Over the last six months, UFP Industries’s shares have sunk to $103.78, producing a disappointing 19% loss while the S&P 500 was flat. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in UFP Industries, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is UFP Industries Not Exciting?

Despite the more favorable entry price, we're swiping left on UFP Industries for now. Here are three reasons why there are better opportunities than UFPI and a stock we'd rather own.

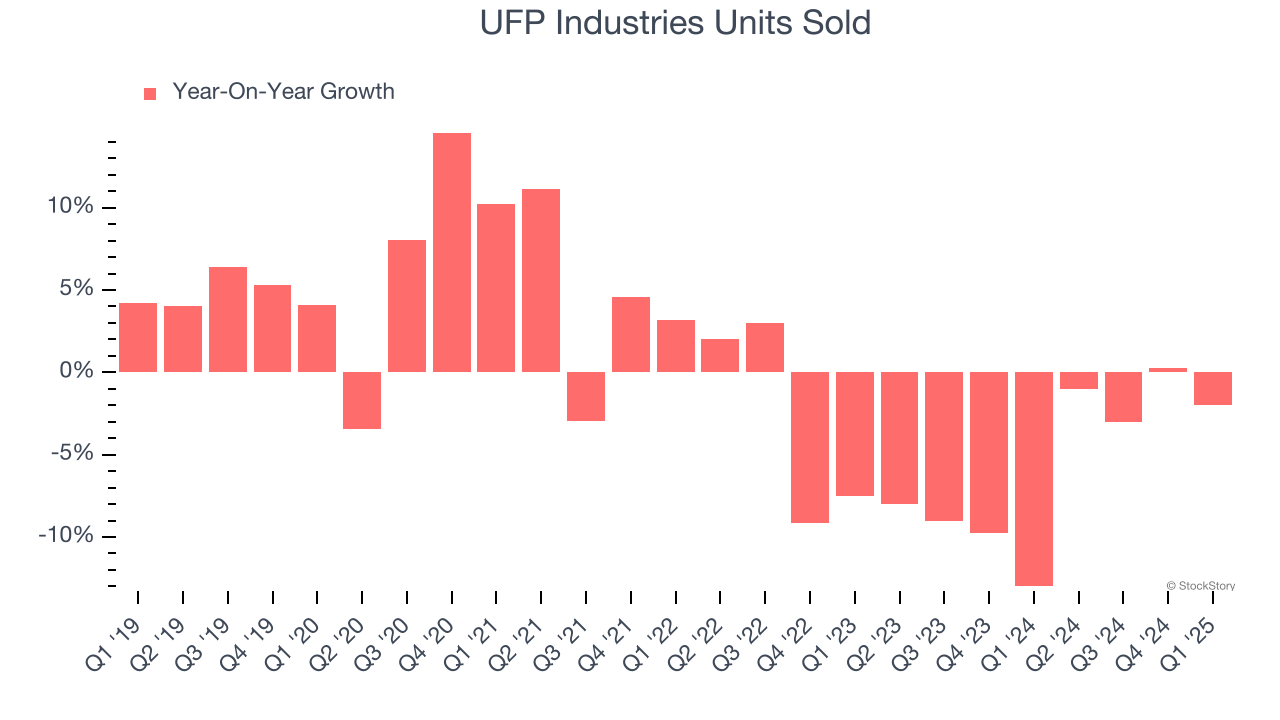

1. Demand Slipping as Sales Volumes Decline

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Building Materials company because there’s a ceiling to what customers will pay.

Over the last two years, UFP Industries’s units sold averaged 5.7% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests UFP Industries might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

