In the United States, much of the attention in autonomous cars lands on Alphabet (GOOG) (GOOGL) subsidiary Waymo, Tesla (TSLA), and Zoox, which is owned by Amazon (AMZN). But the total market is much bigger than that. North America only represents 37% of the global market, according to Grand View Research, with the Asia-Pacific region standing out as the fastest-growing market.

Chinese company WeRide (WRD) is one of the standout companies looking to take advantage of this opportunity and just received a federal-level license to operate fully driverless robotaxis in the United Arab Emirates. It’s an expansion of WeRide’s Middle East business, where it has already been operating in Abu Dhabi since last December.

With the global market expected to grow from $68.09 billion in 2024 to $214.32 billion by 2030—a compound annual growth rate of 19.9%—should investors be looking overseas for the best opportunity to invest in autonomous vehicles? Let’s take a closer look at WeRide.

About WeRide Stock

WeRide is an up-and-coming company based in Guangzhou, China. It specializes in autonomous vehicles, including self-driving commercial vehicles, including taxis, buses, vans, and robosweeper street sweeping vehicles.

The company operates in 11 countries and works on products between Level 2 and Level 4 automation as described by the Society of Automotive Engineers. Level 2 vehicles are partially automated and require human monitoring and intervention; Level 4 vehicles are fully automated within a defined operational design domain and require no human intervention as long as they remain in that domain.

WeRide started trading on the Nasdaq exchange on Oct. 24, 2025, and the stock soared in the first quarter as Nvidia (NVDA) disclosed a $25 million investment but has been steadily dropping since. Since its inception, WRD stock is down 31%. Its year-to-date (YTD) loss of 24% badly trails the Nasdaq Composite ($NASX), which has seen a 23% gain in 2025 so far.

WeRide carries a high valuation, with a price-to-sales ratio of 33.5—exceptionally high compared to Tesla’s 16.8 or Alphabet’s 8.9.

A Look at WeRide Earnings

WeRide has only been in business for six years and publicly traded for one. So not surprisingly, the company isn’t profitable yet, although it’s slowly taking steps to narrow its losses. The company’s second-quarter earnings report showed revenue of $17.8 million, up 60.8% from a year ago. It posted a net loss of $56.7 million, down 1.7% from last year. However, it has a strong cash position of $570.6 million.

Product revenue in the quarter increased 309% due to sales of robotaxis and robosweepers; services revenue was up 4.3% to $9.4 million. Revenues from the company’s robotaxis jumped 836.7% to $6.4 million in the quarter, accounting for 36.1% of the company’s total revenue for the quarter.

“A major driver of our momentum is the increasing contribution from our robotaxi business, which now plays a central role in our revenue mix and overall financial strength,” Chief Financial Officer Jennifer Li said. “As our international footprint grows—particularly in regions like Abu Dhabi—we are seeing clear signs of improved unit economics and growing commercial viability.”

The company also announced its upgraded platform powered by Nvidia Drive AGX Thor chips, cutting the costs of its autonomous driving suite by 50% and achieving 100% automotive grade. WeRide also tripled its robotaxi fleet—operated in partnership with Uber (UBER)—in Abu Dhabi, covering about half of the city’s core area. The companies say they have plans to operate hundreds of WeRide-Uber autonomous taxis in Abu Dhabi.

What Do Analysts Expect for WRD Stock?

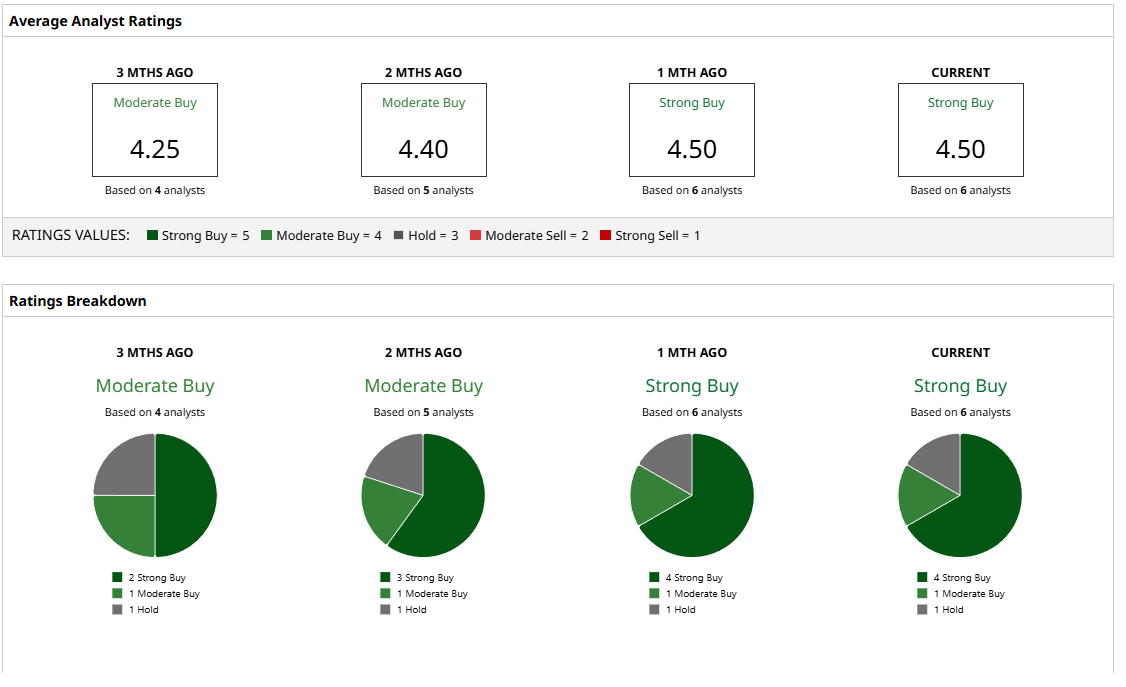

Analysts are generally positive when considering the Chinese autonomous driving technology company. WeRide is currently covered by six analysts, with four of them giving WRD stock a “Strong Buy” rating. A fifth gives it a “Moderate Buy” rating, and the final analyst recommends holding.

The stock’s mean price target of $16.98 indicates a potential 59% jump for the stock, with the most bullish analyst's target of $21 hinting at a possible 98% increase. Even the lowest estimate of $12 promises a 12% increase in the stock price in the short term.

WeRide isn’t profitable, and the stock is having a poor year. But this may be a golden opportunity to buy an autonomous vehicle stock on the dip. If the company can continue its promising moves into the next few quarters, WeRide is going to look like an incredible bargain.

On the date of publication, Patrick Sanders had a position in: NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart