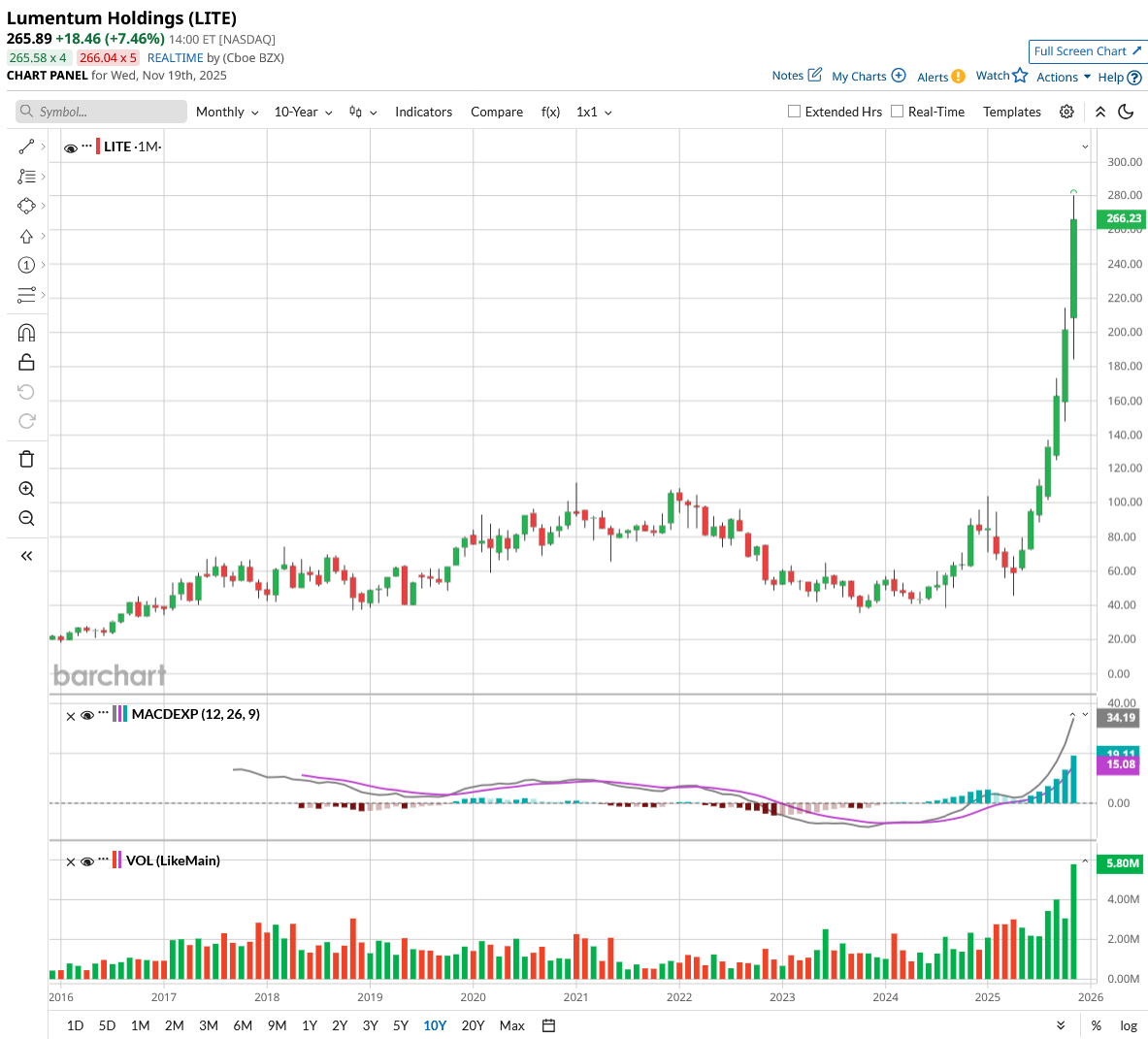

Lumentum Holdings (LITE) just received a major vote of confidence from Wall Street as Mizuho initiated coverage with an “Outperform” rating and a street-high price target of $290. The optical components maker is emerging as a critical player in the buildout of artificial intelligence infrastructure, commanding over 50% market share in indium phosphide lasers that power advanced AI servers.

