In a post on the social media platform Truth Social, President Trump announced that he is “instructing” his “representatives” to buy $200 billion in mortgage bonds. He also claimed that doing so would lower rates for homebuyers and reduce monthly payments.

Federal Housing Finance Agency (FHFA) Director Bill Pulte posted on X, “We are on it. Thanks to President Trump, Fannie and Freddie will be executing,” referring to Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corporation). President Trump also claimed that the two institutions are not lacking cash.

Following the announcement, shares of mortgage lenders surged on Jan. 9. PennyMac Financial Services (PFSI) climbed 6.4% intraday, as lower rates would create more homebuying opportunities, which would increase the company’s service volume.

So is PennyMac stock a buy this month?

About PennyMac Stock

Headquartered in Westlake Village, California, prominent U.S. mortgage lender PennyMac excels in loan origination, servicing, and investment management. The company has a market capitalization of $7.60 billion.

Through its Production division, the company sources, purchases, and markets primarily conventional and government-backed residential first-lien mortgages for profit. Its Servicing operations oversee loan portfolios, including payment collection, restructuring, and investor updates.

Lower rates boosted mortgage originations and servicing, with the stock outperforming broader indices amid artificial intelligence (AI) integration and steady dividends. Over the past 52 weeks, PennyMac’s stock has gained 52%, while it has been up 46.27% over the past six months. It reached a 52-week high of $146.68 on Jan. 9, following President Trump’s announcement, and is down marginally from that level. Over the past five days, the stock has risen 9%.

PennyMac’s price-to-non-GAAP-earnings ratio is 9.61x, lower than the industry average of 11.57x, indicating that the stock is trading at a relatively cheaper valuation now.

PennyMac Delivered Solid Quarterly Earnings

On Oct. 21, PennyMac delivered solid third-quarter results for fiscal 2025. The company’s total net revenues increased by 53.7% year-over-year (YOY) to $632.90 million. This was based on net loan servicing fees increasing by 218.1% from the prior-year period to $241.24 million.

The company also reported that its total loan acquisitions and originations, which included those fulfilled for the PennyMac Mortgage Investment Trust (PMT), increased by 15% from the third quarter of the prior year to $36.50 billion in unpaid principal balance (UPB). PennyMac’s book value per share increased from $78.04 at June 30, 2025, to $81.12 by the end of Q3.

On the $632.90 million top line, PennyMac earned $181.50 million in quarterly net income, up 161.7% YOY. Its EPS was $3.37, up 159.2% from the year-ago value.

Wall Street analysts are optimistic about PennyMac’s future earnings. They expect the company’s EPS to climb by 12.2% YOY to $3.23 for the fourth quarter of fiscal 2025. For FY2025, EPS is projected to grow 1.7% annually to $11.71, followed by a 29.9% increase to $15.21 in FY2026.

What Do Analysts Think About PennyMac’s Stock?

Recently, Barclays analyst Terry Ma raised PennyMac’s stock price target from $139 to $158 while maintaining an “Overweight” rating. The analyst sees upside in the stock, given a “benign” credit environment that could drive loan growth. Barclays also expects a better mortgage origination market this year.

Wells Fargo analyst Donald Fandetti kept an “Overweight” rating on PennyMac’s shares, while raising the price target from $135 to $150. Wells Fargo is bullish on the consumer finance sector’s prospects in the last quarter of 2025 and expects larger tax refunds in the first half of this year.

Last month, BTIG analysts maintained their “Buy” rating on the stock and raised the price target from $135 to $150. Analysts at the firm expect that low interest rate volatility may contribute to more moderate and predictable hedging costs. While most mortgage lenders are expected to benefit, PennyMac is expected to be at the forefront because of its hedging activities in its MSR portfolio.

Jefferies analysts also initiated coverage of the stock last month, assigning a “Buy” rating and a $160 price target, citing the company’s diversified business model that enables it to generate positive returns even in higher-rate environments.

