Valued at a market cap of $78.3 billion, Marriott International, Inc. (MAR) is a leading hospitality company that operates a broad portfolio of hotels and related lodging businesses across luxury, premium, and select-service categories. The Bethesda, Maryland-based company operates through renowned brands such as The Ritz-Carlton, St. Regis, JW Marriott, Westin, and Courtyard.

This hospitality company has lagged behind the broader market over the past 52 weeks. Shares of MAR are up marginally over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.6%. Moreover, on a YTD basis, the stock has gained 3%, compared to SPX’s 14.6% return.

Nonetheless, zooming in further, MAR has outperformed the AdvisorShares Hotel ETF’s (BEDZ) 2.8% downtick over the past 52 weeks and 2.1% YTD drop.

MAR’s shares surged 3.2% on Nov. 4, after its stronger-than-expected Q3 earnings release. The company reported total revenue of $6.5 billion, up 3.7% year-over-year and marginally ahead of analyst estimates. Its global RevPAR rose 0.5% from the year-ago quarter, with International RevPAR increasing 2.6% and U.S. & Canada RevPAR declining 0.4% due to weaker demand in the lower chain scales. However, luxury hotels continued to outperform, driven by robust demand and strong rate performance. Additionally, on the earnings front, its adjusted EPS of $2.47 advanced 9.3% from the prior-year quarter, surpassing consensus estimates of $2.41.

For the current fiscal year, ending in December, analysts expect MAR’s EPS to grow 7.6% year over year to $10.04. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

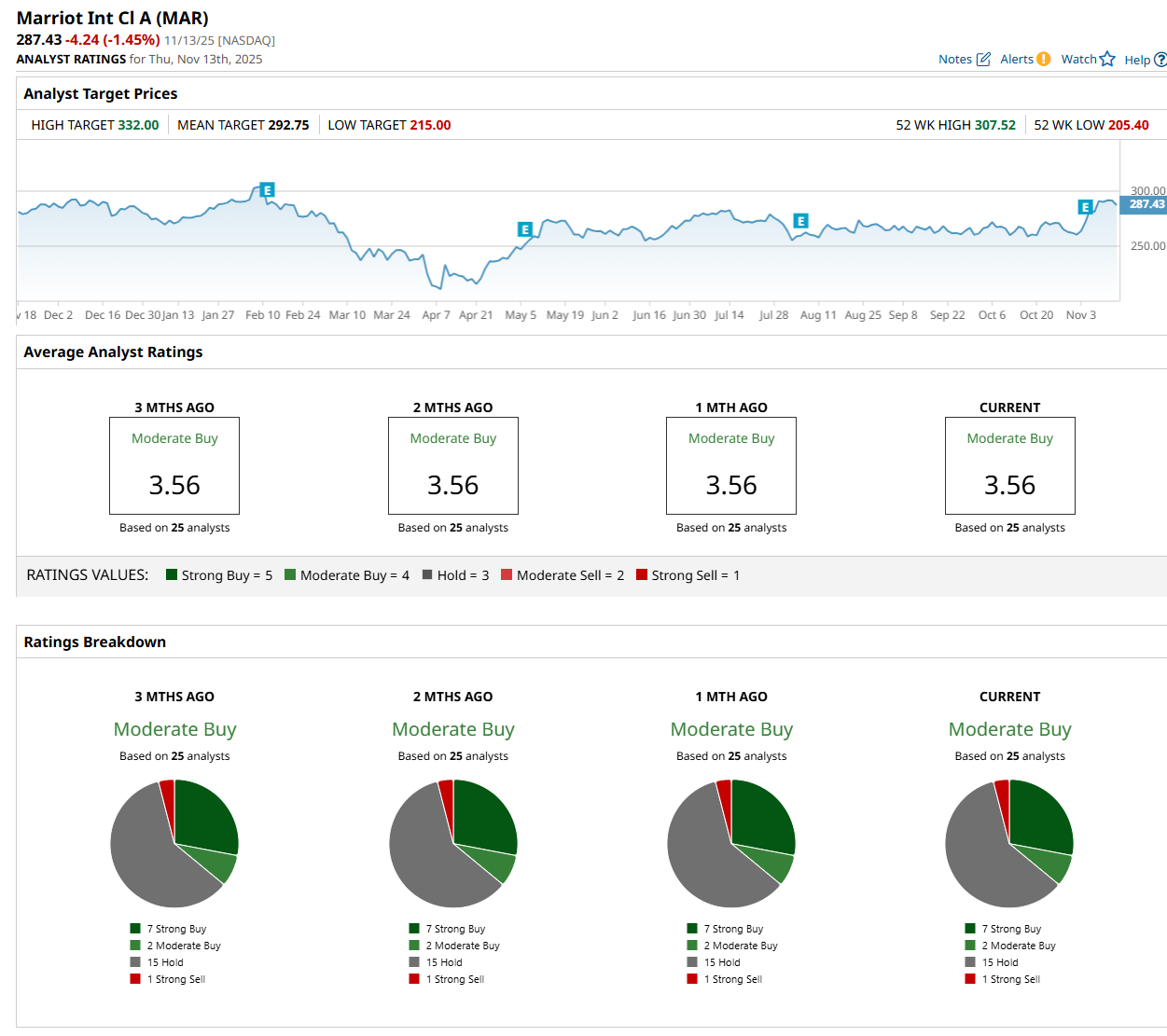

Among the 25 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on seven “Strong Buy,” two "Moderate Buy,” 15 "Hold,” and one “Strong Sell” rating.

This configuration has remained consistent over the past three months.

On Nov. 12, Richard Clarke from AllianceBernstein Holding L.P. (AB) maintained a “Buy” rating on MAR, with a price target of $327, indicating a 13.8% potential upside from the current levels.

The mean price target of $292.75 represents a 1.9% premium from MAR’s current price levels, while the Street-high price target of $332 suggests a 15.5% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Stock Index Futures Slip on Fed Rate-Cut Doubts and Valuation Concerns

- Ray Dalio Warns the Next Big Debt Crisis Won’t Come From Banks. It’ll Come From Governments.

- This ‘Strong Buy’ Dividend Stock Yields 8%. Should You Add It to Your Portfolio?

- Who Is Phil Clifton? Michael Burry Names Successor as Famed Investor Deregisters Hedge Fund.