Covington, Louisiana-based Pool Corporation (POOL) is the world's leading independent distributor of swimming pool supplies, equipment, and related leisure products. With a market cap of $9.5 billion, Pool operates in nearly 450 locations through its distribution networks and serves over 125,000 customers worldwide.

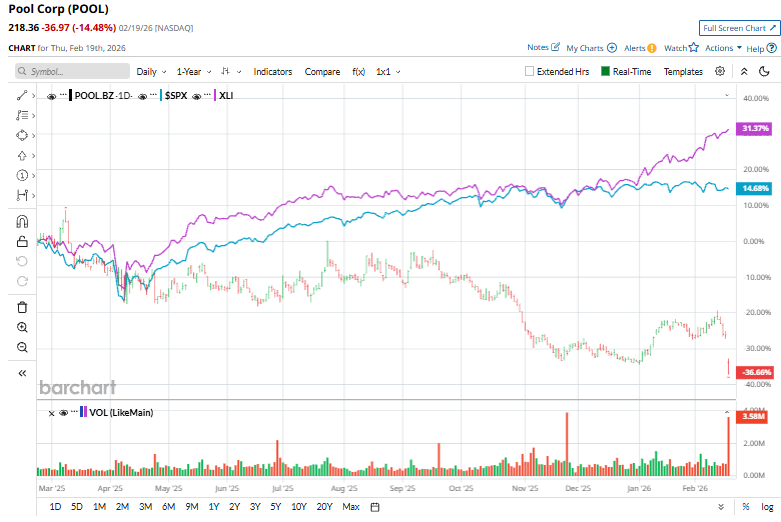

Pool stock has plummeted 35.9% over the past 52 weeks and 4.5 on a YTD basis, compared to the S&P 500 Index’s ($SPX) 11.7% gains over the past year and marginal surge in 2026.

Narrowing the focus, Pool stock has also underperformed the sector-focused State Street Industrial Select Sector SPDR Fund’s (XLI) 27.1% gains over the past 52 weeks and 13.7% surge on a YTD basis.

On Feb. 19, Pool Corporation’s shares dropped 13% after the company reported disappointing Q4 2025 results and issued a weaker-than-expected 2026 outlook. Its sales dopped 1% year over year to $982.2 million, missing estimates, while EPS fell to $0.84 from $0.97 and also came in below forecasts. The negative reaction was amplified by 2026 EPS guidance with a midpoint of $11, which trailed analyst expectations and signaled concerns about near-term profitability and growth.

For the full fiscal 2026, ending in December, analysts expect Pool to deliver an EPS of $11, up 2.5% year over year. The company has a mixed earnings surprise history overall. While it surpassed the Street’s bottom-line projections twice over the past four quarters, it missed the estimates on two other occasions.

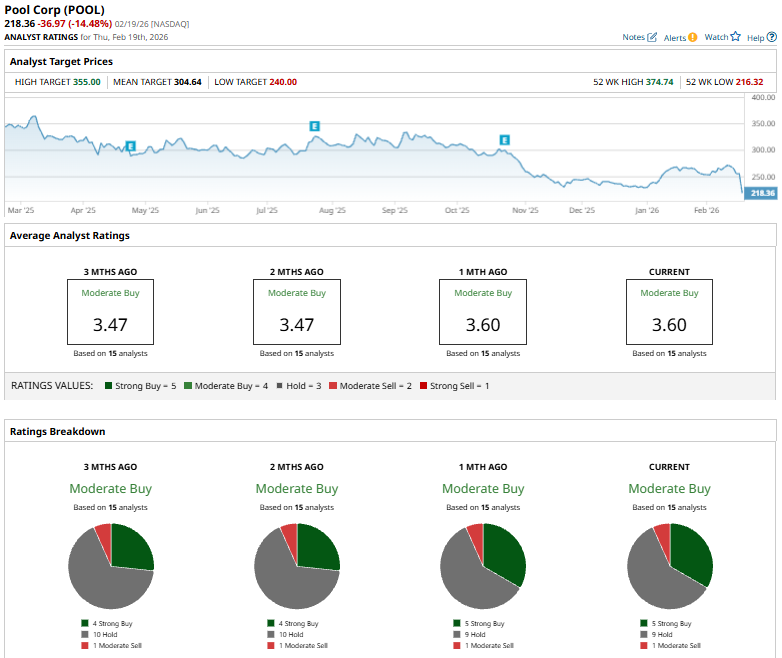

The company has a consensus “Moderate Buy” rating overall. Of the 15 analysts covering the Pool stock, opinions include five “Strong Buys,” nine “Holds,” and one “Moderate Sell.”

This configuration is bullish than two months ago when the stock had four “Strong Buy” suggestions.

On Feb. 11, Wells Fargo analyst Sam Reid raised Pool Corp.’s price target to $275 from $250 while maintaining an “Equal-Weight” rating, reflecting a modestly improved valuation outlook. The update follows cautious signals from the firm’s January real estate agent survey, which informs its views ahead of upcoming housing-related earnings across late-cycle, housing-adjacent companies.

As of writing, Pool’s mean price target of $304.64 represents a 39.5% premium to current price levels. Meanwhile, the street-high target of $355 suggests a 62.6% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart