Genomics company Illumina (NASDAQ: ILMN) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 5% year on year to $1.16 billion. The company’s full-year revenue guidance of $4.55 billion at the midpoint came in 3.1% above analysts’ estimates. Its non-GAAP profit of $1.35 per share was 8.3% above analysts’ consensus estimates.

Is now the time to buy Illumina? Find out by accessing our full research report, it’s free.

Illumina (ILMN) Q4 CY2025 Highlights:

- Revenue: $1.16 billion vs analyst estimates of $1.12 billion (5% year-on-year growth, 3.2% beat)

- Adjusted EPS: $1.35 vs analyst estimates of $1.25 (8.3% beat)

- Adjusted Operating Income: $275 million vs analyst estimates of $253 million (23.7% margin, 8.7% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $5.13 at the midpoint, beating analyst estimates by 1.1%

- Operating Margin: 17.4%, up from 15.9% in the same quarter last year

- Free Cash Flow Margin: 23%, down from 30.3% in the same quarter last year

- Organic Revenue rose 5% year on year (beat)

- Market Capitalization: $20.5 billion

"The Illumina team delivered a strong finish to 2025, marking a return to growth through disciplined execution against our strategy," said Jacob Thaysen, Chief Executive Officer of Illumina.

Company Overview

Pioneering the ability to read the human genome at unprecedented speed and affordability, Illumina (NASDAQ: ILMN) develops and sells advanced DNA sequencing and microarray technologies that allow researchers and clinicians to analyze genetic variations and functions.

