Opendoor Technologies (OPEN) reported its Q4 2025 earnings after the market closed yesterday, revealing a mixed bag that greatly excited investors. While revenue came in at $736 million, surpassing Wall Street estimates of around $594 million, the company posted a significant GAAP net loss of $1.1 billion, far wider than anticipated due to debt extinguishment costs. Adjusted EPS showed a smaller loss of $0.07 per share, better than the expected $0.08 loss, but the headline miss on unadjusted earnings overshadowed this.

Despite the red ink, shares are surging. OPEN stock was up 14% in premarket trading and currently sits up over 8% for the day, fueled by a 46% quarter-over-quarter increase in home acquisitions to 1,706 units, signaling a robust rebound in its core iBuying operations amid improving housing market dynamics.

About Opendoor Technologies Stock

Opendoor Technologies operates a digital platform seeking to revolutionize residential real estate by enabling seamless buying and selling of homes via mobile devices. Headquartered in Tempe, Arizona, the company's iBuying program has faced headwinds like elevated mortgage rates, a cooled housing market, and past cash burn from aggressive expansion, leading to inventory overhang and profitability challenges. Tailwinds include AI-driven pricing improvements, faster inventory turns, and a potential housing recovery, positioning it for efficiency gains in its "Opendoor 2.0" strategy.

In 2026, OPEN stock has declined 11% year-to-date (YTD), significantly underperforming the S&P 500 ($SPX), which has been essentially flat with a 0.7% gain. This follows a volatile 2025, where shares rose over 200% from lows but remain far from 52-week highs. Valuation metrics show a price-to-sales ratio of 0.72, below historical averages around 1.0-1.5 during growth phases and industry peers in software (often 5-10), indicating potential undervaluation if margins improve. Price-to-book stands at 4.13, higher than historical lows but reasonable given asset-heavy operations. With no P/E due to losses, the stock appears undervalued on sales multiples, betting on operational turnaround, though risks persist.

