Is there a more intriguing stock to talk about right now than Intel (INTC)? Because while AI’s leading players steal the spotlight every day, the pure drama surrounding this once-iconic chip maker, a true market hero of the 1990s, is about to get weirder. Yes, I said weirder.

Since that time late last century, when INTC literally powered the growth of personal computing, it has lost its way. Then, recently, the company found it again. Thanks to a most unusual investment event. The U.S. government, specifically President Donald Trump’s administration, decided to invest in the company. Last August’s announcement of an $8.9 billion investment in INTC stock was billed as a way to “support the continued expansion of American technology and manufacturing leadership.” But it was also a rare move by a government in this country, even if it is common elsewhere around the globe.

INTC earnings are out tonight after market close. The pre-earnings reaction is a “parabolic” warning sign on the charts. That does not mean it can’t continue. And in that sense, INTC is now just one of the gang, a tech stock that has flown higher, and is both expensive and not yet broken, technically speaking.

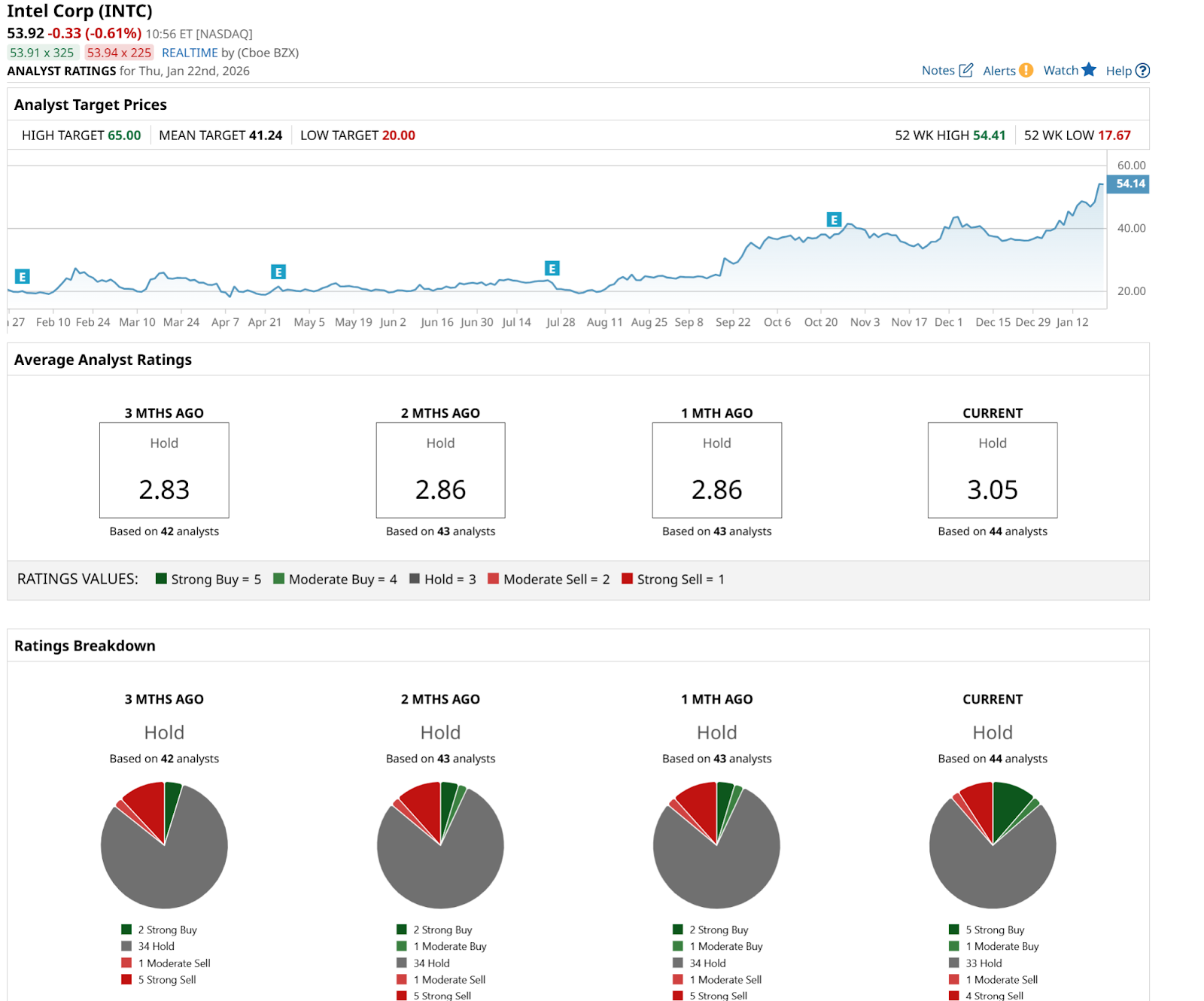

Analysts have INTC as a “Hold,” as they have for a while.

