Infrastructure construction company Primoris (NYSE: PRIM) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 20.9% year on year to $1.89 billion. Its non-GAAP profit of $1.68 per share was 55.4% above analysts’ consensus estimates.

Is now the time to buy Primoris? Find out by accessing our full research report, it’s free.

Primoris (PRIM) Q2 CY2025 Highlights:

- Revenue: $1.89 billion vs analyst estimates of $1.69 billion (20.9% year-on-year growth, 12.1% beat)

- Adjusted EPS: $1.68 vs analyst estimates of $1.08 (55.4% beat)

- Adjusted EBITDA: $154.8 million vs analyst estimates of $112.1 million (8.2% margin, 38.1% beat)

- Management raised its full-year Adjusted EPS guidance to $5 at the midpoint, a 16.3% increase

- EBITDA guidance for the full year is $500 million at the midpoint, above analyst estimates of $453 million

- Operating Margin: 6.7%, up from 5.5% in the same quarter last year

- Free Cash Flow was $33,100, up from -$8.14 million in the same quarter last year

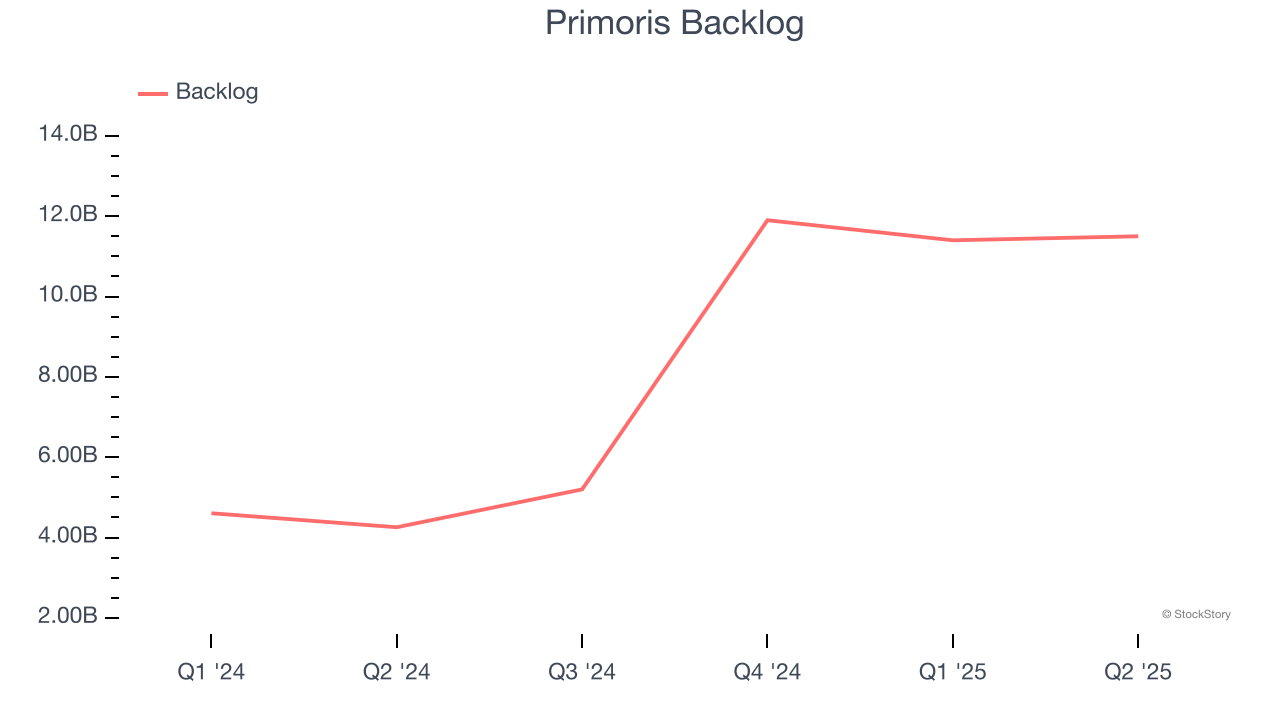

- Backlog: $11.5 billion at quarter end, up 170% year on year

- Market Capitalization: $4.92 billion

Company Overview

Listed on the NASDAQ in 2008, Primoris (NYSE: PRIM) builds, maintains, and upgrades infrastructure in the utility, energy, and civil construction industries.

Revenue Growth

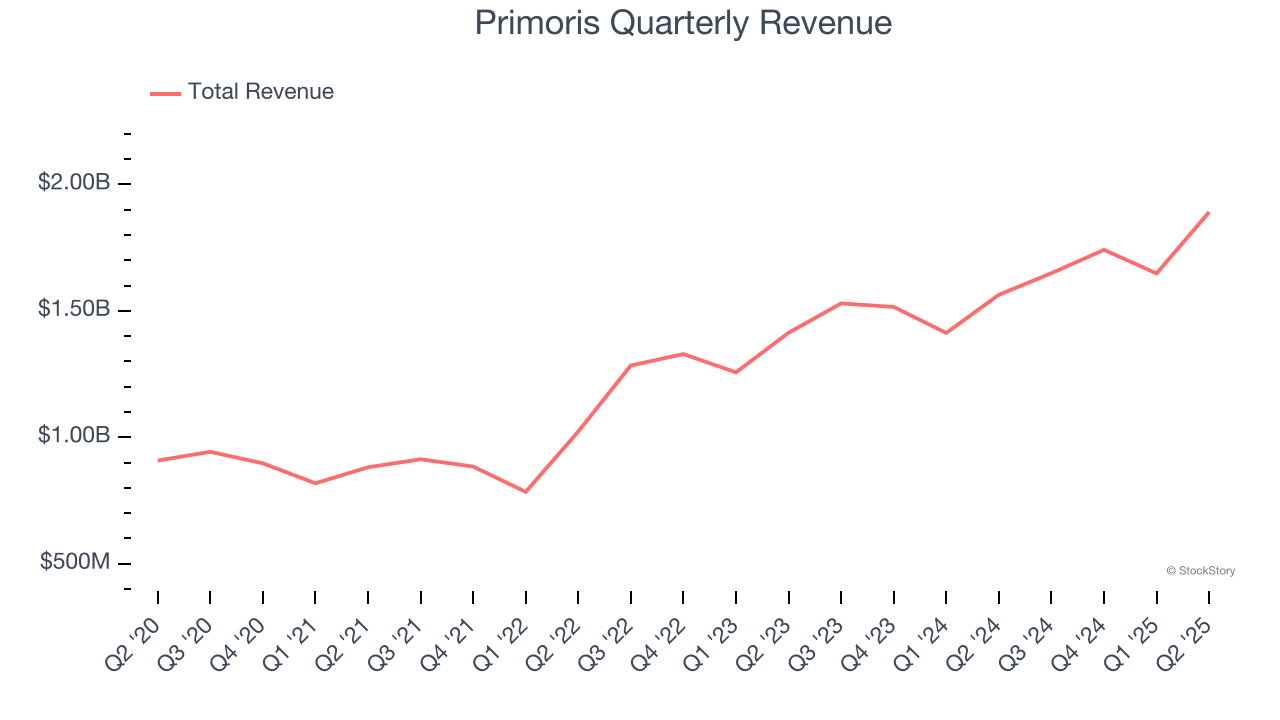

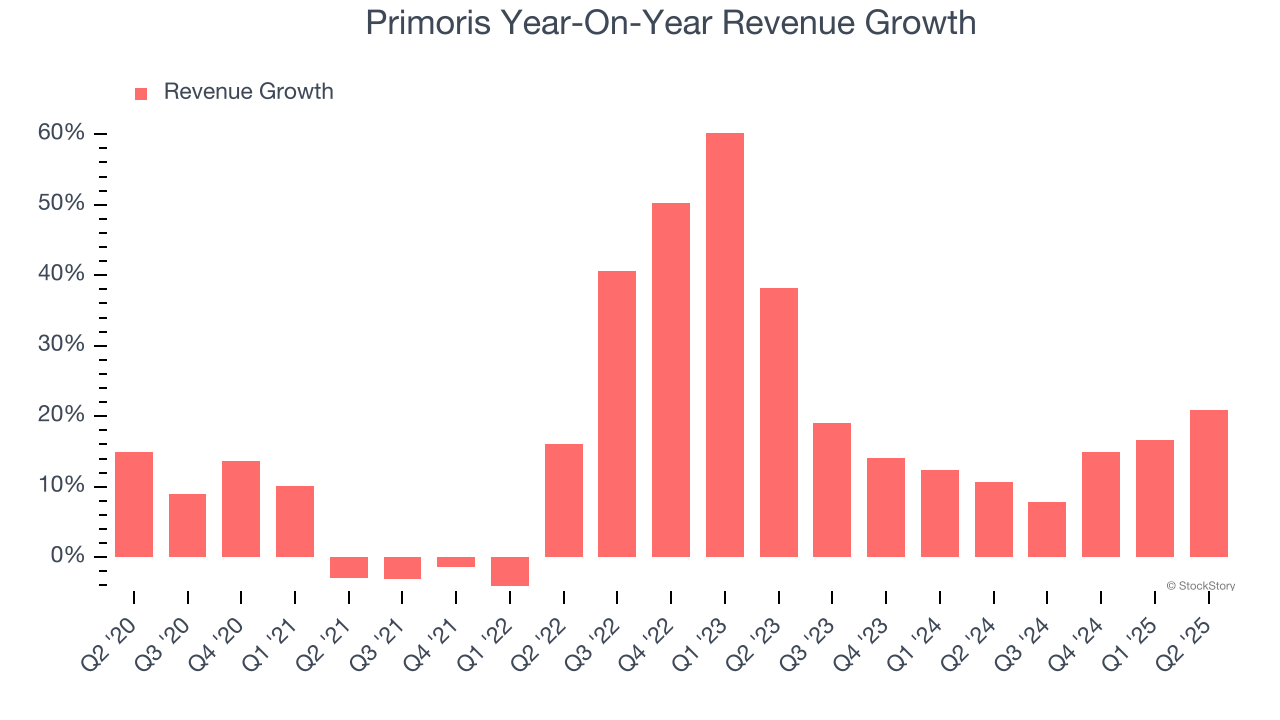

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Primoris’s sales grew at an incredible 15.9% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Primoris’s annualized revenue growth of 14.5% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Primoris’s backlog reached $11.5 billion in the latest quarter and averaged 159% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Primoris’s products and services but raises concerns about capacity constraints.