Market Shrugs Off Opendoor's Big Earnings Miss

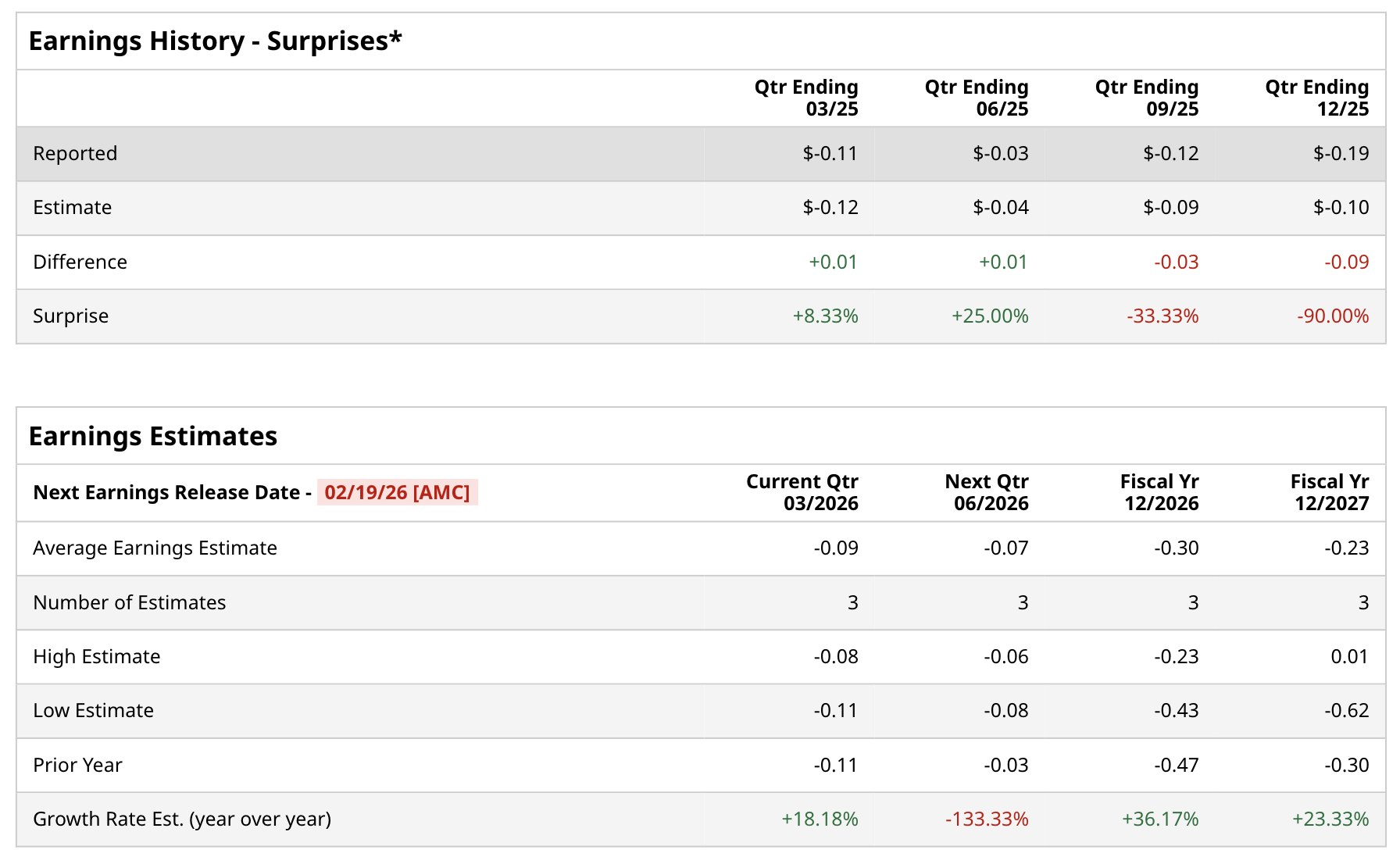

Opendoor's Q4 2025 results highlighted resilience in a tough environment, with revenue of $736 million beating estimates by 23.41% but down 32% year-over-year (YoY) from $1.08 billion amid a deliberate portfolio contraction. Adjusted EPS came in at a loss of $0.07, better than the consensus $0.10 loss and an improvement from the prior year's $0.11 loss, reflecting tighter operations. However, GAAP net loss ballooned to $1.1 billion, driven by one-time debt extinguishment charges, marking the "big miss" that initially raised eyebrows. Full-year revenue totaled $4.371 billion, down from $5.153 billion in 2024, underscoring a shift toward efficiency over volume.

Management's guidance for Q1 2026 projects revenue down about 10% sequentially to roughly $662 million, below consensus forecasts of $872 million, signaling caution in a volatile market. Adjusted EBITDA loss is expected in the low to mid-$30 million range, an improvement from Q4's $43 million loss but still short of breakeven hopes. For the full fiscal year 2026, analysts anticipate an EPS loss of $0.30 on $4.61 billion in revenue, with Opendoor aiming for adjusted net income profitability by year-end.

Key context from the report emphasizes Opendoor's transformation under its 2.0 strategy. Home acquisitions surged 46% to 1,706, exceeding targets of at least 35% growth, while sales hit 1,978 homes, 20% above estimates. Inventory turns accelerated, with homes lingering over 120 days dropping from 51% to 33%, thanks to AI-enhanced pricing and selective buying. Cost-cutting shone through, with fixed operating expenses reduced to $35 million from $43 million YoY. No major new product launches were announced, but leadership highlighted disciplined risk management and plans to scale seller transactions, positioning for profitability amid housing headwinds.

What Do Analysts Expect for OPEN Stock?

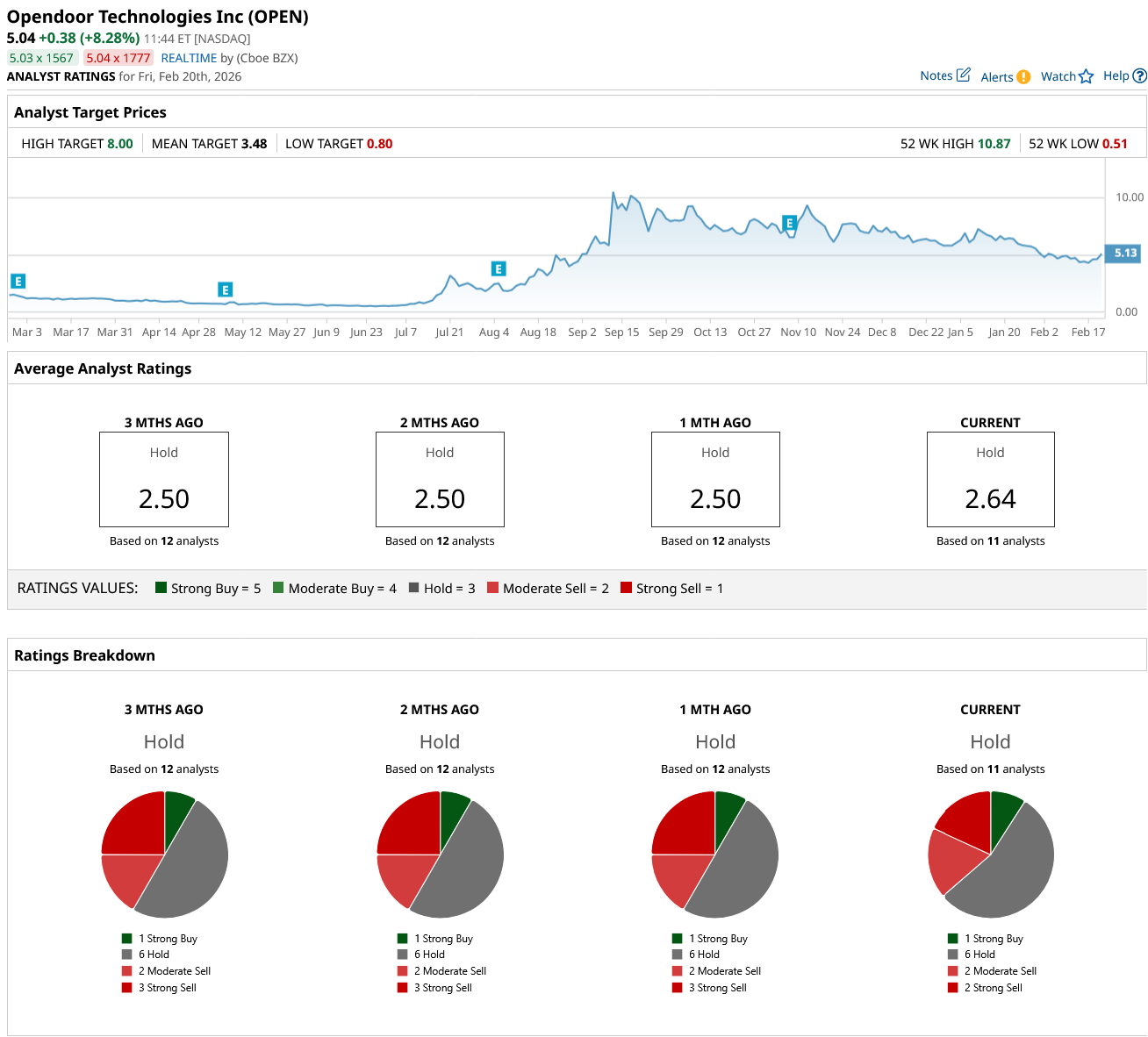

Consensus among analysts rates OPEN stock as a "Hold," with coverage from 11 analysts. The ratings breakdown shows one analyst with a "Strong Buy" rating, six "Hold" ratings, two "Moderate Sell" ratings, and two "Strong Sell" ratings. Notable changes include recent downgrades, such as Keefe, Bruyette & Woods to “Underperform” and Citigroup to “Sell” in 2025, reflecting concerns over losses and strategy. Consensus has held steady at “Hold” over recent months, with EPS estimates steady in the past 60 days.

The mean price target stands at $3.48, reflecting substantial downside potential from yesterday's close but even more so if today's gains hold. However, analysts could always revise their targets higher after the earnings report.

On the date of publication, Rich Duprey did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart