Valued at a market cap of $27.5 billion, EMCOR Group, Inc. (EME) is a leading provider of mechanical, electrical, building automation, industrial, and energy infrastructure services. The Norwalk, Connecticut-based company’s capabilities span Heating, Ventilation, and Air Conditioning (HVAC), electrical construction, fire protection, energy-efficiency upgrades, and mission-critical facility services.

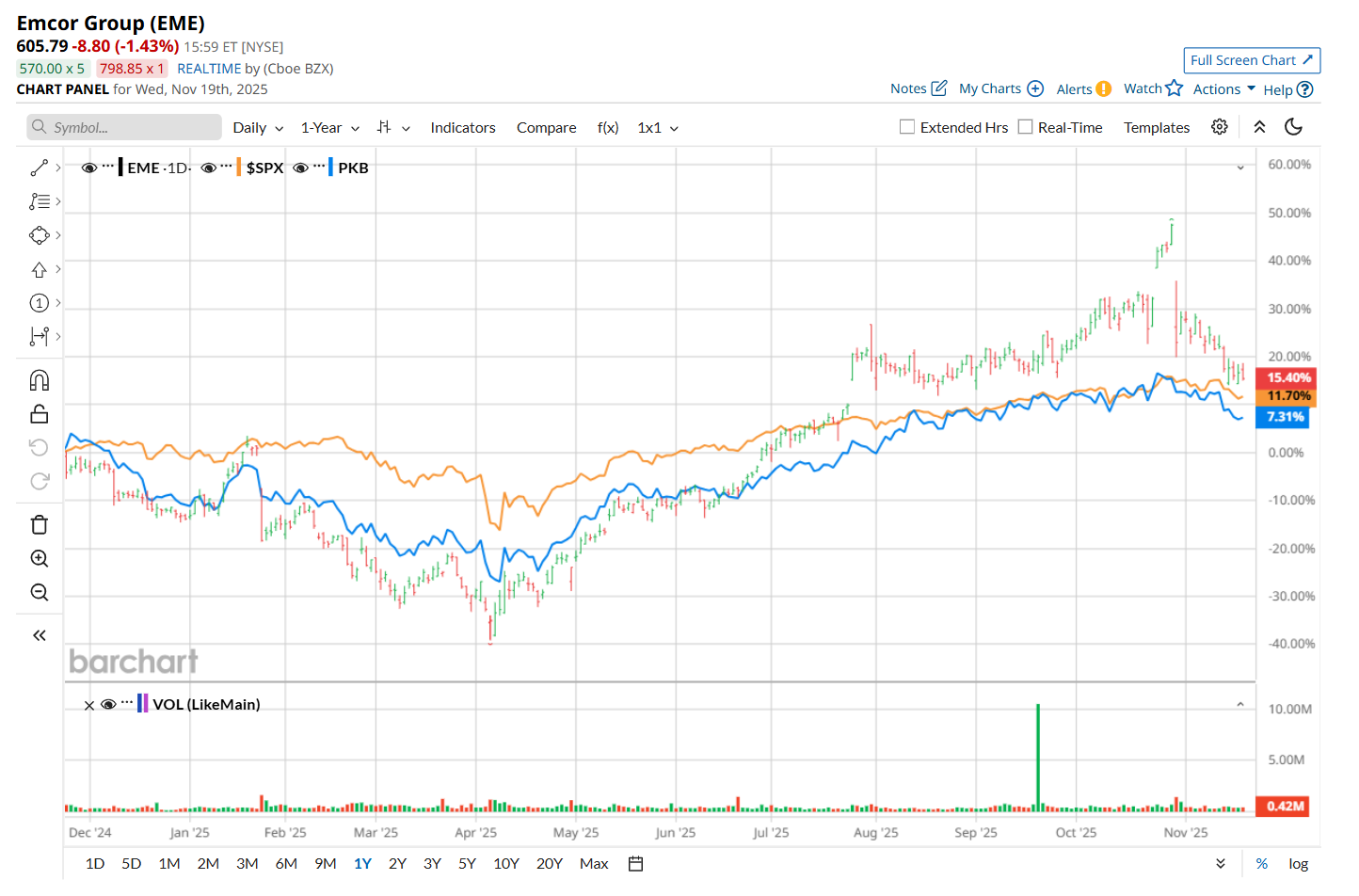

This industrial company has outpaced the broader market over the past 52 weeks. Shares of EME have rallied 18.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.1%. Moreover, on a YTD basis, the stock is up 34.5%, compared to SPX’s 12.8% return.

Zooming in further, EME has also outperformed the Invesco Building & Construction ETF’s (PKB) 8.9% uptick over the past 52 weeks and 20.8% YTD rise.

On Oct. 30, shares of EME crashed 16.6% after its Q3 earnings release. The company’s revenue advanced 16.4% year-over-year to $4.3 billion. Moreover, its Remaining Performance Obligations (RPOs) as of Sep. 30, 2025, reached a record $12.6 billion, supported by growth across most of the sectors it serves. However, while its EPS of $6.57 also increased 13.3% from the year-ago quarter, it missed the consensus estimates by 1.2%, lowering investor confidence in the stock.