Revenue Growth

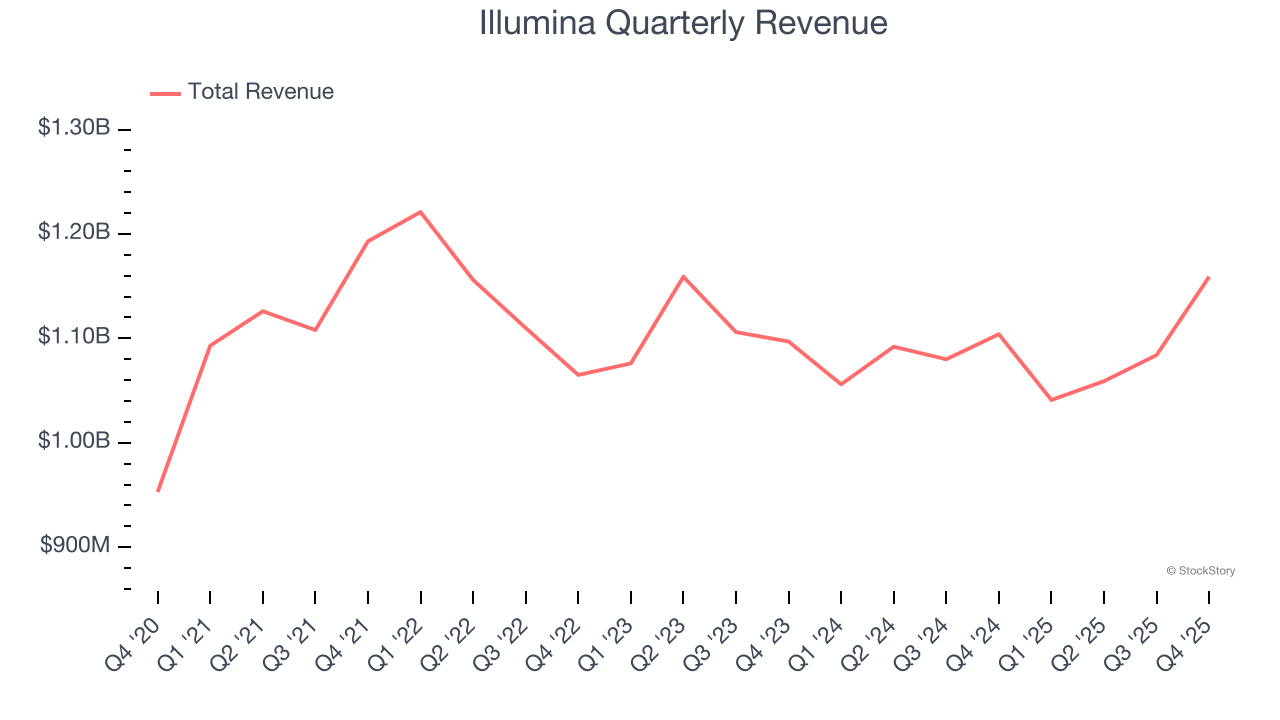

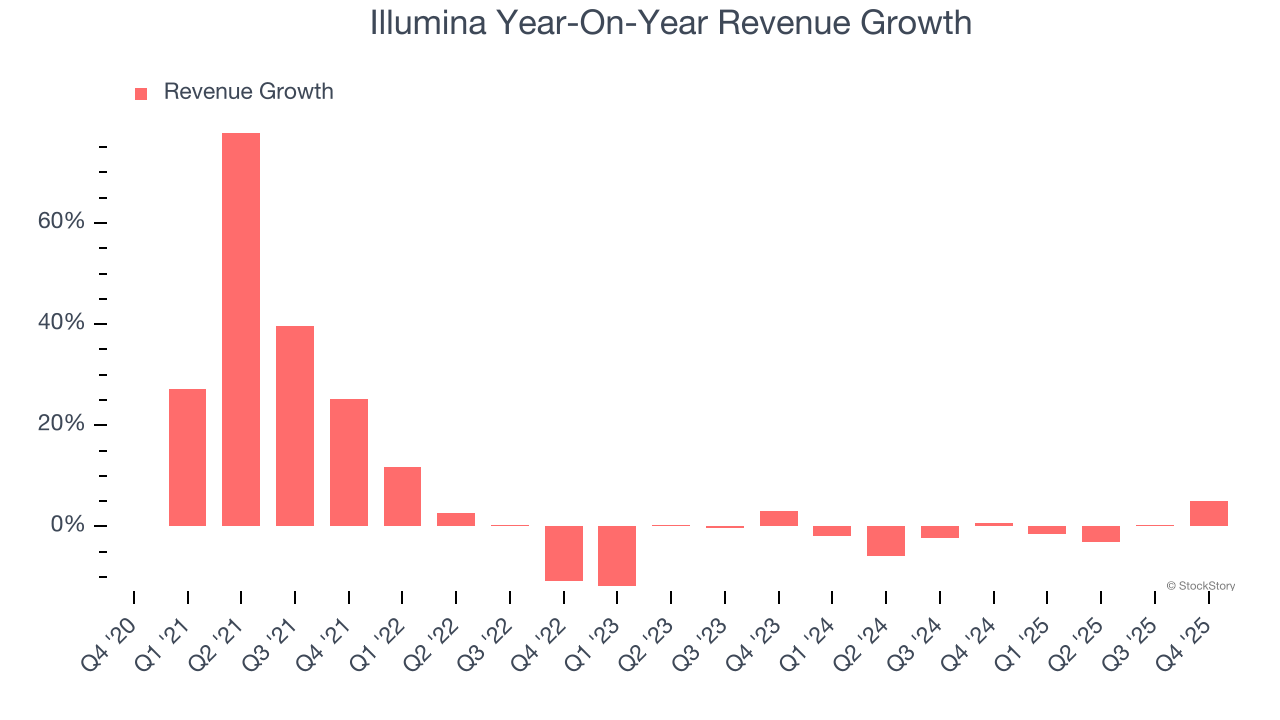

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Illumina’s sales grew at a mediocre 6% compounded annual growth rate over the last five years. This was below our standard for the healthcare sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Illumina’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.1% annually.

