RFID manufacturer Impinj (NASDAQ: PI) beat Wall Street’s revenue expectations in Q1 CY2025, but sales fell by 3.3% year on year to $74.28 million. The company expects next quarter’s revenue to be around $93.5 million, close to analysts’ estimates. Its non-GAAP profit of $0.21 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Impinj? Find out by accessing our full research report, it’s free.

Impinj (PI) Q1 CY2025 Highlights:

- Revenue: $74.28 million vs analyst estimates of $71.6 million (3.3% year-on-year decline, 3.7% beat)

- Adjusted EPS: $0.21 vs analyst estimates of $0.08 (significant beat)

- Revenue Guidance for Q2 CY2025 is $93.5 million at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for Q2 CY2025 is $0.72 at the midpoint, above analyst estimates of $0.57

- EBITDA guidance for Q2 CY2025 is $24.75 million at the midpoint, above analyst estimates of $21.38 million

- Operating Margin: -12.9%, up from -15.3% in the same quarter last year

- Free Cash Flow was -$13.01 million, down from $53.94 million in the same quarter last year

- Inventory Days Outstanding: 238, up from 199 in the previous quarter

- Market Capitalization: $2.12 billion

Company Overview

Founded by Caltech professor Carver Mead and one of his students Chris Diorio, Impinj (NASDAQ: PI) is a maker of radio-frequency identification (RFID) hardware and software.

