Over the past six months, Commerce Bancshares’s shares (currently trading at $53.01) have posted a disappointing 8.4% loss, well below the S&P 500’s 13% gain. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Commerce Bancshares, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is Commerce Bancshares Not Exciting?

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons we avoid CBSH and a stock we'd rather own.

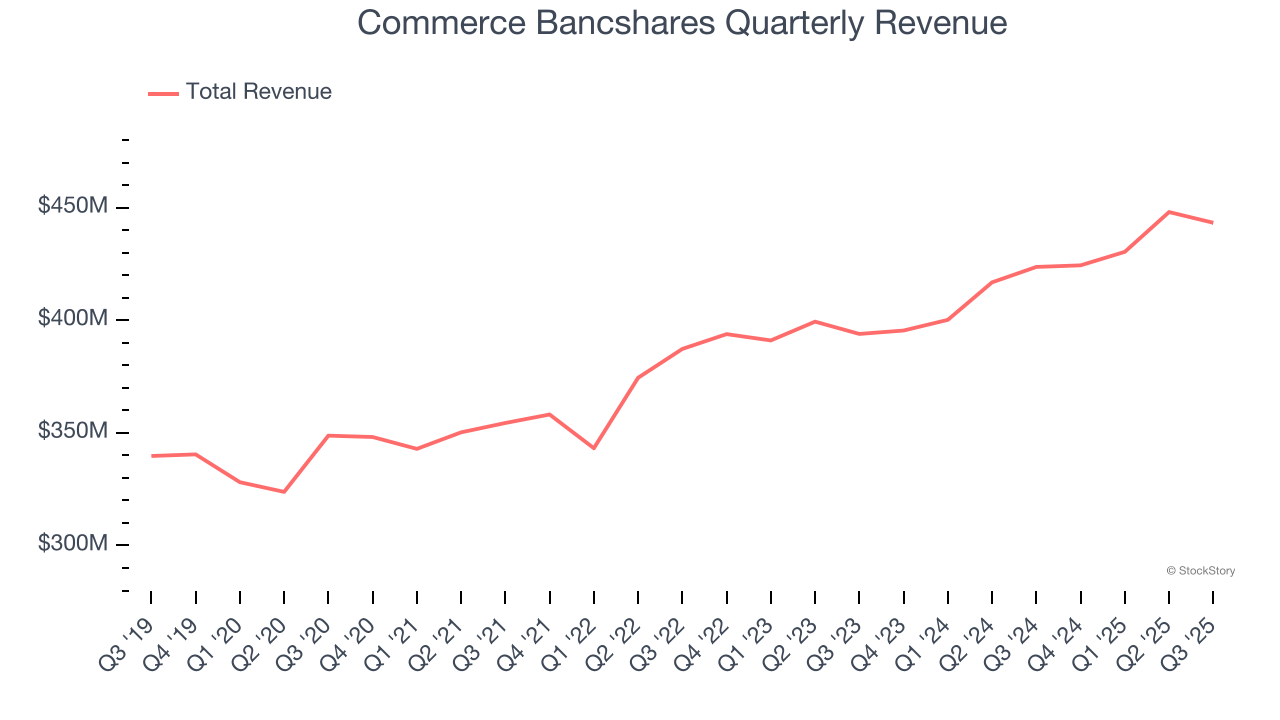

1. Long-Term Revenue Growth Disappoints

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities.

Regrettably, Commerce Bancshares’s revenue grew at a sluggish 5.4% compounded annual growth rate over the last five years. This was below our standard for the banking sector.

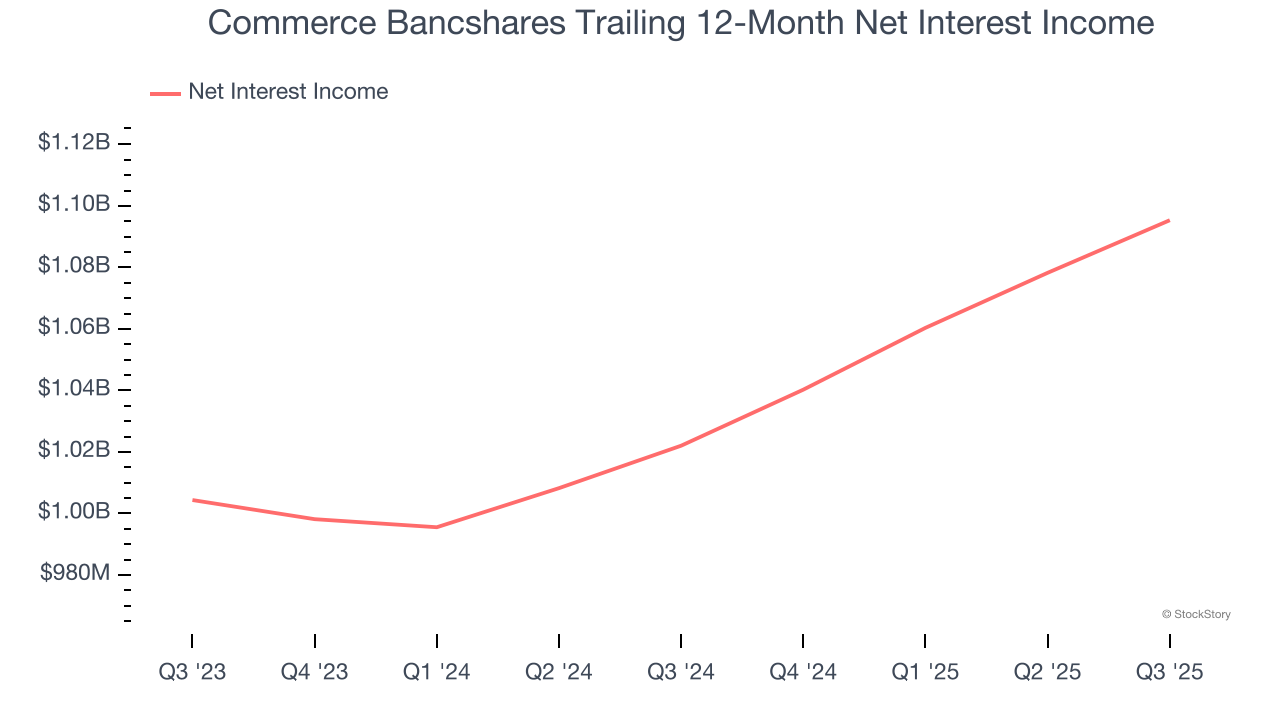

2. Net Interest Income Points to Soft Demand

Net interest income commands greater market attention due to its reliability and consistency, whereas one-time fees are often seen as lower-quality revenue that lacks the same dependable characteristics.

Commerce Bancshares’s net interest income has grown at a 5.9% annualized rate over the last five years, worse than the broader banking industry and in line with its total revenue.

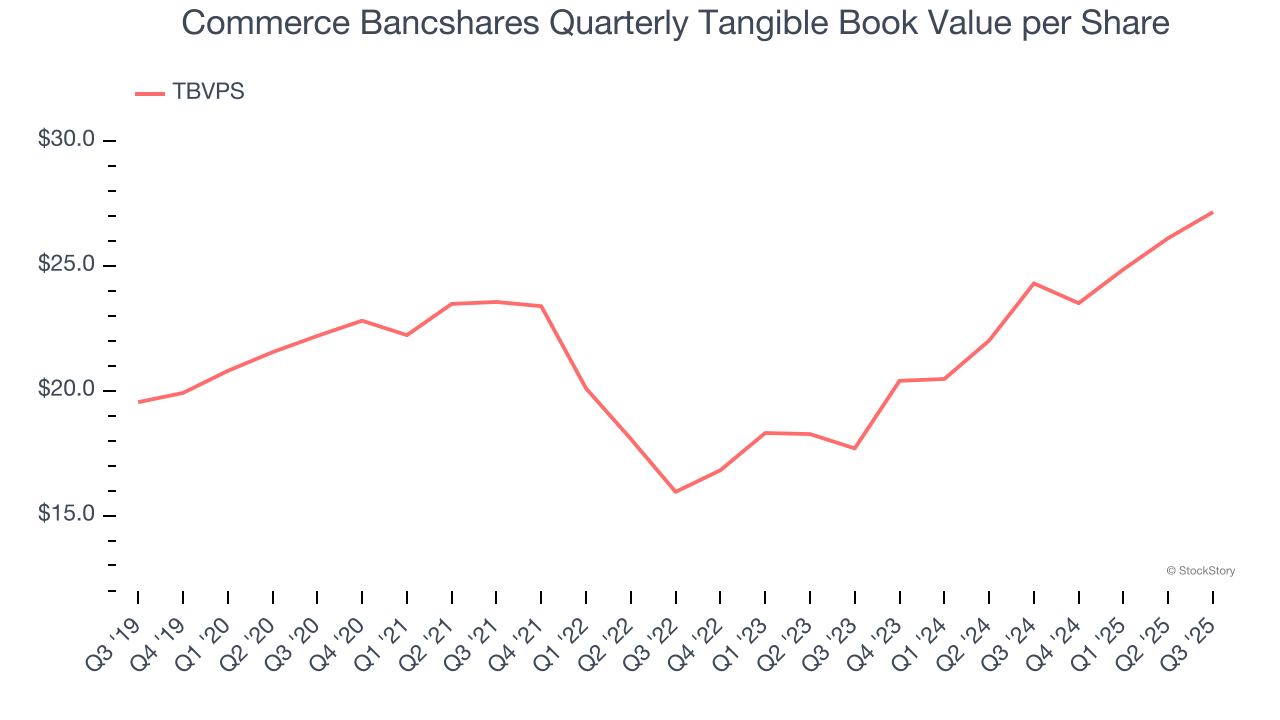

3. Projected TBVPS Growth Is Slim

The key to tangible book value per share (TBVPS) growth is a bank’s ability to earn consistent returns on its assets that exceed its funding costs and credit losses.

Over the next 12 months, Consensus estimates call for Commerce Bancshares’s TBVPS to grow by 5.2% to $28.57, lousy growth rate.

Final Judgment

Commerce Bancshares isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 1.9× forward P/B (or $53.01 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are superior stocks to buy right now. Let us point you toward one of our top software and edge computing picks.

Stocks We Would Buy Instead of Commerce Bancshares

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.