IT infrastructure services provider Kyndryl (NYSE: KD) fell short of the market’s revenue expectations in Q2 CY2025, with sales flat year on year at $3.74 billion. Next quarter’s revenue guidance of $3.81 billion underwhelmed, coming in 1.5% below analysts’ estimates. Its non-GAAP profit of $0.37 per share was in line with analysts’ consensus estimates.

Is now the time to buy Kyndryl? Find out by accessing our full research report, it’s free.

Kyndryl (KD) Q2 CY2025 Highlights:

- Revenue: $3.74 billion vs analyst estimates of $3.80 billion (flat year on year, 1.5% miss)

- Adjusted EPS: $0.37 vs analyst estimates of $0.36 (in line)

- Adjusted EBITDA: $647 million vs analyst estimates of $628 million (17.3% margin, 3% beat)

- Revenue Guidance for Q3 CY2025 is $3.81 billion at the midpoint, below analyst estimates of $3.87 billion

- Operating Margin: 4%, up from 2.5% in the same quarter last year

- Free Cash Flow was -$267 million compared to -$27.75 million in the same quarter last year

- Market Capitalization: $8.42 billion

"Our first quarter reflected steady progress across key growth areas of our business, with contributions from Kyndryl Consult, hyperscaler-related activity, scope expansions and productivity gains. Our expertise in mission-critical technology and our unique operational capabilities, including Kyndryl Bridge, are helping customers innovate and creating new growth opportunities for Kyndryl," said Chairman and Chief Executive Officer Martin Schroeter.

Company Overview

Born from IBM's managed infrastructure services business in a 2021 spinoff, Kyndryl (NYSE: KD) is the world's largest IT infrastructure services provider that designs, builds, and manages technology environments for enterprise customers.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $15.06 billion in revenue over the past 12 months, Kyndryl is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. To expand meaningfully, Kyndryl likely needs to tweak its prices, innovate with new offerings, or enter new markets.

