The start of 2026 hasn’t been smooth sailing for Rigetti Computing (RGTI). The pure-play quantum contender recently pushed the “general availability” of its flagship 108-qubit Cepheus-1-108Q system to the end of the first quarter. The firm cited the need for additional testing and performance optimization, a move that sent ripples through a market already pricing in extreme growth potential for quantum technologies.

Cepheus-1-108Q is built from 12 9-qubit chiplets using Rigetti’s proprietary modular chip architecture, making it both the company’s highest-qubit system to date and the largest modular quantum computing system currently available in the industry.

The market reacted almost immediately, with RGTI stock slipping modestly as traders digested the implications of the delay. This is an industry where timelines signal credibility and momentum; even short postponements can influence sentiment and near-term price action.

So, is RGTI stock a tactical buying opportunity in January 2026? Or a risk-laden play better approached with caution?

About Rigetti Stock

Rigetti Computing, founded in 2013 and headquartered in Berkeley, California, is a leading developer of full-stack quantum computing solutions. That is, it designs, manufactures, and deploys superconducting quantum processors and supporting software platforms like Forest and Quantum Cloud Services.

The company carries a market capitalization of $8.4 billion, reflecting growing investor interest in its potential despite ongoing challenges in scaling its technology and sustaining profitability.

Over the past several years, Rigetti Computing stock has been a dramatic story of volatility, speculative enthusiasm, and sharp price swings, reflecting both the nascent promise and execution challenges of the quantum computing industry. After a languishing period, RGTI stock transitioned into a meteoric growth phase, with its share price surging substantially in 2024 as investor appetite for quantum technology picked up and early milestones suggested momentum toward commercialization.

That remarkable run set the stage for continued gains in 2025, with RGTI stock climbing to a high of $58.15 on Oct. 14. The stock has gained 128% over the past 52 weeks, while its two-year return stands at 2,436%.

However, the stock has retreated by about 56% from the $58 peak, highlighting how quickly gains can be retraced when catalysts are absent or delayed, such as the recent postponement of its 108-qubit system. That's especially true for a company without meaningful revenue or profitability.

Notably, RGTI stock fell 2.1% on Jan. 9 following the company’s announcement of the delay in launching Cepheus-1-108Q.

As of this writing, the stock trades at a lofty valuation compared to the sector median at 970 times forward sales.

Rigetti Remains Deep in the Investment Phase

Rigetti Computing released its third-quarter 2025 financial results on Nov. 10. Total revenue for the quarter came in at $1.9 million, falling short of broader expectations and marking a year-over-year (YOY) decline of 18%. Rigetti posted an operating loss of $20.5 million. Meanwhile, its non-GAAP net loss was $10.7 million, or $0.03 per share, an improvement from the prior year’s loss but still a clear reflection of its heavy investment in R&D and expansion.

The company’s cash position came in at around $558.9 million in cash, cash equivalents and available-for-sale investments as of Sept. 30. That was later bolstered to approximately $600 million through warrant exercises.

While revenue remains modest relative to its market valuation, Rigetti also pointed to several commercial traction indicators, including purchase orders of roughly $5.7 million for two 9-qubit Novera systems expected to be delivered in the first half of 2026, as well as ongoing demand for its on-premises quantum systems and expanding collaborations with government and academic partners.

Furthermore, Rigetti’s updated technology roadmap for 2026 and 2027 provided a vision for scaling its quantum computing platforms. Management reaffirmed its commitment to deliver a 100-plus qubit chiplet-based system with an anticipated 99.5% median two-qubit gate fidelity by the end of 2025. By the end of 2026, Rigetti expects to deploy a 150-plus qubit system aiming for approximately 99.7% median two-qubit gate fidelity. Finally, by the end of 2027, it anticipates pushing its architecture to a 1,000-plus qubit system with median two-qubit gate fidelity near 99.8%.

Meanwhile, analysts anticipate loss per share to improve 47% YOY to $0.19 in fiscal 2025, before improving by another 5% to reach a loss of $0.18 in fiscal 2026.

What Do Analysts Expect for Rigetti Stock?

Recently, Rosenblatt Securities initiated coverage on Rigetti Computing with a “Buy” rating and a $40 price target, citing confidence in the company’s modular qubit-scaling strategy and in-house fabrication capabilities. While the firm acknowledged near-term challenges, including the delayed launch of Rigetti’s Cepheus system due to difficulties, it expressed some optimism that these issues can be resolved by the end of Q1 2026.

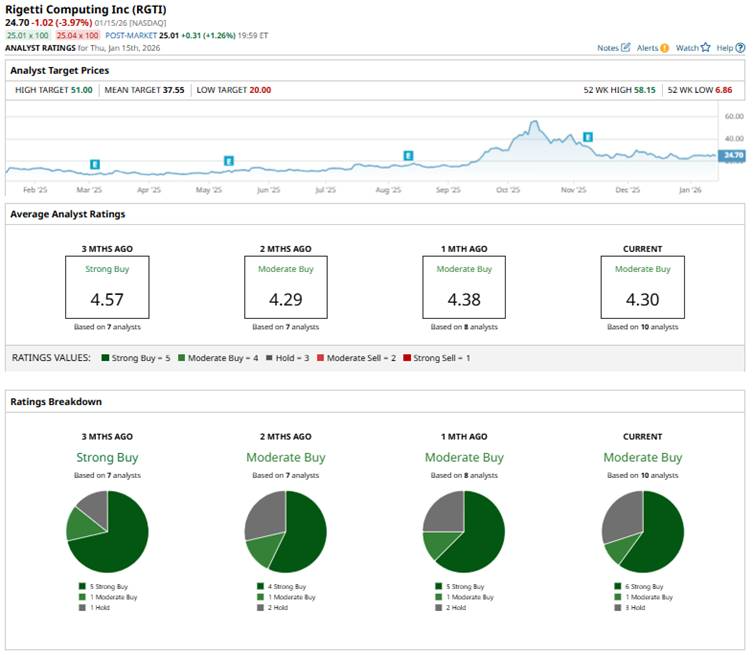

Overall, Wall Street is fairly bullish on RGTI stock with a consensus “Moderate Buy” rating. Of the 11 analysts covering the stock, seven advise a “Strong Buy,” one suggests a “Moderate Buy,” and three advise a “Hold” rating.

The average analyst price target for RGTI is $37.80, indicating potential upside of 48%. The Street-high target price of $51 suggests that the stock could rally as much as 99% from current levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- After Rigetti Announced a Quantum Computing Delay, How Should You Play RGTI Stock in January 2026?

- Wells Fargo Says You Should Buy the Dip in Broadcom Stock

- Taiwan Semi Crushed Q4 Earnings. That Makes This 1 AI Chip Stock a Top Buy.

- As Trump Hits AMD MI325X Chips with a 25% Tariff, How Should You Play AMD Stock?