This quarter, Primoris reported robust year-on-year revenue growth of 20.9%, and its $1.89 billion of revenue topped Wall Street estimates by 12.1%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

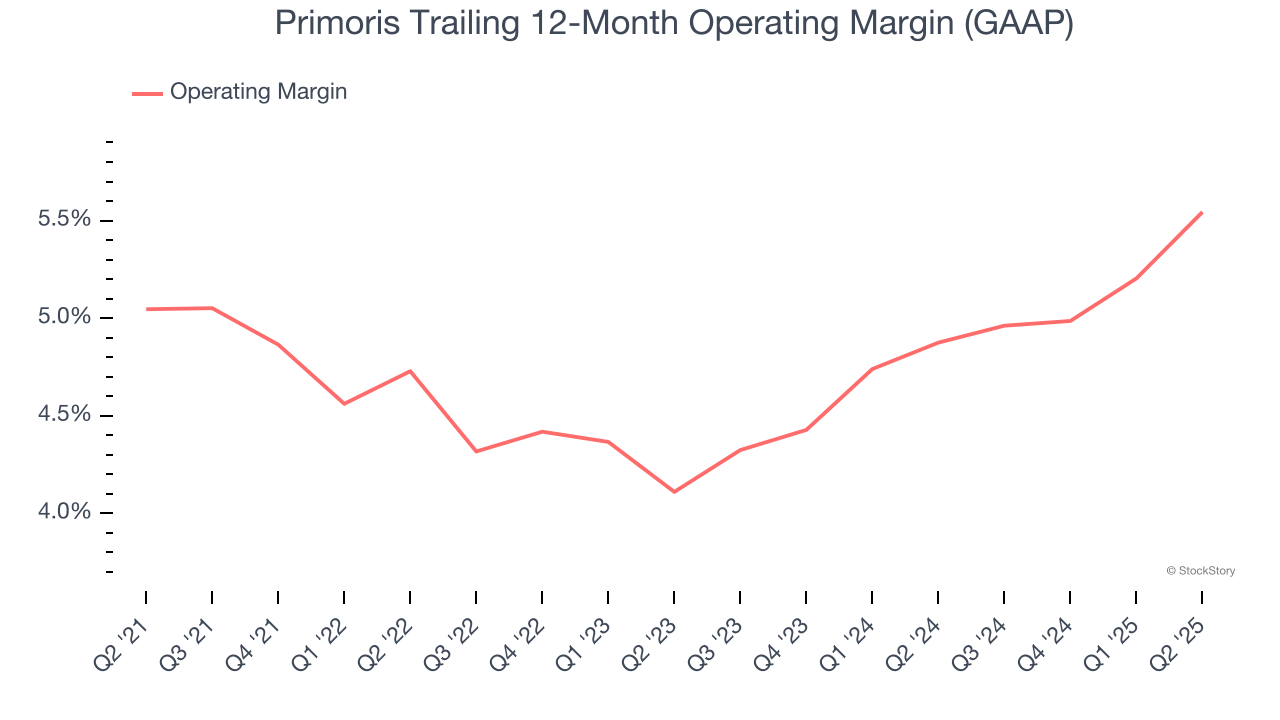

Primoris’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 4.9% over the last five years. This profitability was paltry for an industrials business and caused by its suboptimal cost structureand low gross margin.

