Wrapping up Q2 earnings, we look at the numbers and key takeaways for the gaming solutions stocks, including Churchill Downs (NASDAQ: CHDN) and its peers.

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

The 7 gaming solutions stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 2.2%.

While some gaming solutions stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2% since the latest earnings results.

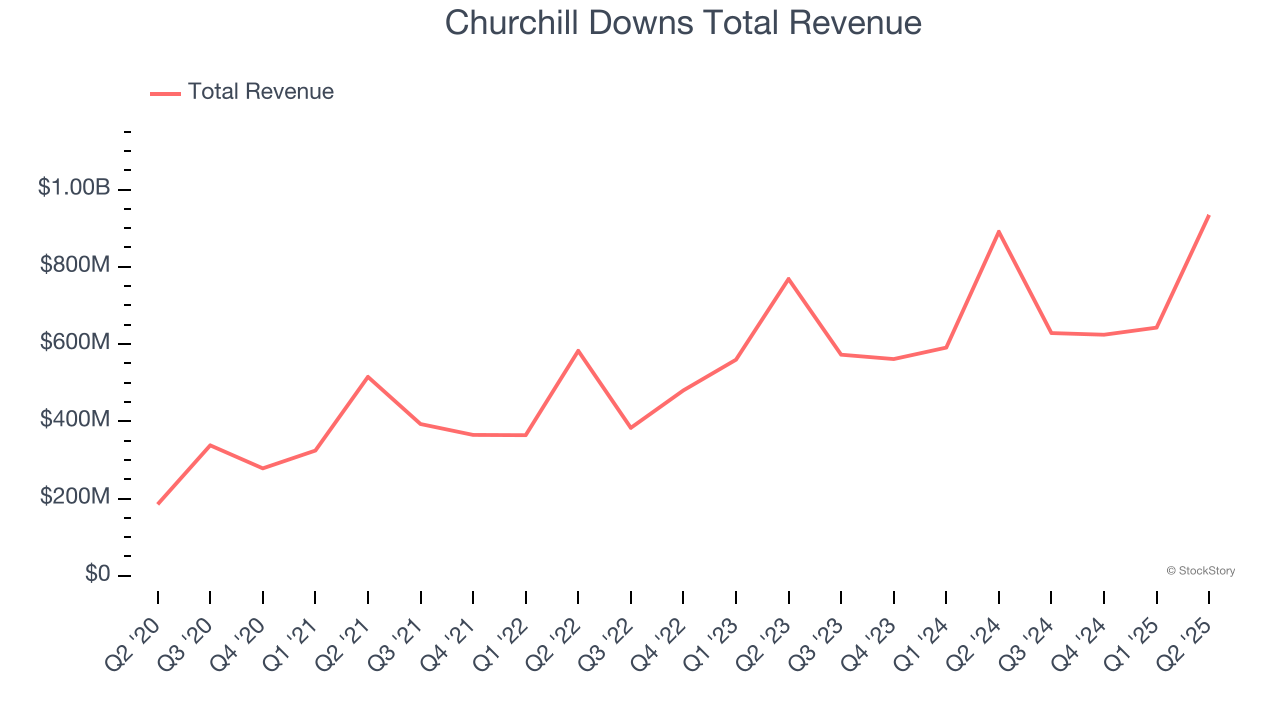

Churchill Downs (NASDAQ: CHDN)

Famous for hosting the Kentucky Derby, Churchill Downs (NASDAQ: CHDN) operates a horse racing, online wagering, and gaming entertainment business in the United States.

Churchill Downs reported revenues of $934.4 million, up 4.9% year on year. This print exceeded analysts’ expectations by 1.4%. Despite the top-line beat, it was still a mixed quarter for the company with a decent beat of analysts’ EBITDA estimates but a miss of analysts’ adjusted operating income estimates.

Unsurprisingly, the stock is down 4.3% since reporting and currently trades at $104.48.

Is now the time to buy Churchill Downs? Access our full analysis of the earnings results here, it’s free.