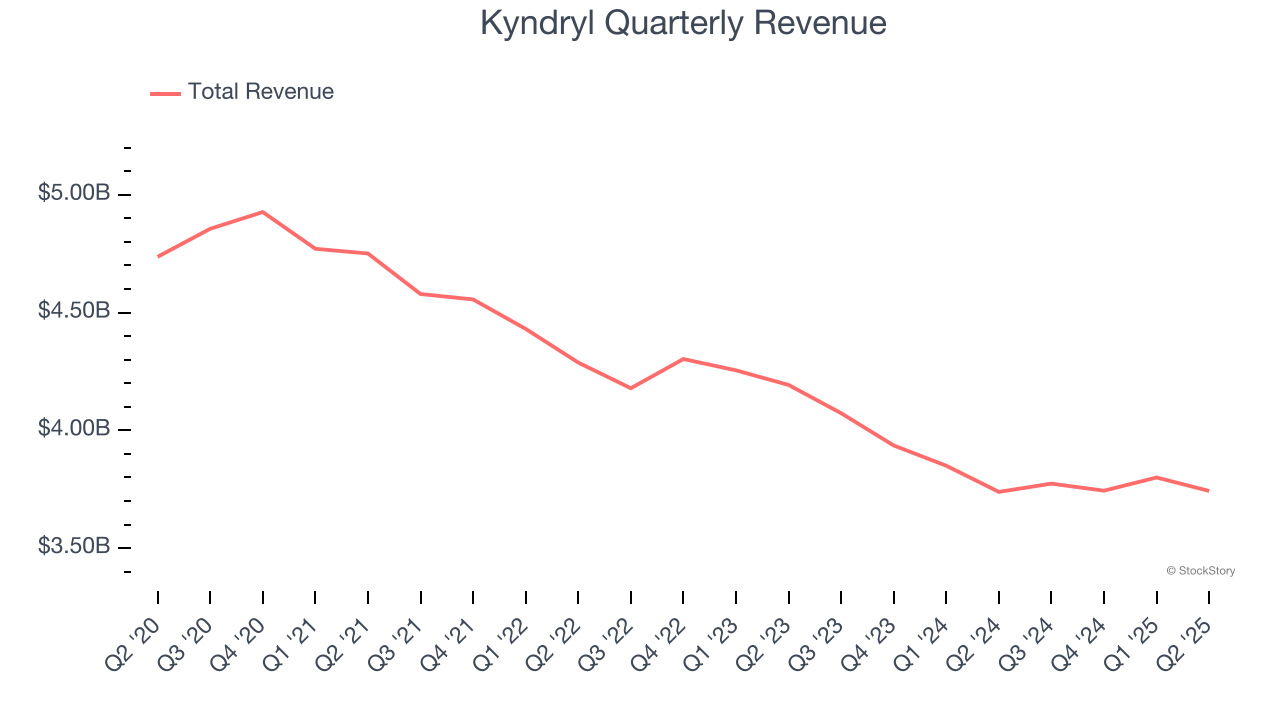

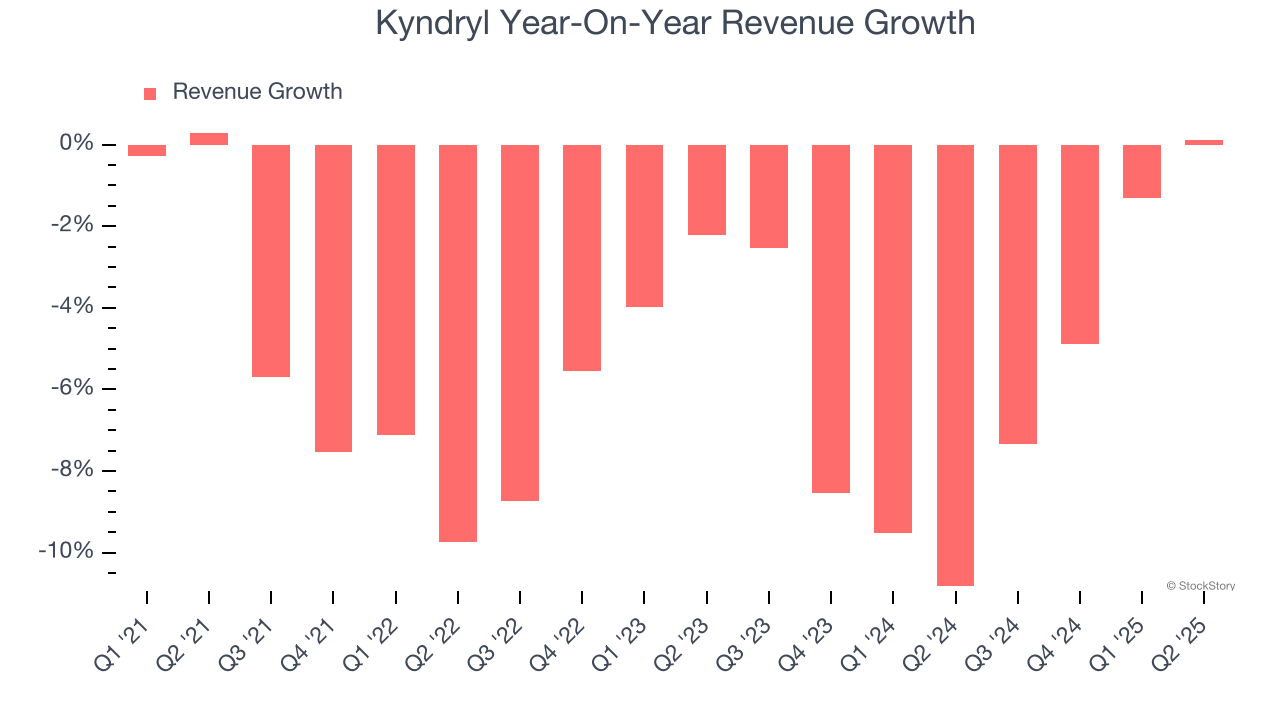

As you can see below, Kyndryl struggled to generate demand over the last five years. Its sales dropped by 4.6% annually, a tough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Kyndryl’s recent performance shows its demand remained suppressed as its revenue has declined by 5.7% annually over the last two years.

This quarter, Kyndryl’s $3.74 billion of revenue was flat year on year, falling short of Wall Street’s estimates. Company management is currently guiding for a 1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.4% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

