- Survey finds ETF strategies are used by majority of financial advisors and institutions; adoption by individual investors on the rise

- Education key to increasing use of ETFs by individuals

- Most institutional investors and financial advisors are bullish on the S&P 500’s 2024 returns

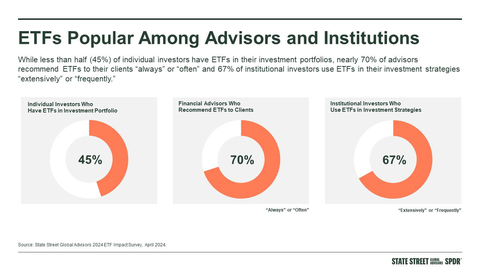

State Street Global Advisors, the asset management business of State Street Corporation (NYSE: STT) today released the results of its 2024 ETF Impact Survey, which reveals more than two thirds of financial advisors (70%) “always” or “often” recommend ETFs to their clients and a similar percentage of institutional investors (67%) use ETFs in investment strategies. While less than half of all individual investors (45%) currently have ETFs in their portfolio —adoption by individuals is up from 40% in 2022 and appears poised for additional growth with more education. The survey was first conducted in 2022 and is designed to understand a wide range of investor attitudes and perceptions about ETFs, the market and the economy.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240719373253/en/

While less than half (45%) of individual investors have ETFs in their investment portfolios, nearly 70% of financial advisors recommend ETFs to their clients “always” or “often” and 67% of institutional investors use ETFs in their investment strategies “extensively” or “frequently.” (Source: State Street Global Advisors 2024 ETF Impact Survey, April 2024)

The use of ETFs by individual investors is highest among younger individuals, as 58% of Millennial investors report they hold ETFs, compared to 47% of Gen Xers and 37% of Baby Boomers. The top reasons individual investors cite for holding ETFs in a portfolio include diversification benefits (49%), access to specific asset classes/exposures (47%) and lower costs/expense ratios (39%).

Notably, 65% of investors say that ETFs have improved the overall performance of their portfolio (up from 59% in 2022), and the percentage of investors who believe ETFs have made them a better investor has held steady at 54%, compared to 53% in 2022.

"There is still growing confidence that ETFs should be a core part of a diversified portfolio," said Anna Paglia, chief business officer for State Street Global Advisors. "The rapid growth and lower cost of ETFs since their introduction over 30 years ago has made it easier for people from all walks of life to become investors.”

Among individuals who do not own ETFs, a significant knowledge gap exists with 71% reporting the tax efficiency of ETFs is difficult to understand compared to 48% of ETF investors. Similarly, more than two-thirds of investors (69%) who don’t own ETFs say ETF pricing is difficult to understand (compared to 35% of ETF investors) and more than half (57%) say they have a difficult time understanding the difference between mutual funds and ETFs (compared to 23% of ETF investors).

“Despite their popularity, significant investor education still needs to be done to close the knowledge gap about ETFs,” said Paglia. “We know many investors are initially drawn to ETFs for their low cost, but more work needs to be done to raise awareness of all the financial advantages ETFs offer investors, beyond cost.”

Institutions & Financial Advisors More Bullish Than Individual Investors

A majority of institutional investors (57%) and financial advisors (55%) are bullish, expecting the S&P 500® to post gains in 2024. Individual investors are less certain with 44% predicting the index will finish up, 31% expecting S&P 500 returns to be flat, and 15% anticipating it will finish the year in the red.

However, despite individual investors’ mixed outlook on the near-term performance of the stock market, when it comes to the long-term view of their own financial futures, they are decidedly more optimistic. Eighty-four percent (84%) indicate they are optimistic about their own financial futures in the year ahead — up from 71% in Q4 2022.

There is a similar gap in confidence among individual investors regarding their outlook for the country’s economic situation, with just 32% indicating they are optimistic about the economy in the year ahead.

Additional findings from State Street Global Advisors 2024 US ETF Impact Survey for financial advisors and institutions include:

Financial Advisors

- The top three reasons for recommending ETFs to clients include cost efficiency (44%), diversification benefits (43%) and trading flexibility (43%).

- When making a choice between ETFs that offer the same or similar exposure, the most important factors considered by advisors are best track record/performance (58%), lowest expense ratio (54%), and highest liquidity (54%).

- More than three-quarters of advisors (77%) are optimistic about the outlook for the US economy and 68% are optimistic about the global economy.

Institutional Investors

- The top three reasons why institutions use ETFs include diversification benefits (65%), cost efficiency (60%) and cash/liquidity management (54%).

- When making a choice between ETFs that offer the same or similar exposure, the most important factors considered by institutions are highest liquidity (66%), best track record/performance (62%), and lowest total cost (53%).

