Internet retail giant Alibaba Group Holding Limited (BABA) was named on an updated Pentagon list of major Chinese tech firms allegedly aiding the Chinese military. The so-called 1260H list does not formally add sanctions on Chinese firms. However, a new law prevents the department from contracting or procuring from the mentioned companies. Importantly, the list was later withdrawn from publication.

While the reason for the withdrawal was unclear, it may be due to the U.S. government’s efforts to improve relations with China following a trade truce. President Trump is expected to visit China in April. Alibaba’s stock slid on news of the blacklist, but a company spokesperson stated that the firm is “not a Chinese military company nor part of any military-civil fusion strategy.”

At this point, then, should you still consider investing in the stock?

About Alibaba Stock

Headquartered in Causeway Bay, Hong Kong, Alibaba is a leading internet retail company. It operates major online marketplaces that connect sellers and buyers worldwide, making shopping easy and accessible. Alibaba operates a robust logistics network for rapid delivery and offers cloud computing services to power businesses of all sizes.

The company also explores media, digital payments, and innovative technologies to help merchants streamline operations and reach more customers. Through these efforts, Alibaba drives e-commerce growth and supports digital transformation worldwide, fostering efficient trade and economic opportunities for many. The company has a market capitalization of $371.07 billion.

Alibaba’s stock has been facing some positive macroeconomic developments. China has announced an investigation into competition among food delivery companies amid a price war. This was welcome news for Alibaba, as it is expected to help reduce its cash burn.

Additionally, China’s 2028 action plan places significant emphasis on artificial intelligence (AI), which is expected to benefit the company. Against this backdrop, Alibaba recently unveiled the Qwen3.5 AI model, which offers enhanced capabilities, as it seeks to stay ahead amid intensifying competition in the Chinese AI market.

