As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the online marketplace industry, including eHealth (NASDAQ: EHTH) and its peers.

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

The 13 online marketplace stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 2.8% while next quarter’s revenue guidance was in line.

Luckily, online marketplace stocks have performed well with share prices up 32.8% on average since the latest earnings results.

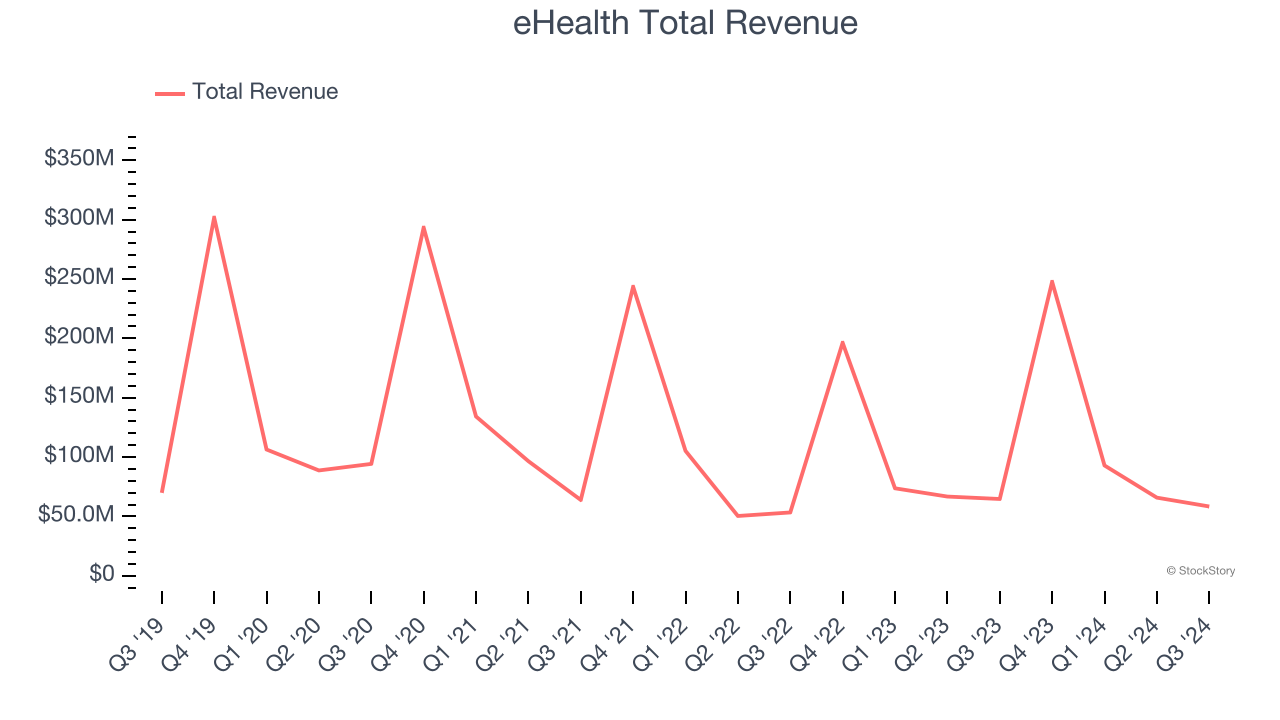

eHealth (NASDAQ: EHTH)

Aiming to address a high-stakes and often confusing decision, eHealth (NASDAQ: EHTH) guides consumers through health insurance enrollment and related topics.

eHealth reported revenues of $58.41 million, down 9.7% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with full-year EBITDA guidance missing analysts’ expectations.

eHealth delivered the slowest revenue growth of the whole group. The stock is up 96.1% since reporting and currently trades at $10.

Read our full report on eHealth here, it’s free.

