Bitcoin (BTCUSD) exchange-traded funds (ETFs) have a new source of inflows, thanks to a regulatory change which allows investors in the cryptocurrency to convert their holdings into shares of Bitcoin ETFs. What’s next, world peace?

Buy-and-Holders and Buy-and-Hodlers Break Digital Bread

Some investors are devout believers in what they own, to the point where they will be happy to never think about selling. Maybe ever. Essentially, a generational asset.

With Bitcoin, that has yet to be put to the test, since it has not reached its second generation. But it is getting closer. And there are now enough Bitcoin millionaires and billionaires to make it into a Bernie Sanders speech.

The question is, will they still have that status years down the road?

None of us will know that for sure any time soon. Bitcoin has been resilient over the years. In order to be considered resilient, an asset has to have been knocked down first. That’s happened enough in Bitcoin’s relatively brief history that it begs the question: Is this the type of asset that will be an enduring candidate to be transferred from its purer form into an ETF that owns the same type of asset?

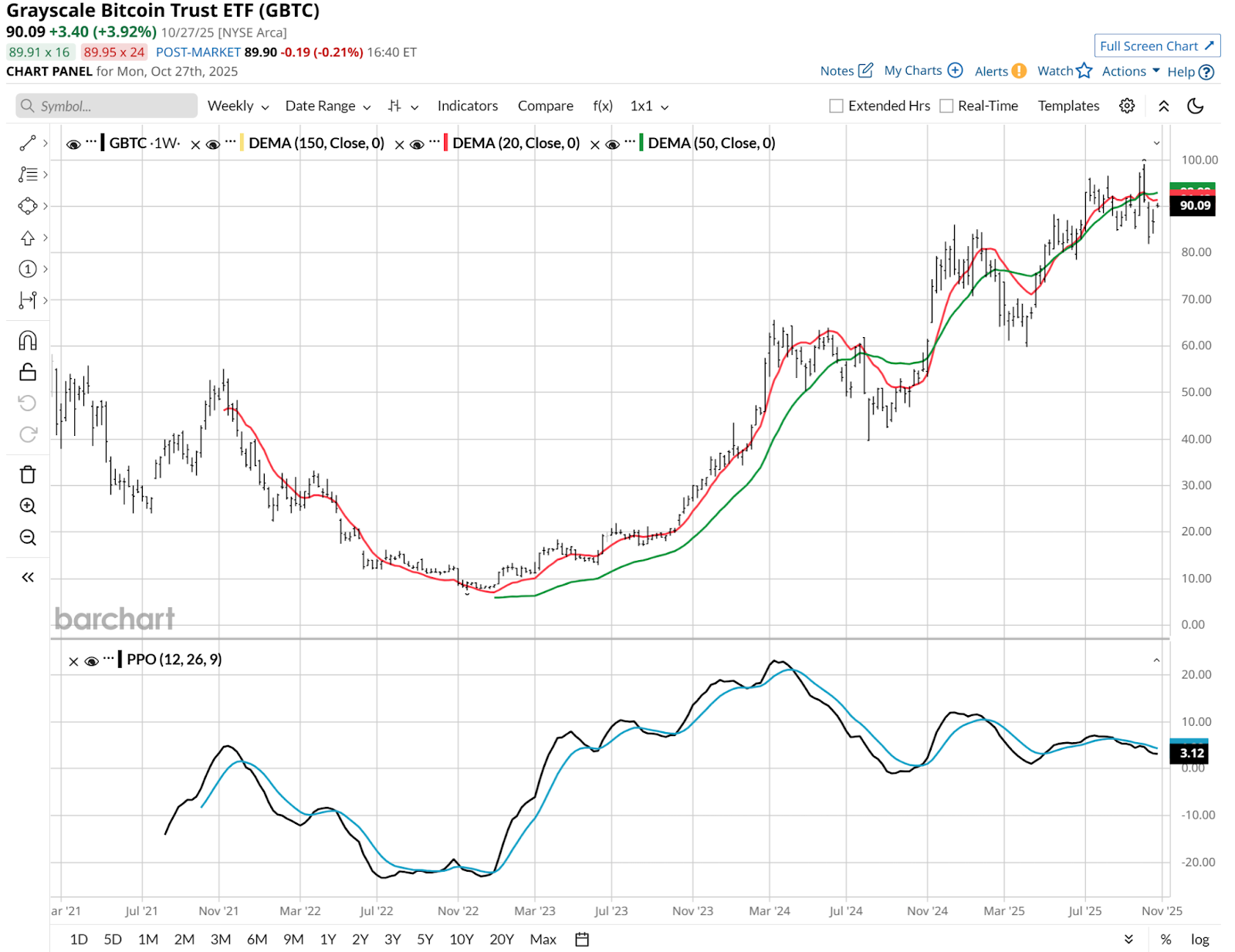

Using the chart above as a proxy, the biggest Bitcoin ETF prior to the debut of funds based on the “spot” price of that leading crypto asset in early 2024, Bitcoin has moved from its Feb. 15, 2021 peak of $55 a share to $90 as of Monday’s close. That’s about 63% over more than 4.5 years. A solid return, no doubt.

But will the next, likely inevitable Bitcoin decline cause long-termers to reconsider moving into the Wall Street circle? After all, Bitcoin is as much a rebellion against traditional finance and its institutions as anything we’ve seen.

That hasn’t stopped a few billion of these in-kind transfers from occurring already. And as I understand it, the goal of moving Bitcoin from one’s own wallet into an ETF is to have those assets count on the books of the brokerage taking them in. A good news, bad news situation, I think.

The good news is for the investor who does this, they suddenly have an asset that could be eligible to borrow against. The bad news is the same thing, should they get ahead of their skis.

Stop Me If You’ve Heard This One Before

Maybe you can’t think back to 1999-2000, or to 2006-2008 like some of us “senior” types can. Those were the last two times the market attitude went from “this asset will be fine” to “my bank or brokerage just called in my line of credit, since my collateral is not worth nearly what it had been.” Oops.

This is another risk-reward tradeoff like any other in investing. It is a case of each investor deciding what the benefits and risks of their actions are. Sort of like when you take a prescription medicine for the first time. Hopefully, the conversion of Bitcoin into ETFs that own that invisible asset will be an expanded tool for successful crypto holders, and not a bitter pill.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Bitcoin Whales Are Swimming Into ETFs. This Could Transform Crypto or End Up a Jagged Little Pill.

- This Analyst Is Warning that a Popular AI Data Center Stock Could Plunge More Than 30% from Here

- 1 Fintech Stock Under $400 to Buy and Hold Forever

- A $9.5 Billion Reason to Buy This High-Performance Computing Stock