The doom-and-gloom crowd has been calling for MicroStrategy's, now going by just “Strategy” (MSTR), collapse at every Bitcoin (BTCUSD) dip. Now that Bitcoin is trading near its multi-year lows, the alarm bells are ringing again.

But CEO Michael Saylor isn't flinching. And when you look at the actual numbers, it's easy to understand why.

Strategy's Bitcoin War Chest Towers Over Its Debt

Strategy holds 717,131 Bitcoin, acquired at an average cost of about $76,000 per coin, according to the company's dashboard. At recent prices, that stash is worth roughly $48.7 billion. Comparatively, MSTR ended 2025 with $8.2 billion in debt.

That's nearly six times as much in assets as in liabilities. As Strategy CEO Phong Le put it plainly on the earnings call, Bitcoin would need to fall all the way to $8,000 per coin and stay there for five to six years before the company would face any real trouble covering its convertible debt.

"It really doesn't mean anything," Le said of Bitcoin trading below the company's average purchase price. "It doesn't mean that we have any issues servicing our debt or paying the dividends on our preferreds."

One of the biggest misconceptions floating around is that a Bitcoin price drop forces Strategy to sell its holdings. However, every Bitcoin the company holds is unencumbered, meaning none of it is pledged as collateral. Moreover, there are no margin calls or any price-triggered covenants.

Critics also argue that $888 million in annual dividend obligations will drain the company's Bitcoin reserves. Strategy set aside a $2.25 billion cash reserve in the fourth quarter of 2025, enough to cover more than 30 months of dividend payments without touching a single Bitcoin.

Notably, the first major debt maturity isn't until September 2027, providing MSTR with enough runway.

What Changes for MSTR Stock When Bitcoin Falls

The real squeeze isn't about solvency. It's about Strategy's ability to grow.

The company funds most of its Bitcoin purchases by selling new shares through at-the-market equity offerings. That model works beautifully when the stock trades at a premium to the value of its Bitcoin holdings, a metric known as the market net asset value (mNAV).

When mNAV is above 1, issuing shares adds Bitcoin per share to existing investors' holdings. When it falls below one, new share sales become dilutive. That's the real pressure. With Bitcoin recently sliding into the mid-$60,000s and below, Strategy's mNAV has compressed to roughly 0.87x, pausing the company's primary growth mechanism.

For context, Strategy added only about 10,000 Bitcoin during all of 2022, when shares spent most of the year below the value of its underlying holdings, according to company records.

What is the MSTR Stock Price Target?

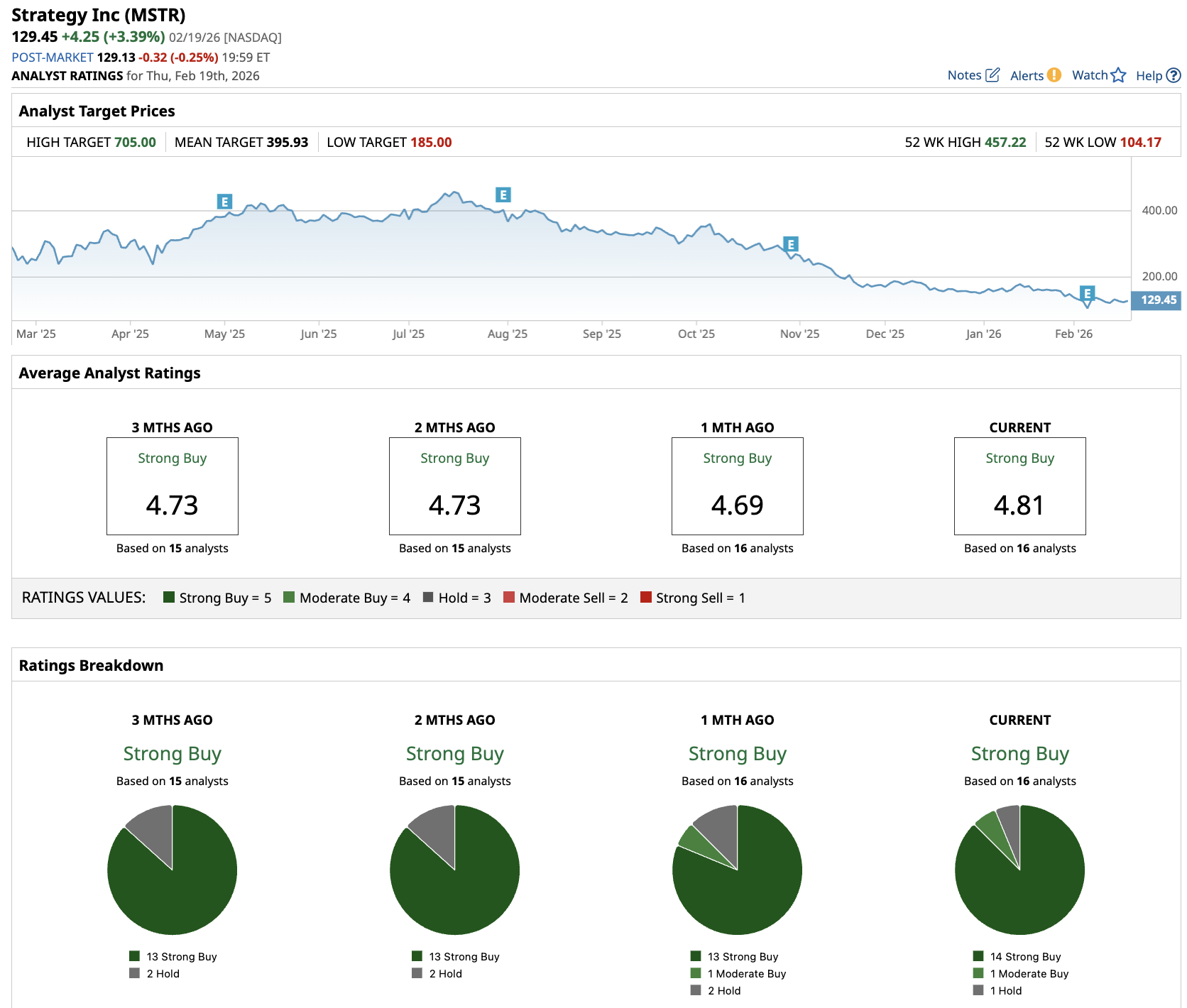

Out of the 16 analysts covering MSTR stock, 14 recommend “Strong Buy,” one recommends “Moderate Buy,” and one recommends “Hold.” The average MSTR stock price target is $396, above the current price of $129.

Strategy is battle-tested. During the 2022 crypto winter, Bitcoin fell more than 50% below the company's average purchase price and stayed there for 16 months. But the margin for error has narrowed. If Bitcoin stays depressed for an extended stretch and the mNAV premium doesn't recover, refinancing gets harder, and dilution risk grows.

Saylor remains firmly in the long-term camp. On the earnings call, he told investors the only question that matters is whether you believe in Bitcoin over a decade-long time horizon. For those who do, he argued the math still holds up. For those who want exposure without volatility, Strategy offers its Stretch preferred security, which pays an 11.25% monthly dividend with far fewer price swings.

The "Strategy goes bankrupt" narrative makes for a compelling headline. The balance sheet tells a different story.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- David Einhorn Is Buying the Dip in This Penny Stock: Should You Too?

- Opendoor Jumps on iBuying Surge Despite Big Earnings Miss

- This Stock Lets You Collect a Dividend While on Vacation

- You’ll ‘Make More Money When Snoring Than When Active’: Warren Buffett Says Stop Trading Stocks, and You’ll Make More Money with Less Effort