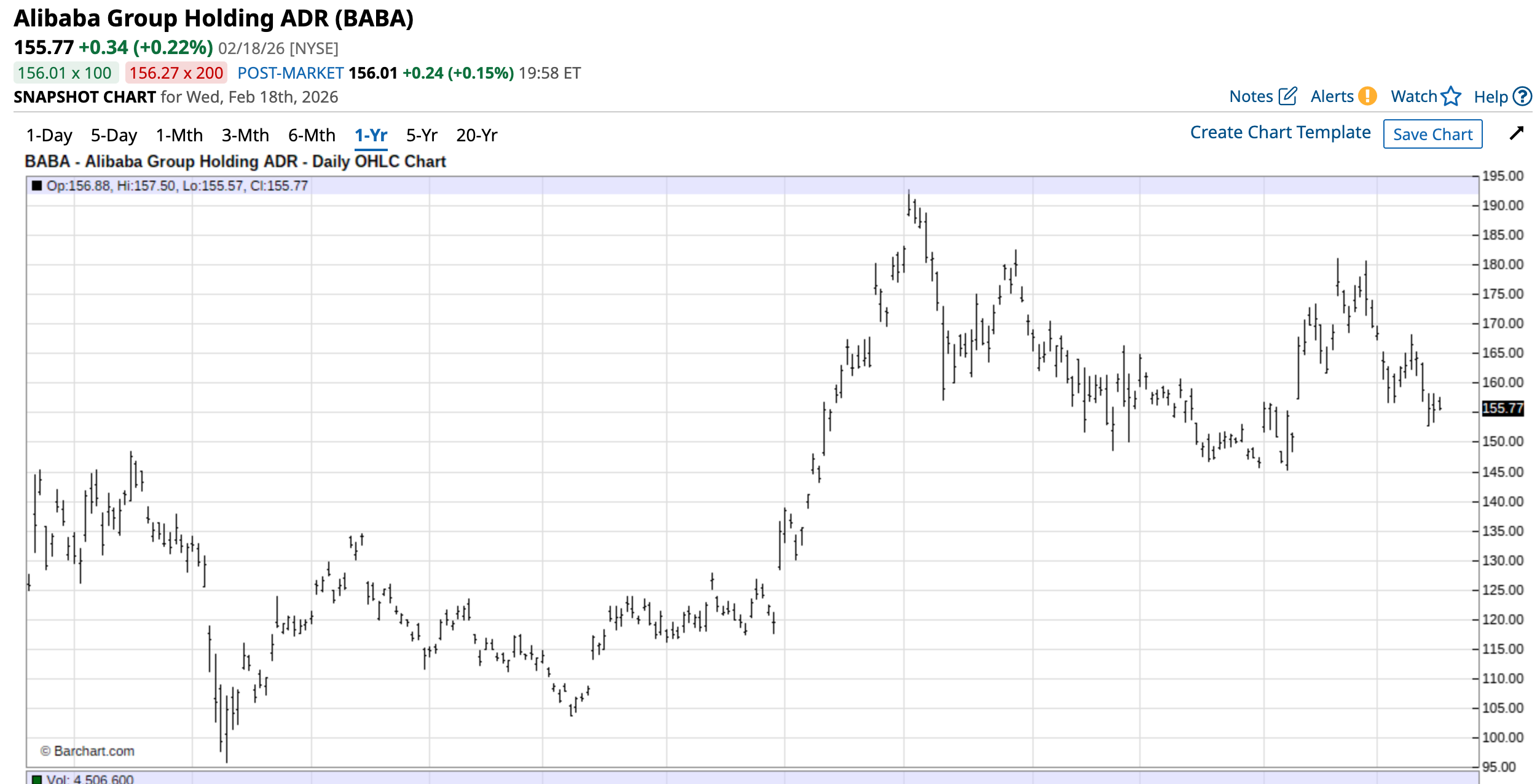

Over the past 52 weeks, Alibaba’s stock has gained 22.75%, while it has been up 6.27% year-to-date (YTD). The company’s shares had reached a 52-week high of $192.67 in October 2025, but are down 23.69% from that level.

On a forward-adjusted basis, Alibaba’s price-to-earnings ratio of 29.47x is higher than the industry average of 17.34x.

Alibaba’s Earnings Snapshot

For the quarter ended Sept. 30, Alibaba reported solid results driven by growth in its cloud business. The company’s total revenue increased by 5% year-over-year (YOY) to RMB 247.80 billion ($34.81 billion). Alibaba recorded 10% YOY growth in its customer management revenue to RMB 78.93 billion ($11.09 billion), primarily driven by an improvement in take rate. The company’s growing quick-commerce business has contributed to a rapid increase in monthly active consumers on the Taobao app.

However, the big story for the quarter was Alibaba’s cloud operations. Revenue from the Cloud Intelligence Group grew 34% from the prior-year period to RMB 39.82 billion ($5.59 billion). This was mainly due to the strong growth in Alibaba’s public cloud revenue, which, in turn, was driven by the increasing adoption of its AI-related products. In fact, the company’s AI-related product revenue delivered triple-digit YOY growth.

However, Alibaba’s bottom line financials have come under pressure. The company’s adjusted earnings per ADS declined by 71% YOY to $0.61. Due to investments in quick commerce, user experience, and technology, its adjusted EBITA decreased 78% from the year-ago period to RMB 9.07 billion ($1.27 billion). The company remains focused on growing its cloud and AI businesses. However, Alibaba has warned that, as it continues to reinvest its profits and free cash flow, near-term profitability is subject to fluctuations.

Wall Street analysts have a tepid view about Alibaba’s bottom line trajectory. For the quarter ended December 2025, its EPS is expected to drop 37.6% YOY to $1.73. For the current fiscal year (ending in March 2026), EPS is expected to decline by 36% to $5.29. On the other hand, for the next fiscal year, the company’s EPS is projected to increase by 51.2% annually to $8.00.

What Do Analysts Think About Alibaba’s Stock?

Wall Street analysts remain robustly bullish on Alibaba. In January, Morgan Stanley analysts reiterated their “Overweight” rating on the stock and maintained an $180 price target, citing strong growth in its Qwen AI assistant. Analysts also believe that Qwen could become an “all-in-one AI superapp and life assistant.” Jefferies analysts also maintained a “Buy” rating on Alibaba and a $225 price target, expecting to see market-share growth in the company’s AI cloud business.

