Since October 2024, CoStar has been in a holding pattern, posting a small return of 2.1% while floating around $80.01. However, the stock is beating the S&P 500’s 8.9% decline during that period.

Given the relative strength, is there still a buying opportunity in CSGP? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does CSGP Stock Spark Debate?

With a research department that makes over 10,000 property updates daily to its 35-year-old database, CoStar Group (NASDAQ: CSGP) provides comprehensive real estate data, analytics, and online marketplaces for commercial and residential properties in the U.S. and U.K.

Two Positive Attributes:

1. Skyrocketing Revenue Shows Strong Momentum

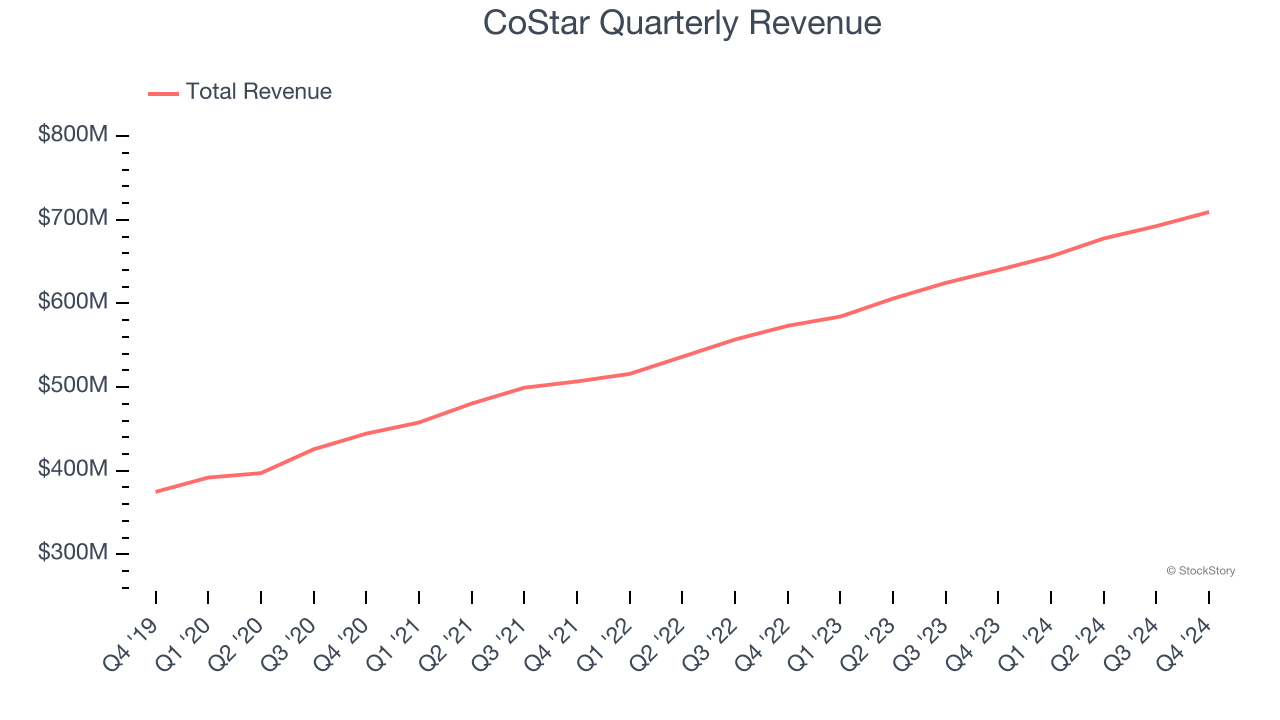

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, CoStar’s sales grew at an exceptional 14.3% compounded annual growth rate over the last five years. Its growth surpassed the average business services company and shows its offerings resonate with customers.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect CoStar’s revenue to rise by 15.3%, an improvement versus its 12% annualized growth for the past two years. This projection is eye-popping and suggests its newer products and services will fuel better top-line performance.

One Reason to be Careful:

Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

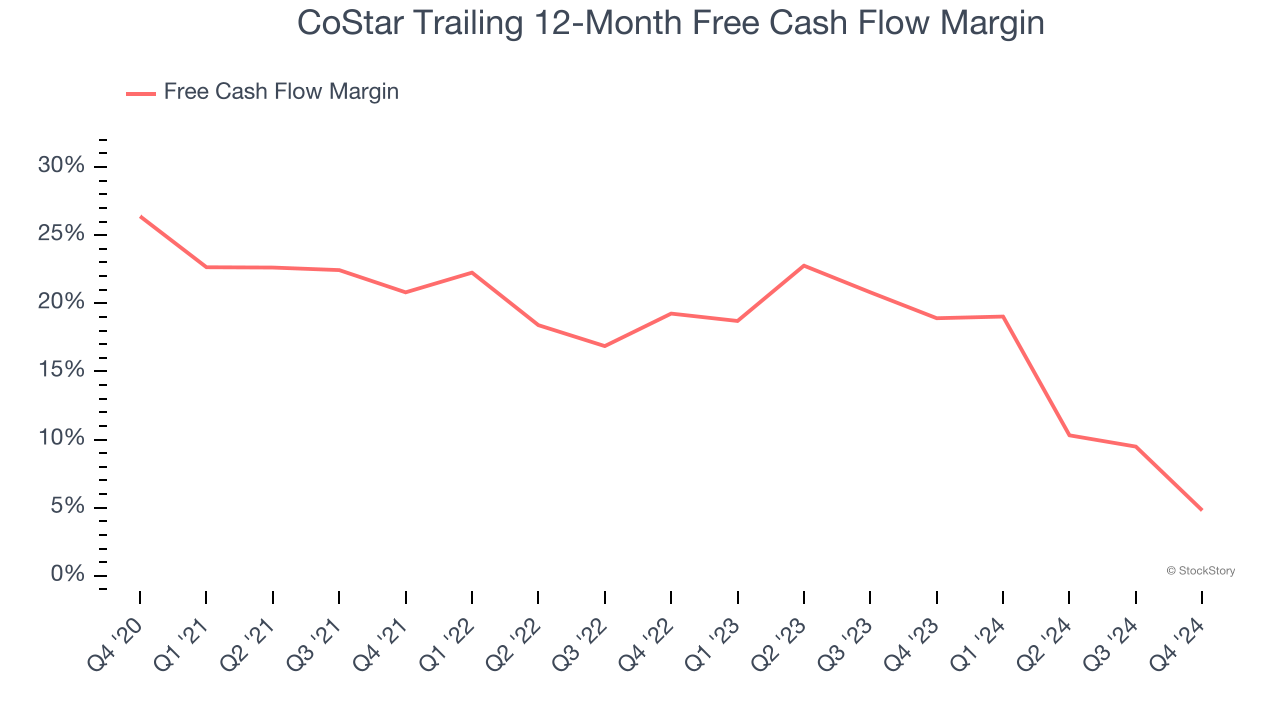

As you can see below, CoStar’s margin dropped by 21.6 percentage points over the last five years. Continued declines could signal it is in the middle of an investment cycle. CoStar’s free cash flow margin for the trailing 12 months was 4.8%.

Final Judgment

CoStar’s merits more than compensate for its flaws, and after its recent outperformance in a weaker market environment, the stock trades at 71.5× forward price-to-earnings (or $80.01 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than CoStar

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.