- A majority of institutional investors (60%) are optimistic about the outlook for the US economy and 41% are optimistic about the global economy.

- The top three concerns among institutional investors include inflation (73%), fluctuations in interest rates (66%), and geopolitical instability (65%).

“The nuances in how and why institutions, advisors, and individuals are using ETFs speak to the many different investor benefits provided by the ETF wrapper,” continued Paglia. “State Street Global Advisors will continue to innovate and evolve its ETF offerings to meet the changing demands of a wide variety of investor segments.”

The SPDR ETF Impact Report 2024-2025: The Next Wave of Innovation provides a comprehensive analysis of the global survey findings and SPDR’s top predictions on the future of ETF growth.

For more information, visit the ETF Impact Survey landing zone.

About State Street Global Advisors 2024 ETF Impact Survey

The survey was designed to understand investor attitudes and perceptions about ETFs, the market and the economy in the US, APAC and EMEA. The data reported here focuses on findings for the US.

State Street Global Advisors, in partnership with A2Bplanning and Prodege, conducted an online survey among individual investors, financial advisors and institutional investors. In the US, data was collected from April 1-25, 2024 from a nationally representative sample of 1,000 adults 18+. It was then filtered for analysis among 319 Individual Investors with investable assets of $250,000 or more, 201 financial advisors with AUM of $25 million or more with 90% with AUM of $50 million or more, and 100 institutional investors who are involved in the decision making for AUM of $1 billion or more.

About State Street Global Advisors

For four decades, State Street Global Advisors has served the world’s governments, institutions, and financial advisors. With a rigorous, risk-aware approach built on research, analysis, and market-tested experience, we build from a breadth of index and active strategies to create cost-effective solutions. As pioneers in index and ETF investing, we are always inventing new ways to invest. As a result, we have become the world’s fourth-largest asset manager* with US $4.42 trillion† under our care.

*Pensions & Investments Research Center, as of 12/31/23.

†This figure is presented as of June 30, 2024 and includes ETF AUM of $1,393.92 billion USD of which approximately $69.35 billion USD is in gold assets with respect to SPDR products for which State Street Global Advisors Funds Distributors, LLC (SSGA FD) acts solely as the marketing agent. SSGA FD and State Street Global Advisors are affiliated. Please note all AUM is unaudited.

Important Risk Information

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

Past performance is not a reliable indicator of future performance.

Investing involves risk including the risk of loss of principal.

The views expressed in this material are the views of the State Street Global Advisors Practice Management Group through the period ended May 30, 2024 are subject to change based on market and other conditions. The opinions expressed may differ from those with different investment philosophies. The information provided does not constitute investment advice and it should not be relied on as such. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon.

All information is from SSGA unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Diversification does not ensure a profit or guarantee against loss. The trademarks and service marks referenced herein are the property of their respective owners.

Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs net asset value. Brokerage commissions and ETF expenses will reduce returns. Frequent trading of ETFs could significantly increase commissions and other costs such that they may offset any savings from low fees or costs.

The S&P 500® Index is a product of S&P Dow Jones Indices LLC or its affiliates (“S&P DJI”) and have been licensed for use by State Street Global Advisors. S&P®, SPDR®, S&P 500®,US 500 and the 500 are trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and has been licensed for use by S&P Dow Jones Indices; and these trademarks have been licensed for use by S&P DJI and sublicensed for certain purposes by State Street Global Advisors. The fund is not sponsored, endorsed, sold or promoted by S&P DJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of these indices.

In general, ETFs can be expected to move up or down in value with the value of the applicable index. Although ETF shares may be bought and sold on the exchange through any brokerage account, ETF shares are not individually redeemable from the Fund. Investors may acquire ETFs and tender them for redemption through the Fund in Creation Unit Aggregations only. Please see the prospectus for more details.

Distributor: State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs.

Before investing, consider the funds’ investment objectives, risks, charges and expenses. To obtain a prospectus or summary prospectus which contains this and other information, call 1-866-787-2257 or visit ssga.com. Read it carefully.

Not FDIC Insured - No Bank Guarantee - May Lose Value

State Street Global Advisors Fund Distributors, LLC, member FINRA, SIPC

© 2024 State Street Corporation. All Rights Reserved.

State Street Global Advisors Funds Distributors, LLC, One Iron Street, Boston, MA 02210

6790707.1.1.AM.RTL Exp. Date: 07/31/2025

View source version on businesswire.com: https://www.businesswire.com/news/home/20240719373253/en/

Contacts

Deborah Heindel

617-662-9927

dheindel@statestreet.com