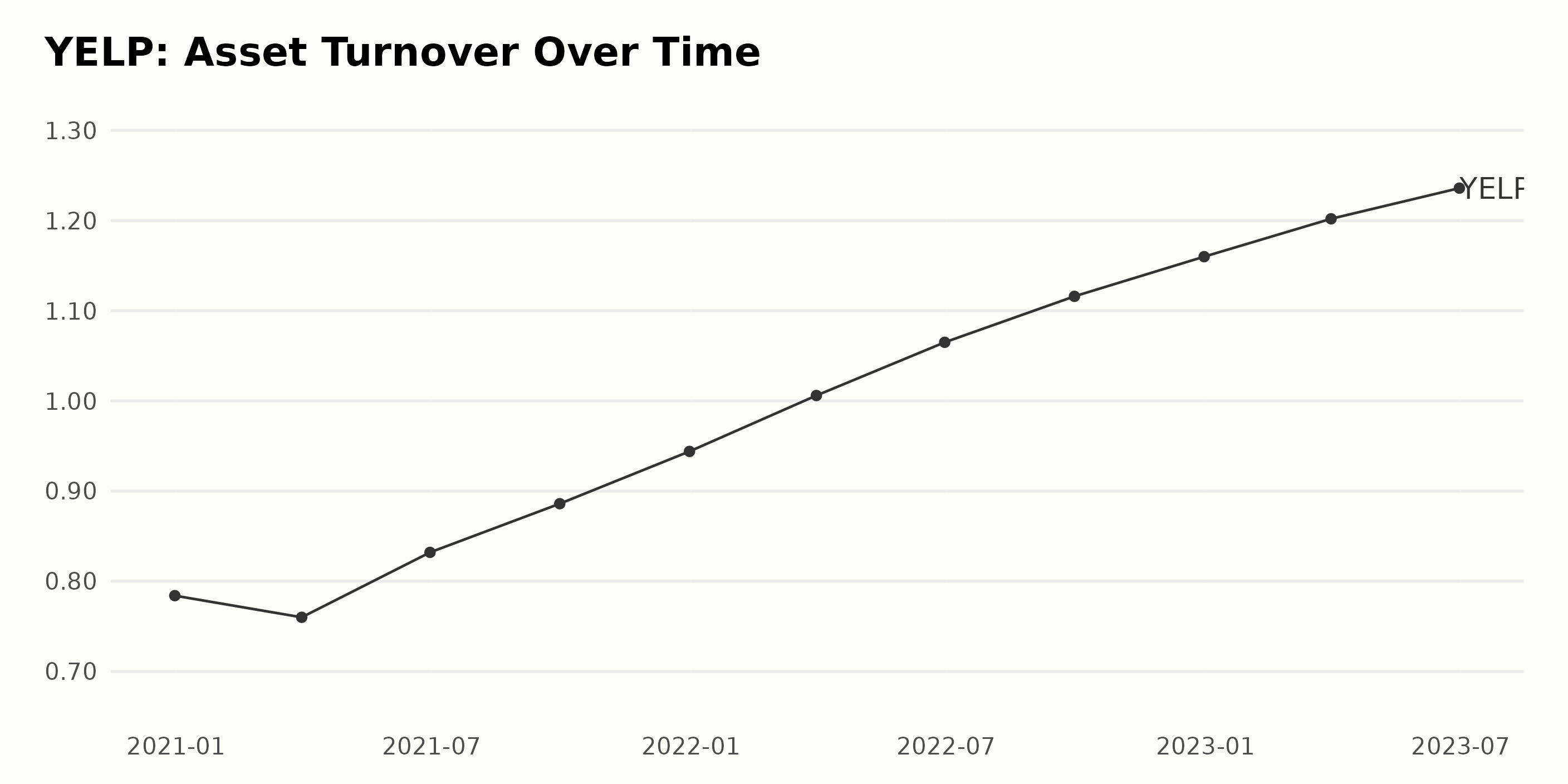

The trend and fluctuations of YELP’s Asset Turnover during the period from December 2020 to June 2023 demonstrate a consistent increase with minor fluctuations.

- As of December 2020, the Asset Turnover stood at 0.784.

- Following this, there was a slight dip in March 2021, with the value receding to 0.76.

- The trend shifted upwards from June 2021, recording an Asset Turnover of 0.832, and the company saw steady growth for the rest of the year, ending December 2021 at 0.944.

- For the year 2022, Yelp continued its positive trajectory, starting at 1.006 Asset Turnover in March and finishing at 1.16 in December.

- Focusing on more recent data, the first half of 2023 has seen further growth, with March’s value standing at 1.202 and June reaching 1.236.

Between December 2020 and June 2023, the Asset Turnover grew by approximately 58%. Despite the occasional peaks and valleys, Yelp’s overall trend indicates an enhanced efficiency in using the company’s assets to generate sales over this period.

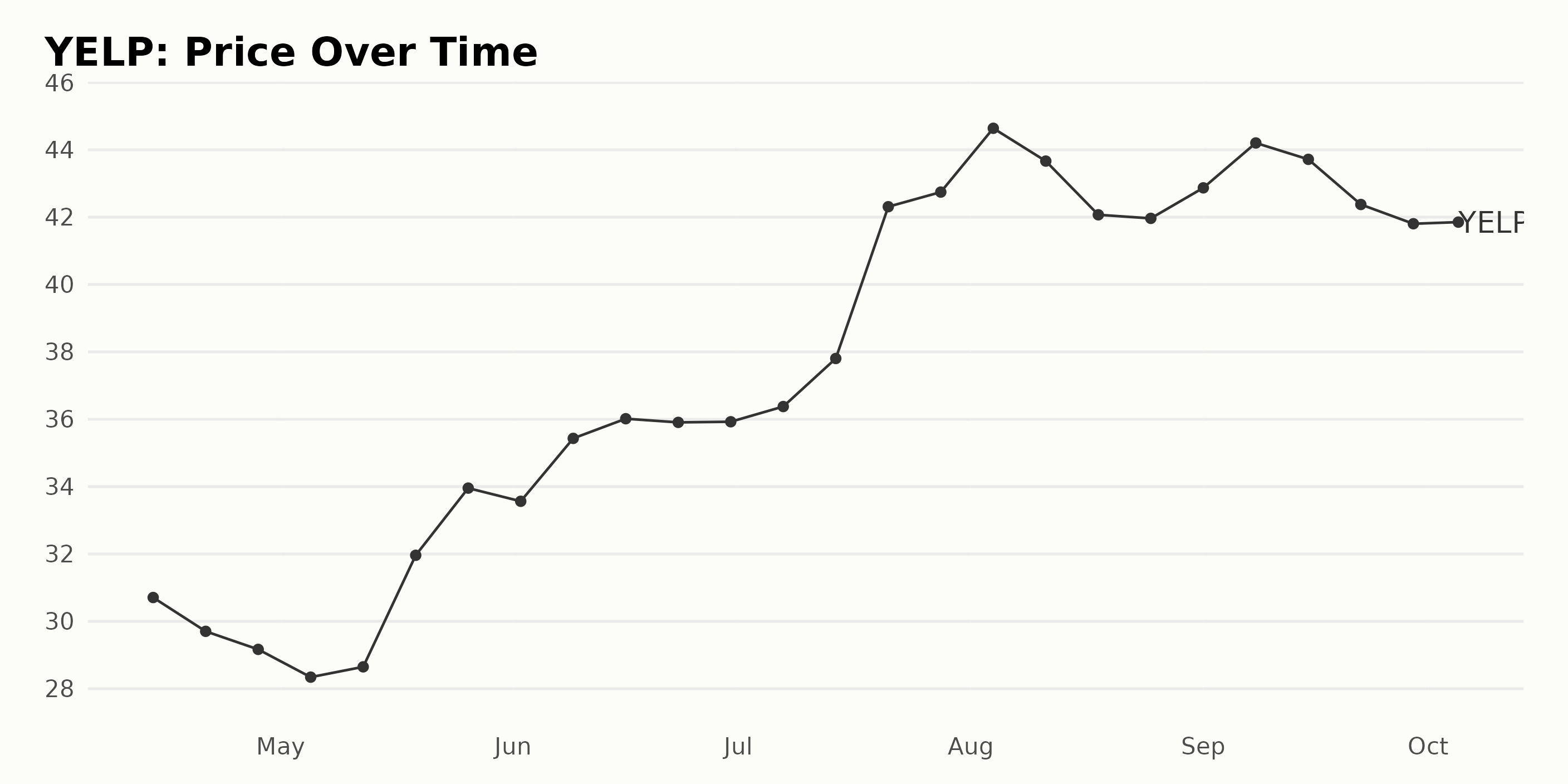

Yelp Inc.’s Share Price Journey: A Period of Fluctuation and Growth, April-October 2023

The data for YELP indicates a general increase in the share price, with some fluctuations, over a period from April 2023 to October 2023. Here’s a detailed breakdown:

- April 14, 2023: Beginning at $30.71

- April - May 2023: The share price saw a mild decrease before stabilizing at $28.34 by May 5th, followed by an increase to $31.96 by May 19.

- May - June 2023: The share price experienced steady growth during this month, culminating at $36.01 on June 16.

- June - July 2023: There was a slow but steady increase in share value throughout these months, becoming more pronounced by mid-July. Based on the data, we can observe an uptick trend with the share price reaching its peak of $42.74 by the end of July.

- August 2023: Share price peaked early on August 4th at $44.64, before experiencing a slight decline towards the end of the month.

- September - October 2023: Despite some fluctuations, the overall trend in September appears to be downward, carrying through to early October where it settled down to $41.85.

Therefore, in conclusion, the share price of Yelp Inc. appears to be on an upward trend from April, reaching their peak in August, before plateauing and finally experiencing a slight decline towards the end of the given time frame. Here is a chart of YELP’s price over the past 180 days.

Analyzing Yelp’s Performance: Growth, Quality and Value Trends (April-October 2023)

YELP has an overall A rating, translating to a Strong Buy in our POWR Ratings system. It is ranked first out of the 57 stocks in the Internet category.

In the POWR Ratings for YELP, the three most noteworthy dimensions over the given period - April to October 2023 - have been Growth, Quality, and Value. Below is a discussion of each’s performance.

Quality:

- This dimension consistently ranks the highest of the six, with a rating of 100 throughout the time period from April to October 2023.

Value:

- In April 2023, the value was rated at 96.

- By October 2023, there was a slight decrease to a rating of 85.

- The downward trend in the value metric shows a gradual decline over the period.

Growth:

- Starting with a rating of 57 in April 2023, the growth dimension showed a significant increase, reaching a rating of 99 by September 2023, where it remained until October.

- This sharp upward trend indicates substantial improvement in Yelp’s growth performance over this period.

It should be noted that while these trends are clear, they are part of a broader picture that would require considering all six dimensions of the POWR Ratings.

How does Yelp Inc. (YELP) Stack Up Against its Peers?

Other stocks in the Internet sector that may be worth considering are Travelzoo (TZOO), Despegar.com Corp. (DESP), and trivago N.V. (TRVG) -- they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

YELP shares were trading at $42.55 per share on Friday afternoon, up $0.91 (+2.19%). Year-to-date, YELP has gained 55.63%, versus a 13.94% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Can Yelp Inc. (YELP) Regain Its Stride in October? appeared first on StockNews.com