Analog Semiconductors

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

Sales Growth

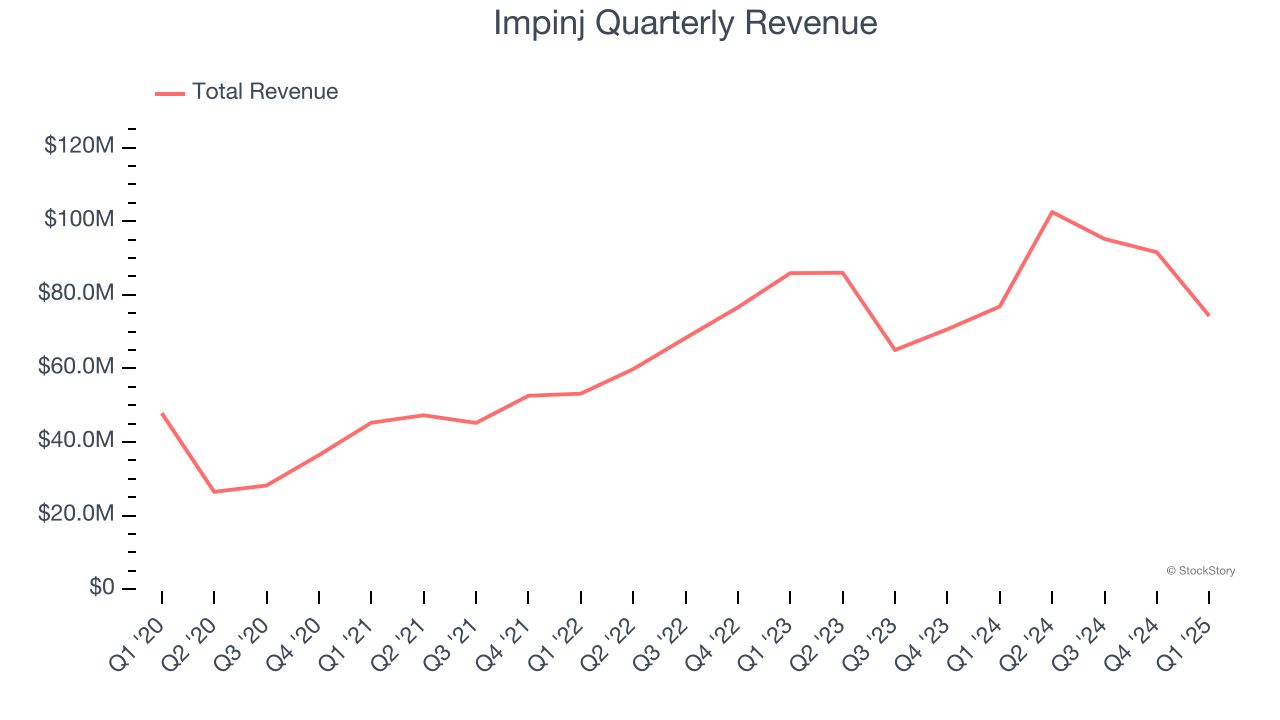

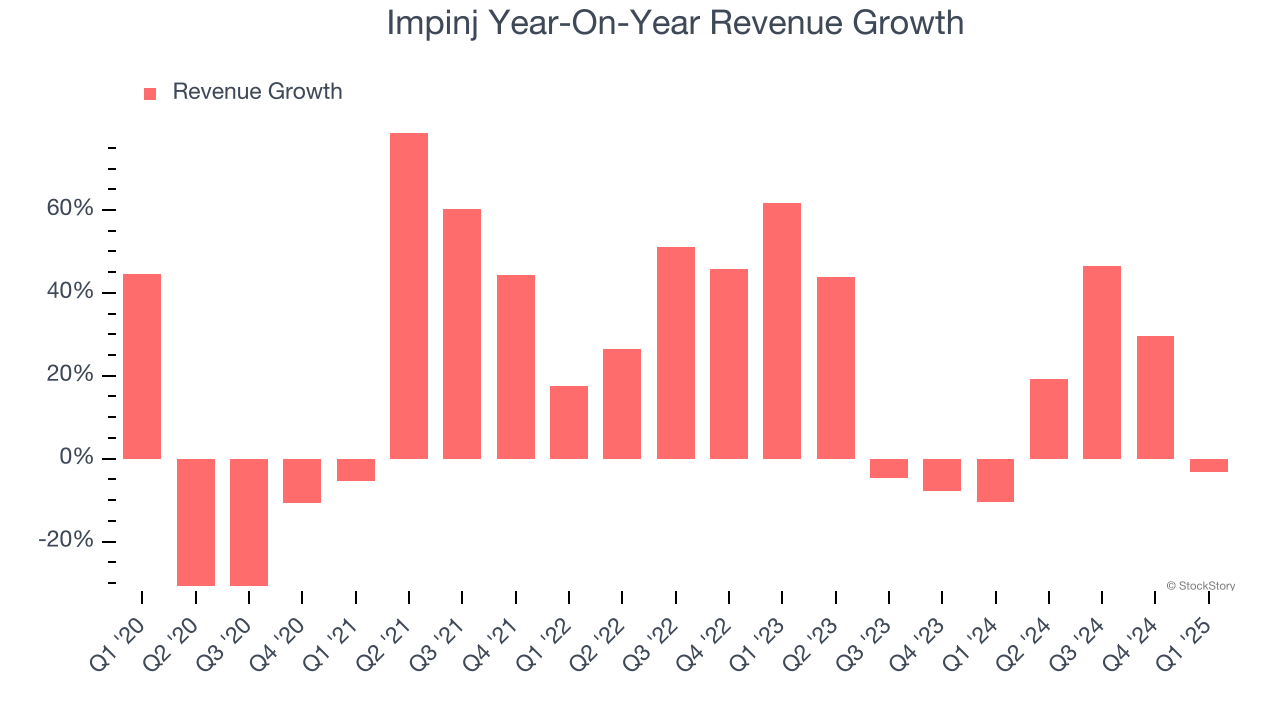

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Impinj grew its sales at an excellent 16.8% compounded annual growth rate. Its growth beat the average semiconductor company and shows its offerings resonate with customers, a helpful starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Impinj’s annualized revenue growth of 11.9% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Impinj’s revenue fell by 3.3% year on year to $74.28 million but beat Wall Street’s estimates by 3.7%. Company management is currently guiding for a 8.8% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.9% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

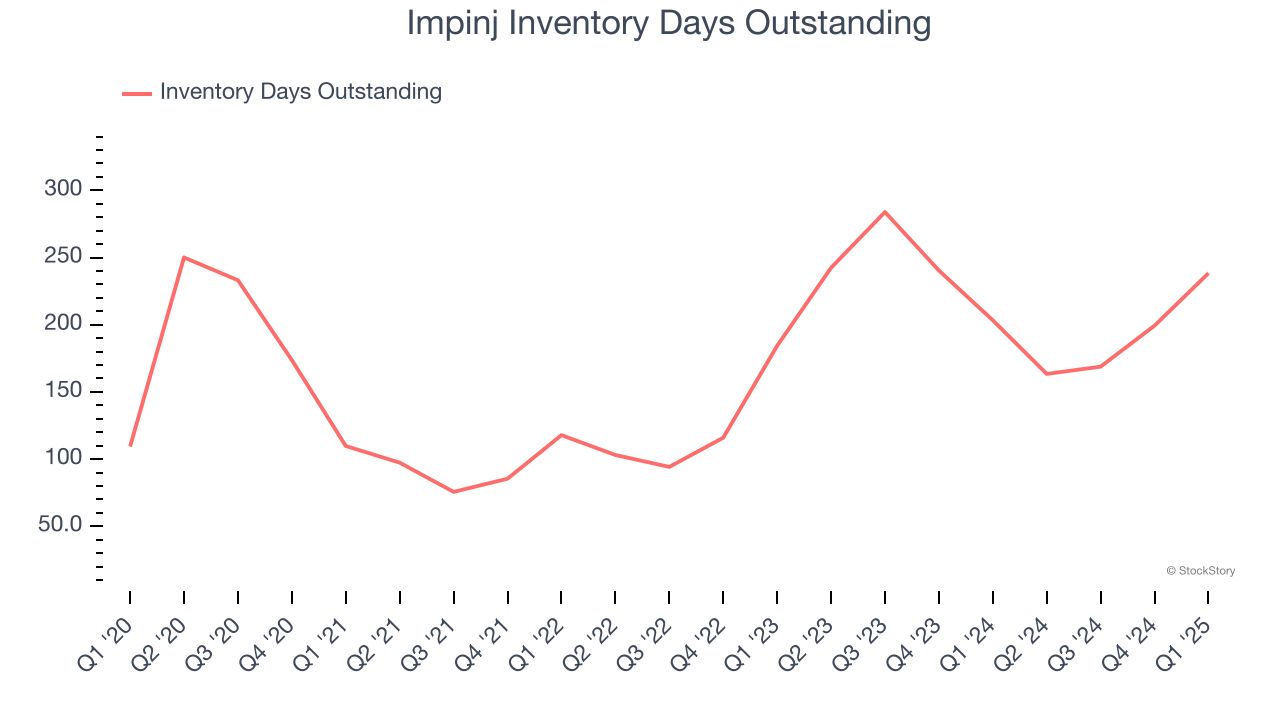

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Impinj’s DIO came in at 238, which is 69 days above its five-year average, suggesting that the company’s inventory has grown to higher levels than we’ve seen in the past.

Key Takeaways from Impinj’s Q1 Results

We were impressed by how significantly Impinj blew past analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Looking ahead, EBITDA and EPS guidance for the next quarter came in ahead. Overall, this quarter was quite strong. The stock traded up 11.9% to $86.25 immediately following the results.

Sure, Impinj had a solid quarter, but if we look at the bigger picture, is this stock a buy? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.