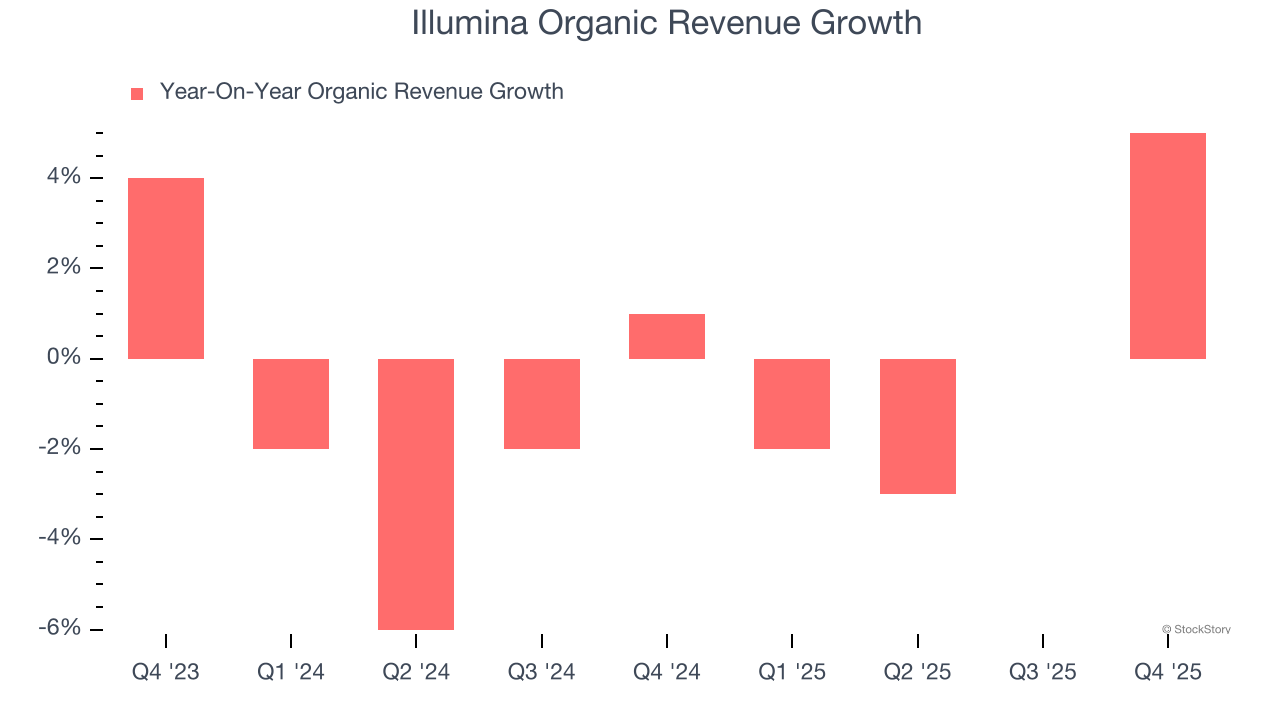

Illumina also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Illumina’s organic revenue averaged 1.1% year-on-year declines. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Illumina reported modest year-on-year revenue growth of 5% but beat Wall Street’s estimates by 3.2%.

Looking ahead, sell-side analysts expect revenue to grow 1.7% over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Adjusted Operating Margin