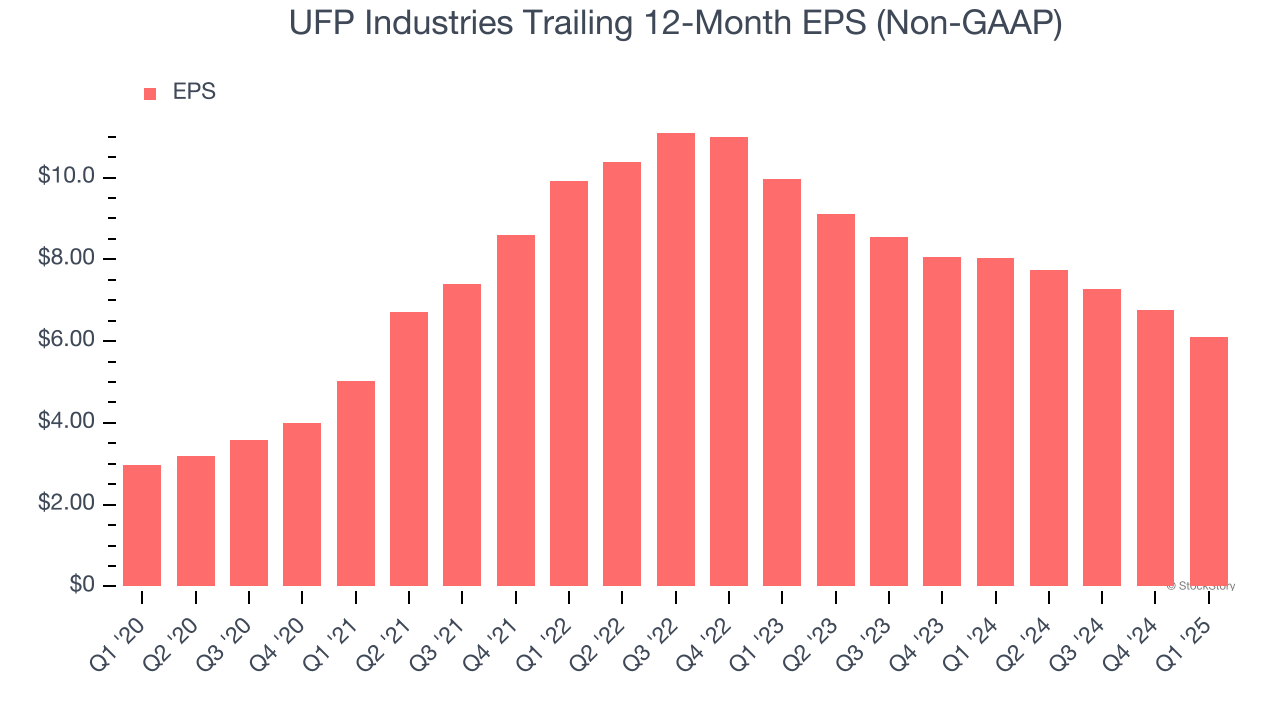

2. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for UFP Industries, its EPS declined by more than its revenue over the last two years, dropping 21.7%. This tells us the company struggled to adjust to shrinking demand.

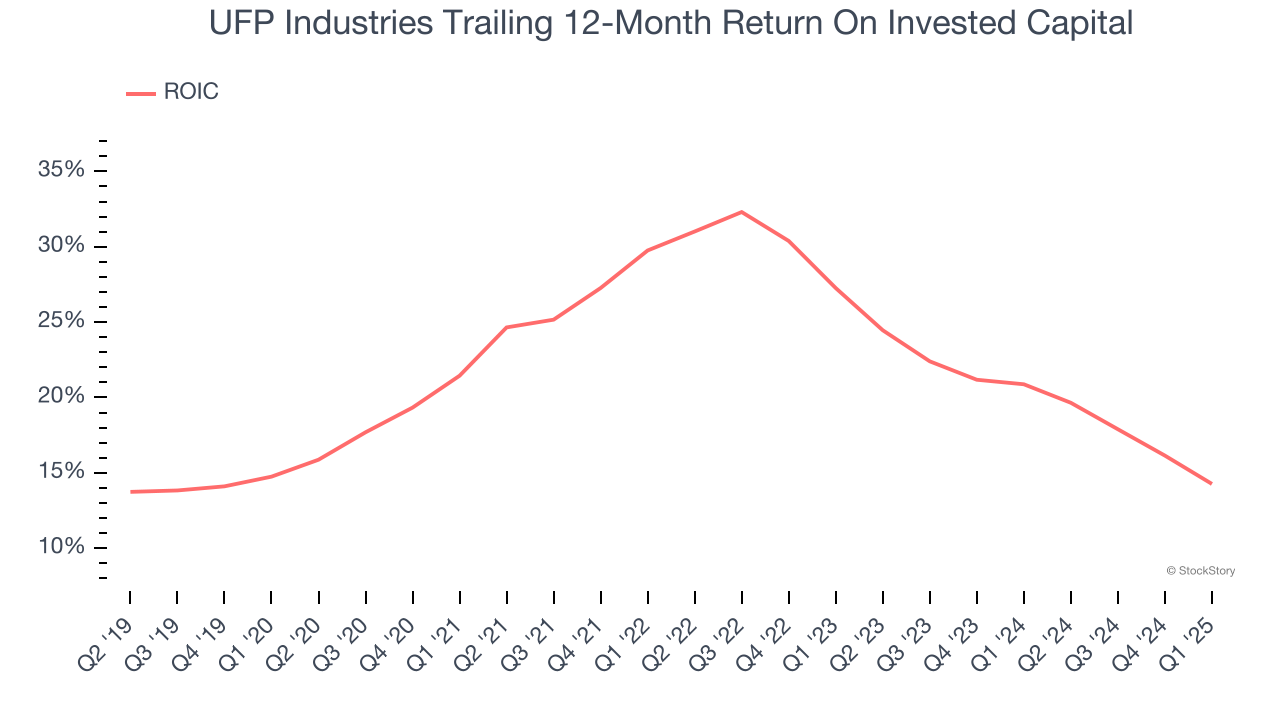

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, UFP Industries’s ROIC has decreased over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

UFP Industries’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 14.3× forward P/E (or $103.78 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward one of our top software and edge computing picks.

Stocks We Would Buy Instead of UFP Industries

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.