Medtronic plc (MDT) is one of the world’s largest medical-technology companies, headquartered in Ireland with major operations in the U.S. With a market cap of $116.3 billion, the company develops and manufactures devices and therapies across areas like cardiac care, diabetes management, surgical technologies, and neurological disorders. Known for products such as pacemakers, insulin pumps, and surgical robotics systems, Medtronic serves hospitals, physicians, and patients globally.

MDT stock has surged marginally over the past year, trailing behind the S&P 500 Index ($SPX), which surged by 19.6% during the same period. Year-to-date, MDT has risen 12.9%, narrowing the gap between the index’s 16.5% advance.

On a sector-relative basis, however, the stock has been a clear outperformer, with the S&P Healthcare Equipment SPDR (XHE) declining 9.4% over the past year and a 9.2% drop year-to-date.

On Sept. 29, Medtronic announced that it completed a €1.5 billion ($1.7 billion) debt offering through its subsidiary, issuing €750 million ($864.2 million) of 2.95% senior notes due 2030 and €750 million ($864.2 million) of 4.20% senior notes due 2045. The proceeds will be used to repay existing Medtronic Luxco notes maturing in 2025. MDT shares rose 1.4% in the next trading session.

For the current year, ending in April 2026, analysts anticipate MDT to achieve EPS growth of 2.4%, reaching $5.62 on a diluted basis. Notably, Medtronic has consistently beaten consensus estimates over the past four quarters.

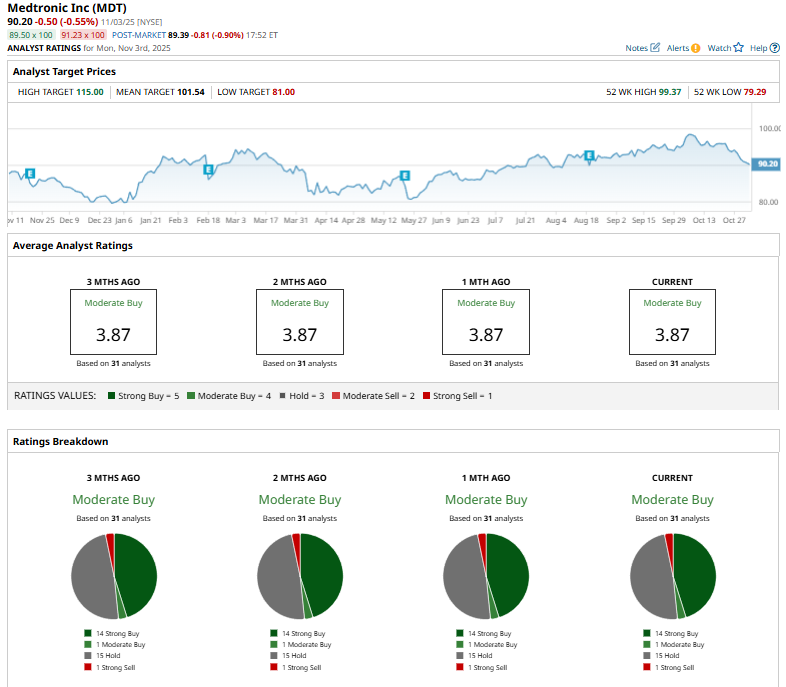

Among 31 analysts covering MDT stock, the consensus rating is a "Moderate Buy," comprising 14 "Strong Buy" ratings, one "Moderate Buy," 15 "Holds," and one “Strong Sell.”

The current configuration has been consistent over the past months.

On October 17, Leerink Partners analyst Mike Kratky reiterated a “Buy” rating on Medtronic and assigned a $114 price target.

The mean price target of $101.54 represents a 12.6% premium to MDT’s current price levels. Meanwhile, the Street-high price target of $115 suggests a potential upside of 27.5%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart