Diner restaurant chain Denny’s (NASDAQ: DENN) fell short of the markets revenue expectations in Q3 CY2025 as sales only rose 1.3% year on year to $113.2 million. Its GAAP profit of $0.01 per share was 90% below analysts’ consensus estimates.

Is now the time to buy Denny's? Find out by accessing our full research report, it’s free for active Edge members.

Denny's (DENN) Q3 CY2025 Highlights:

- Denny's will be purchased by private equity investment company TriArtisan Capital Advisors, investment firm Treville Capital and Yadav Enterprises (one of Denny's largest franchisees) in a deal worth $620 million, including debt. Denny's shareholders will receive $6.25 per share in cash for each share of common stock they own, a 52% premium to Denny's closing stock price Monday.

- Revenue: $113.2 million vs analyst estimates of $117 million (1.3% year-on-year growth, 3.2% miss)

- EPS (GAAP): $0.01 vs analyst expectations of $0.10 (90% miss)

- Adjusted EBITDA: $19.32 million vs analyst estimates of $20.17 million (17.1% margin, 4.2% miss)

- Operating Margin: 9.2%, down from 10.5% in the same quarter last year

- Locations: 1,459 at quarter end, down from 1,586 in the same quarter last year

- Same-Store Sales fell 2.9% year on year (0.1% in the same quarter last year)

- Market Capitalization: $211.7 million

Kelli Valade, Chief Executive Officer, stated, "Our third quarter progress on strategic initiatives demonstrates our ability to remain agile and focused on what is within our control amid a choppy industry backdrop. These achievements are the direct result of our incredible teams and franchisees maintaining their unwavering commitment to our brands and our guests."

Company Overview

Open around the clock, Denny’s (NASDAQ: DENN) is a chain of diner restaurants serving breakfast and traditional American fare.

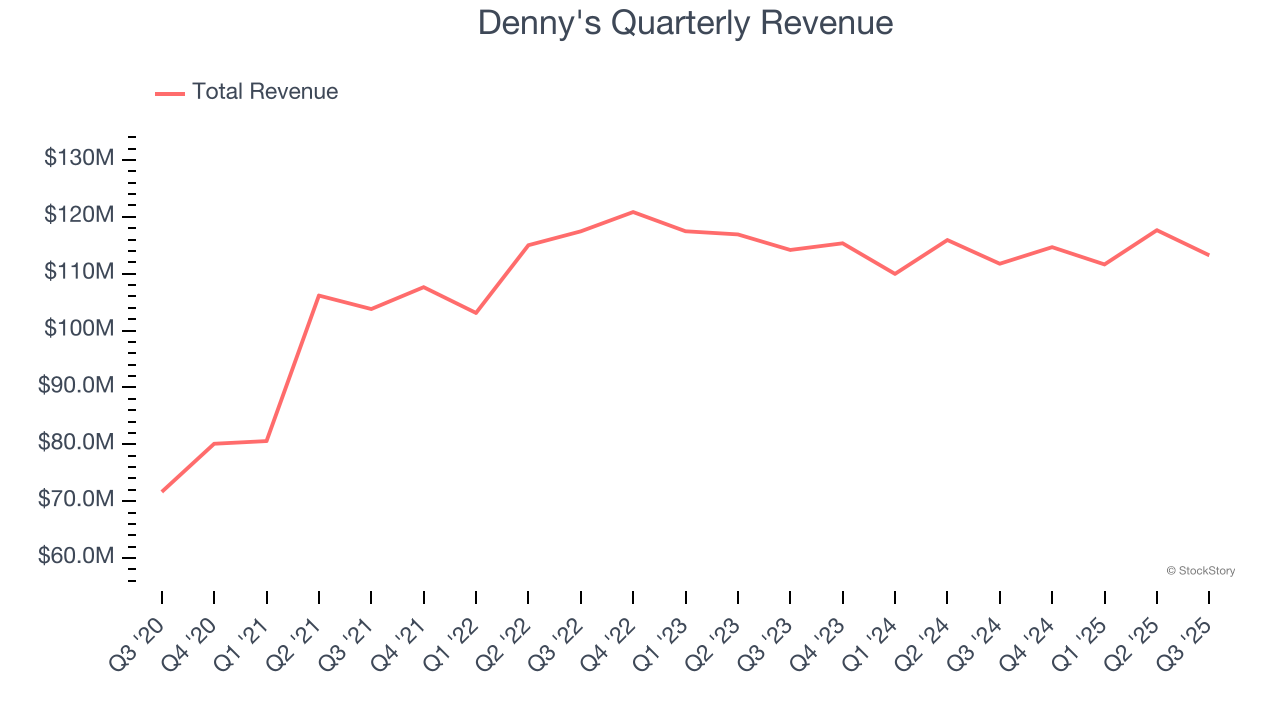

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years.

With $457.2 million in revenue over the past 12 months, Denny's is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

As you can see below, Denny’s demand was weak over the last six years (we compare to 2019 to normalize for COVID-19 impacts). Its sales fell by 4.1% annually as it closed restaurants.

This quarter, Denny’s revenue grew by 1.3% year on year to $113.2 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 7.7% over the next 12 months, an acceleration versus the last six years. This projection is above the sector average and indicates its newer menu offerings will spur better top-line performance.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Restaurant Performance

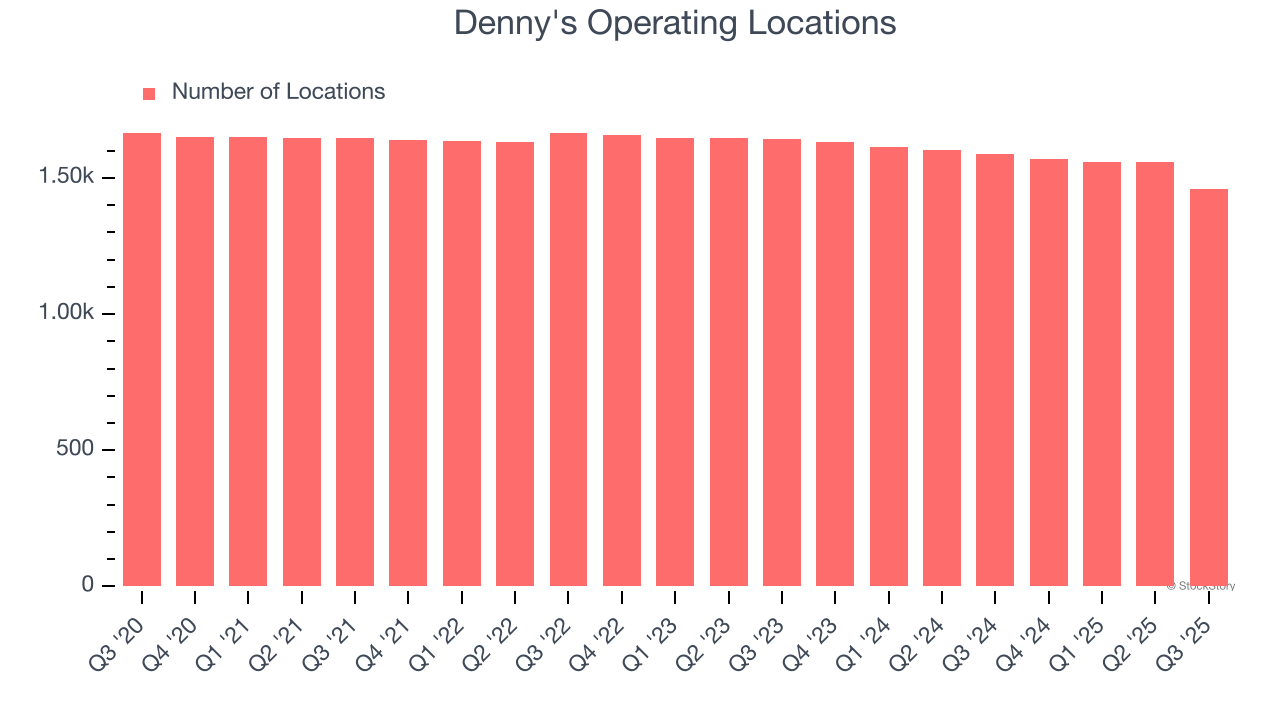

Number of Restaurants

Denny's listed 1,459 locations in the latest quarter and has generally closed its restaurants over the last two years, averaging 3.5% annual declines.

