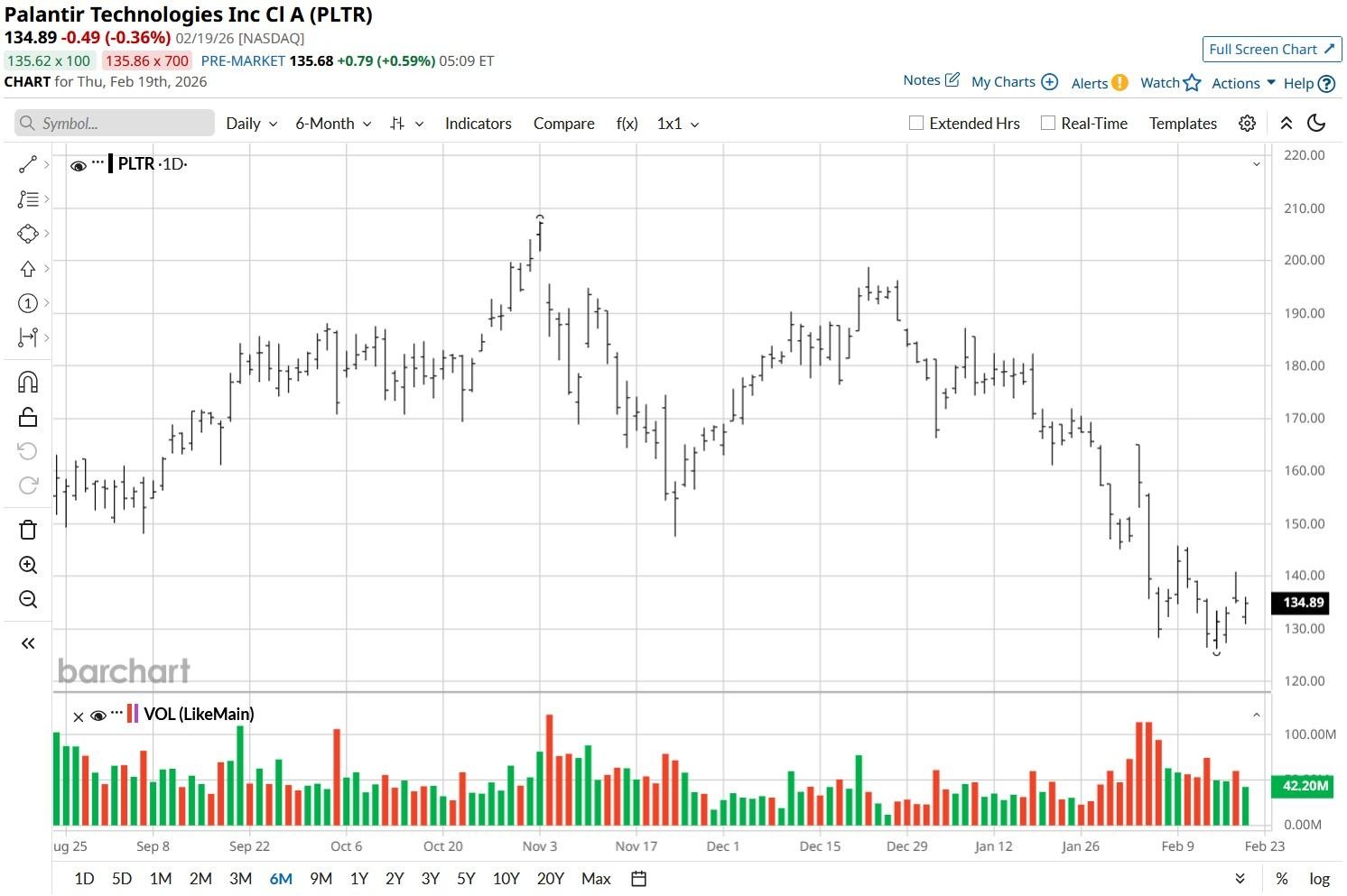

Palantir (PLTR) shares have been in a sharp downtrend since the start of 2026 as sentiment shifted from enthusiasm about artificial intelligence (AI) software vendors to skepticism about their valuations and competitive positioning.

Despite losing some 25% since early January, Palantir is still trading at a forward price-to-earnings (P/E) multiple of nearly 127x, which makes it notably more expensive to own than industry peers.

Still, senior Mizuho analyst Greg Moskowitz recommends buying Palantir stock at current levels, saying it could climb all the way back to near its all-time high as the year unfolds.

What To Expect From Palantir Stock Through the Remainder of 2026

In a research note earlier this week, Moskowitz upgraded PLTR stock to “Outperform” and announced a $195 price target, which signals potential upside of a whopping 44% from here.

The Mizuho analyst cited strong artificial intelligence demand trends and impressive acceleration in the company’s commercial business for his constructive view.

According to him, the Denver-headquartered firm is delivering “total revenue growth, acceleration, and margin expansion at scale that’s unlike anything else in software.” This positions it uniquely among enterprise software vendors in 2026, he concluded.

Technicals Also Warrant Buying PLTR Shares at Current Levels

Palantir shares are worth owning because their relative strength index (14-day) has crashed to about 37, indicating bearish momentum is now approaching exhaustion.

Meanwhile, the Nasdaq-listed firm continues to beat expectations and guide higher, which positions it strongly to resume its upward trajectory once sentiment improves.

Note that Palantir has a history of closing both February and March in green, a seasonal pattern that makes it even more attractive to own in the near term.

Palantir Remains a Buy-Rated Stock Among Wall Street Analysts

Other Wall Street firms do also agree with Mizuho’s view that Palantir’s selloff has gone a bit too far.

According to Barchart, the consensus rating on PLTR shares sits at “Moderate Buy” currently, with the mean target of about $200, indicating potential upside of roughly 50% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Tesla Launches FSD Subscriptions, Should You Buy, Sell, or Hold TSLA Stock?

- Why Michael Saylor Isn’t Worried About MicroStrategy Stock Unless Bitcoin Drops Below $8,000

- This High-Yield Dividend King Has 56 Years of Raises and Wall Street Is Screaming ‘Buy’

- Goldman Sachs Says MP Materials Stock Can Gain More Than 30% From Here. Should You Buy MP Stock?