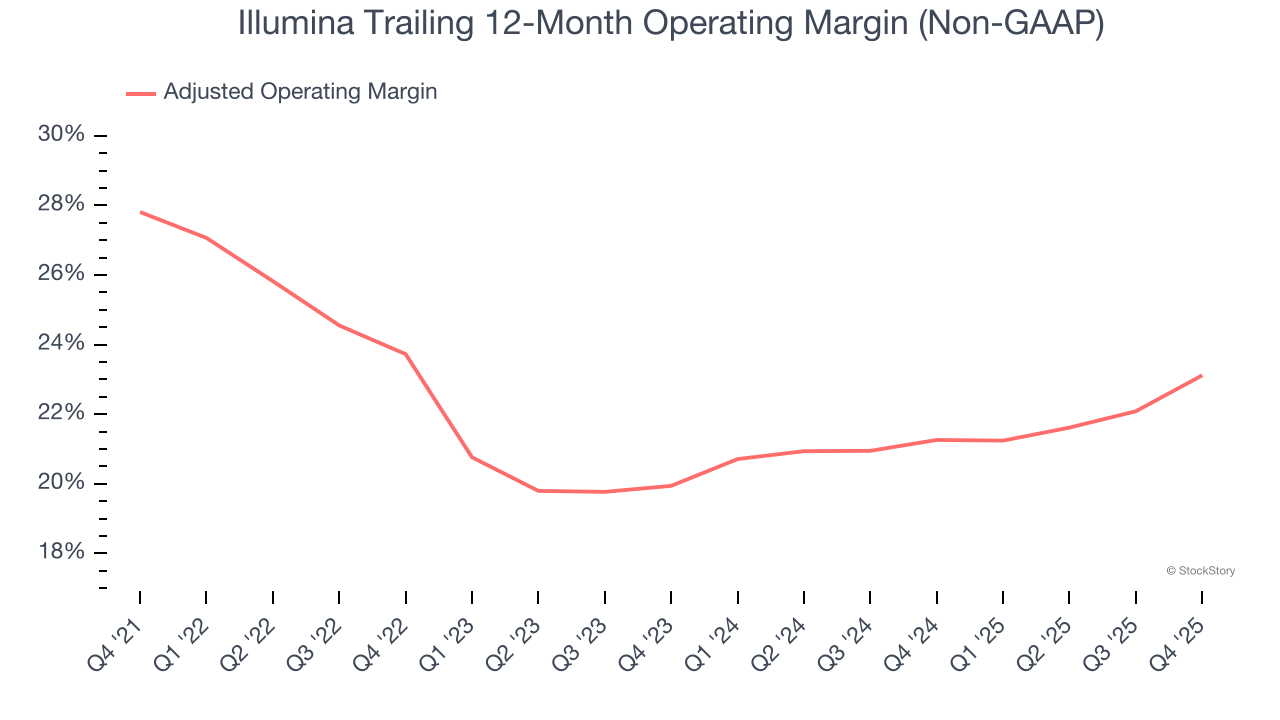

Adjusted operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D. It also removes various one-time costs to paint a better picture of normalized profits.

Illumina has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average adjusted operating margin of 23.2%.

Looking at the trend in its profitability, Illumina’s adjusted operating margin decreased by 4.7 percentage points over the last five years, but it rose by 3.2 percentage points on a two-year basis. Still, shareholders will want to see Illumina become more profitable in the future.

This quarter, Illumina generated an adjusted operating margin profit margin of 23.7%, up 4 percentage points year on year. This increase was a welcome development and shows it was more efficient.