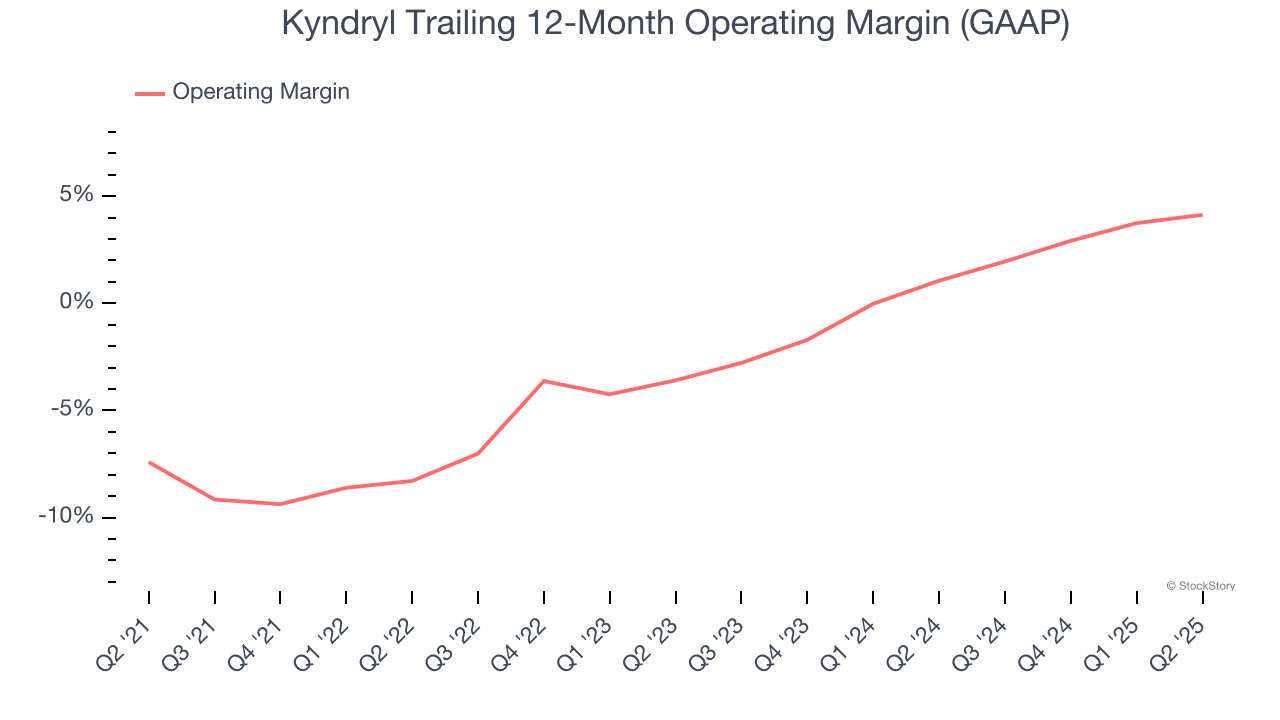

Operating Margin

Although Kyndryl was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 3.2% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Kyndryl’s operating margin rose by 11.5 percentage points over the last five years. Still, it will take much more for the company to show consistent profitability.

In Q2, Kyndryl generated an operating margin profit margin of 4%, up 1.5 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

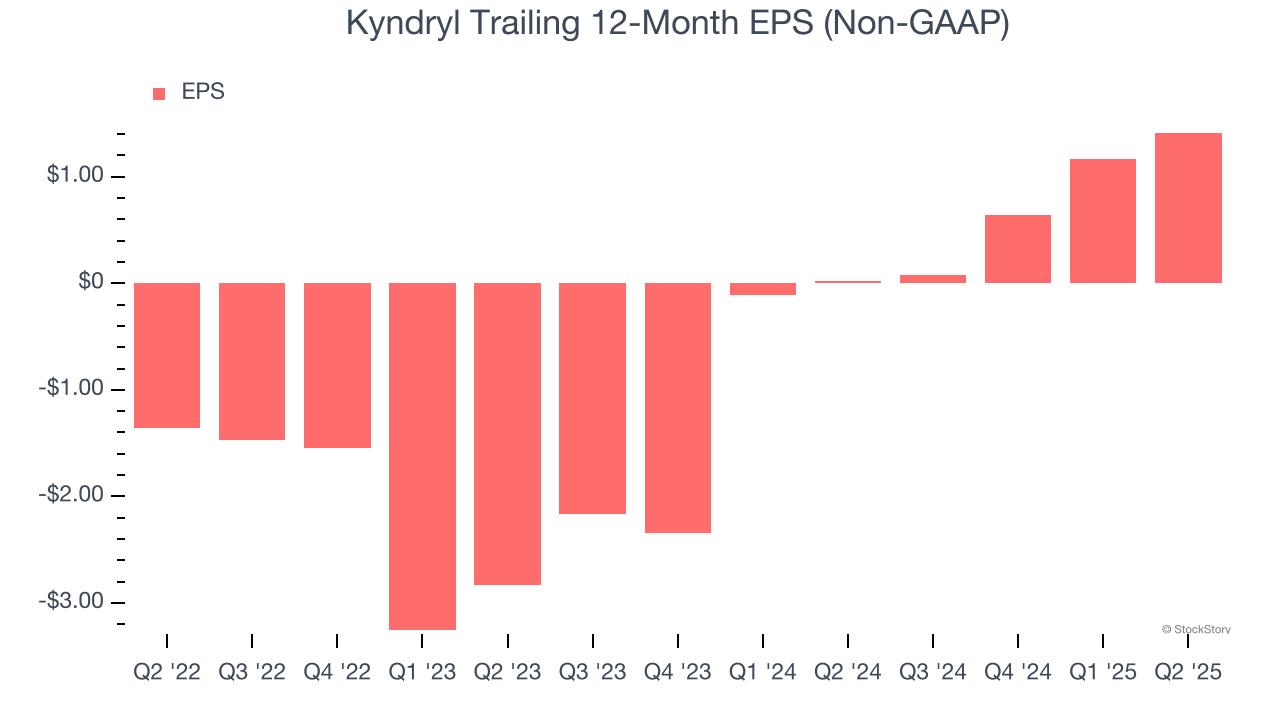

Kyndryl’s full-year EPS flipped from negative to positive over the last two years. This is encouraging and shows it’s at a critical moment in its life.

In Q2, Kyndryl reported adjusted EPS at $0.37, up from $0.13 in the same quarter last year. This print beat analysts’ estimates by 1.8%. Over the next 12 months, Wall Street expects Kyndryl’s full-year EPS of $1.41 to grow 89.1%.

Key Takeaways from Kyndryl’s Q2 Results

It was encouraging to see Kyndryl beat analysts’ EPS expectations this quarter. On the other hand, its revenue slightly missed and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 13% to $31.92 immediately after reporting.

Kyndryl’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.