Analyzing the trend in its profitability, Primoris’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q2, Primoris generated an operating margin profit margin of 6.7%, up 1.2 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

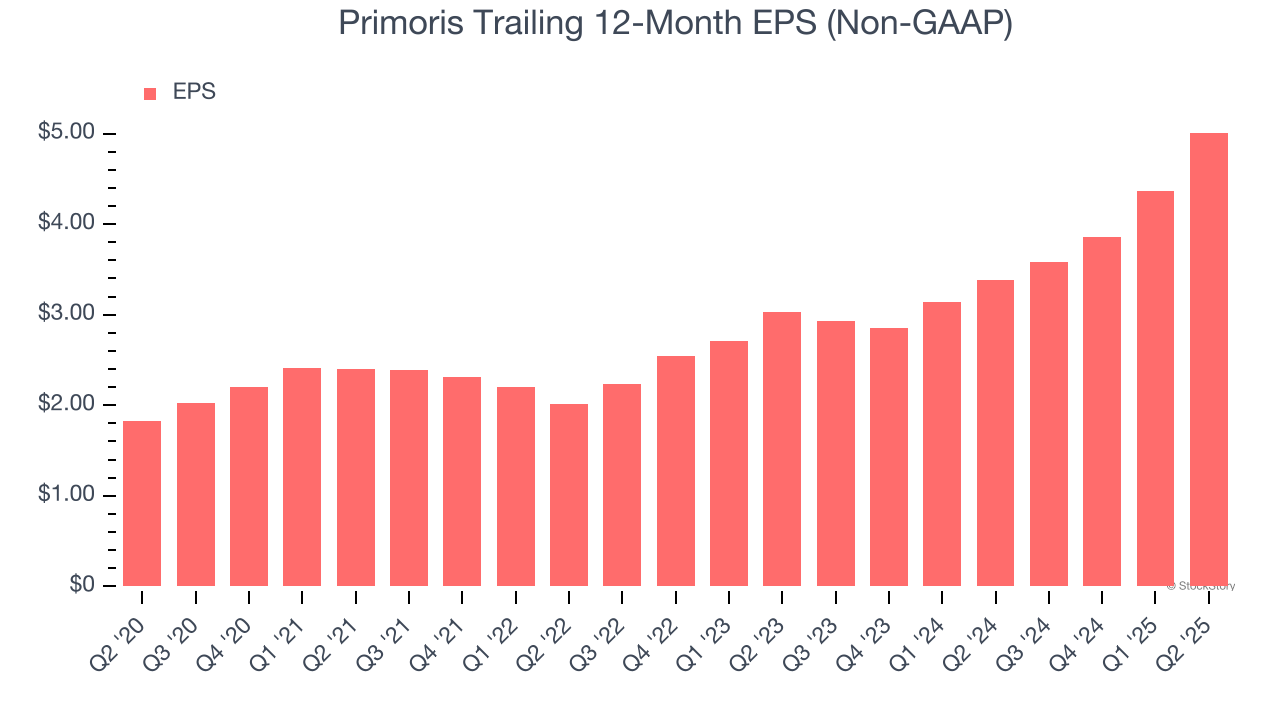

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Primoris’s EPS grew at an astounding 22.3% compounded annual growth rate over the last five years, higher than its 15.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Primoris, its two-year annual EPS growth of 28.6% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q2, Primoris reported adjusted EPS at $1.68, up from $1.04 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Primoris’s full-year EPS of $5.01 to shrink by 8.1%.

Key Takeaways from Primoris’s Q2 Results

We were impressed by how significantly Primoris blew past analysts’ EBITDA and EPS expectations this quarter. Looking ahead, full-year guidance was raised and ahead of Wall Street’s estimates. Zooming out, we think this was a solid print with very little to pick on. The stock traded up 14.9% to $107 immediately after reporting.

Indeed, Primoris had a rock-solid quarterly earnings result, but is this stock a good investment here? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.