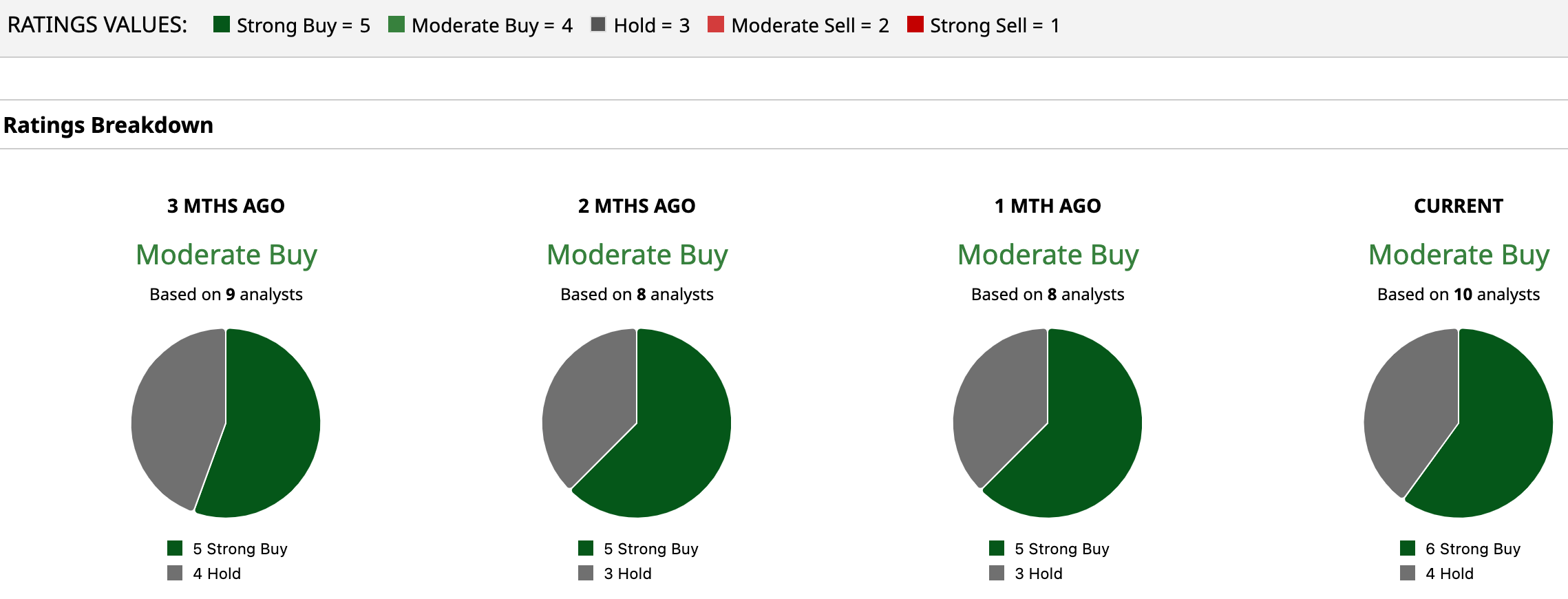

Wall Street analysts remain soundly bullish on PennyMac Financial’s stock, awarding it a consensus “Moderate Buy” rating. Of the 10 analysts covering the stock, six analysts have rated it a “Strong Buy,” and four analysts have given it a “Hold” rating. The consensus price target of $152 represents a 3.85% upside from current levels. However, the Street-high price target of $164 indicates a 12.1% upside.

Key Takeaways

While the extent of the impact of the announced mortgage bond-buying is not yet clear, it is likely positive, as homebuyers receive some relief. Therefore, PennyMac stands to benefit from this development. The company’s diversified business also enables it to withstand pressure from higher rates. Given the company’s solid earnings growth, it might be wise to consider buying the stock now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- These 3 ETFs Help You Prosper in a Volatile Market. Which Is Right for You?

- Rocket Stock Just Hit a New 3-Year High as Trump Touts Plan for Home Affordability. Should You Buy RKT Here?

- How to Trade Venezuela 10 Days Later: Oil Prices, Energy Stocks, and the Biggest Winners and Losers

- Is PennyMac Stock a Buy, Sell, or Hold for January 2026?