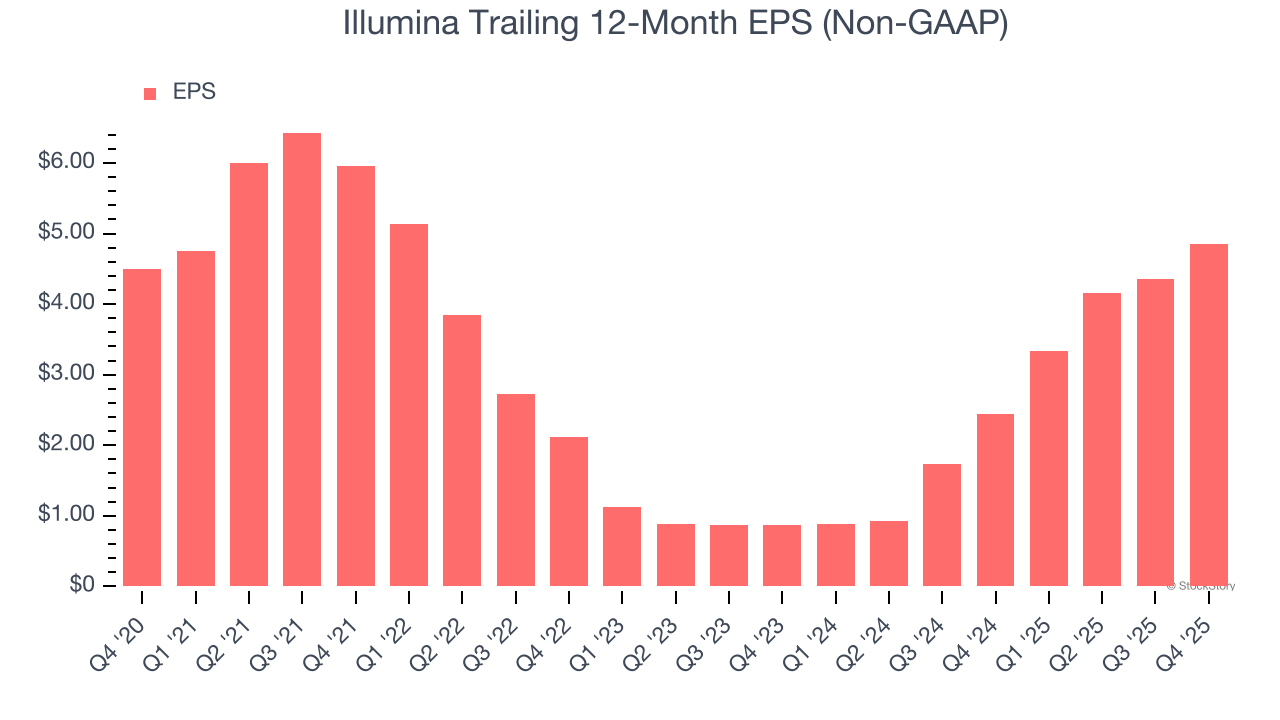

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

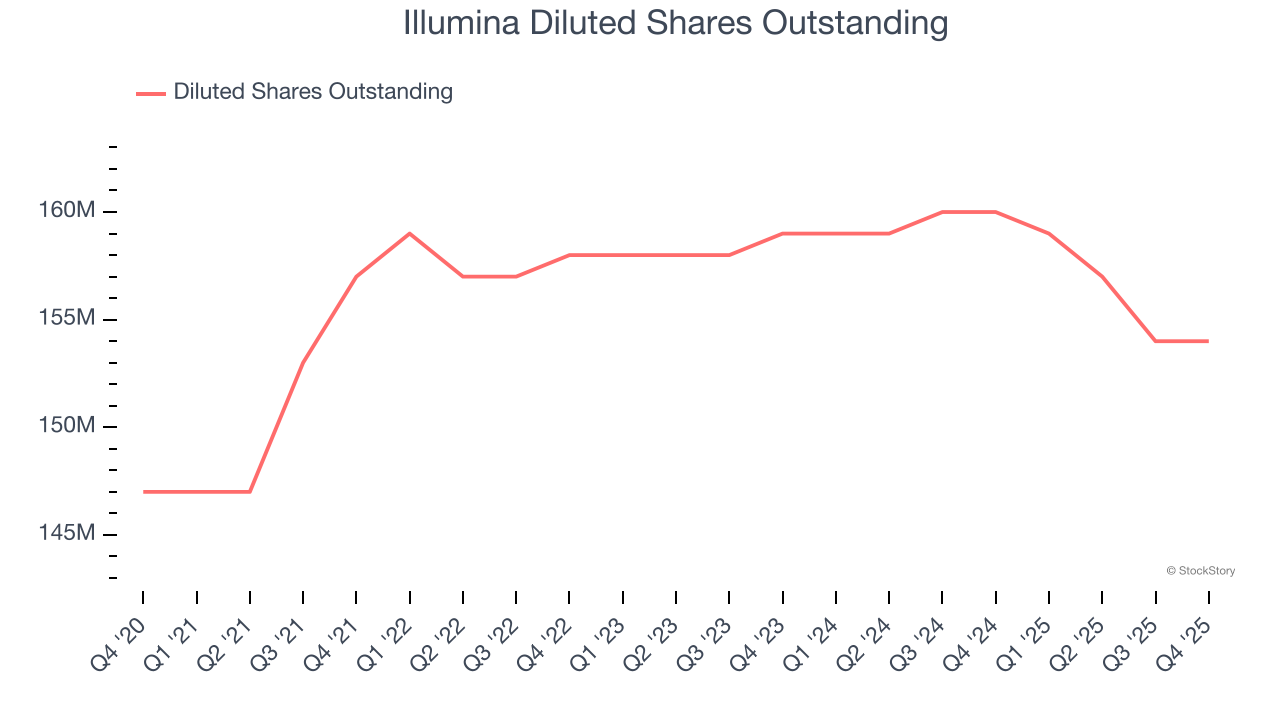

Illumina’s EPS grew at an unimpressive 1.5% compounded annual growth rate over the last five years, lower than its 6% annualized revenue growth. However, its adjusted operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

We can take a deeper look into Illumina’s earnings to better understand the drivers of its performance. As we mentioned earlier, Illumina’s adjusted operating margin expanded this quarter but declined by 4.7 percentage points over the last five years. Its share count also grew by 4.8%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q4, Illumina reported adjusted EPS of $1.35, up from $0.86 in the same quarter last year. This print beat analysts’ estimates by 9.7%. Over the next 12 months, Wall Street expects Illumina’s full-year EPS of $4.85 to grow 4.5%.

Key Takeaways from Illumina’s Q4 Results

We were impressed by Illumina’s optimistic full-year revenue guidance, which blew past analysts’ expectations. We were also glad its organic revenue outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. Investors were likely hoping for more, and shares traded down 1.4% to $131.70 immediately following the results.

So do we think Illumina is an attractive buy at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).