Dayforce has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 34.6% to $68.96 per share while the index has gained 32.7%.

Is now the time to buy Dayforce, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Is Dayforce Not Exciting?

We're sitting this one out for now. Here are three reasons why DAY doesn't excite us and a stock we'd rather own.

1. Weak Billings Point to Soft Demand

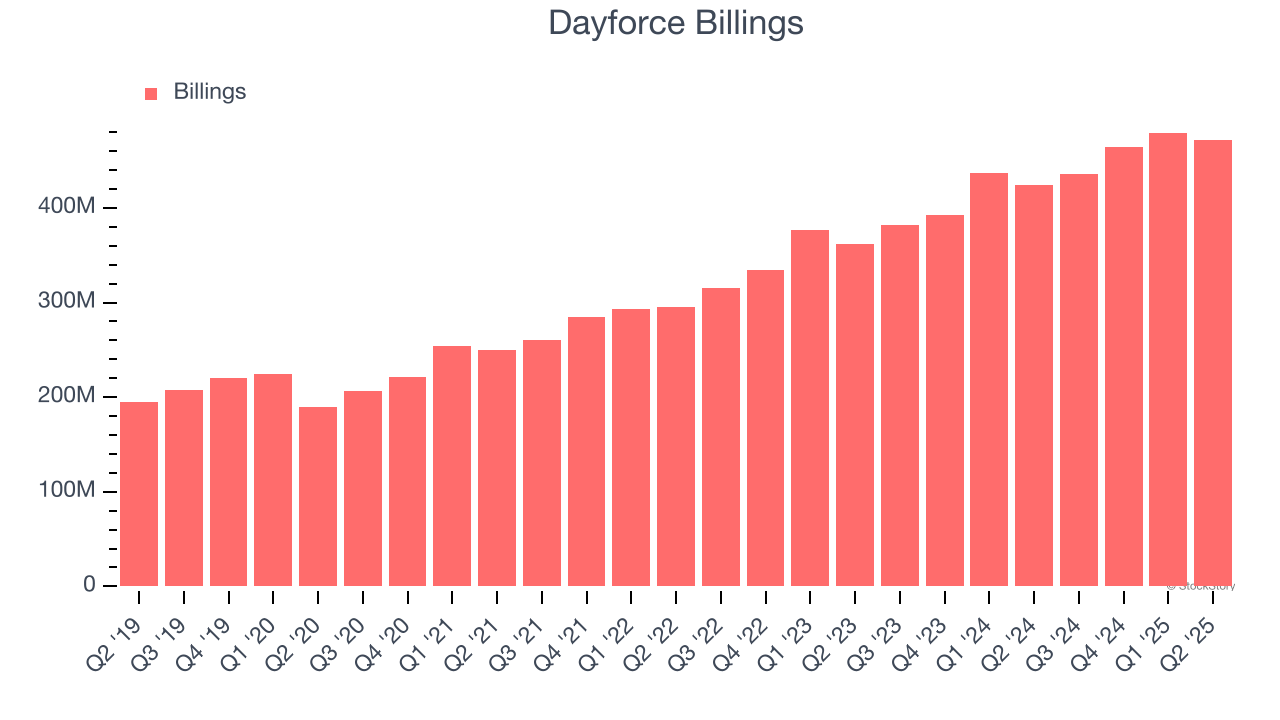

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Dayforce’s billings came in at $471.5 million in Q2, and over the last four quarters, its year-on-year growth averaged 13.4%. This performance slightly lagged the sector and suggests that increasing competition is causing challenges in acquiring/retaining customers.