Mizuho analyst Vijay Rakesh believes the company will ride a massive wave as hyperscalers transition from current 400G and 800G bandwidth to 1.6T and 3.2T connections. This shift is unavoidable as copper cables hit physical limits for reach and power consumption, forcing data center operators toward optical solutions. Lumentum's laser revenue could more than double from roughly $1 billion in fiscal 2025 to $2.2 billion by fiscal 2028, representing 54% of total company revenue.

The growth story extends beyond traditional data center applications. Alphabet (GOOGL) (GOOG) is ramping up optical circuit-switch deployments, while Nvidia (NVDA) plans to use Lumentum's lasers in its next-generation Rubin platform, launching later this year.

These design wins with industry leaders could add $100 million per quarter from hyperscalers by fiscal 2027 and another $50 million per quarter from Nvidia starting in fiscal 2026. Mizuho forecasts 37% annual revenue growth and 74% earnings per share growth through fiscal 2028, making Lumentum one of the most attractive plays on AI infrastructure expansion.

A Strong Performance in Fiscal Q1

Lumentum Holdings delivered a blockbuster first quarter with revenue surging 58% year-over-year (YoY) to $533 million and operating margins expanding by 1,500 basis points. The optical components maker is capitalizing on robust demand for AI infrastructure, as it generates over 60% of total revenue from cloud and AI applications. Management forecasts sales in fiscal Q2 (ending in December) at $650 million, reaching a milestone two quarters earlier than previously targeted.

Better-than-expected progress on manufacturing yields and throughput will deliver approximately 40% more unit capacity over the next few quarters. This capacity expansion comes at a time when the product mix is shifting toward higher-margin 200-gigabit EML lasers, which should account for 10% of the mix by March 2026. The company is also ramping continuous wave lasers for internal use in optical transceivers, with 100-milliwatt versions entering full production in mid-2026.

The optical transceiver business finally appears to have turned a corner after periods of inconsistent execution. Revenue touched previous peak levels last quarter and is projected to grow substantially in December.

For the first time, Lumentum is participating in the early phases of customer ramps rather than missing the front end, creating a layering effect in which new products ramp before older ones decline. The company is targeting a $250 million quarterly run rate in transceivers by focusing on the highest-margin opportunities.

Optical circuit switches represent another major growth driver for Lumentum, given that customer engagement levels are incredibly high and hardware qualification is largely complete across three customers. The primary challenge remains software integration, but management expects full qualification by March 2026.

Revenue should ramp from mid-single-digit millions in December to $100 million quarterly by December 2026, with growing confidence that this target could exceed expectations given intensifying customer interest and expanding use cases across the hyperscaler community.

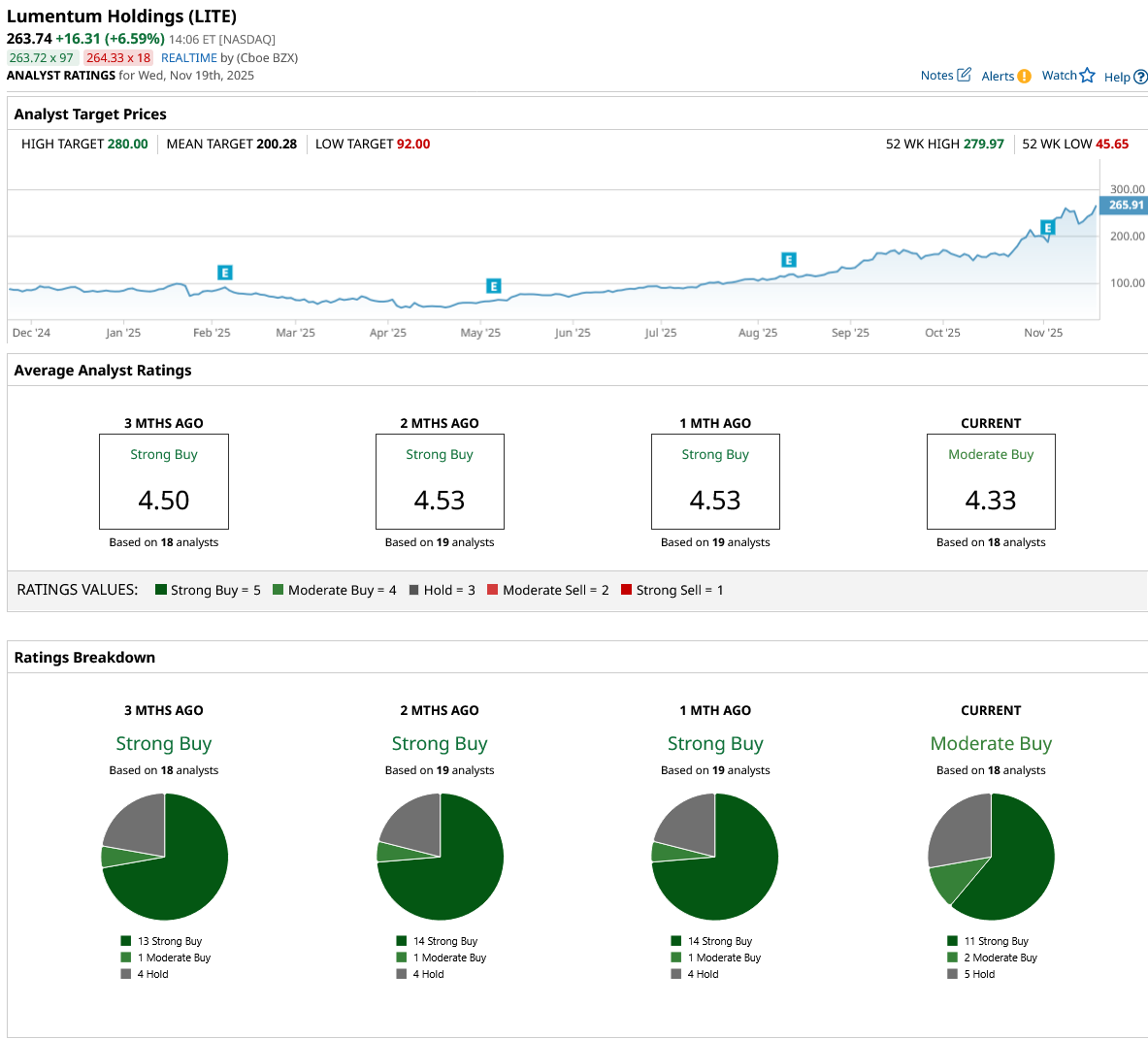

What Is the LITE Stock Price Target?

Analysts tracking LITE stock forecast revenue to increase from $1.65 billion in fiscal 2025 to $3.91 billion in fiscal 2028. In this period, adjusted earnings per share are forecast to grow from $2.06 to $9.51.

LITE stock trades at a forward price-to-earnings (P/E) multiple of 38.5x, which is reasonable given its stellar growth estimates. At its current multiple, the tech stock should trade around $366 in two years, indicating an upside potential of almost 50%.

Out of the 18 analysts covering LITE stock, 11 recommend “Strong Buy,” two recommend “Moderate Buy,” and five recommend “Hold.” The average Lumentum stock price target is $200, well below the current price of $264.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Leading Gene-Editing Stock Could Be Going Private. Should You Buy Its Shares First?

- Small-Cap Stocks Are Sounding a Very Scary Alarm. Here’s How to Protect Yourself… and Even Profit.

- Here’s How You Can Have Your Cake with AMD Stock and Eat It Too – With Just 6.6% Downside Risk

- As Arm Bets on AI Infrastructure with Nvidia, Should You Buy, Sell, or Hold ARM Stock?