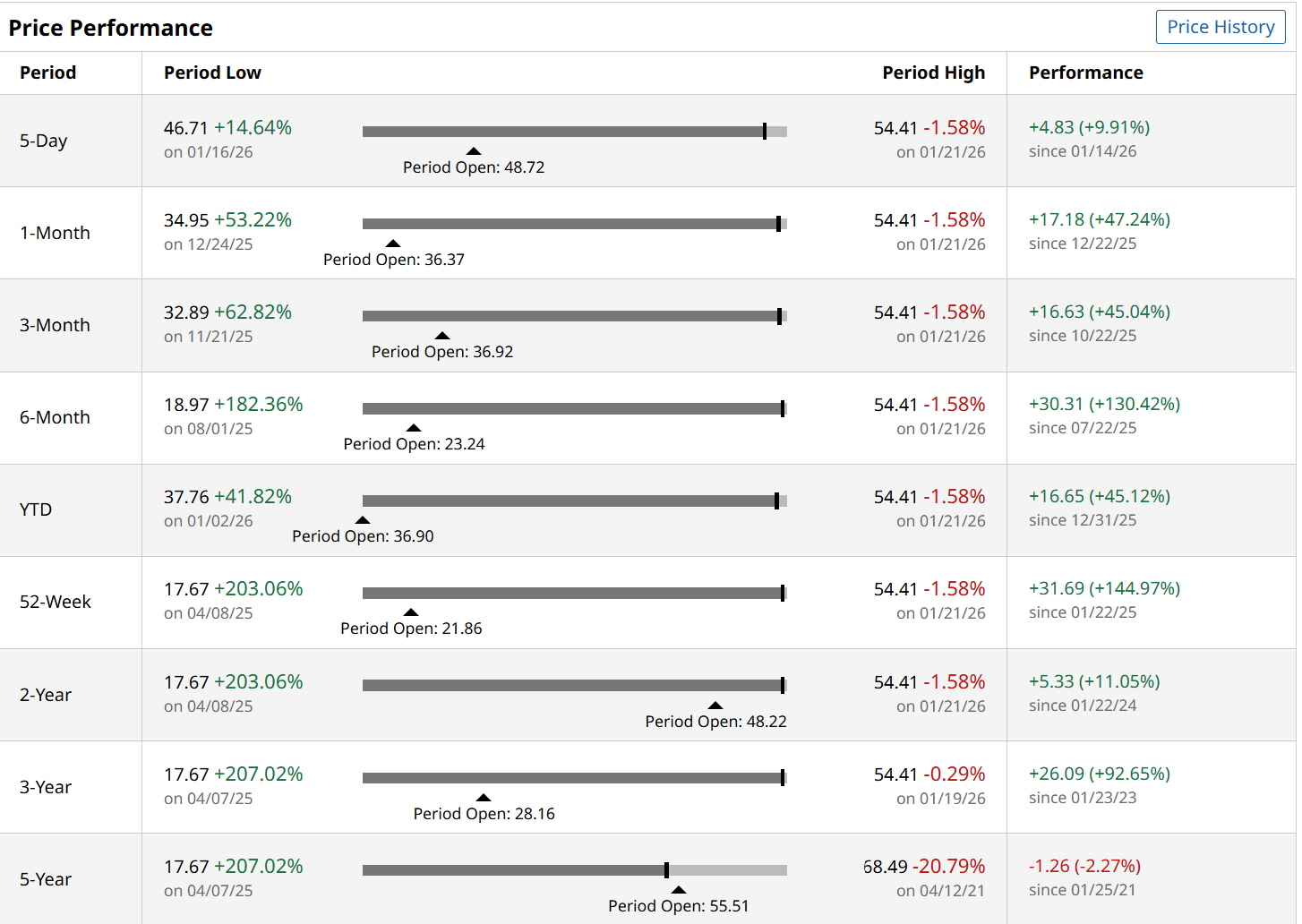

The stock is up an astonishing 45% year to date, and we still have a week remaining in January. That justifies those “Hold” ratings to me, or least would challenge a continued “Buy” rating. Still, this is a massive front-running move by the Street, fueled by analyst upgrades and optimism about Intel’s 18A process node and a potential government-backed turnaround.

Charting INTC has been a case study in how to put a stock on the radar when it is poised to move. Any stock can go up in price at any time, for any reason. Even a social post by POTUS. But the charts are my truth.

Intel’s Line in the Sand

You see that line in the sand in this chart. I drew that a long time ago, so long ago it’s off to the left of this daily chart. Not in the picture at all. But that was the point at which INTC could again be considered as a long-term technical buy. And in typical modern market fashion, it faked once, faked twice, then punched through. Like an NFL team with 3 cracks from the 1-yard line. The last play hit paydirt. For INTC shareholders, including the Trump administration.

That Percentage Price Oscillator (PPO) looks elevated but still OK, at least for now. So let’s look longer term. Here’s the weekly chart, below. This is the most important time frame for me, of the 12 I scout regularly, from 1-minute intervals to 1-month intervals.

Sometimes, the weekly really is the truth about a stock. But with INTC currently, it doesn’t add much to the daily story. Stocks and ETFs go one of two ways when they look like this: notably higher, or they top out. So INTC’s announcement tonight is an event, for sure.

The monthly chart is a case of “ditto,” except for one thing. We can see that all-time high in view with more perspective. And that is where I may differ from many technicians. I see this as a riskier situation than normal.

Why? Because markets have a memory. Like an elephant! And with that all-time high just about 10% north of the price today, I translate that to limited upside to a new all-time high, but 65% downside to where it just came from. Months, not years ago.

None of this dictates particular action, only perspective for any trader wishing to partake here, as a buyer or happy holder looking to reduce their position. But to be clear: Tonight’s announcement has double-digit percentage potential.

Rob Isbitts is a semi-retired fiduciary investment advisor and fund manager. Find his investment research at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app. His new blog on racehorse ownership as an alternative asset is at HorseClaiming.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- How This Options Expert Screens for High-Probability Spread Trades, Step-by-Step

- Calling Back to Jimmy Carter, Citigroup’s CEO Says Credit Card Rate Caps Would ‘Not Be Good’ for the U.S. Economy

- ‘Yes or No AI’: 93% of DuckDuckGo Users Overwhelmingly Reject AI, So What Does This Mean for the Future of Nvidia, Alphabet, and Other AI Stocks?

- KHC Is Low-Hanging Fruit for Greg Abel: Which Warren Buffett Stock Will He Sell Next?