Viatris Inc. (VTRS) is a global healthcare company valued at a market cap of $12 billion. It focuses on providing affordable medicines across a wide range of therapeutic areas, including cardiovascular, infectious disease, oncology, immunology, and central nervous system disorders. The Pennsylvania-based company offers both branded and generic drugs, biosimilars, and over-the-counter products, serving more than 165 countries and territories.

Shares of this global healthcare giant have considerably underperformed the broader market over the past year. VTRS has declined 9.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 19.6%. The gap has widened in 2025, with VTRS down 15.4% year-to-date compared to a 16.5% gain for the $SPX.

Looking more closely, VTRS has also trailed the iShares U.S. Pharmaceuticals ETF (IHE), which has surged 10.8% over the past year and 16.2% on a YTD basis.

On Oct. 15, Viatris announced the acquisition of Aculys Pharma, gaining rights to develop and commercialize two neurological treatments pitolisant and Spydia in Japan. The deal expands Viatris’ CNS portfolio, with the company planning to seek regulatory approval for pitolisant in Japan by late 2025 following strong Phase 3 results, targeting conditions including narcolepsy-related excessive daytime sleepiness and obstructive sleep apnea–related sleepiness. VTRS shares climbed 1.2% in the following trading session.

For the current fiscal year, ending in December, analysts expect VTRS’ EPS to decline 12.8% to $2.31 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

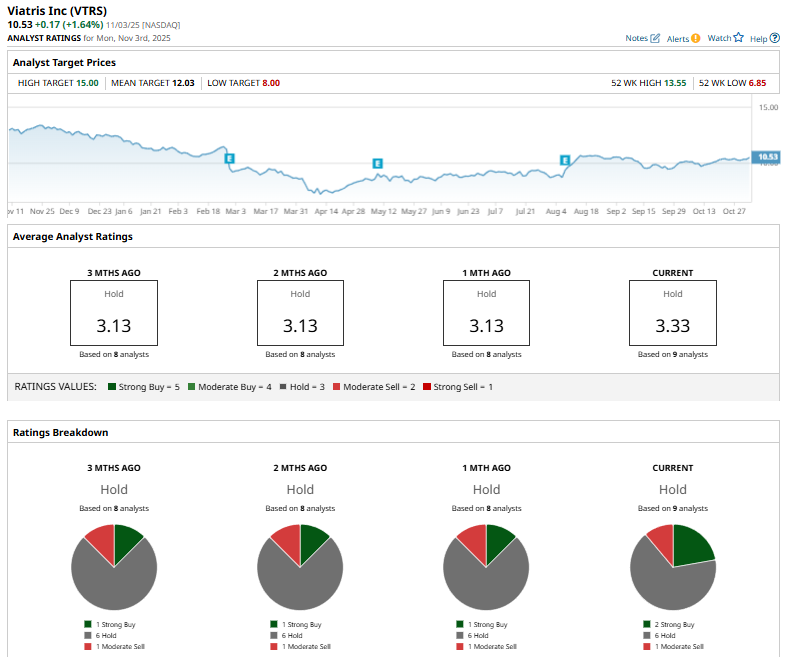

Among the nine analysts covering VTRS stock, the consensus is a “Hold.” That’s based on two “Strong Buy” ratings, six “Holds,” and one “Moderate Sell.”

The configuration is more bullish than it was a month ago, when the stock had only one “Strong Buy” rating.

On Oct. 15, Truist Financial Corporation (TFC) analyst Les Sulewski initiated coverage on Viatris with a “Buy” rating and a $15 price target, expressing confidence in the company’s strategic shift under new leadership. While legacy concerns remain, Truist sees upside supported by Viatris’ strong branded portfolio, expanding generics presence, and promising pipeline. The firm also noted that faster-than-expected recovery at the Indore facility and pipeline execution could further accelerate the company's turnaround.

The mean price target of $12.03 represents a 14.2% premium to VTRS’ current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart