Grocery Outlet’s stock price has taken a beating over the past six months, shedding 27.3% of its value and falling to $9.63 per share. This may have investors wondering how to approach the situation.

Is now the time to buy Grocery Outlet, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Do We Think Grocery Outlet Will Underperform?

Even though the stock has become cheaper, we're swiping left on Grocery Outlet for now. Here are three reasons there are better opportunities than GO and a stock we'd rather own.

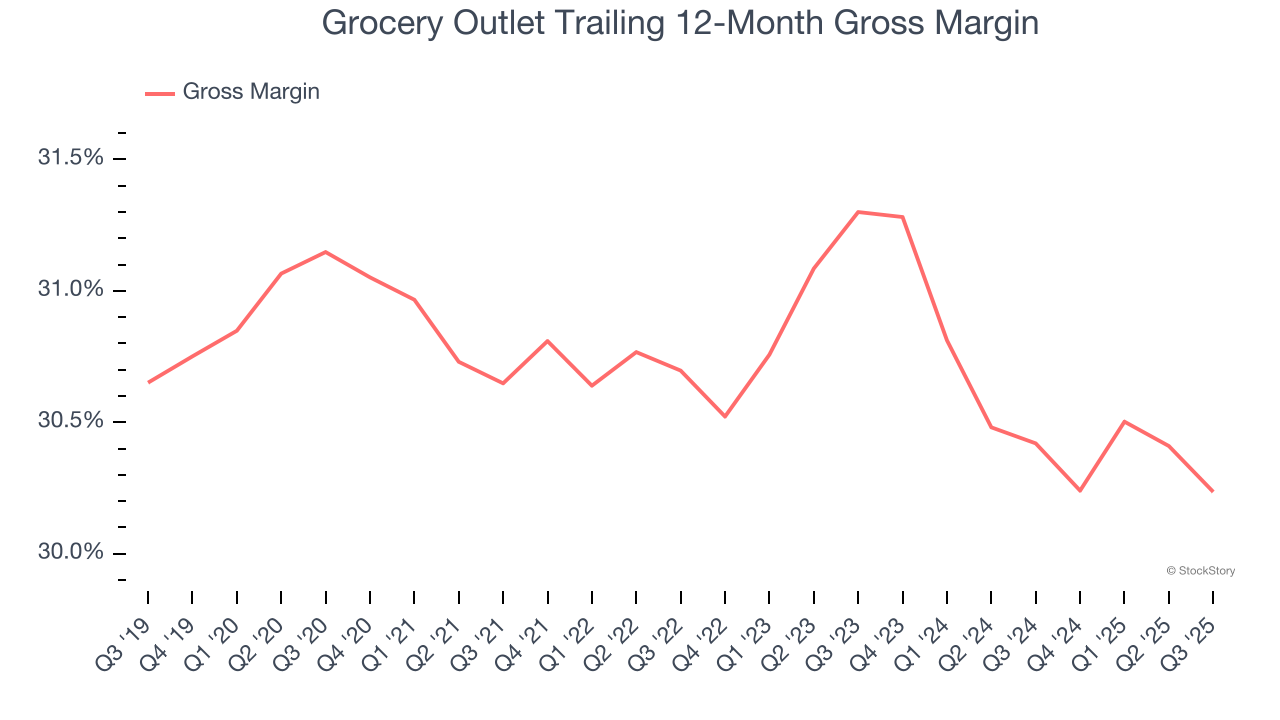

1. Low Gross Margin Reveals Weak Structural Profitability

We prefer higher gross margins because they not only make it easier to generate more operating profits but also indicate product differentiation, negotiating leverage, and pricing power.

Grocery Outlet has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 30.3% gross margin over the last two years. That means Grocery Outlet paid its suppliers a lot of money ($69.68 for every $100 in revenue) to run its business.

2. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Grocery Outlet historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.1%, lower than the typical cost of capital (how much it costs to raise money) for consumer retail companies.

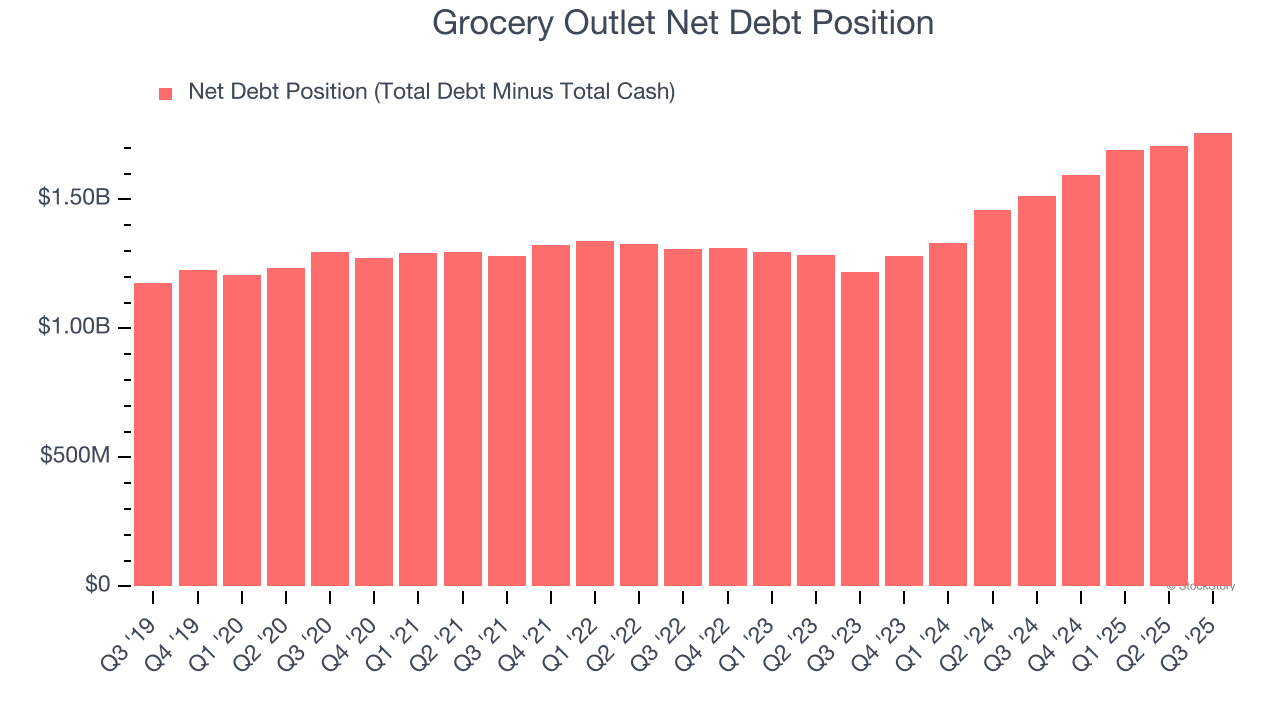

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Grocery Outlet burned through $28.29 million of cash over the last year, and its $1.81 billion of debt exceeds the $52.13 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Grocery Outlet’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Grocery Outlet until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Grocery Outlet, we’ll be cheering from the sidelines. After the recent drawdown, the stock trades at 12.1× forward P/E (or $9.63 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are better investments elsewhere. We’d recommend looking at one of our all-time favorite software stocks.

Stocks We Like More Than Grocery Outlet

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.