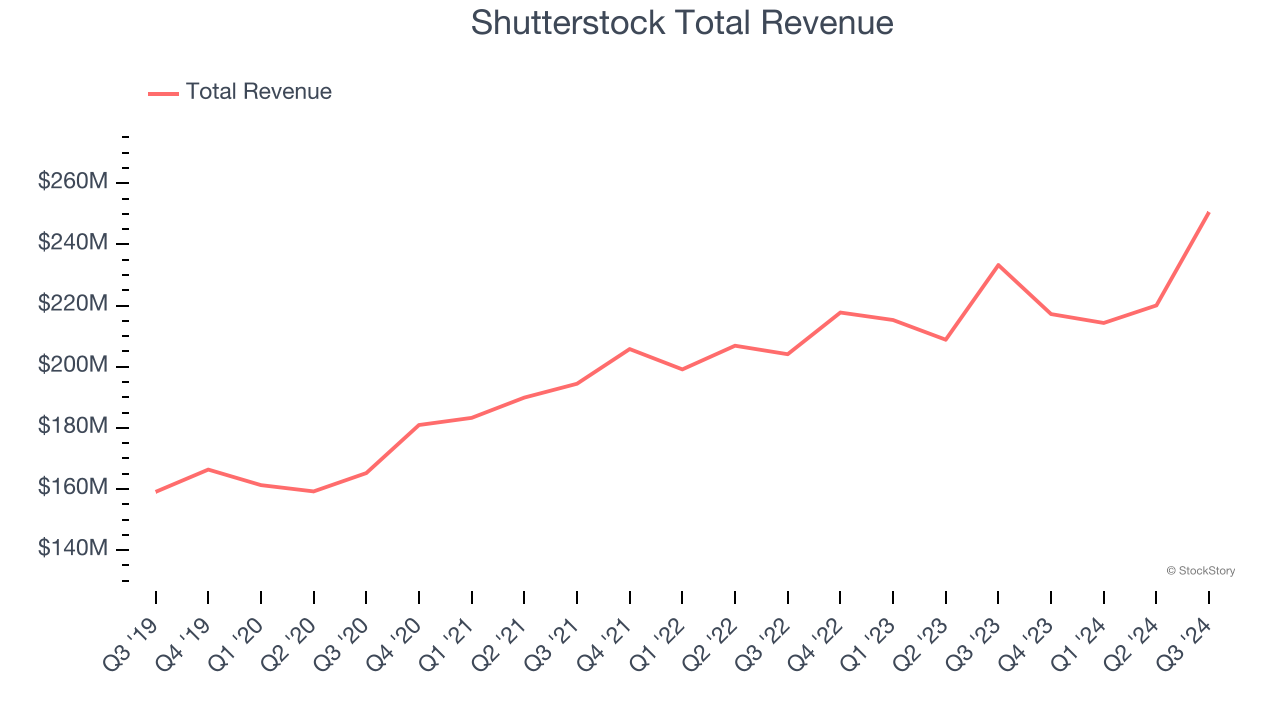

Best Q3: Shutterstock (NYSE: SSTK)

Originally featuring a library that included many of founder Jon Oringer’s photos, Shutterstock (NYSE: SSTK) is now a digital platform where customers can license and use hundreds of millions of pieces of content.

Shutterstock reported revenues of $250.6 million, up 7.4% year on year, outperforming analysts’ expectations by 5.1%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ number of paid downloads estimates.

The market seems happy with the results as the stock is up 8.7% since reporting. It currently trades at $32.09.

Is now the time to buy Shutterstock? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: MercadoLibre (NASDAQ: MELI)

Originally started as an online auction platform, MercadoLibre (NASDAQ: MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

MercadoLibre reported revenues of $5.31 billion, up 35.3% year on year, exceeding analysts’ expectations by 2.5%. Still, it was a slower quarter as it posted a significant miss of analysts’ EBITDA estimates.

As expected, the stock is down 3.8% since the results and currently trades at $2,039.

Read our full analysis of MercadoLibre’s results here.

The RealReal (NASDAQ: REAL)

Founded by consignment store aficionado Julie Wainwright, The RealReal (NASDAQ: REAL) is an online marketplace for buying and selling secondhand luxury goods.

The RealReal reported revenues of $147.8 million, up 11% year on year. This number surpassed analysts’ expectations by 4.5%. Taking a step back, it was a mixed quarter as it also recorded a solid beat of analysts’ EBITDA estimates but a slight miss of analysts’ number of active buyers estimates.

The RealReal pulled off the highest full-year guidance raise among its peers. The company reported 389,000 users, up 6.9%xx year on year. The stock is up 151% since reporting and currently trades at $7.67.

Read our full, actionable report on The RealReal here, it’s free.

ACV Auctions (NASDAQ: ACVA)

Founded in 2014, ACV Auctions (NASDAQ: ACVA) is an online auction marketplace for car dealers and wholesalers to buy and sell used cars.

ACV Auctions reported revenues of $171.3 million, up 44% year on year. This result beat analysts’ expectations by 7%. It was a strong quarter as it also put up a solid beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

ACV Auctions delivered the biggest analyst estimates beat among its peers. The company reported 198,354 units sold, up 32.2%xx year on year. The stock is up 12.7% since reporting and currently trades at $21.98.

Read our full, actionable report on ACV Auctions here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.