For the current fiscal year, ending in December, analysts expect EME’s EPS to grow 17.3% year over year to $25.24. The company’s earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters, while missing on another occasion.

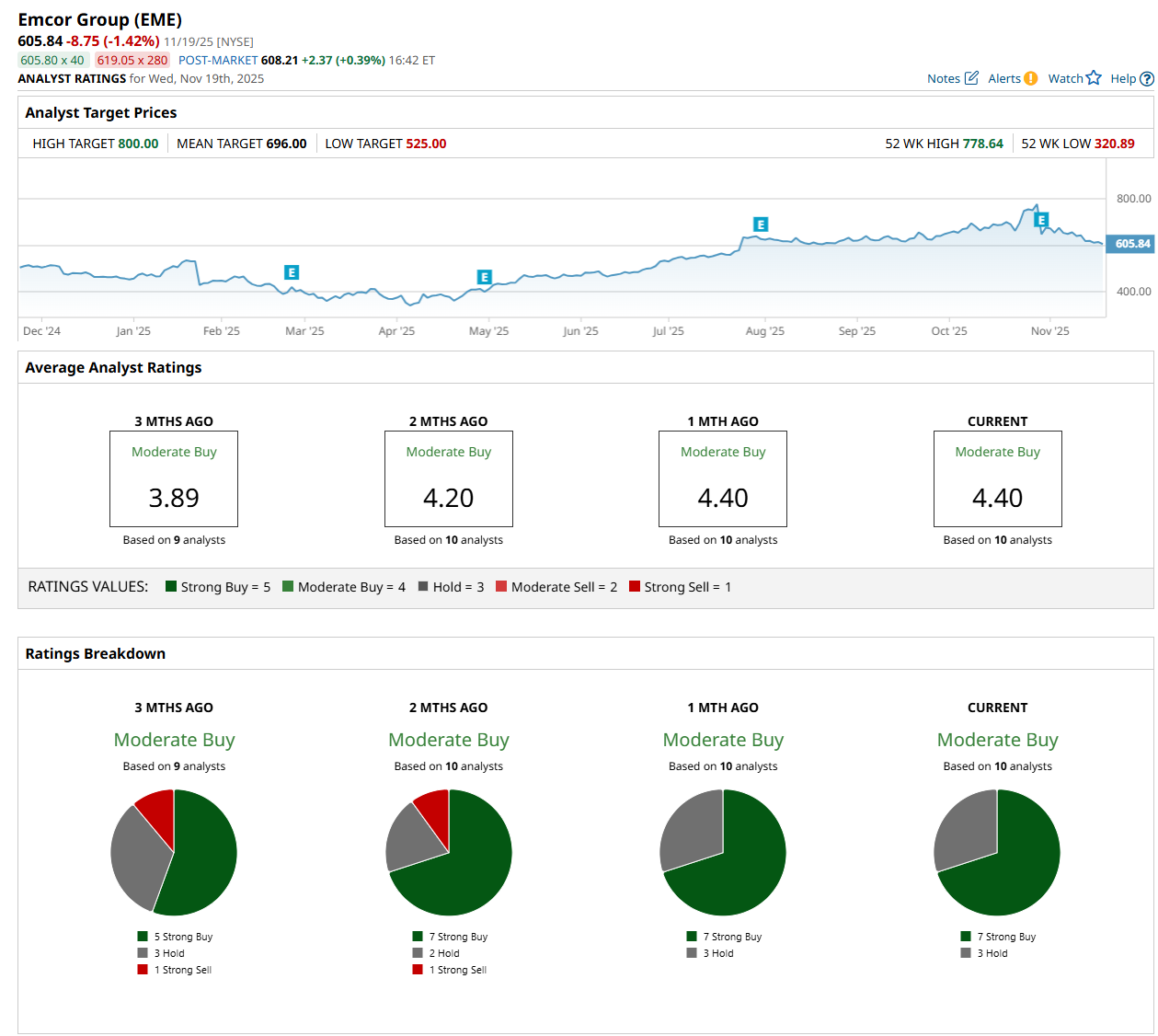

Among the 10 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on seven “Strong Buy” and three "Hold” ratings.

This configuration is more bullish than two months ago, with one analyst suggesting a “Strong Sell” rating.

On Oct. 31, Stifel Financial Corp. (SF) maintained a "Buy" rating on EME, but lowered its price target to $713, indicating a 17.7% potential upside from the current levels.

The mean price target of $696 represents a 14.9% premium from EME’s current price levels, while the Street-high price target of $800 suggests a 32% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- IonQ Stock is on Discount: Here’s How to Tackle It From a Quantitative Angle

- Burry Calls ‘Fraud’ on Hyperscalers: 4 Pins Set to Pop the AI Bubble and the ‘Big Short’ Math on Big Tech

- The Dow Jones Looks Ready for Death, But These 3 Blue-Chip Stocks Have More Life (and Gains) Ahead

- Jensen Huang Says ‘Blackwell Sales Are Off the Charts, and Cloud GPUs Are Sold Out’ as Nvidia Crushes Q3 Earnings and Beats Analyst Expectations