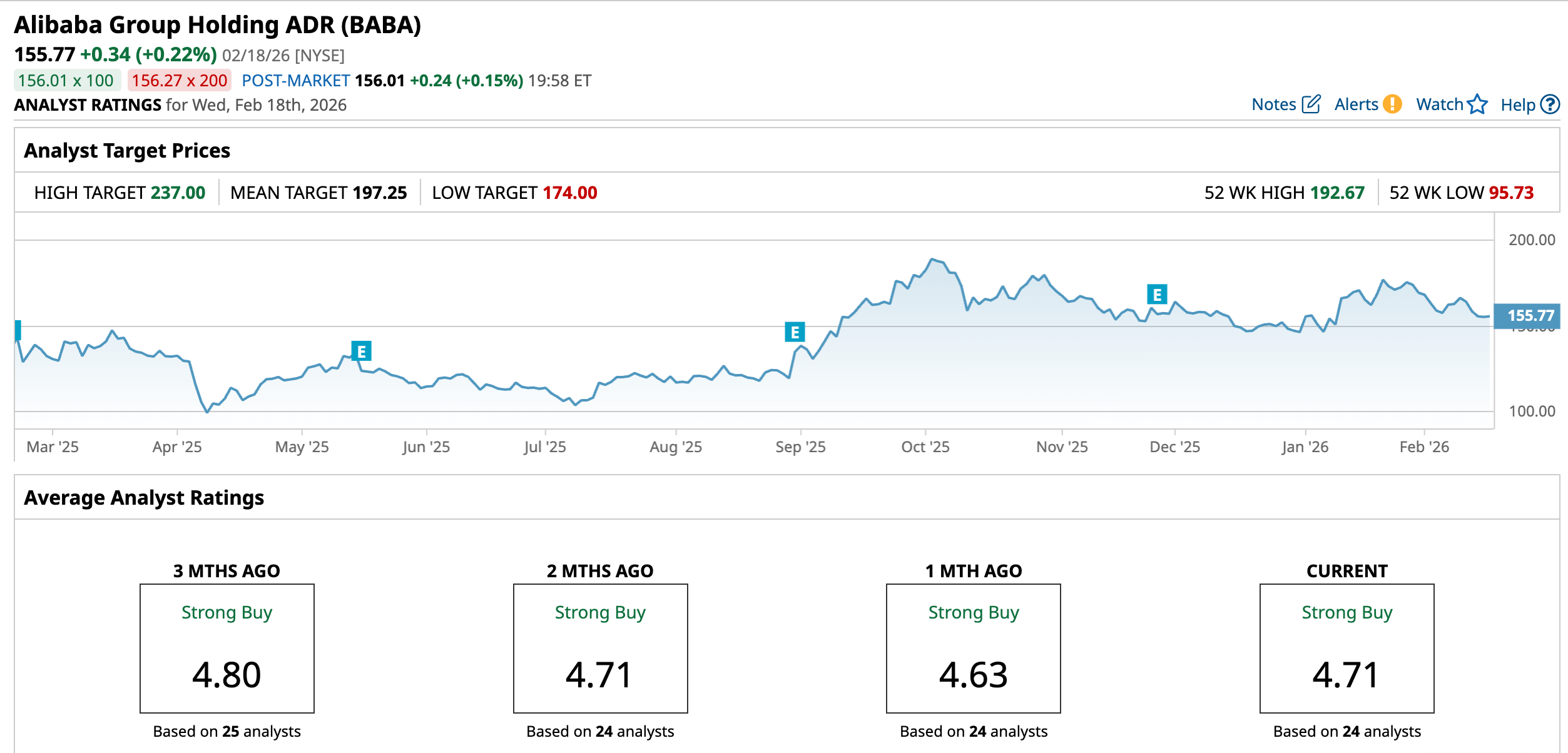

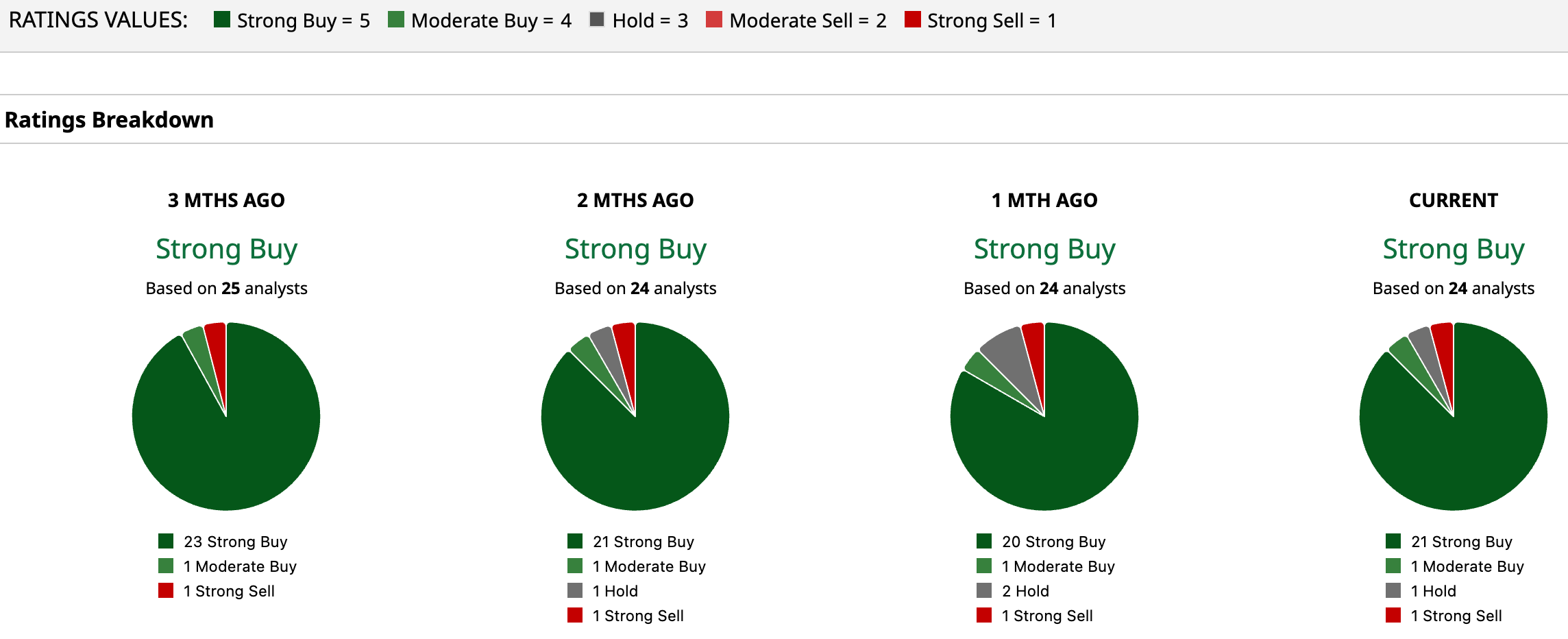

Alibaba is gaining praise on Wall Street, with analysts awarding it a consensus “Strong Buy” rating overall. Of the 24 analysts rating the stock, a majority of 21 analysts have given it a “Strong Buy” rating, one analyst rated it “Moderate Buy,” while one analyst is taking the middle-of-the-road approach with a “Hold” rating, and one suggested “Strong Sell.” The consensus price target of $197.25 represents a 26.6% upside from current levels. The Street-high price target of $237 implies a 52.2% upside.

Key Takeaways

Alibaba is well positioned to grow its operations, supported by its underlying fundamentals. Althought the company’s profitability is declining, that might be temporary due to its reinvestment into its businesses. The withdrawal of the Pentagon blacklist and the growing closeness between the U.S and China might also be a tailwind. Therefore, the stock might still be a buy now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart