Louisville, Kentucky-based Brown-Forman Corporation (BF.B) manufactures, distills, bottles, imports, exports, markets, and sells various alcoholic beverages. Valued at $13.3 billion by market cap, the company’s products include branded whiskey, vodka, wines, tequila, bourbon, and gin.

Shares of this spirits giant have considerably underperformed the broader market over the past year. BF.B has declined 30.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 12.6%. In 2025, BF.B stock is down 26.2%, compared to the SPX’s 14.6% rise on a YTD basis.

Narrowing the focus, BF.B’s underperformance is also apparent compared to the Consumer Staples Select Sector SPDR Fund (XLP). The exchange-traded fund has declined about 4.4% over the past year. Moreover, the ETF’s 1.6% dip on a YTD basis outshines the stock’s double-digit losses over the same time frame.

BF.B's underperformance is due to the loss of revenue from the concluded business relationship with Korbel Champagne Cellars and the lack of a transition services agreement for Sonoma-Cutrer and Finlandia.

On Aug. 28, BF.B shares closed down by 4.9% after reporting its Q1 results. Its revenue stood at $924 million, down 2.8% year-over-year. The company’s EPS declined 12.2% from the year-ago quarter to $0.36.

For the current fiscal year, ending in April 2026, analysts expect BF.B’s EPS to decline 9.8% to $1.66 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters while missing the forecast on two other occasions.

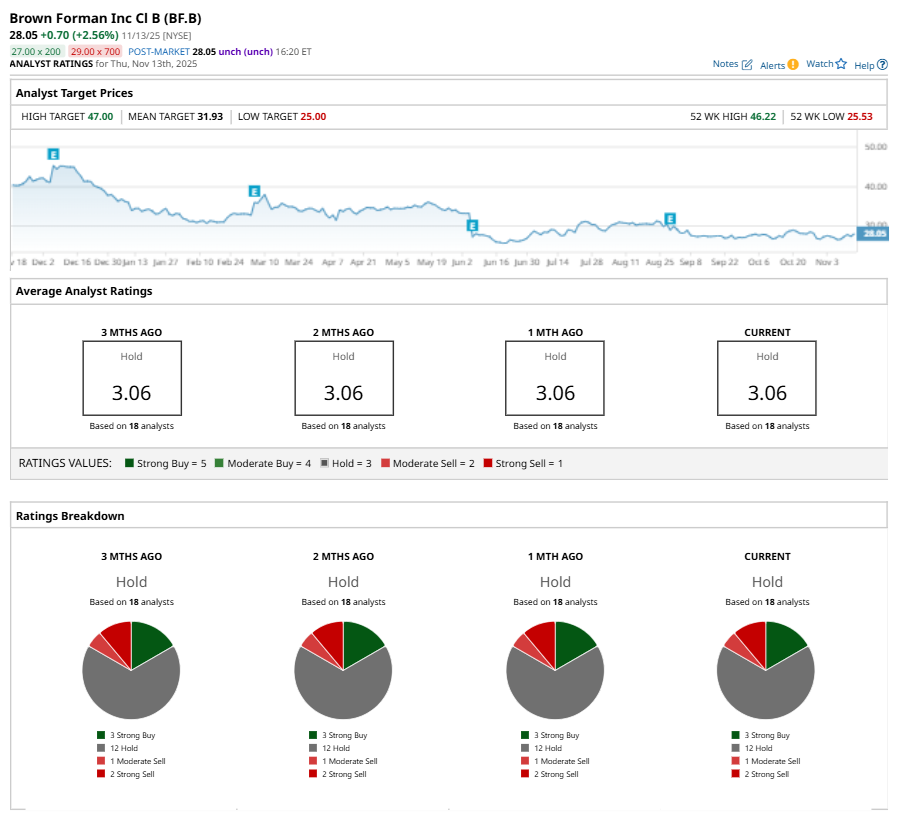

Among the 18 analysts covering BF.B stock, the consensus is a “Hold.” That’s based on three “Strong Buy” ratings, 12 “Holds,” one “Moderate Sell,” and two “Strong Sells.”

The configuration has been consistent over the past three months.

On Nov. 12, Citigroup Inc. (C) analyst Filippo Falorni maintained a “Hold” rating on BF.B and set a price target of $30, implying a potential upside of 7% from current levels.

The mean price target of $31.93 represents a 13.8% premium to BF.B’s current price levels. The Street-high price target of $47 suggests an ambitious upside potential of 67.6%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy the Post-Earnings Dip in Monday.com Stock?

- The ARKK ETF Is Leaking, and the Tech Stock Flood Could Reach Biblical Proportions. What Should You Do With Cathie Wood’s Fund Here?

- 1 Outperforming Growth Stock to Buy as the Government Shutdown Ends

- Stock Index Futures Plunge on Fed Rate-Cut Doubts and Valuation Concerns