Armonk, New York-based International Business Machines Corporation (IBM) operates as an IT solutions company, providing integrated solutions and services worldwide. Valued at $281.2 billion by market cap, IBM operates through Consulting, Software, Infrastructure, and Financing segments.

The tech giant has notably outperformed the broader market in 2025 and over the past year. IBM stock has soared 39.6% on a YTD basis and 47.8% over the past 52 weeks, notably outpacing the S&P 500 Index’s ($SPX) 15.6% gains on a YTD basis and 17.5% returns over the past year.

Narrowing the focus, IBM has also outperformed the sector-focused Technology Select Sector SPDR Fund’s (XLK) 26.9% returns in 2025 and 30.1% surge over the past year.

Despite reporting better-than-expected results, International Business Machines’ stock prices observed a marginal dip in the trading session following the release of its Q3 results on Oct. 22. While the company’s consulting revenues inched up by a modest 2%, its software and infrastructure revenues surged 9% and 17% respectively. Its overall topline grew 9.1% year-over-year to $16.3 billion, beating the Street’s expectation by 1.4%. Meanwhile, its adjusted EPS increased 15.2% year-over-year to $2.65, surpassing the consensus estimates by 8.6%. Following the initial dip, IBM stock soared 7.9% in the subsequent trading session.

For the full fiscal 2025, ending in December, analysts expect IBM to deliver an adjusted EPS of $11.26, up 9% year-over-year. On a positive note, the company has a strong earnings surprise history. It has surpassed analysts’ bottom-line estimates in each of the past four quarters.

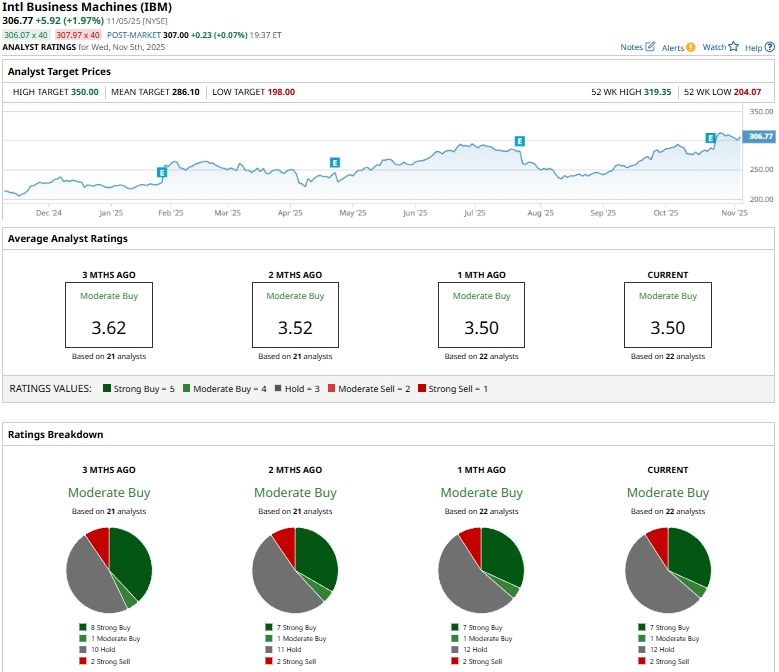

Among the 22 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on seven “Strong Buys,” one “Moderate Buy,” 12 “Holds,” and two “Strong Sells.”

This configuration is slightly less optimistic than three months ago, when eight analysts gave “Strong Buy” recommendations.

On Oct. 24, UBS (UBS) analyst David Vogt maintained a “Sell” rating on IBM, but raised the price target from $200 to $210.

IBM’s mean price target of $286.10 represents a 7.2% premium to current price levels. Meanwhile, the street-high target of $350 suggests a notable 14.1% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- AbbVie Just Raised Its Dividend by 5.5%. Should You Buy ABBV Stock Here?

- 1 High-Risk, High-Reward Way to Trade Earnings with 0DTE Options

- Is This ‘Strong Buy’ Aerospace Stock a Giant Steal in 2025?

- Alex Karp Says ‘We Were Right, You Were Wrong’ as Palantir Delivers Record Revenue. Should You Buy PLTR Stock Here?