2. Low Gross Margin Reveals Weak Structural Profitability

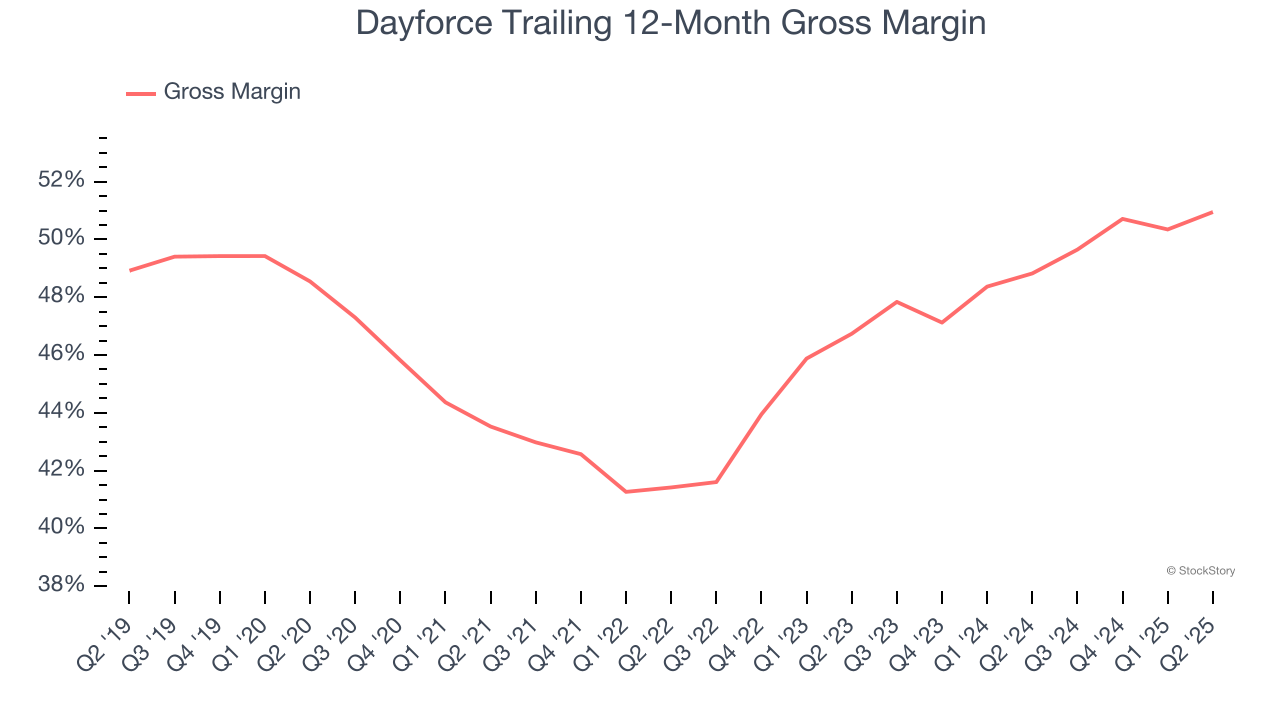

For software companies like Dayforce, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Dayforce’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 50.9% gross margin over the last year. That means Dayforce paid its providers a lot of money ($49.05 for every $100 in revenue) to run its business.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Dayforce has seen gross margins improve by 4.2 percentage points over the last 2 year, which is very good in the software space.

3. Operating Margin in Limbo

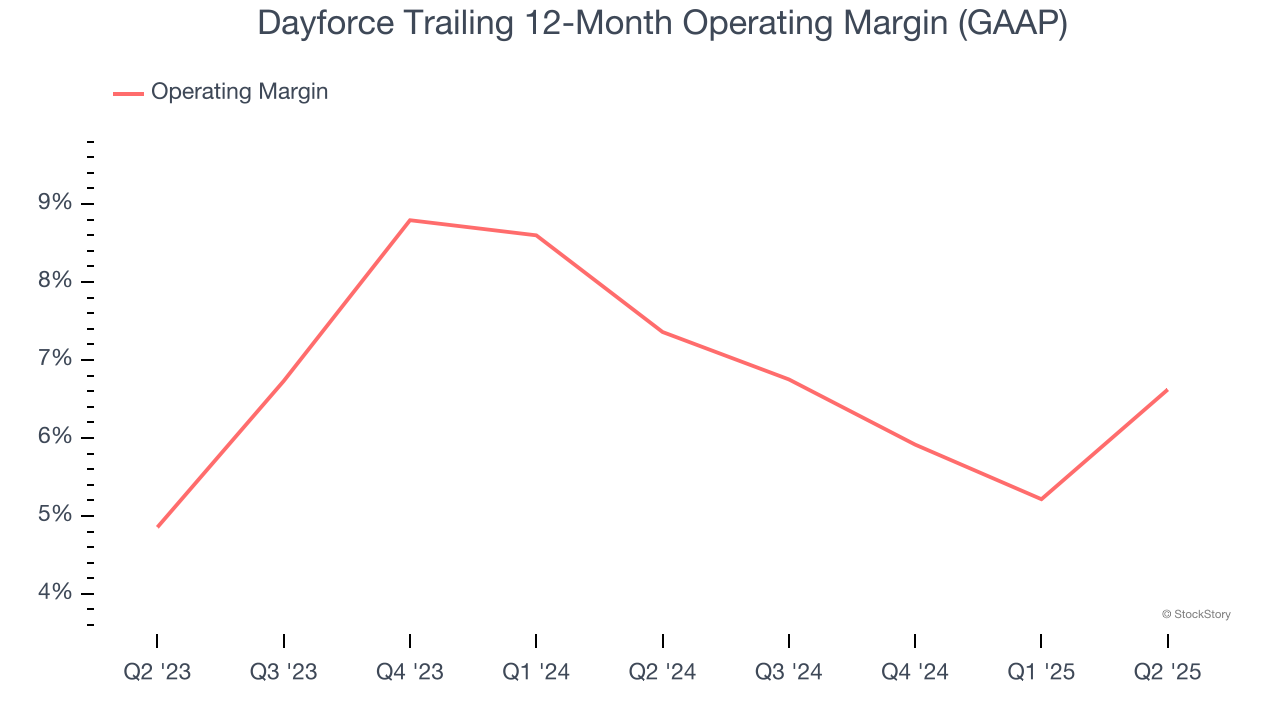

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Analyzing the trend in its profitability, Dayforce’s operating margin might fluctuated slightly but has generally stayed the same over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 6.6%.

Final Judgment

Dayforce isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 5.4× forward price-to-sales (or $68.96 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at the most entrenched endpoint security platform on the market.

Stocks We Like More Than Dayforce

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.