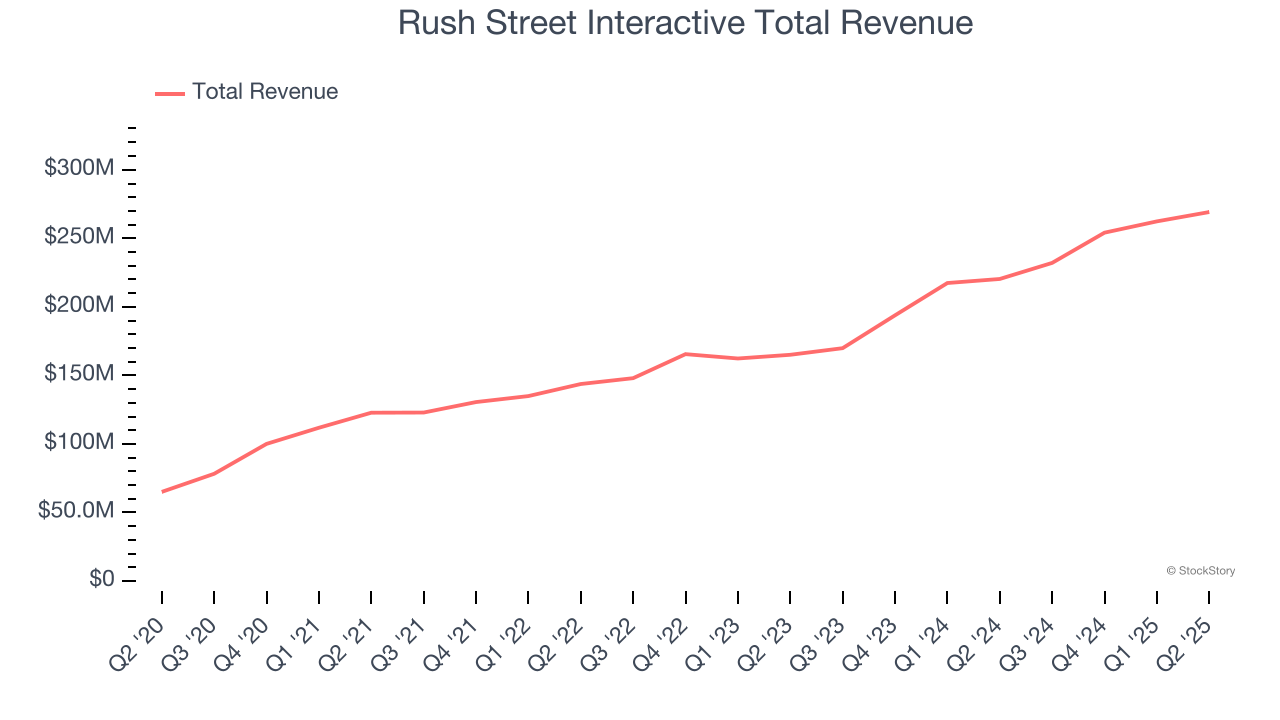

Best Q2: Rush Street Interactive (NYSE: RSI)

Specializing in online casino gaming and sports betting, Rush Street Interactive (NYSE: RSI) is an operator of digital gaming platforms.

Rush Street Interactive reported revenues of $269.2 million, up 22.2% year on year, outperforming analysts’ expectations by 7.6%. The business had a stunning quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Rush Street Interactive achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 21.6% since reporting. It currently trades at $19.50.

Is now the time to buy Rush Street Interactive? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Light & Wonder (NASDAQ: LNW)

With names as crazy as Ultimate Fire Link Power 4 for its products, Light & Wonder (NASDAQ: LNW) is a gaming company supplying the casino industry with slot machines, table games, and digital games.

Light & Wonder reported revenues of $809 million, down 1.1% year on year, falling short of analysts’ expectations by 4.4%. It was a softer quarter as it posted a significant miss of analysts’ EPS estimates and a miss of analysts’ iGaming revenue estimates.

Light & Wonder delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 1.8% since the results and currently trades at $89.30.

Read our full analysis of Light & Wonder’s results here.

Accel Entertainment (NYSE: ACEL)

Established in Illinois, Accel Entertainment (NYSE: ACEL) is a provider of electronic gaming machines and interactive amusement terminals to bars and entertainment venues.

Accel Entertainment reported revenues of $335.9 million, up 8.6% year on year. This print beat analysts’ expectations by 1%. Aside from that, it was a satisfactory quarter as it also logged a beat of analysts’ EPS estimates but a miss of analysts’ adjusted operating income estimates.

The stock is down 9.6% since reporting and currently trades at $11.20.

Read our full, actionable report on Accel Entertainment here, it’s free.

PlayStudios (NASDAQ: MYPS)

Founded by a team of former gaming industry executives, PlayStudios (NASDAQ: MYPS) offers free-to-play digital casino games.

PlayStudios reported revenues of $59.34 million, down 18.3% year on year. This result missed analysts’ expectations by 2.8%. Zooming out, it was a mixed quarter as it also recorded full-year revenue guidance beating analysts’ expectations but a miss of analysts’ daily active users estimates.

PlayStudios delivered the highest full-year guidance raise but had the slowest revenue growth among its peers. The company reported 2.35 million monthly active users, down 27.1% year on year. The stock is down 15.4% since reporting and currently trades at $0.93.

Read our full, actionable report on PlayStudios here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.