When a chain shutters restaurants, it usually means demand for its meals is waning, and it is responding by closing underperforming locations to improve profitability.

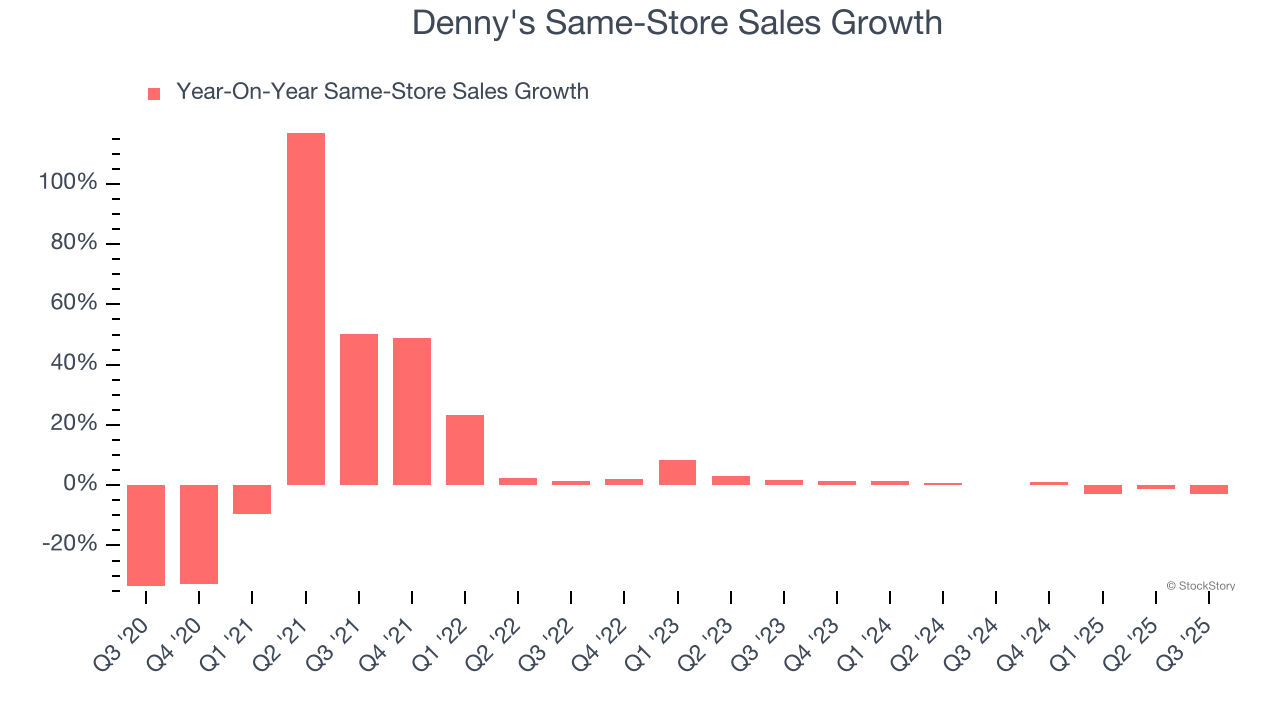

Same-Store Sales

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at restaurants open for at least a year.

Denny’s demand within its existing dining locations has barely increased over the last two years as its same-store sales were flat. This performance isn’t ideal, and Denny's is attempting to boost same-store sales by closing restaurants (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Denny’s same-store sales fell by 2.9% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Denny’s Q3 Results

Denny's will be purchased by private equity investment company TriArtisan Capital Advisors, investment firm Treville Capital and Yadav Enterprises (one of Denny's largest franchisees) in a deal worth $620 million, including debt. Denny's shareholders will receive $6.25 per share in cash for each share of common stock they own, a 52% premium to Denny's closing stock price Monday. This overshadows the results in the quarter. The stock traded up 46.5% to $6.03 immediately following the results.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.